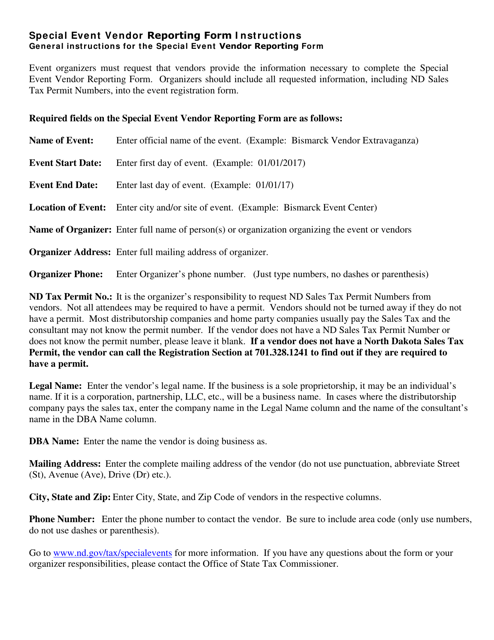

Instructions for Form SFN21911 Special Event Vendor Reporting Form - North Dakota

This document contains official instructions for Form SFN21911 , Special Event Vendor Reporting Form - a form released and collected by the North Dakota Office of State Tax Commissioner. An up-to-date fillable Form SFN21911 is available for download through this link.

FAQ

Q: What is Form SFN21911?

A: Form SFN21911 is the Special Event Vendor Reporting Form in North Dakota.

Q: Who needs to file Form SFN21911?

A: Vendors participating in special events in North Dakota need to file Form SFN21911.

Q: What is considered a special event in North Dakota?

A: Any event or occasion where vendors sell or provide goods, services, or food is considered a special event in North Dakota.

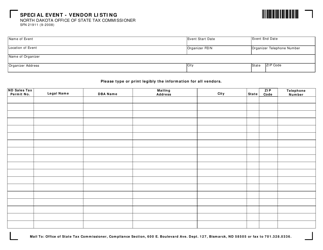

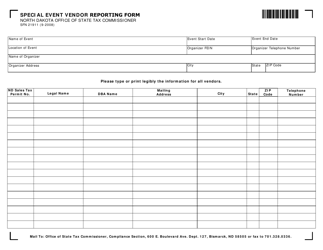

Q: What information is required on Form SFN21911?

A: Form SFN21911 requires vendors to provide their contact information, tax ID number, event details, and gross sales information.

Q: When is Form SFN21911 due?

A: Form SFN21911 is typically due 30 days after the end of the special event.

Q: Are there any penalties for not filing Form SFN21911?

A: Failing to file Form SFN21911 or providing false information can result in penalties and fines.

Q: Is Form SFN21911 specific to North Dakota?

A: Yes, Form SFN21911 is specific to special events in North Dakota and is not applicable to other states.

Q: Can I get an extension to file Form SFN21911?

A: Requests for extensions to file Form SFN21911 may be granted, but they must be submitted prior to the original due date.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the North Dakota Office of State Tax Commissioner.