This version of the form is not currently in use and is provided for reference only. Download this version of

Form CMG3001

for the current year.

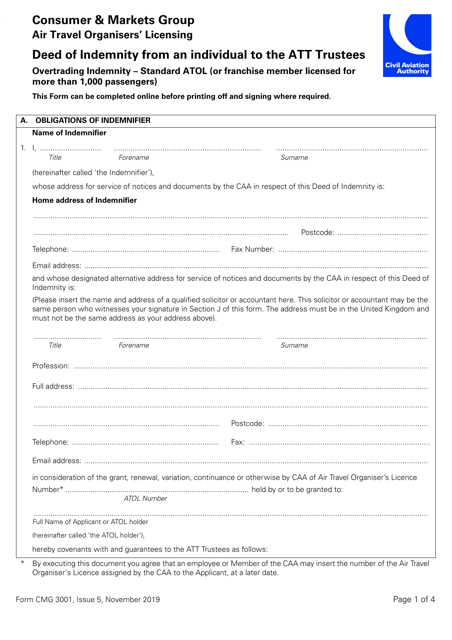

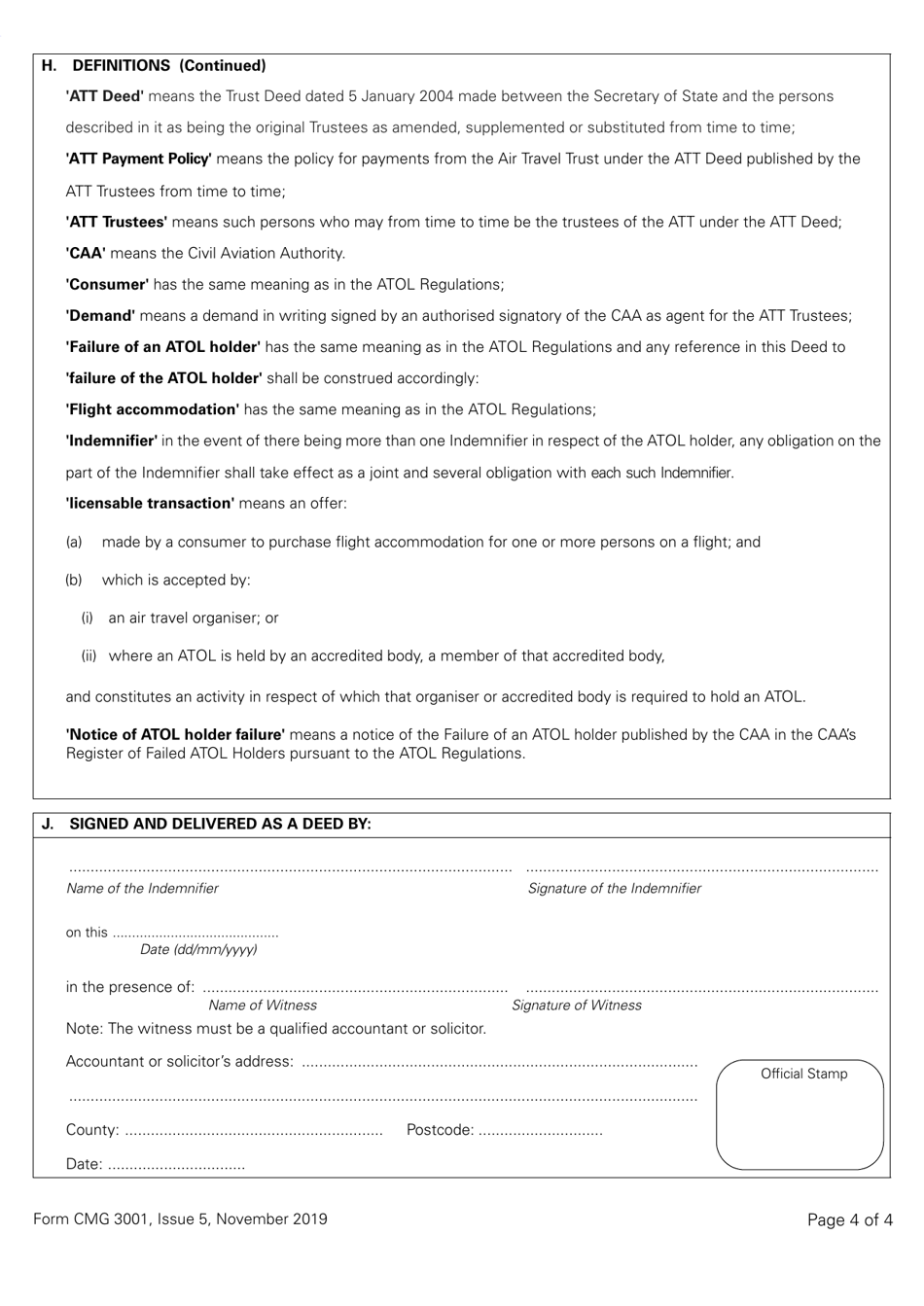

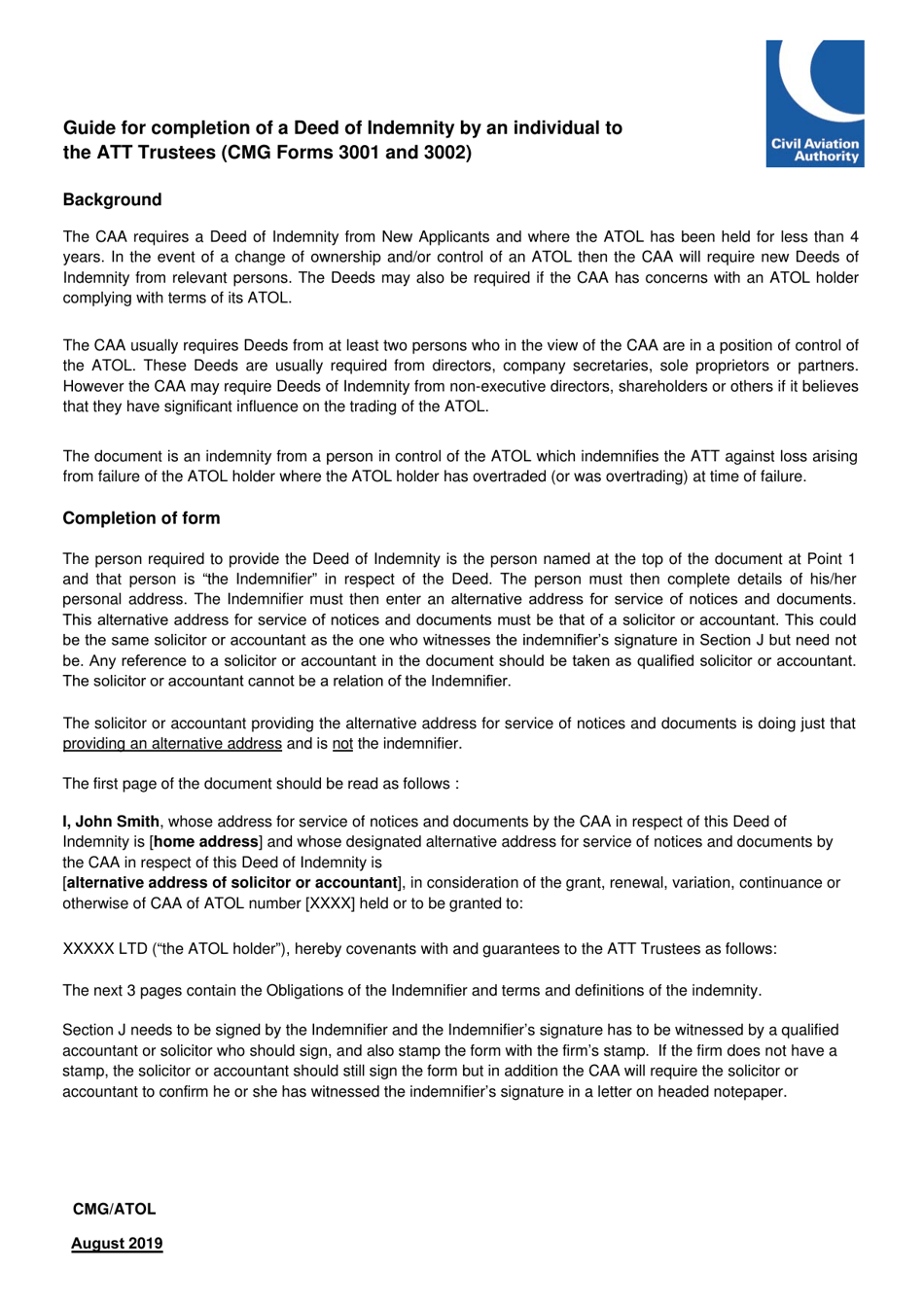

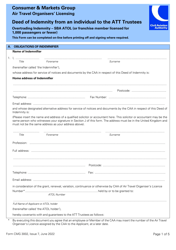

Form CMG3001 Deed of Indemnity From an Individual to the Att Trustees Overtrading Indemnity - Standard Atol (Or Franchise Member Licensed for More Than 1,000 Passengers) - United Kingdom

Form CMG3001 Deed of Indemnity From an Individual to the ATOL Trustees Overtrading Indemnity - Standard ATOL (or Franchise Member Licensed for More Than 1,000 Passengers) is a legal document used in the United Kingdom. It is a deed of indemnity that provides protection to the Air Travel Organisers' Licensing (ATOL) Trustees in the event of overtrading by an individual or company holding an ATOL or Franchise license for more than 1,000 passengers. It ensures that the trustees are indemnified against any losses incurred due to potential overtrading.

The Form CMG3001 Deed of Indemnity from an individual to the ATT Trustees overtrading indemnity - Standard ATOL (or franchise member licensed for more than 1,000 passengers) is filed by the individual in the United Kingdom.

FAQ

Q: What is a CMG3001 Deed of Indemnity?

A: A CMG3001 Deed of Indemnity is a legal document in the United Kingdom that provides indemnity protection for overtrading to the Att Trustees.

Q: Who is the deed of indemnity from?

A: The deed of indemnity is from an individual to the Att Trustees.

Q: What does overtrading indemnity mean?

A: Overtrading indemnity refers to protection against losses or liabilities that may arise from excessive or risky trading activities.

Q: What is an ATOL?

A: ATOL stands for Air Travel Organiser's Licence. It is a UK government-backed scheme that provides financial protection to consumers for certain types of travel bookings.

Q: What is a franchise member licensed for more than 1,000 passengers?

A: A franchise member licensed for more than 1,000 passengers refers to a travel company that has a licensed agreement with a larger organization and is authorized to carry more than 1,000 passengers.

Q: What is the purpose of this deed of indemnity?

A: The purpose of this deed of indemnity is to provide protection to the Att Trustees against any losses or liabilities resulting from overtrading by the individual.

Q: What are the obligations of the individual under this deed of indemnity?

A: The individual agrees to indemnify and hold harmless the Att Trustees from any losses, costs, or expenses arising from overtrading.

Q: Is this deed of indemnity specific to the United Kingdom?

A: Yes, the CMG3001 Deed of Indemnity is specific to the United Kingdom.

Q: Why would someone enter into a deed of indemnity for overtrading?

A: Someone may enter into a deed of indemnity for overtrading to provide financial protection to the Att Trustees in case of any losses or liabilities resulting from risky trading activities.

Q: Is this deed applicable to all travel companies in the UK?

A: No, this deed is specifically for franchise members licensed for more than 1,000 passengers under the ATOL scheme.