This version of the form is not currently in use and is provided for reference only. Download this version of

Form ChV1

for the current year.

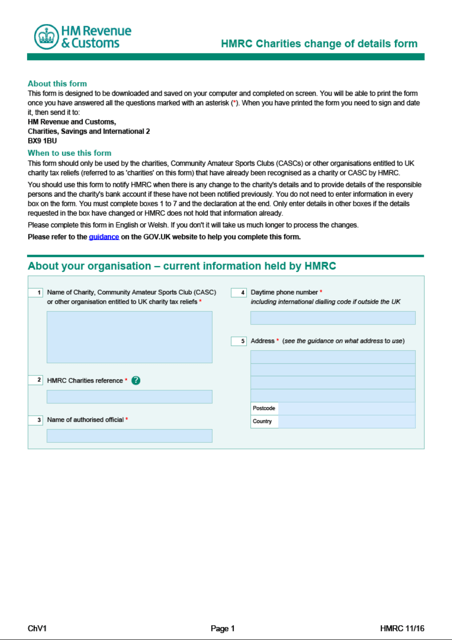

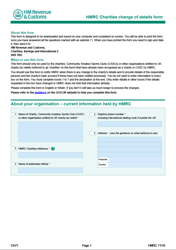

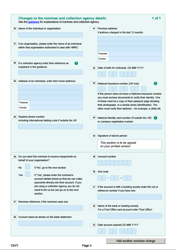

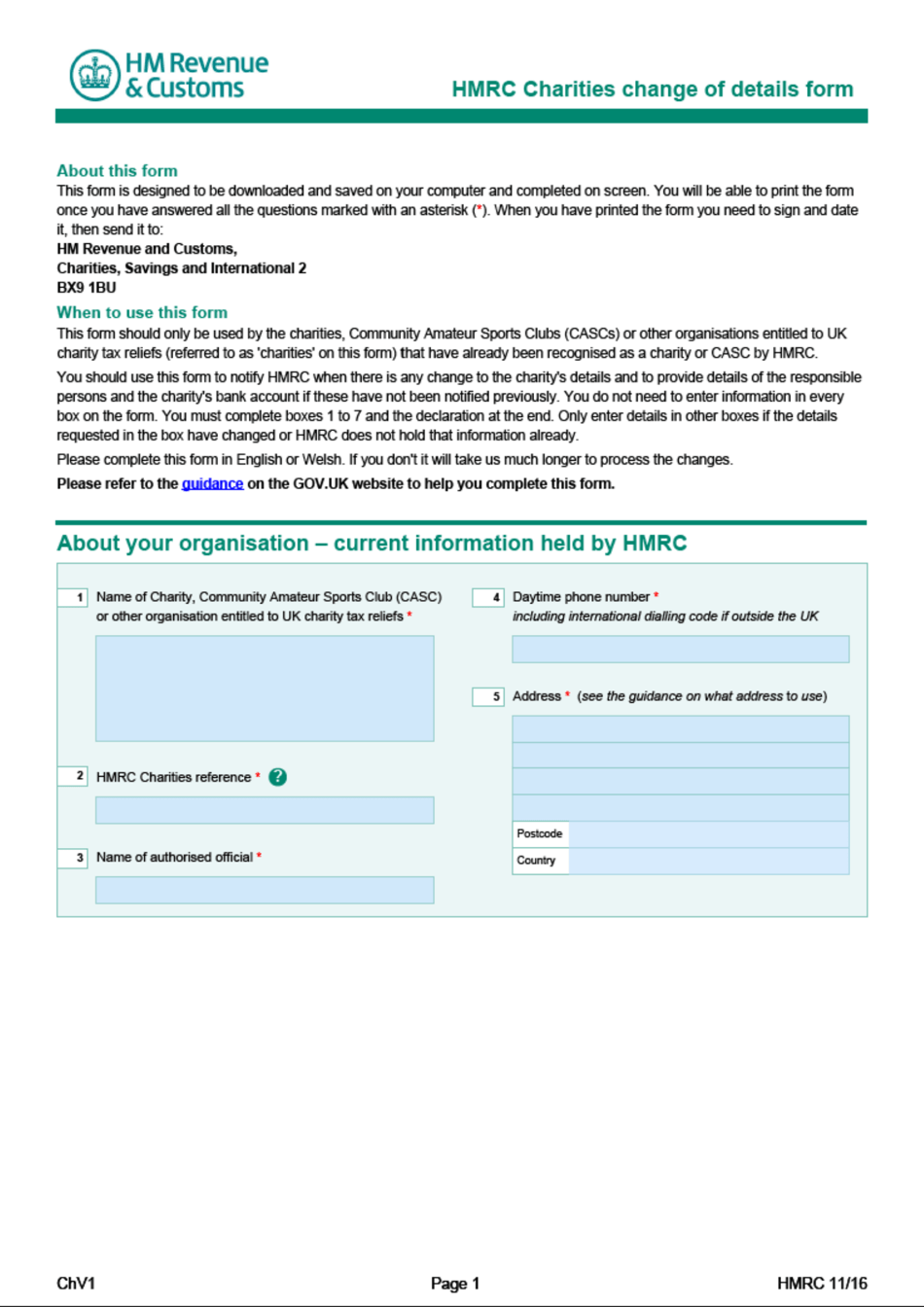

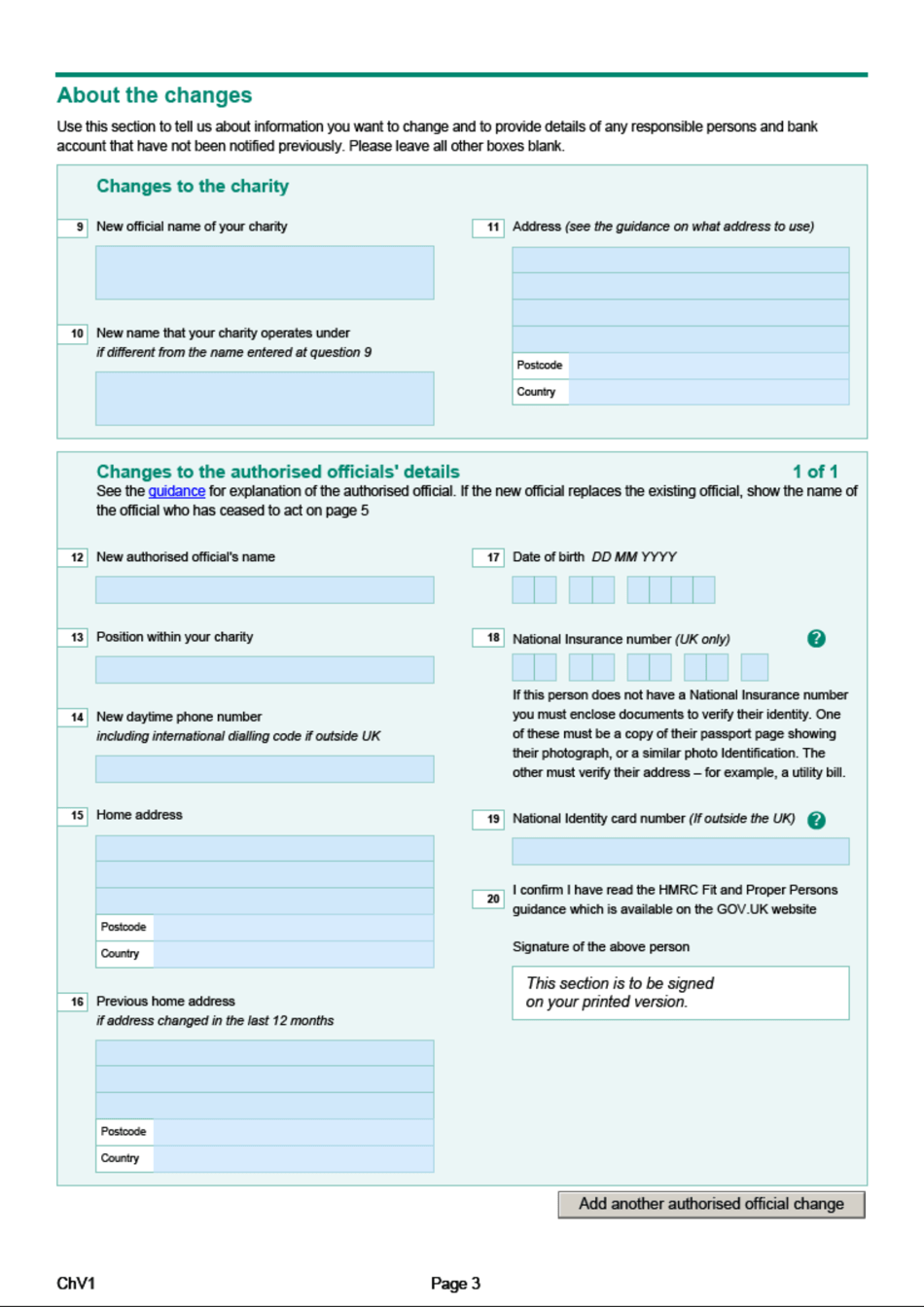

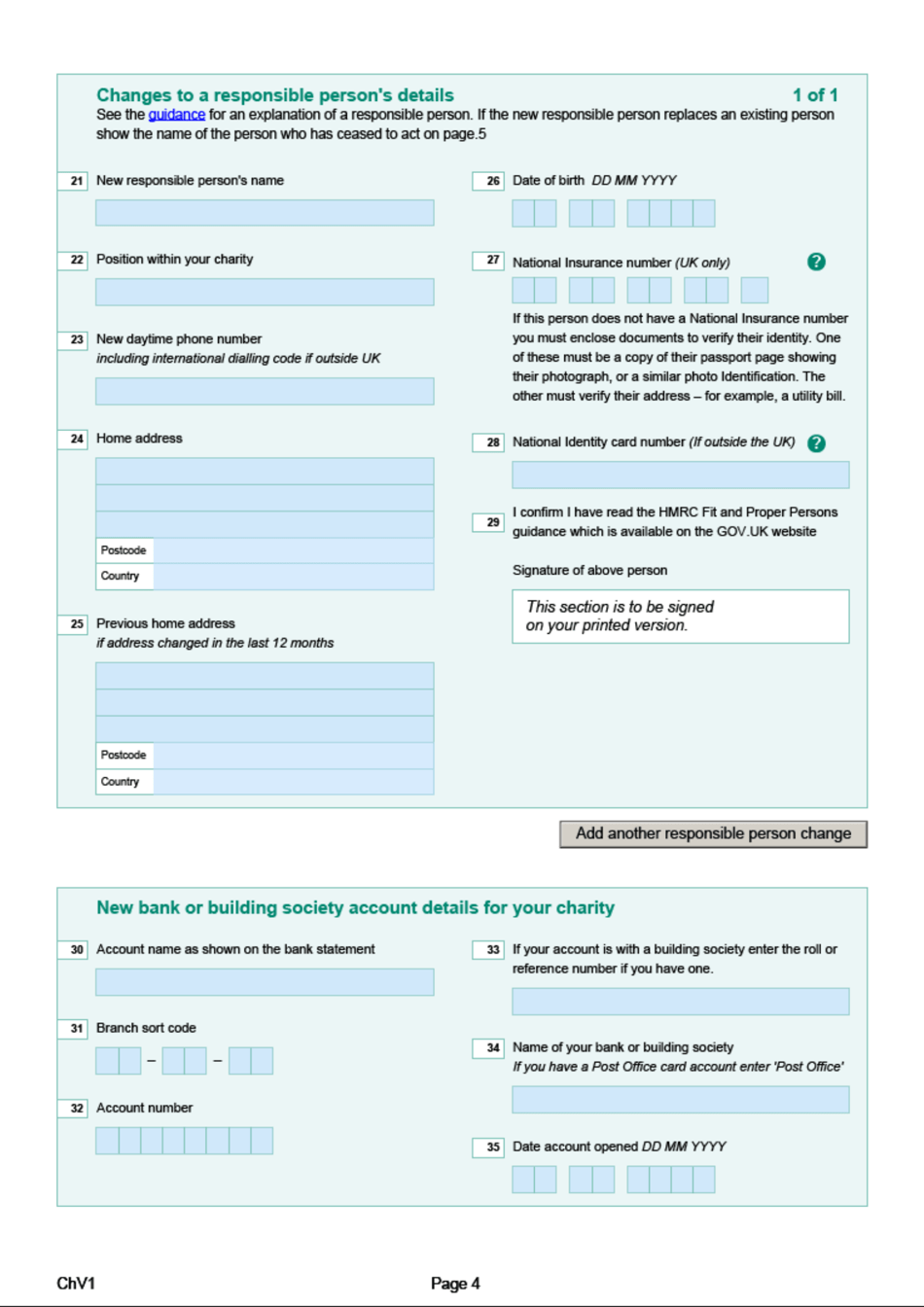

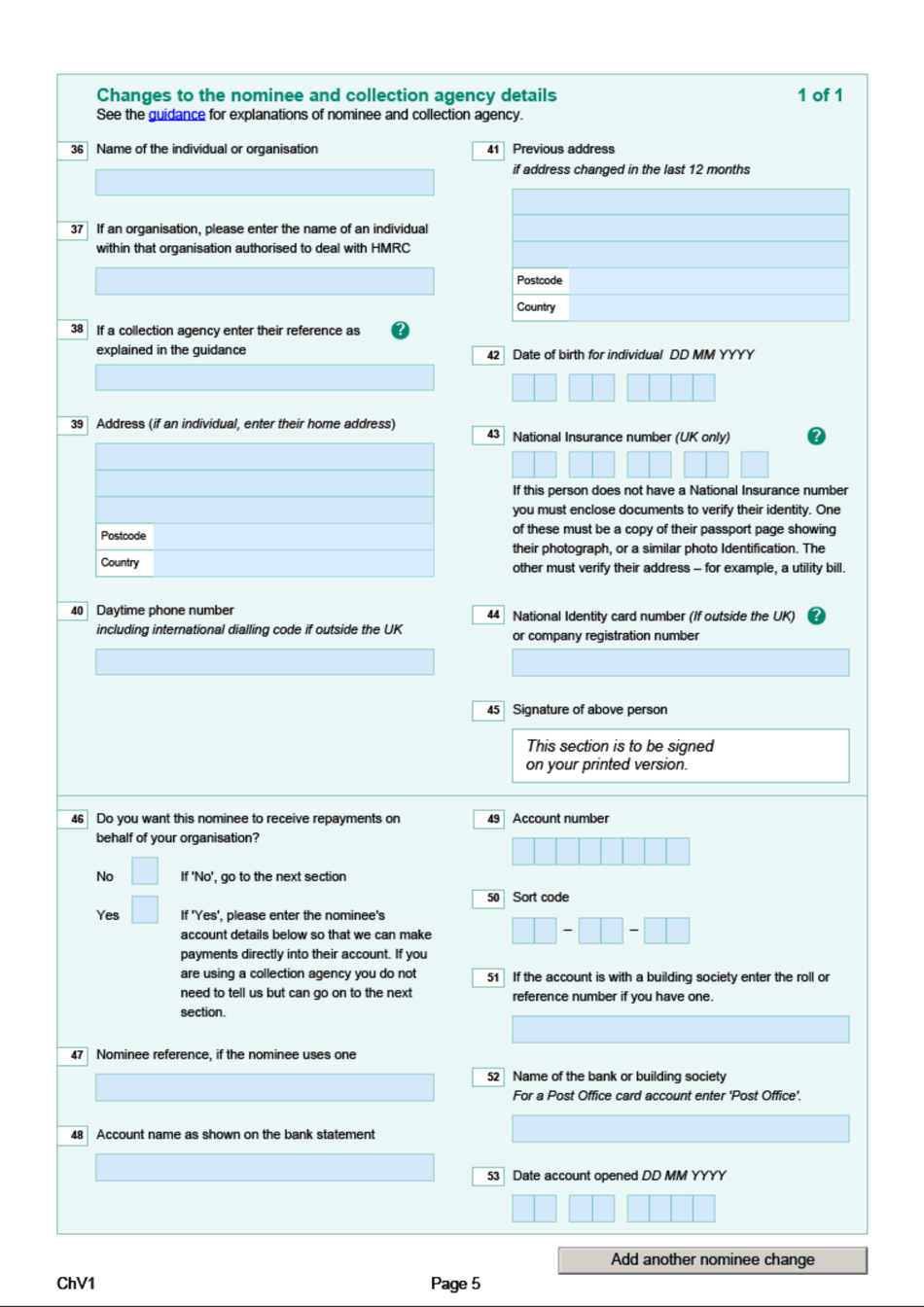

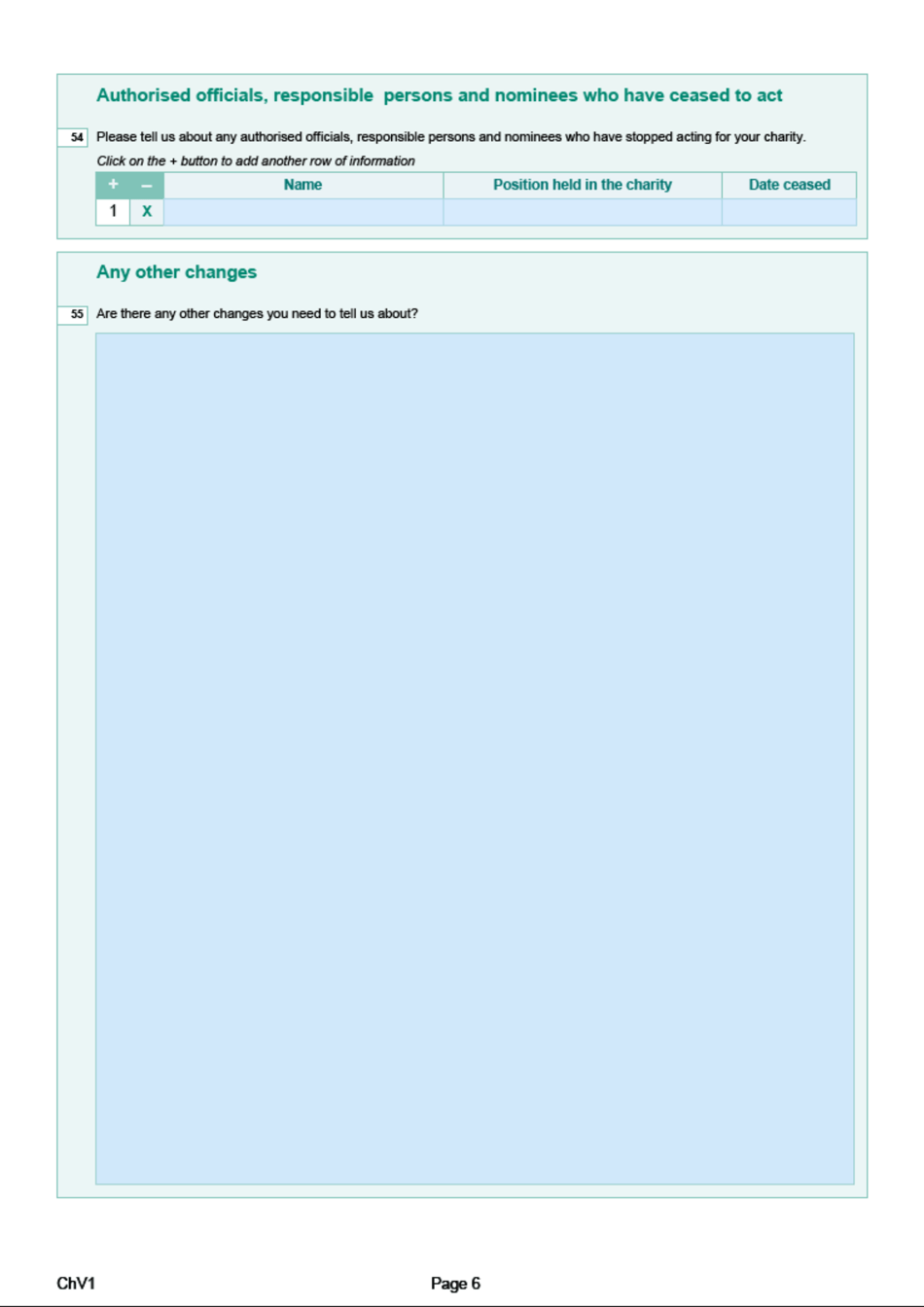

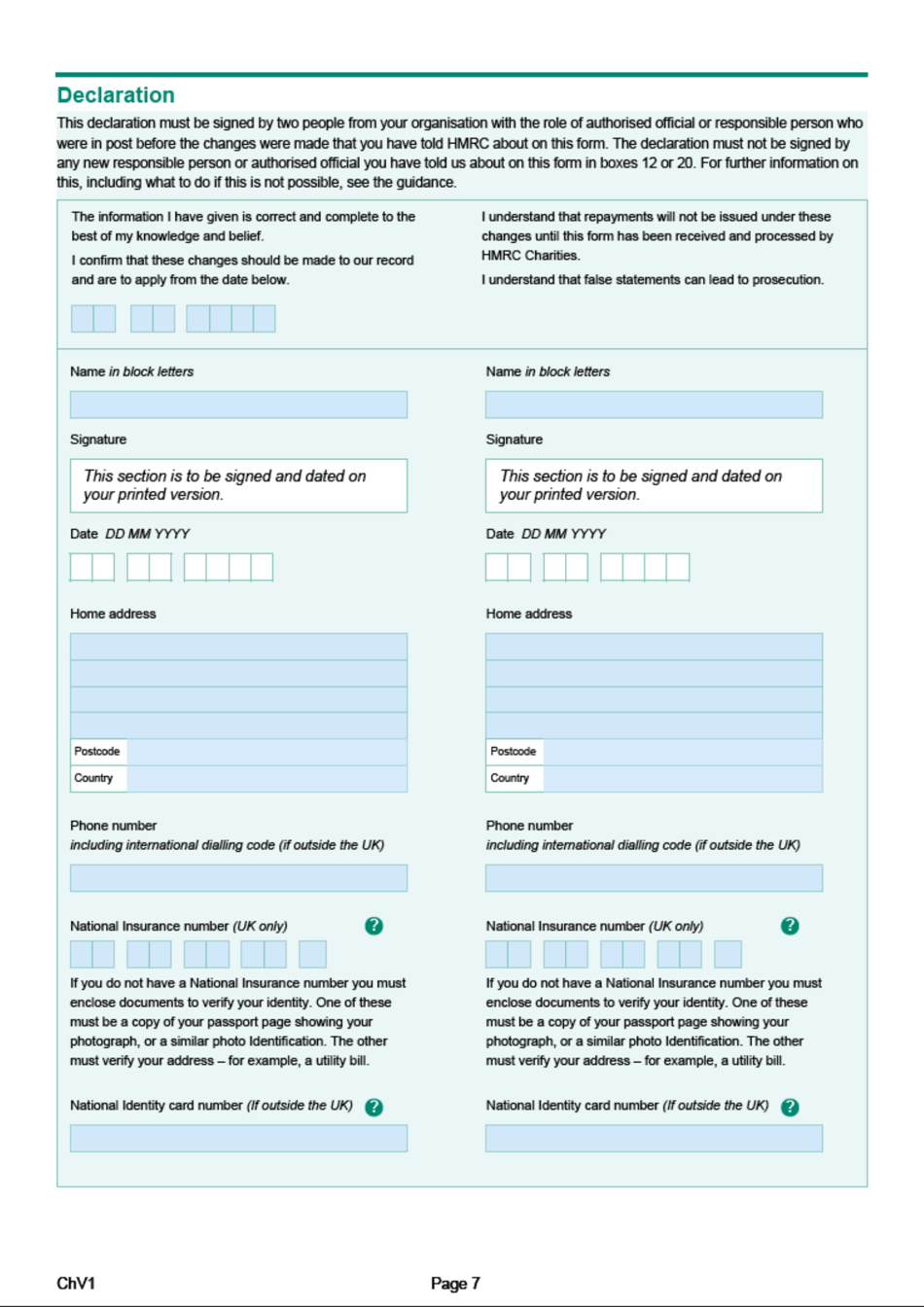

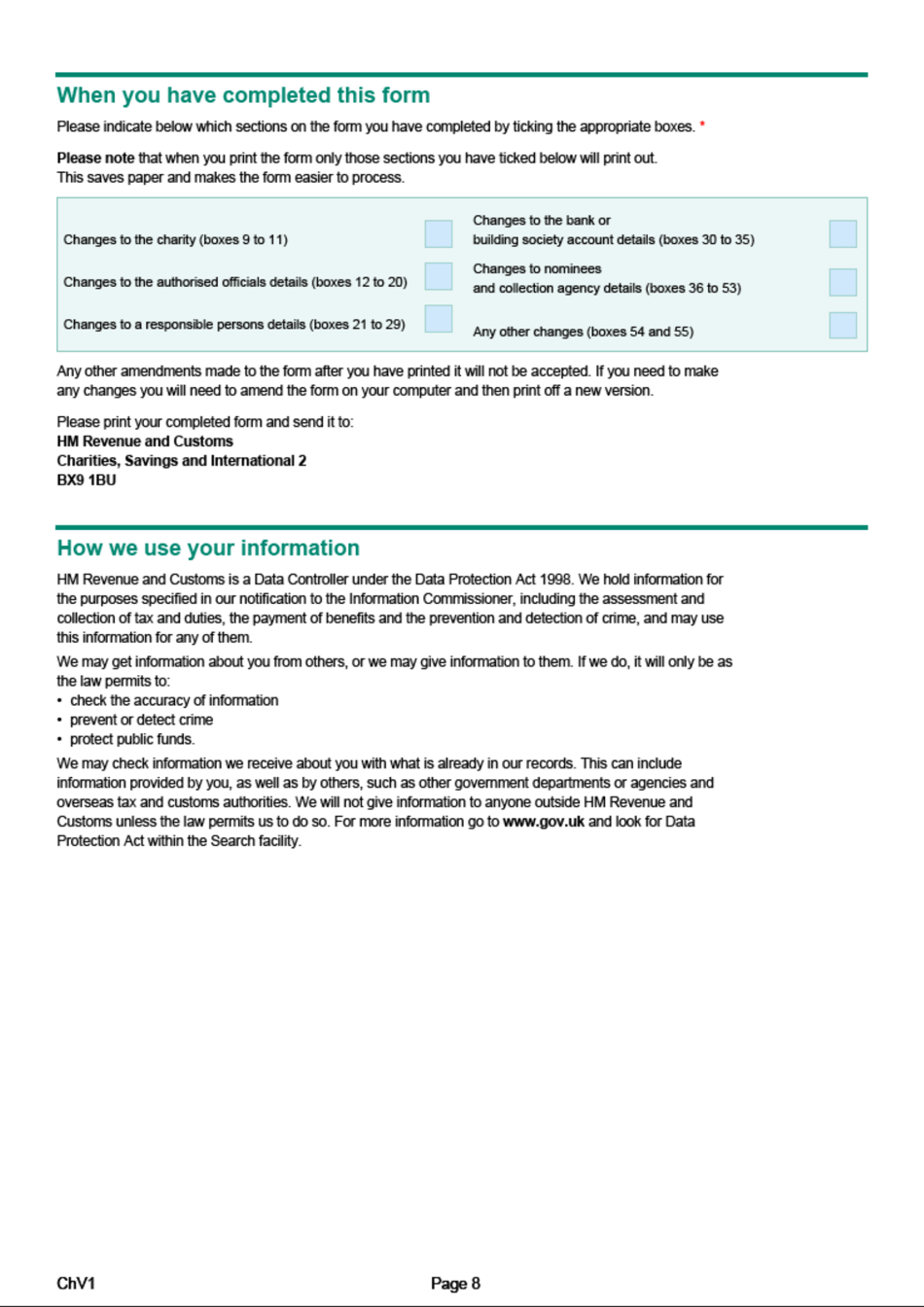

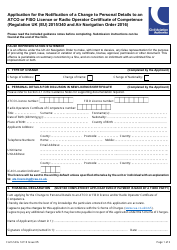

Form ChV1 Hmrc Charities Change of Details Form - United Kingdom

Form ChV1 is used by charities in the United Kingdom to notify HMRC (Her Majesty's Revenue and Customs) about any changes to their details, such as a change in address, contact information, or trustees.

The Form ChV1 HMRC Charities Change of Details Form in the United Kingdom is filed by registered charities to notify HMRC (Her Majesty's Revenue and Customs) of any changes to their details.

FAQ

Q: What is the HMRC Charities Change of Details Form?

A: The HMRC Charities Change of Details Form is a form used in the United Kingdom to update the details of a charity with the HM Revenue and Customs (HMRC).

Q: Why would a charity need to update their details with HMRC?

A: Charities may need to update their details with HMRC to ensure that they are complying with the law and receiving any relevant tax benefits or exemptions.

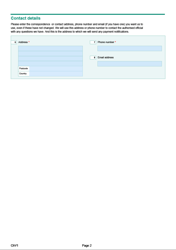

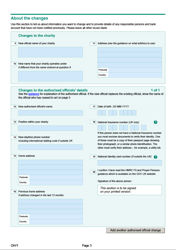

Q: What information needs to be updated on the form?

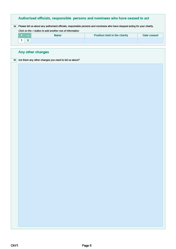

A: The form typically requires the charity to update information such as their contact details, trustees, and any changes to their charitable activities or reporting requirements.

Q: Are there any fees associated with updating charity details with HMRC?

A: No, there are no fees associated with updating charity details with HMRC. The form is free to submit.

Q: Is it mandatory for charities to update their details with HMRC?

A: Yes, it is mandatory for charities to keep HMRC updated with any changes to their details within a certain timeframe to ensure compliance with regulations.

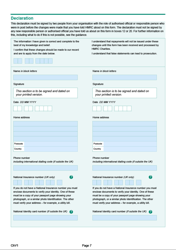

Q: What happens after the form is submitted?

A: After the HMRC Charities Change of Details Form is submitted, HMRC will update their records accordingly and may contact the charity for further information or clarification if needed.

Q: How long does it take for the changes to be processed?

A: The processing time for changes to be updated by HMRC may vary, but it is advisable for charities to allow for an appropriate amount of time for the changes to take effect.

Q: What should I do if I made a mistake on the form?

A: If a mistake was made on the HMRC Charities Change of Details Form, it is recommended to contact HMRC directly to rectify the error as soon as possible.