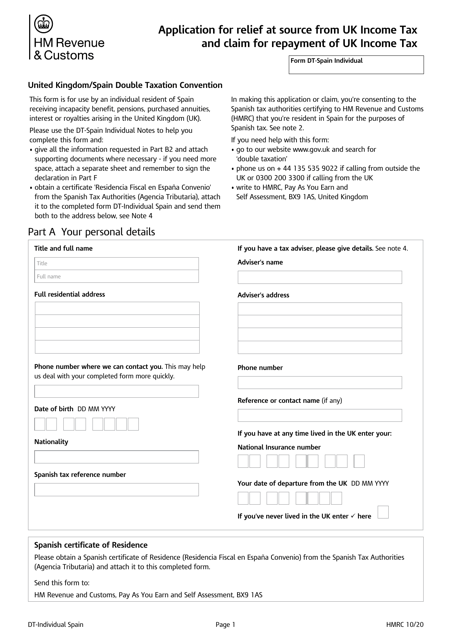

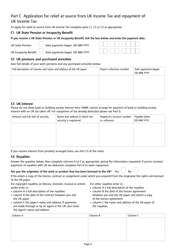

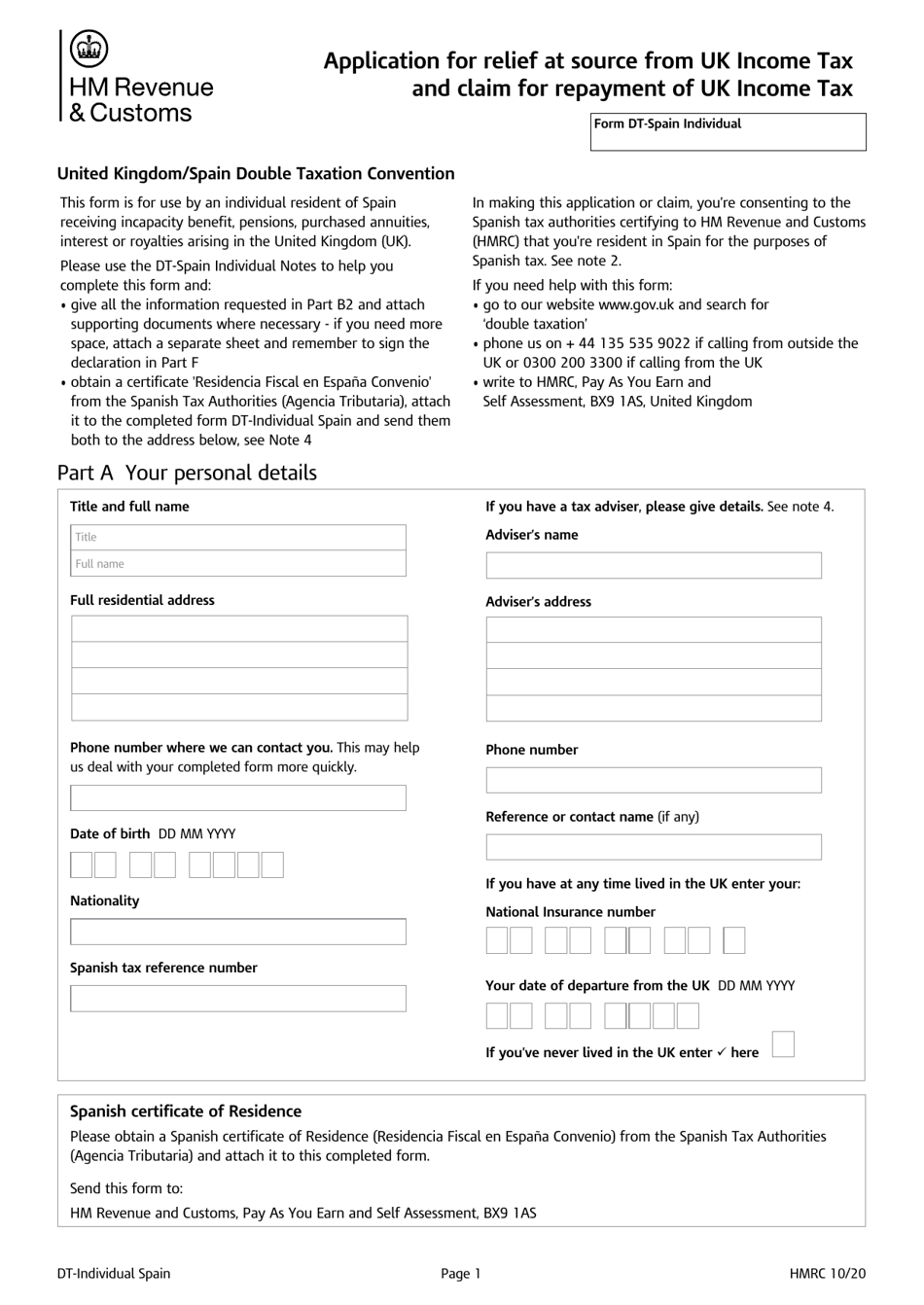

Form DT-SPAIN INDIVIDUAL Application for Relief at Source From UK Income Tax and Claim for Repayment of UK Income Tax - United Kingdom

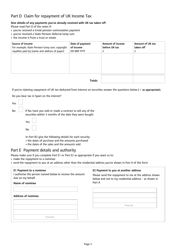

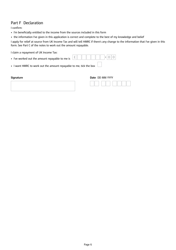

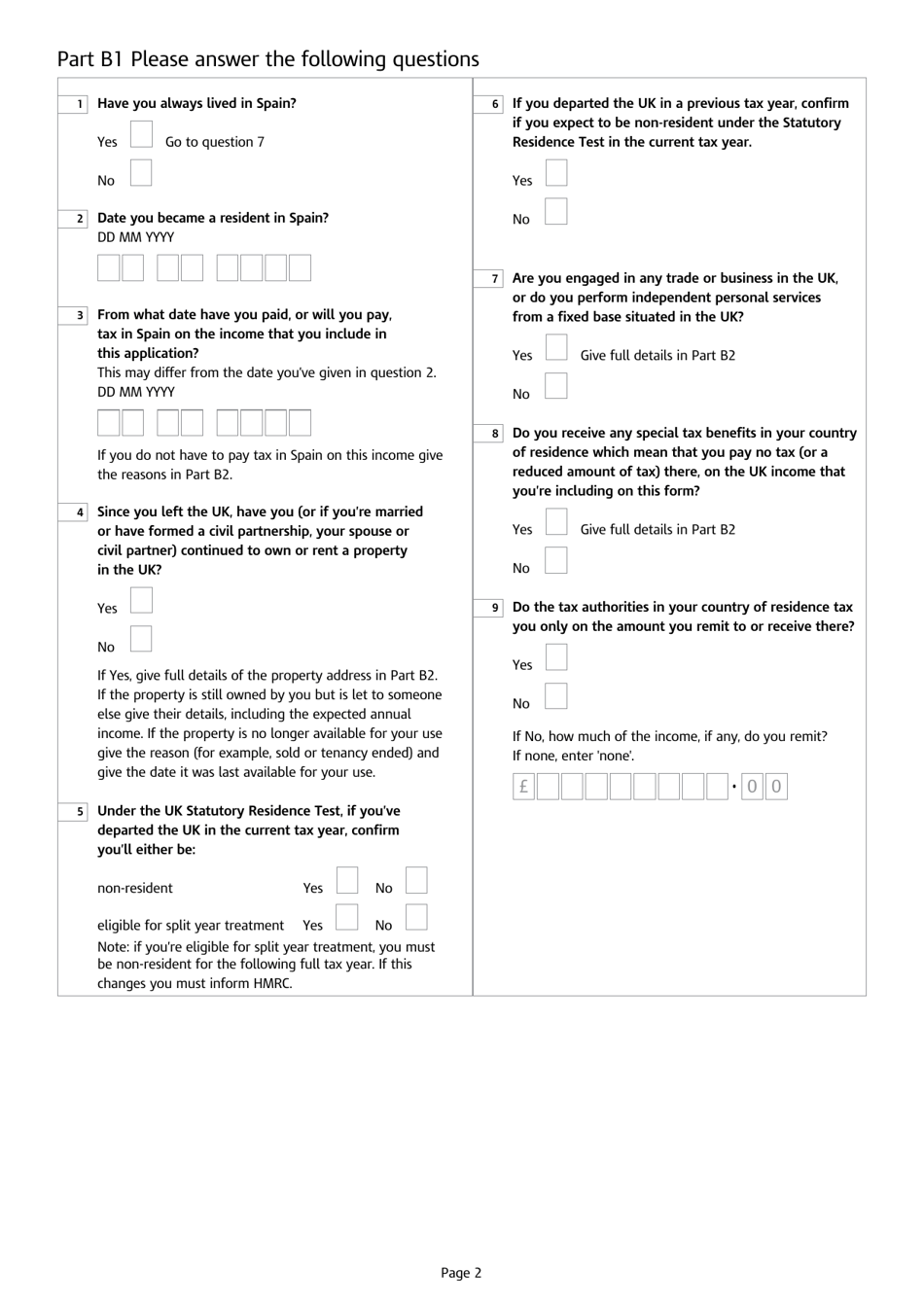

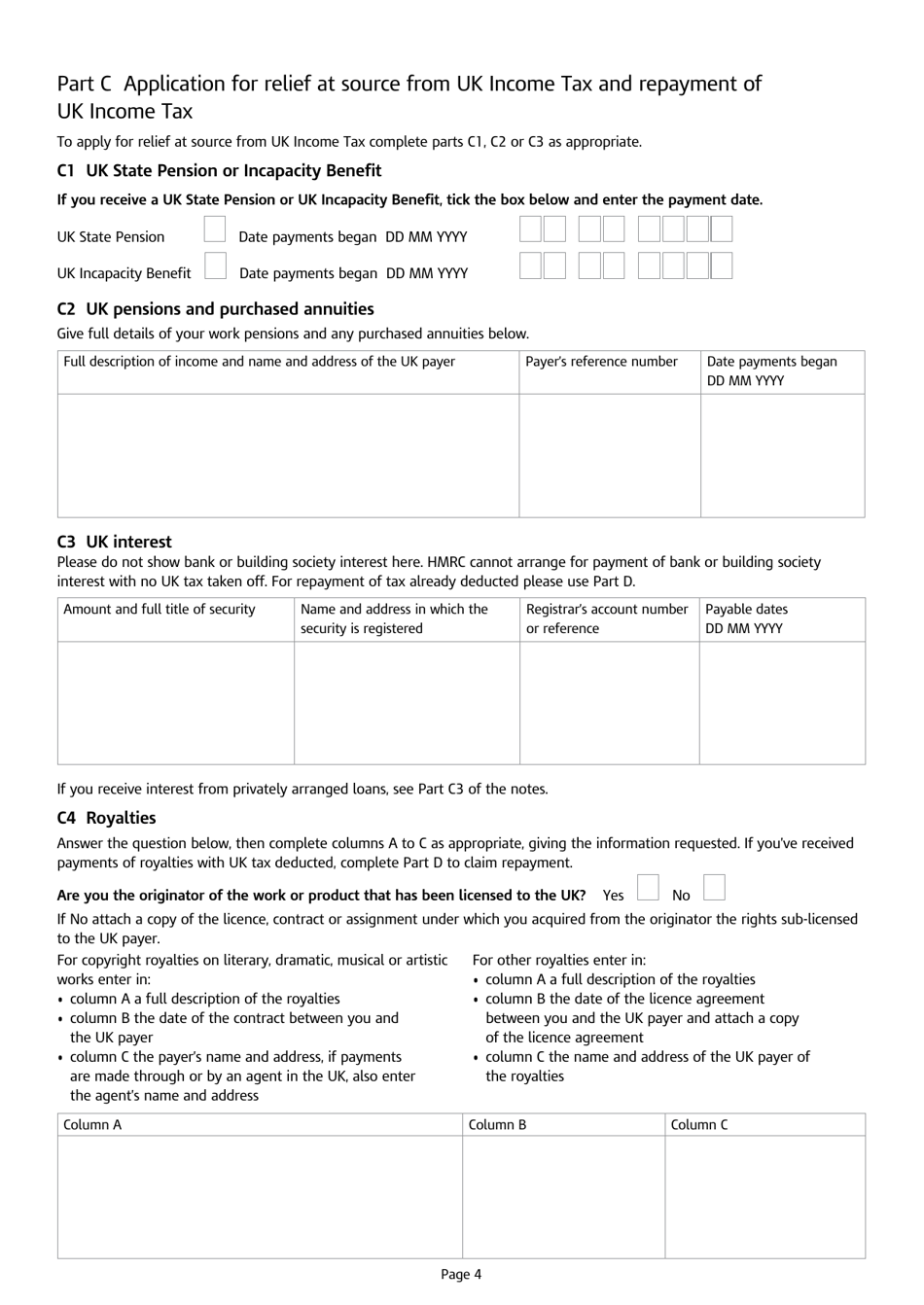

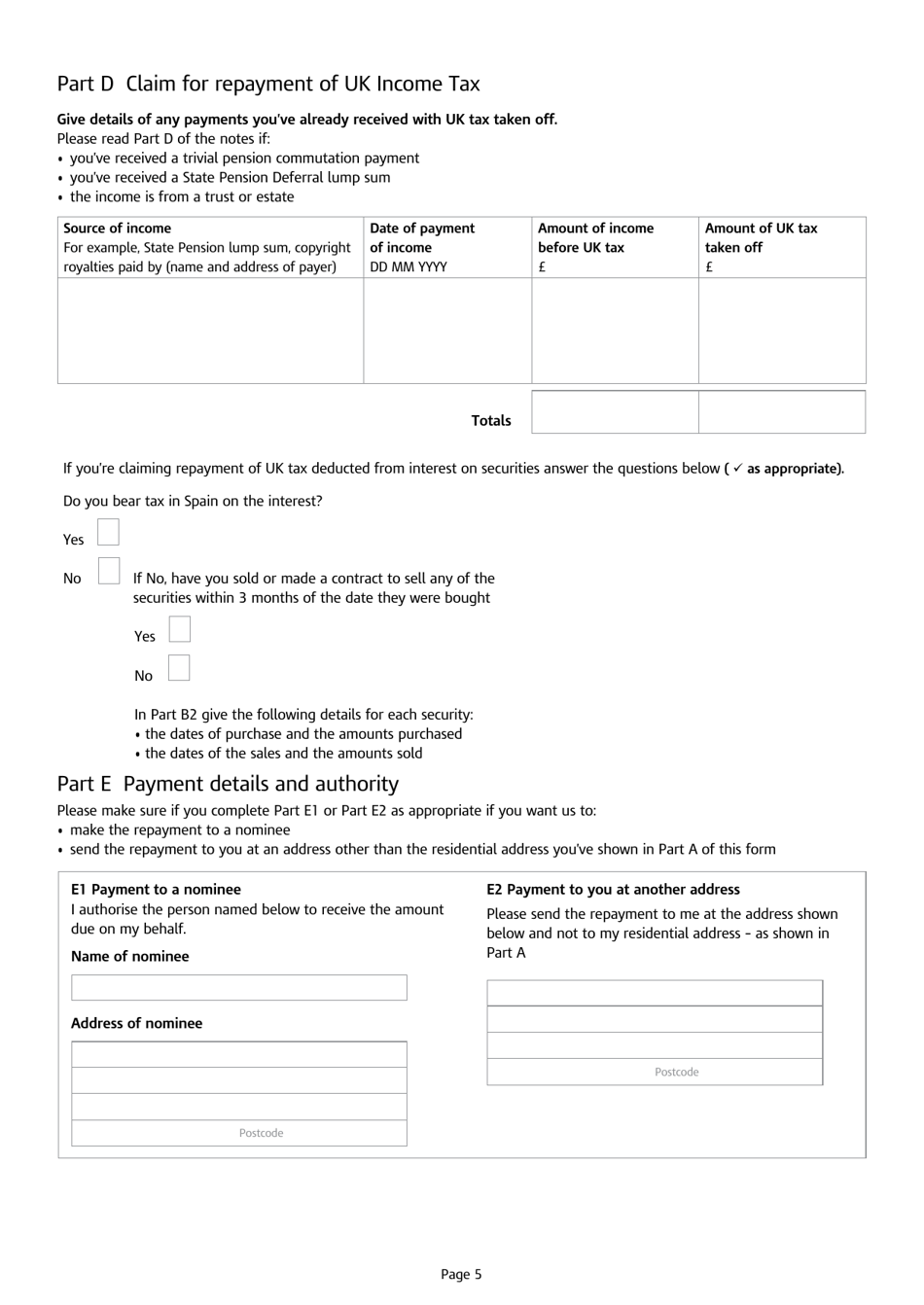

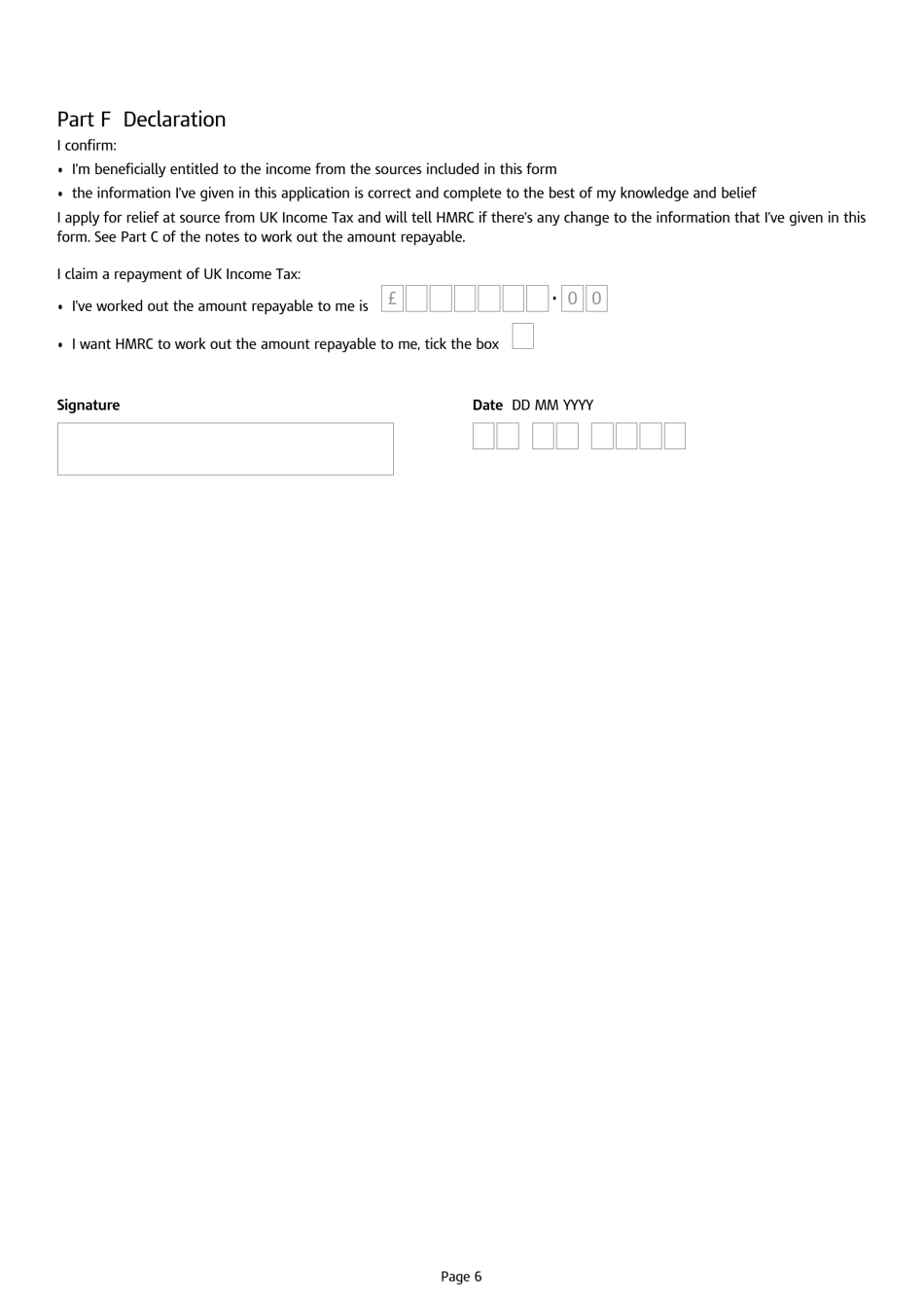

Form DT-SPAIN INDIVIDUAL Application for Relief at Source From UK Income Tax and Claim for Repayment of UK Income Tax is a form used by individuals who are residents of Spain to apply for relief from UK income tax and claim a repayment of any UK income tax paid. This form is specific to residents of Spain who have income taxable in the UK.

FAQ

Q: What is Form DT-SPAIN INDIVIDUAL?

A: Form DT-SPAIN INDIVIDUAL is an application for relief at source from UK income tax and claim for repayment of UK income tax.

Q: Who can use Form DT-SPAIN INDIVIDUAL?

A: Individuals who are residents of Spain and want to claim relief from UK income tax can use Form DT-SPAIN INDIVIDUAL.

Q: What is the purpose of Form DT-SPAIN INDIVIDUAL?

A: The purpose of this form is to apply for relief at source from UK income tax and claim repayment of UK income tax under the UK-Spain Double Taxation Convention.

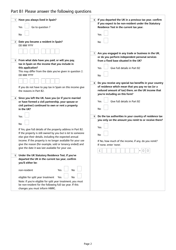

Q: What documents are required to support the application?

A: You will need to provide certain supporting documents such as a certificate of residency, a statement of UK income, and evidence of UK tax deducted or withheld.