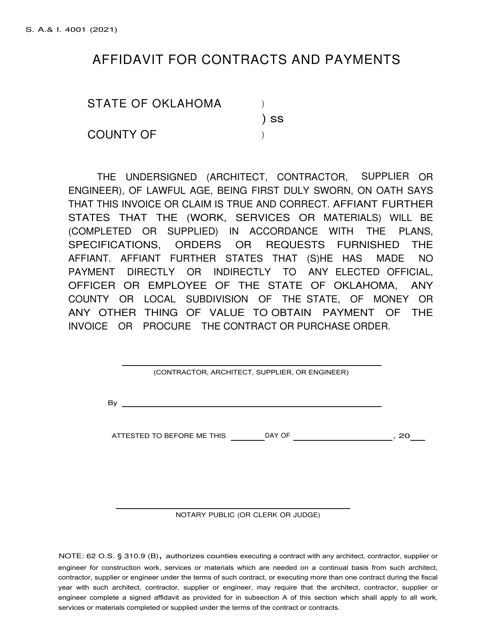

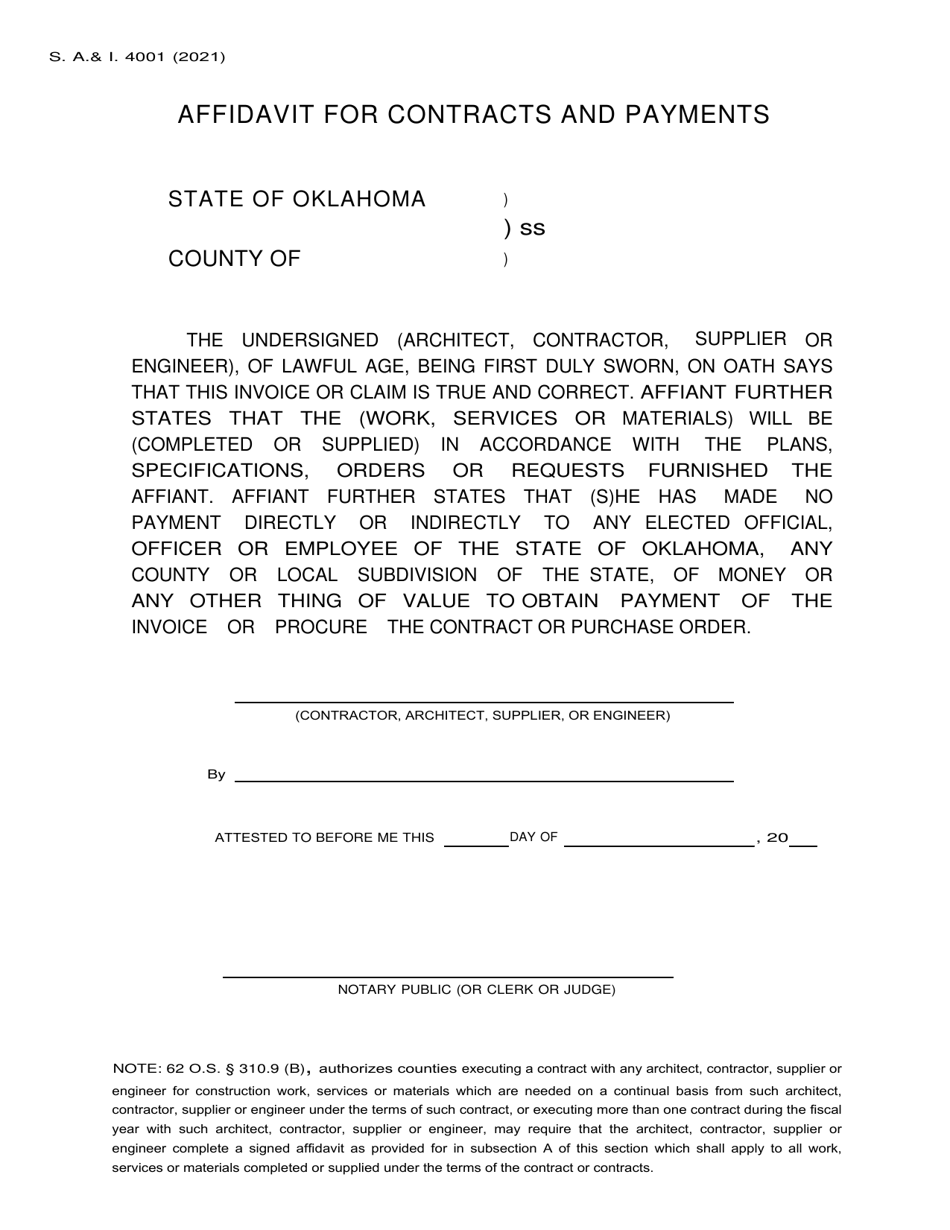

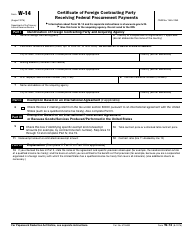

Form S.A.& I.4001 Affidavit for Contracts and Payments - Oklahoma

What Is Form S.A.& I.4001?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.4001?

A: Form S.A.& I.4001 is an Affidavit for Contracts and Payments in Oklahoma.

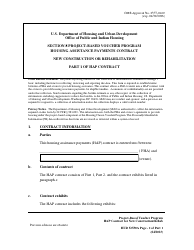

Q: Who should use Form S.A.& I.4001?

A: Individuals or businesses who need to provide an affidavit for contracts and payments in Oklahoma.

Q: What is the purpose of Form S.A.& I.4001?

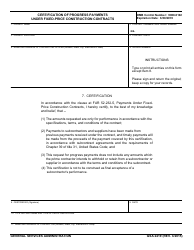

A: The purpose of Form S.A.& I.4001 is to verify the accuracy and legitimacy of contracts and payments in Oklahoma.

Q: Is Form S.A.& I.4001 required for all contracts and payments in Oklahoma?

A: No, Form S.A.& I.4001 is only required for certain contracts and payments as specified by the Oklahoma Tax Commission.

Q: Are there any fees associated with filing Form S.A.& I.4001?

A: There may be filing fees associated with Form S.A.& I.4001. Please refer to the instructions on the form or contact the Oklahoma Tax Commission for more information.

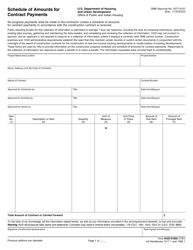

Q: What documents should be attached to Form S.A.& I.4001?

A: You may be required to attach supporting documents such as contracts, invoices, or receipts to Form S.A.& I.4001. Refer to the instructions on the form for specific requirements.

Q: How long does it take to process Form S.A.& I.4001?

A: Processing times for Form S.A.& I.4001 may vary. Contact the Oklahoma Tax Commission for information on processing times.

Q: What should I do if I have questions or need assistance with Form S.A.& I.4001?

A: If you have questions or need assistance with Form S.A.& I.4001, you can contact the Oklahoma Tax Commission for guidance.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S.A.& I.4001 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.