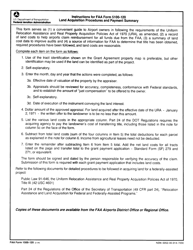

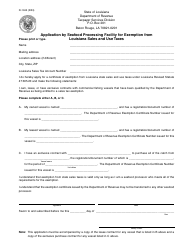

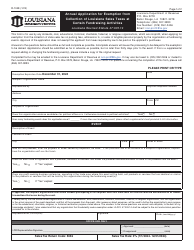

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

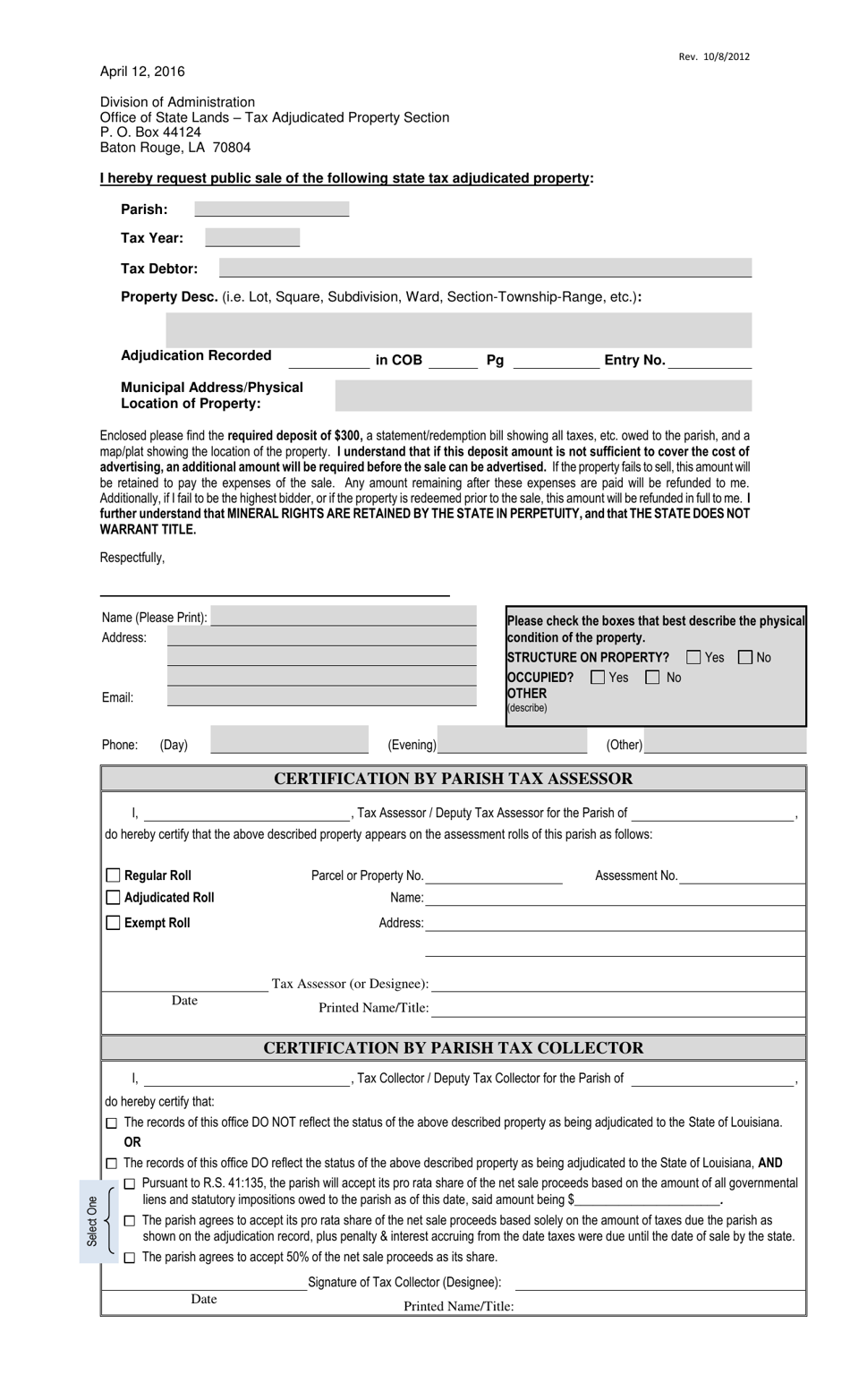

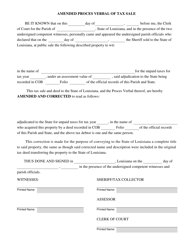

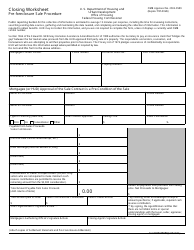

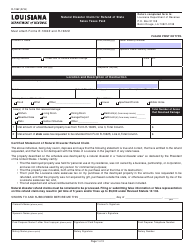

Tax Land Sale Procedures and Request Form - Louisiana

Tax Land Sale Procedures and Request Form is a legal document that was released by the Louisiana Division of Administration - a government authority operating within Louisiana.

FAQ

Q: What is tax land sale?

A: Tax land sale is a public auction where properties with unpaid taxes are sold to the highest bidder.

Q: Who can participate in tax land sales?

A: Anyone can participate in tax land sales, including individuals and companies.

Q: What happens if the property is not sold at the tax land sale?

A: If the property is not sold at the tax land sale, it may be re-offered at a later sale or become available for purchase through other means.

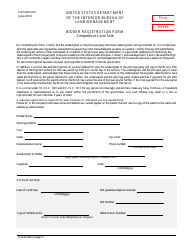

Q: What is the procedure for participating in a tax land sale?

A: To participate in a tax land sale, you need to register, provide a deposit, and be prepared to bid on the properties you are interested in.

Q: What happens after I win a property at a tax land sale?

A: After winning a property at a tax land sale, you will need to pay the remaining balance, complete any necessary paperwork, and comply with any additional requirements set by the tax collector's office.

Q: Can I finance the purchase of a property obtained through a tax land sale?

A: Financing options for properties obtained through tax land sales may vary. It is recommended to consult with your financial institution or a real estate professional for guidance.

Q: What rights do I have as the new owner of a property obtained through a tax land sale?

A: As the new owner of a property obtained through a tax land sale, you have the right to possess, use, and potentially sell or develop the property.

Q: Are there any risks associated with purchasing properties through tax land sales?

A: There are risks involved, such as the possibility of having to deal with existing liens or other legal issues related to the property. It is advisable to thoroughly research and assess the properties before bidding.

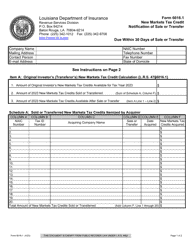

Form Details:

- Released on April 12, 2016;

- The latest edition currently provided by the Louisiana Division of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Louisiana Division of Administration.