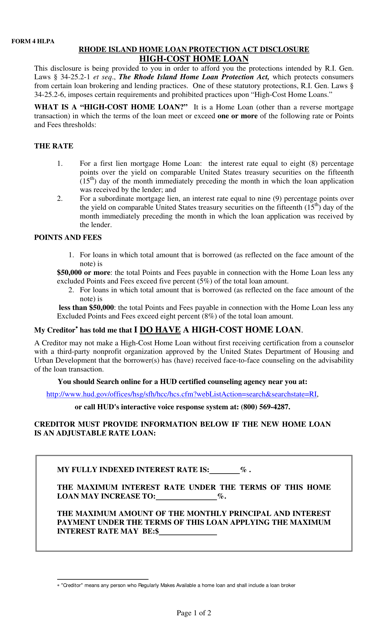

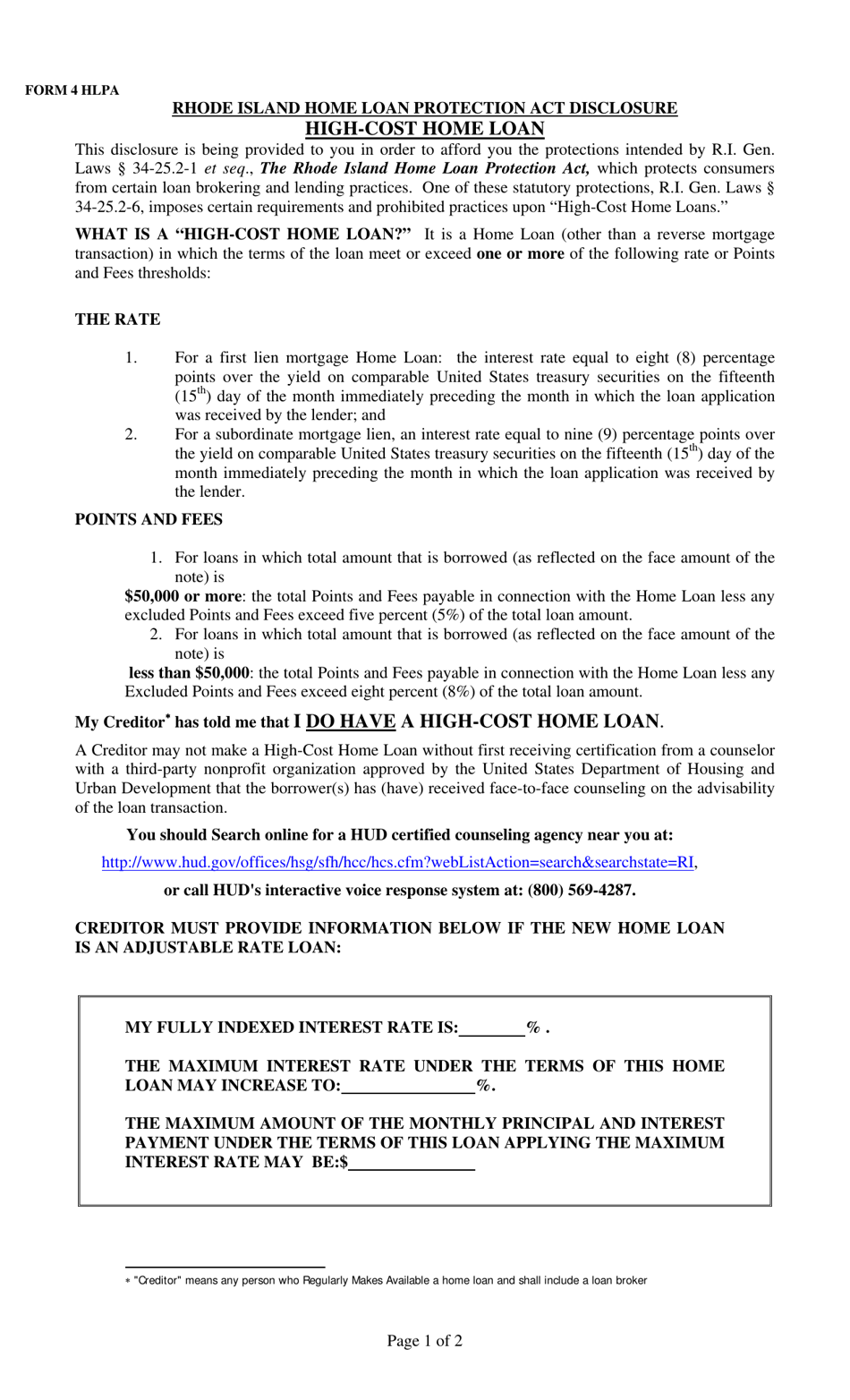

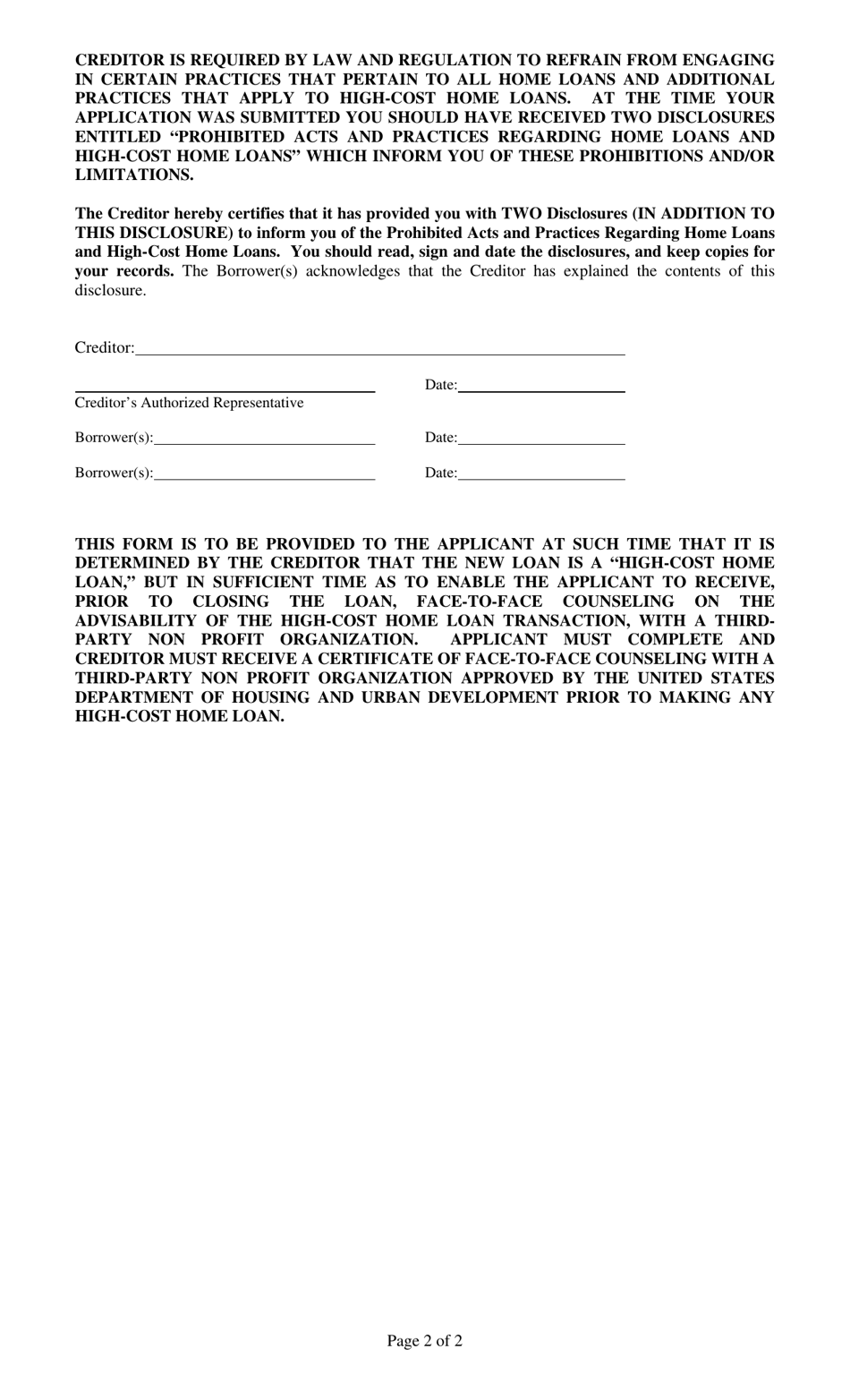

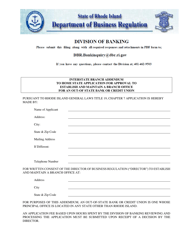

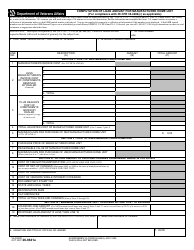

Form 4 Rhode Island Home Loan Protection Act Disclosure High-Cost Home Loan - Rhode Island

What Is Form 4?

This is a legal form that was released by the Rhode Island Department of Business Regulation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Rhode Island Home Loan Protection Act?

A: The Rhode Island Home Loan Protection Act is a law that aims to protect borrowers in Rhode Island from high-cost home loans.

Q: What is a high-cost home loan?

A: A high-cost home loan is a mortgage loan with high interest rates and fees, often targeting borrowers with poor credit or limited financial resources.

Q: What are the key provisions of the Rhode Island Home Loan Protection Act?

A: The key provisions of the Rhode Island Home Loan Protection Act include restrictions on interest rates, fees, points, and prepayment penalties for high-cost home loans.

Q: Who does the Rhode Island Home Loan Protection Act apply to?

A: The Rhode Island Home Loan Protection Act applies to lenders and borrowers of high-cost home loans in Rhode Island.

Q: What are the consequences for lenders who violate the Rhode Island Home Loan Protection Act?

A: Lenders who violate the Rhode Island Home Loan Protection Act may be subject to penalties and fines, as well as potential cancellation or modification of the loan.

Q: Is the Rhode Island Home Loan Protection Act applicable to all types of mortgages?

A: No, the Rhode Island Home Loan Protection Act applies specifically to high-cost home loans in Rhode Island and is not applicable to other types of mortgages or loans.

Form Details:

- The latest edition provided by the Rhode Island Department of Business Regulation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Business Regulation.