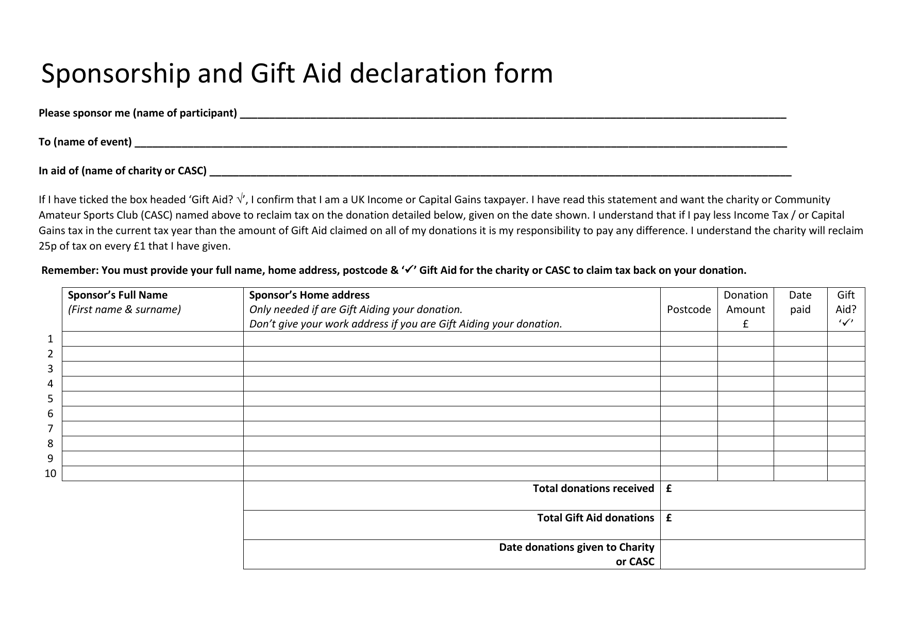

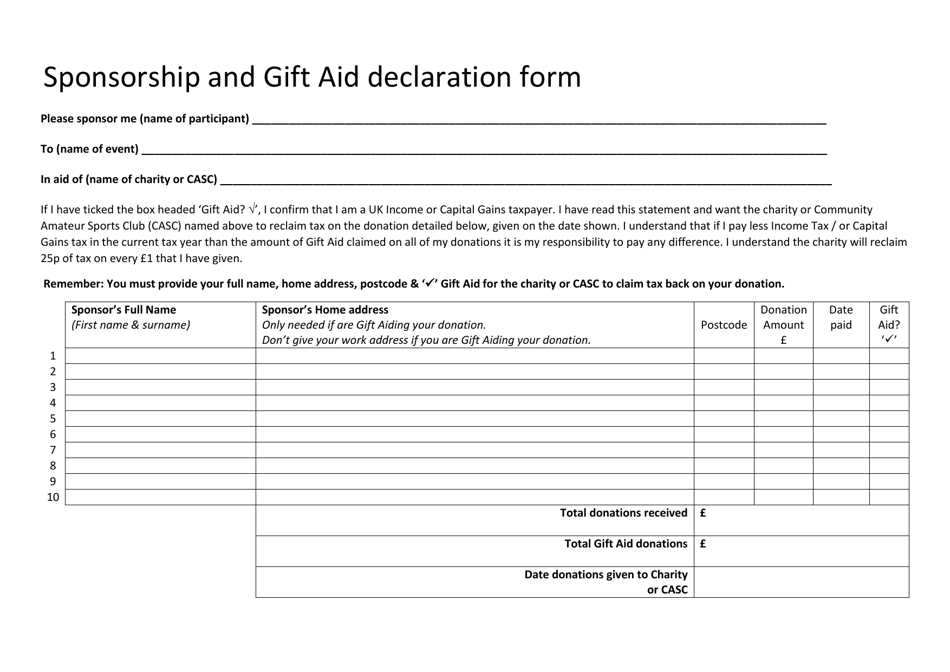

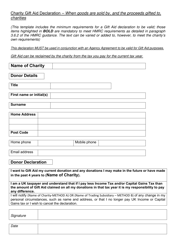

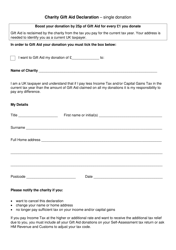

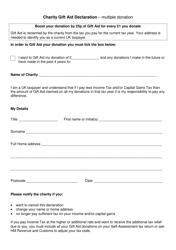

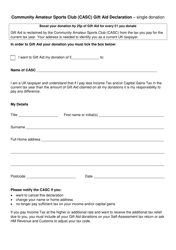

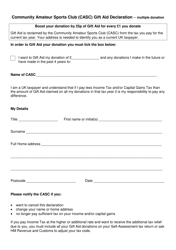

Sponsorship and Gift Aid Declaration Form - United Kingdom

The Sponsorship and Gift Aid Declaration Form in the United Kingdom is used to declare sponsorship and request Gift Aid, which allows charities to claim back tax on donations made by individuals.

In the United Kingdom, the individual or organization making the sponsorship or gift aid must file the Sponsorship and Gift Aid Declaration form.

FAQ

Q: What is a sponsorship and Gift Aid declaration form?

A: A sponsorship and Gift Aid declaration form is a document used in the United Kingdom to allow individuals to declare their sponsorship and give consent for Gift Aid on their donations.

Q: What is Gift Aid?

A: Gift Aid is a scheme in the United Kingdom that allows registered charities to claim back tax on donations made by UK taxpayers, increasing the value of the donation.

Q: Who can use a sponsorship and Gift Aid declaration form?

A: Individuals who are making a sponsorship or donation to a registered charity in the United Kingdom can use a sponsorship and Gift Aid declaration form.

Q: What information is typically required on a sponsorship and Gift Aid declaration form?

A: A sponsorship and Gift Aid declaration form usually requires the donor's personal details, the details of the charity or organization being sponsored, and confirmation of the donation amount.

Q: Why is a sponsorship and Gift Aid declaration form important?

A: A sponsorship and Gift Aid declaration form is important because it allows the charity to claim Gift Aid on the donation, increasing its value, and also provides a record of the donor's consent for tax purposes.