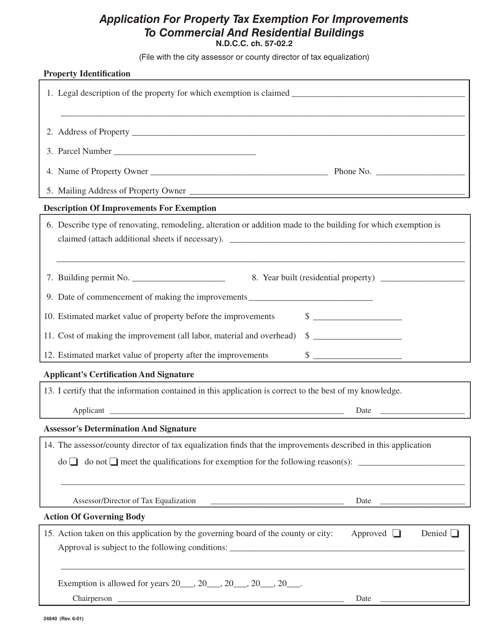

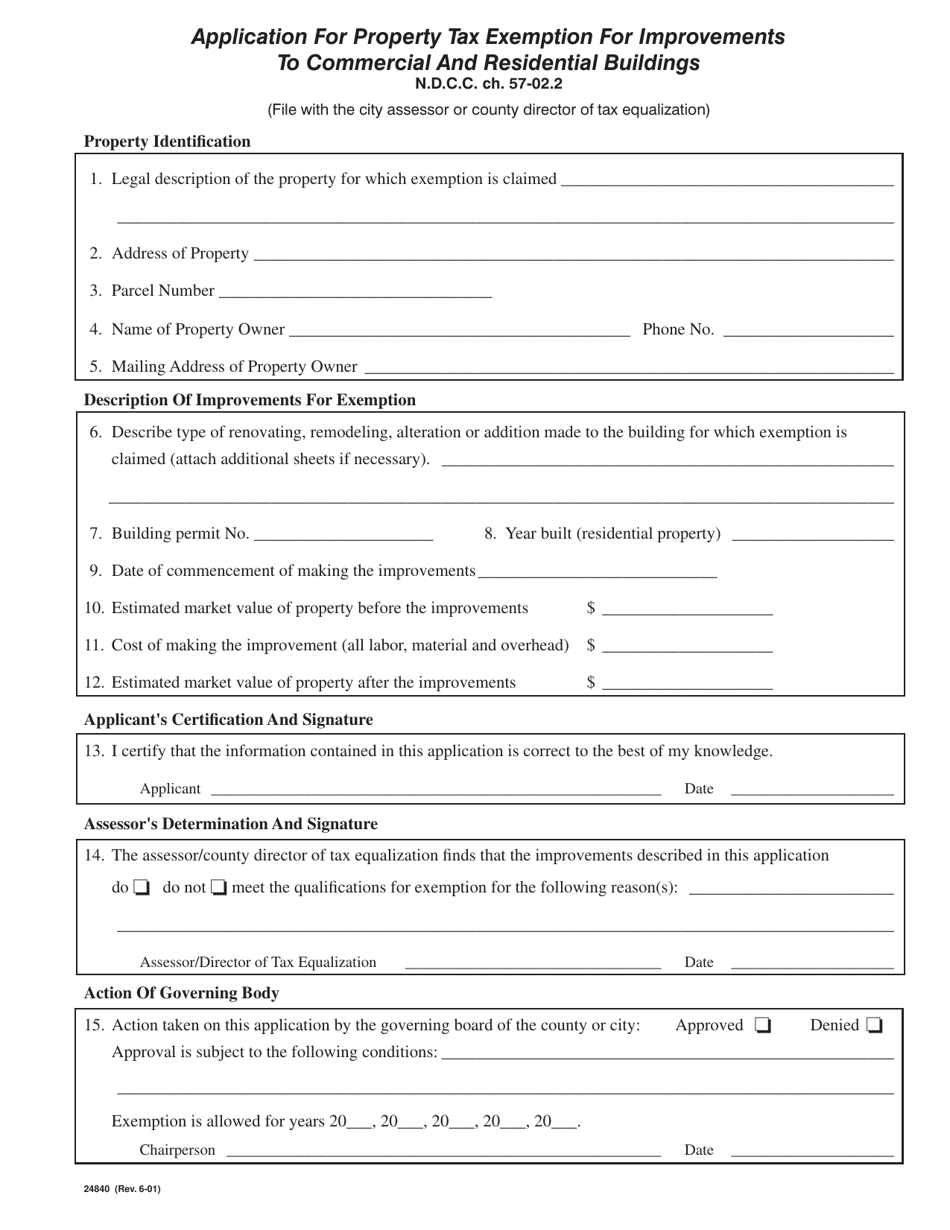

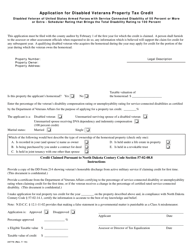

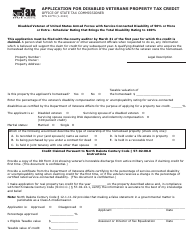

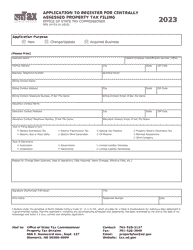

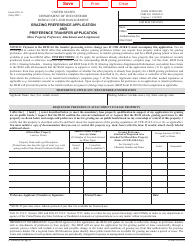

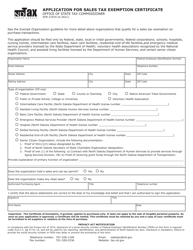

Form 24840 Application for Property Tax Exemption for Improvements to Commercial and Residential Buildings - North Dakota

What Is Form 24840?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 24840?

A: Form 24840 is an application for property tax exemption for improvements to commercial and residential buildings in North Dakota.

Q: Who can use Form 24840?

A: Property owners in North Dakota who have made improvements to their commercial or residential buildings may use Form 24840.

Q: What is the purpose of Form 24840?

A: The purpose of Form 24840 is to apply for a property tax exemption for improvements made to commercial and residential buildings in North Dakota.

Q: What is a property tax exemption?

A: A property tax exemption is a reduction or elimination of property taxes, usually granted for specific reasons such as making improvements to a property.

Q: What types of improvements qualify for the tax exemption?

A: Various types of improvements may qualify for the tax exemption, such as renovations, expansions, and energy efficiency upgrades.

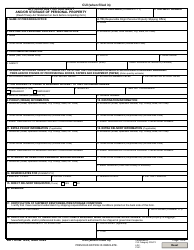

Q: What information is required on Form 24840?

A: Some of the information required on Form 24840 includes the property owner's name, property address, description of improvements, and estimated costs.

Q: When is the deadline to submit Form 24840?

A: The deadline to submit Form 24840 for property tax exemption on improvements is typically March 1st of the assessment year.

Q: Are there any fees associated with the application?

A: There are no fees associated with submitting Form 24840 for property tax exemption on improvements.

Q: Who should I contact for more information?

A: For more information and specific guidance, it is recommended to contact the local county assessor's office or the North Dakota State Tax Commissioner's office.

Form Details:

- Released on June 1, 2001;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 24840 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.