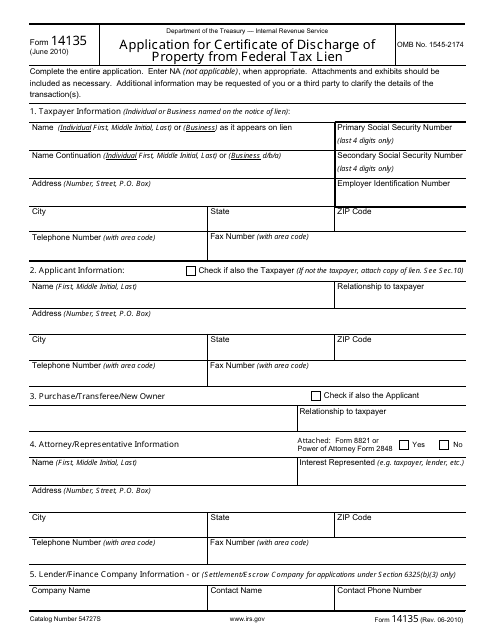

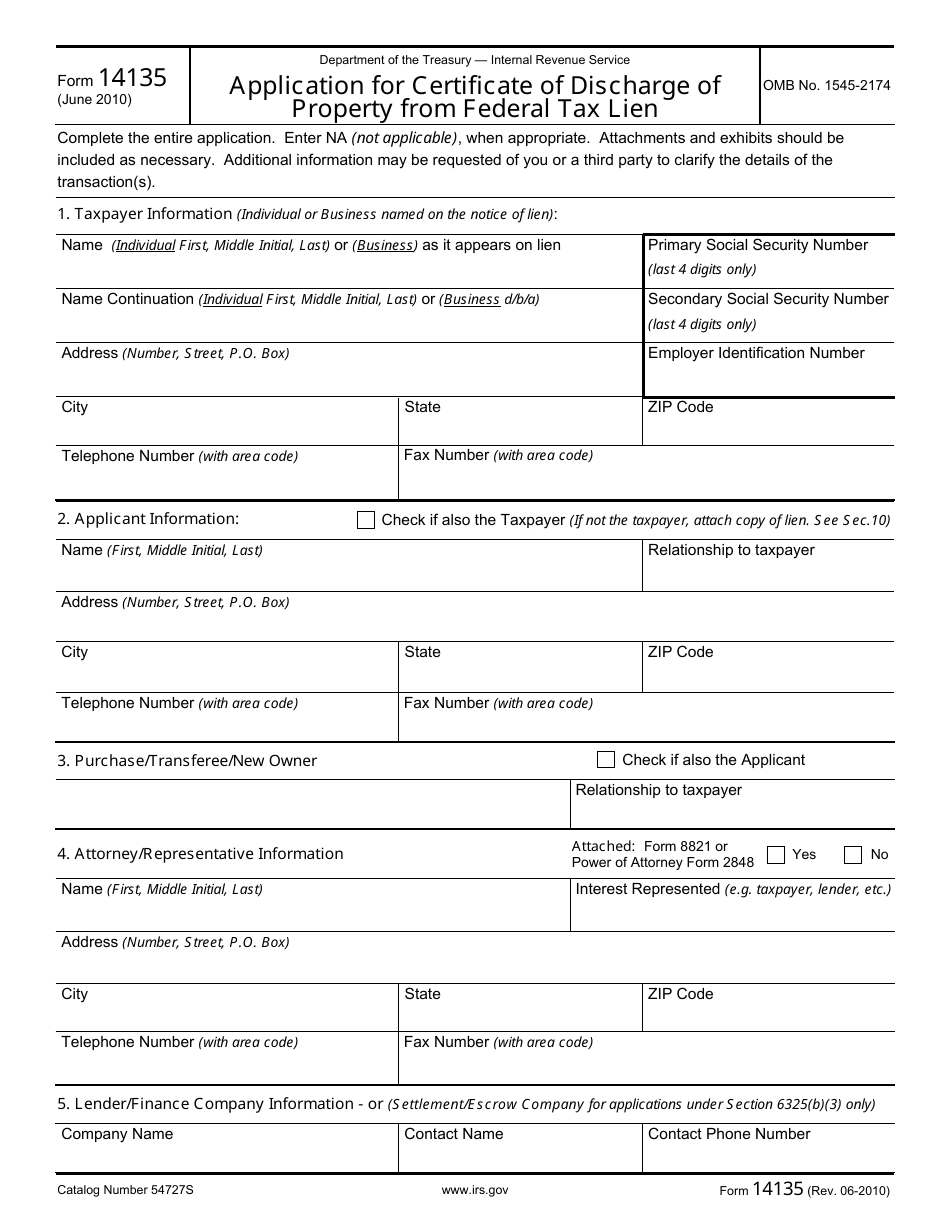

IRS Form 14135 Application for Certificate of Discharge of Property From Federal Tax Lien

What Is IRS Form 14135?

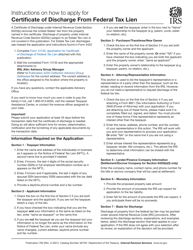

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2010. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 14135?

A: IRS Form 14135 is the Application for Certificate of Discharge of Property From Federal Tax Lien.

Q: What is the purpose of Form 14135?

A: The purpose of Form 14135 is to request the release of a federal tax lien on a specific property.

Q: Who needs to file Form 14135?

A: Anyone who wants to have a federal tax lien on a property discharged needs to file Form 14135.

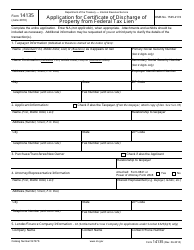

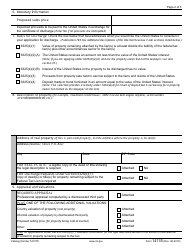

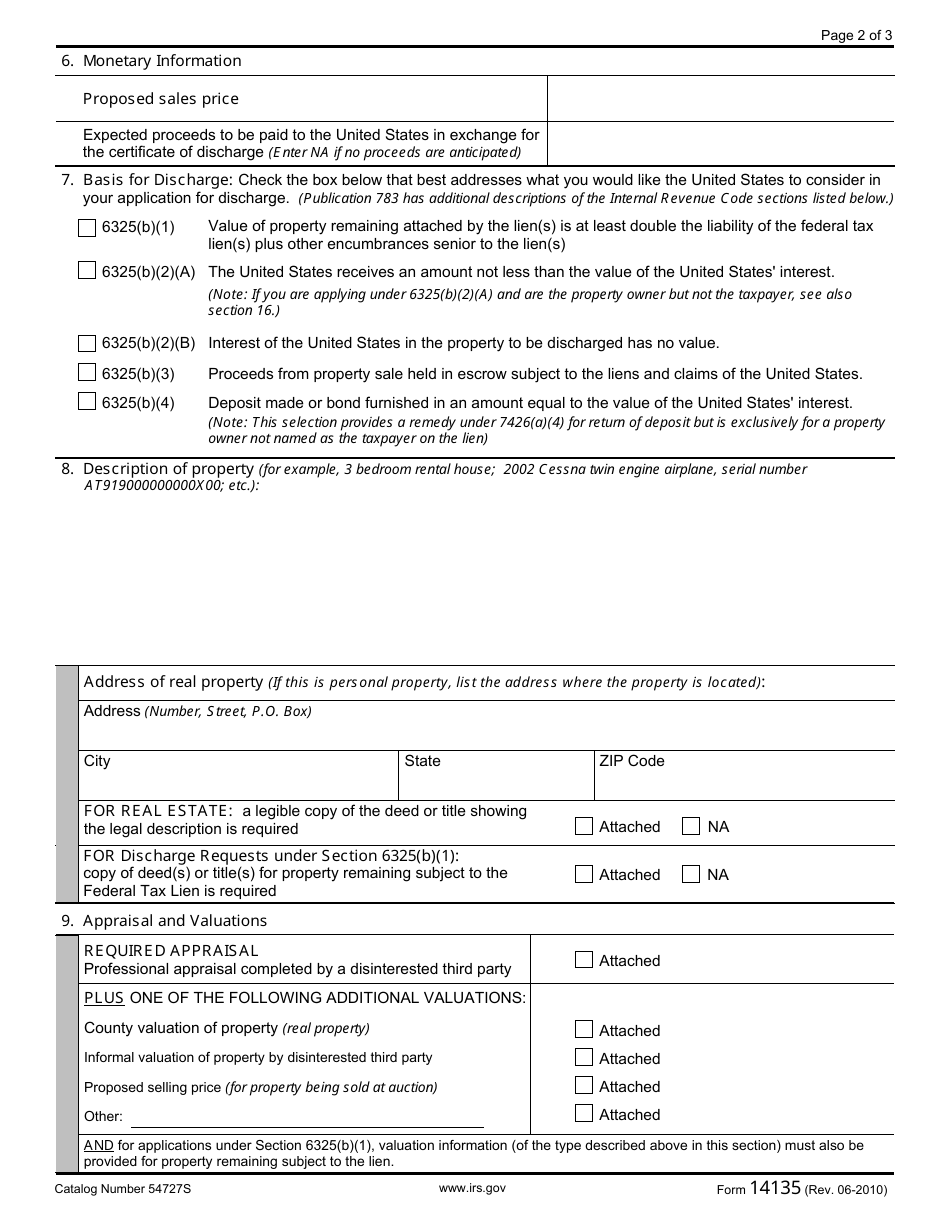

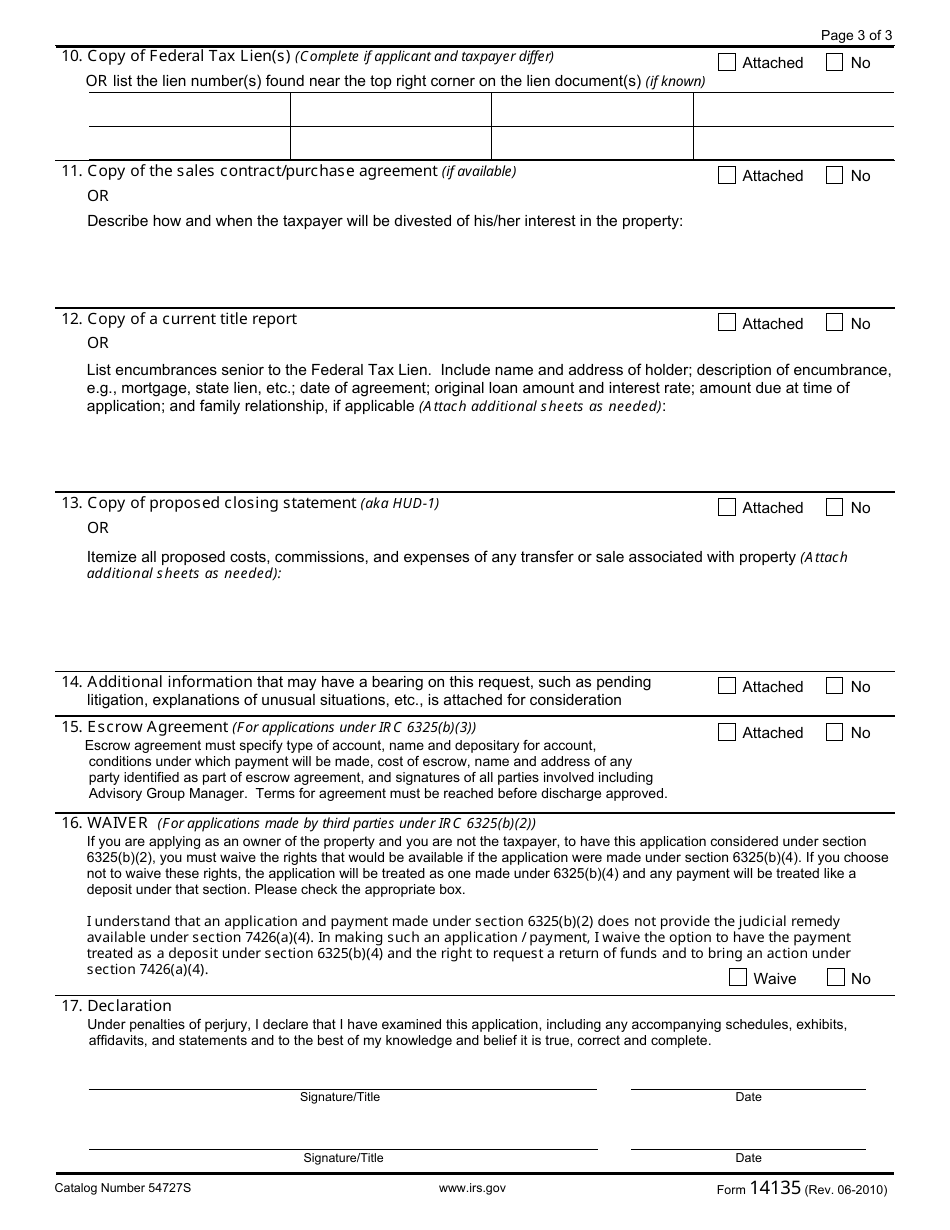

Q: What information is required on Form 14135?

A: Form 14135 requires information about the taxpayer, the property, and the tax lien in question.

Q: Are there any fees associated with filing Form 14135?

A: Yes, there is a fee for filing Form 14135. The amount may vary depending on the circumstances.

Q: What happens after I file Form 14135?

A: After you file Form 14135, the IRS will review your application and make a decision on whether to discharge the tax lien.

Q: How long does it take for the IRS to process Form 14135?

A: The processing time for Form 14135 can vary, but it typically takes several months for the IRS to make a decision.

Q: What happens if my application is approved?

A: If your application is approved, the IRS will issue a Certificate of Discharge of Property From Federal Tax Lien.

Q: What happens if my application is denied?

A: If your application is denied, you will receive a letter from the IRS explaining the reason for the denial.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14135 through the link below or browse more documents in our library of IRS Forms.