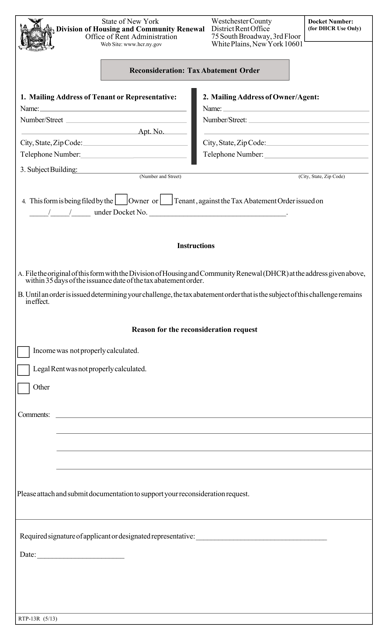

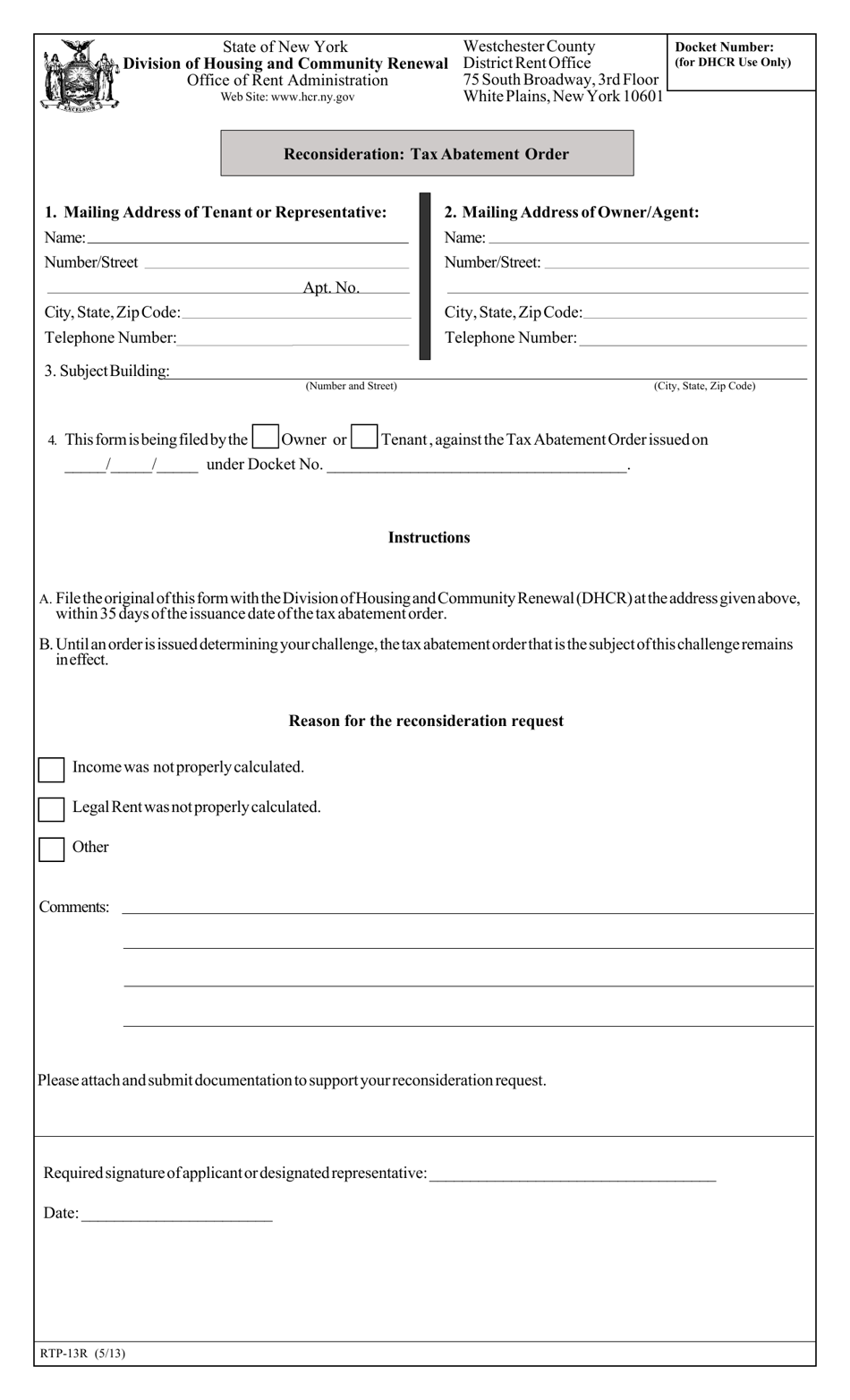

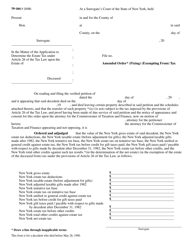

Form RTP-13R Reconsideration: Tax Abatement Order - New York

What Is Form RTP-13R?

This is a legal form that was released by the New York State Homes and Community Renewal - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RTP-13R?

A: Form RTP-13R is a form used for filing a reconsideration request for a tax abatement order in New York.

Q: What is a reconsideration request?

A: A reconsideration request is a formal request to review and reassess a decision made by a tax authority.

Q: What is a tax abatement order?

A: A tax abatement order is an official document that grants a reduction or exemption from taxes.

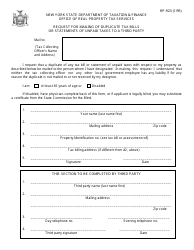

Q: Who can file Form RTP-13R?

A: Any individual or business who wishes to request a reconsideration of a tax abatement order in New York can file Form RTP-13R.

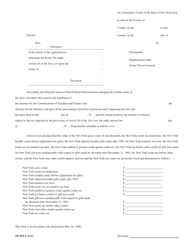

Q: What information is required on Form RTP-13R?

A: Form RTP-13R requires information such as the taxpayer's name, address, tax abatement order number, reason for the reconsideration request, and supporting documentation.

Q: Is there a deadline for filing Form RTP-13R?

A: Yes, there is usually a deadline for filing Form RTP-13R. It is important to check with the tax authority in New York for the specific deadline.

Q: What happens after filing Form RTP-13R?

A: After filing Form RTP-13R, the tax authority will review the reconsideration request and make a decision based on the information provided.

Q: Can I appeal the decision made on the reconsideration request?

A: Yes, if you are not satisfied with the decision made on the reconsideration request, you may have the option to appeal the decision through the appropriate appeals process.

Q: Are there any fees associated with filing Form RTP-13R?

A: There may be filing fees associated with filing Form RTP-13R. It is advisable to check with the tax authority in New York for the current fee schedule.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the New York State Homes and Community Renewal;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RTP-13R by clicking the link below or browse more documents and templates provided by the New York State Homes and Community Renewal.