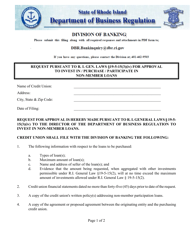

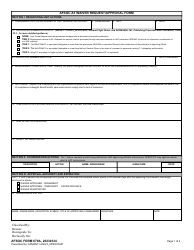

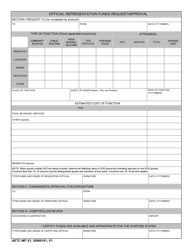

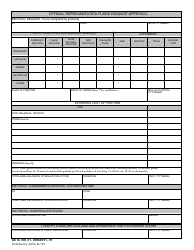

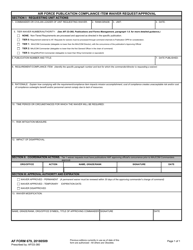

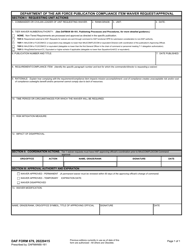

Request for Approval of a Plan of Liquidation Pursuant to a Voluntary Liquidation of a Financial Institution or Credit Union - Rhode Island

Request for Approval of a Plan of Liquidation Pursuant to a Voluntary Liquidation of a Financial Institution or Credit Union is a legal document that was released by the Rhode Island Department of Business Regulation - a government authority operating within Rhode Island.

FAQ

Q: What is a Plan of Liquidation?

A: A Plan of Liquidation is a document that outlines the process of winding up the affairs of a financial institution or credit union.

Q: What is a Voluntary Liquidation?

A: Voluntary Liquidation refers to the decision of a financial institution or credit union to close and distribute its assets to its shareholders or members.

Q: Who approves the Plan of Liquidation?

A: The Plan of Liquidation must be approved by the regulatory authorities overseeing the financial institution or credit union.

Q: What is the purpose of a Plan of Liquidation?

A: The purpose of a Plan of Liquidation is to provide a framework for the orderly distribution of assets and the repayment of creditors.

Q: What happens to the assets of a liquidated financial institution or credit union?

A: The assets of a liquidated financial institution or credit union are distributed to its shareholders or members according to the Plan of Liquidation.

Q: Is there a specific process for voluntary liquidation in Rhode Island?

A: Yes, Rhode Island has specific laws and regulations governing the voluntary liquidation of financial institutions and credit unions.

Q: Are there any legal requirements for a Plan of Liquidation?

A: Yes, a Plan of Liquidation must comply with all applicable federal and state laws and regulations.

Q: Can creditors make claims against a liquidated financial institution or credit union?

A: Yes, creditors can make claims against a liquidated financial institution or credit union to seek repayment of their debts.

Form Details:

- Released on January 1, 2012;

- The latest edition currently provided by the Rhode Island Department of Business Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Business Regulation.