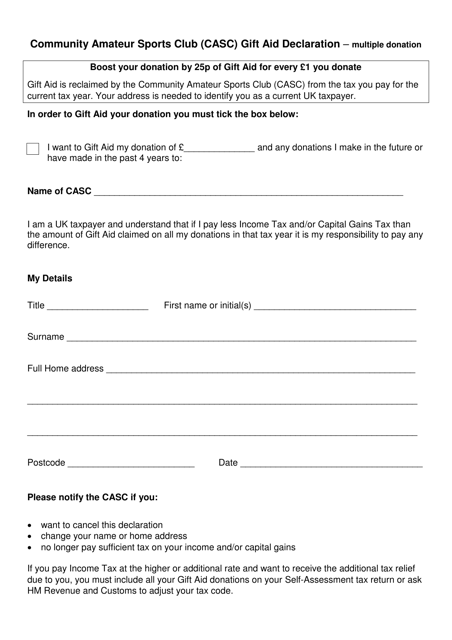

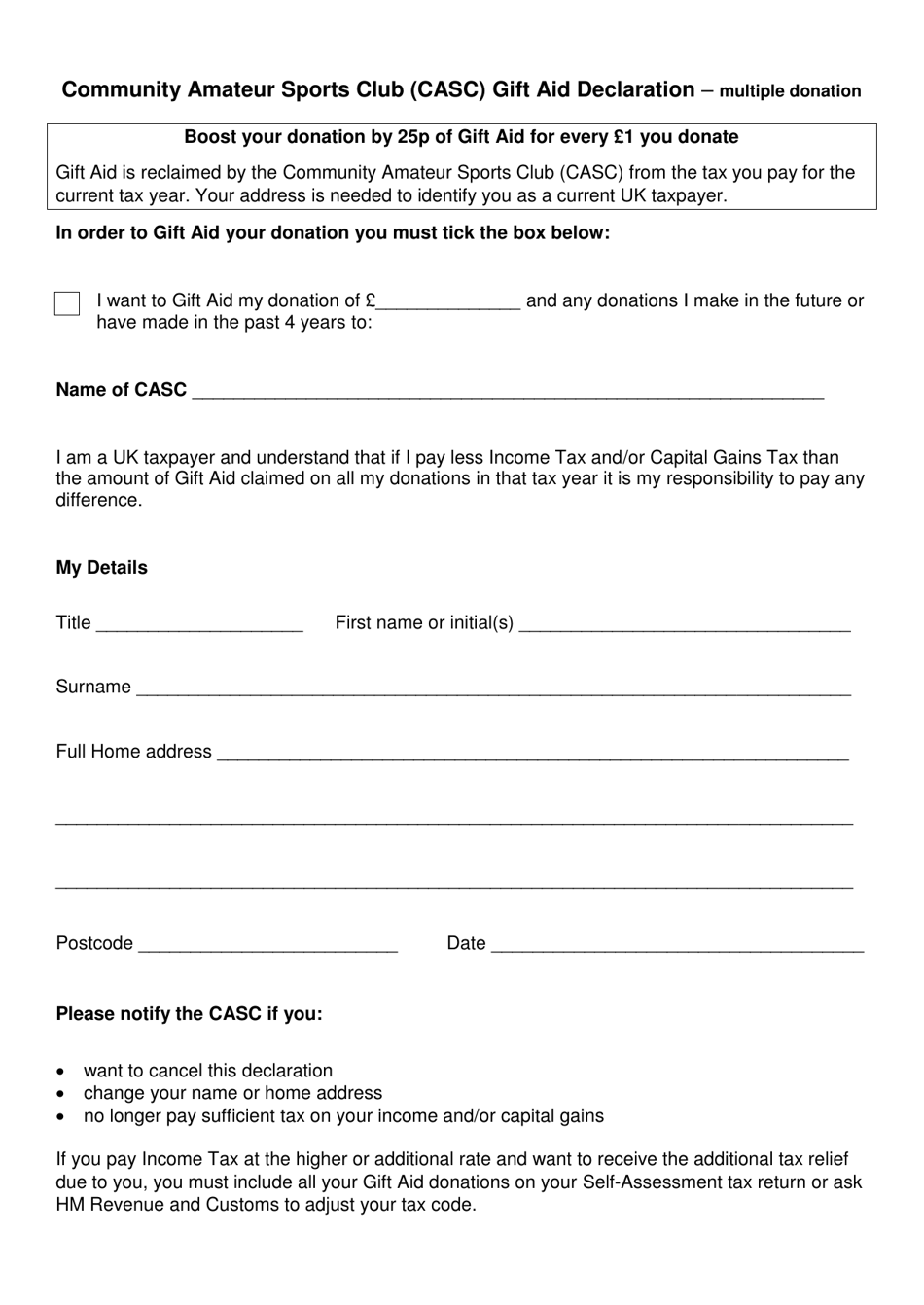

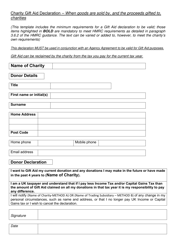

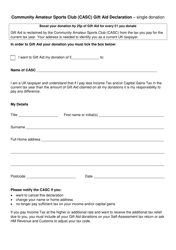

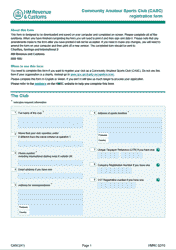

Community Amateur Sports Club (CASC) Gift Aid Declaration - Multiple Donation - United Kingdom

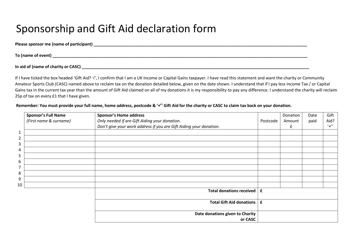

The Community Amateur Sports Club (CASC) Gift Aid Declaration - Multiple Donation is used in the United Kingdom for individuals to declare their intention to make multiple donations to a community amateur sports club. This declaration allows the club to claim Gift Aid on these donations, which provides them with additional funding.

The Community Amateur Sports Club (CASC) Gift Aid Declaration - Multiple Donation in the United Kingdom is typically filed by the donor themselves.

FAQ

Q: What is a Community Amateur Sports Club (CASC)?

A: A Community Amateur Sports Club (CASC) is a type of sports club that meets specific criteria and receives special tax benefits in the United Kingdom.

Q: What is a Gift Aid Declaration?

A: A Gift Aid Declaration is a form that allows individuals in the United Kingdom to declare their intention to donate to a charitable organization and to indicate that they want the organization to claim Gift Aid on their donation.

Q: What is Gift Aid?

A: Gift Aid is a UK tax incentive that allows charities and Community Amateur Sports Clubs (CASCs) to claim an additional 25% from the government on eligible donations made by taxpayers.

Q: What is a Multiple Donation Gift Aid Declaration?

A: A Multiple Donation Gift Aid Declaration is a specific type of Gift Aid Declaration that allows individuals to declare their intention to make multiple donations to a charity or CASC over time, and for the organization to claim Gift Aid on each of those donations.

Q: Who can make a Multiple Donation Gift Aid Declaration?

A: Any individual who is a taxpayer in the United Kingdom and plans to make multiple donations to a charity or CASC can make a Multiple Donation Gift Aid Declaration.

Q: What are the requirements for making a Multiple Donation Gift Aid Declaration?

A: To make a Multiple Donation Gift Aid Declaration, the individual must be a taxpayer in the UK, have paid enough tax to cover the amount of Gift Aid that will be claimed by the charity/CASC, and have a suitable record-keeping system to keep track of their donations.

Q: How does the charity or CASC claim Gift Aid on multiple donations?

A: The charity or CASC will keep a record of each donation made by the individual and claim Gift Aid on those donations by submitting their details to HM Revenue and Customs (HMRC).