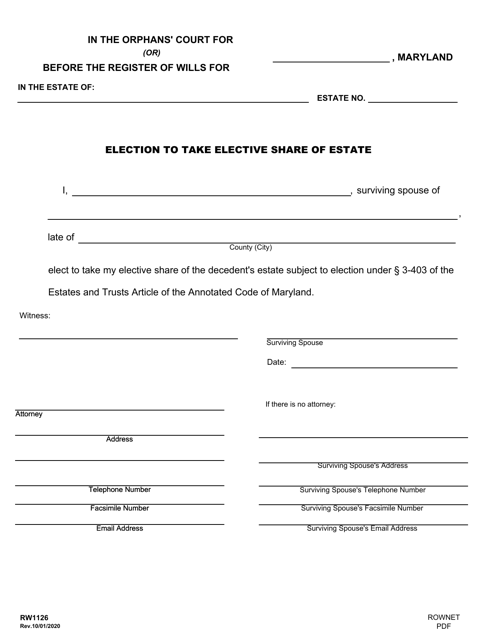

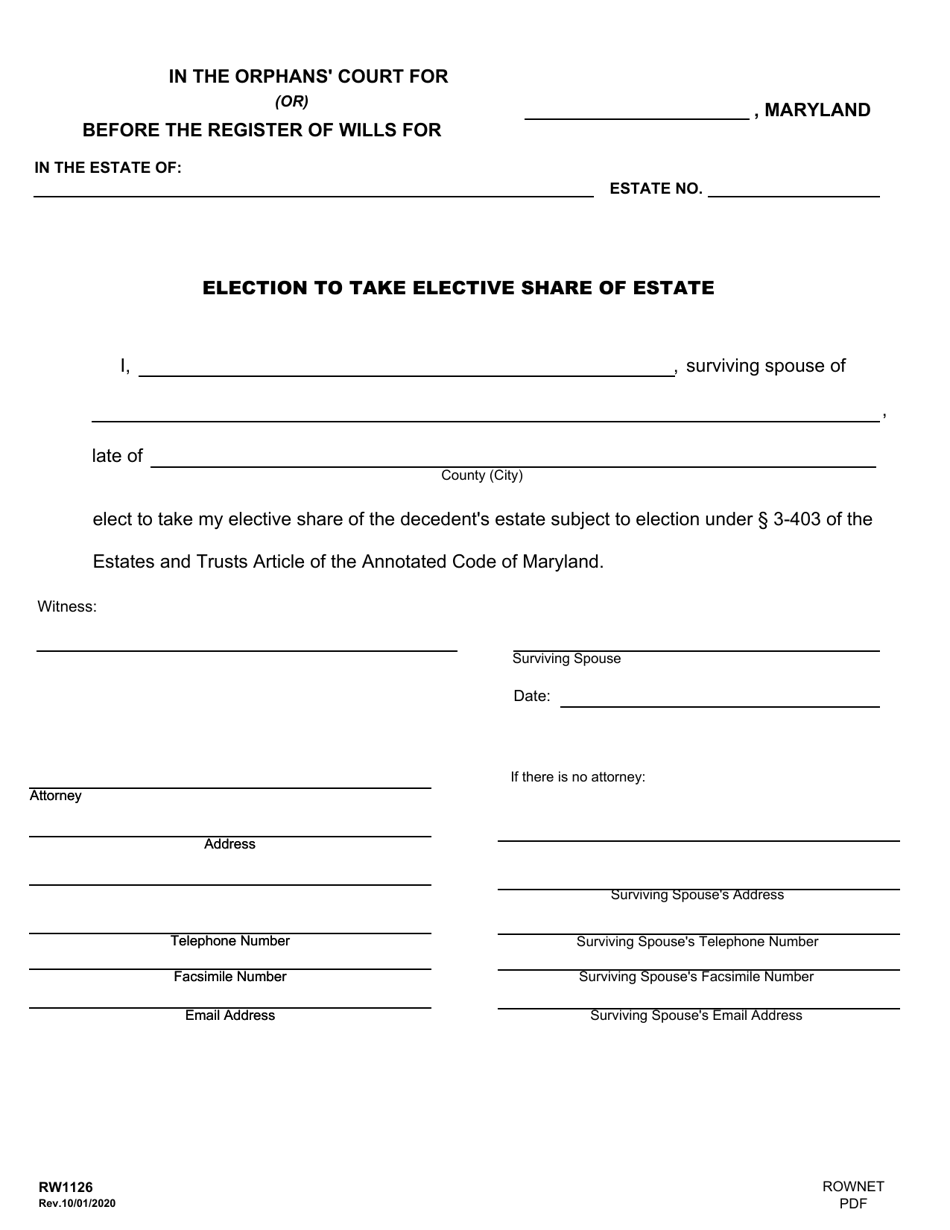

Form RW1126 Election to Take Elective Share of Estate - Maryland

What Is Form RW1126?

This is a legal form that was released by the Maryland Offices of the Registers of Wills - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RW1126?

A: Form RW1126 is the Election to Take Elective Share of Estate specifically for residents of Maryland.

Q: What is the Elective Share of Estate?

A: The Elective Share of Estate is a legal right of a surviving spouse to receive a portion of the deceased spouse's estate, regardless of what the will says.

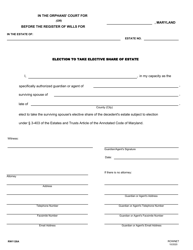

Q: Who can use Form RW1126?

A: Form RW1126 is used by surviving spouses in Maryland who wish to exercise their right to claim an elective share of their deceased spouse's estate.

Q: Why would a surviving spouse use Form RW1126?

A: A surviving spouse may choose to use Form RW1126 if they are dissatisfied with the provisions made for them in the deceased spouse's will and want to claim a larger share of the estate.

Q: Are there any deadlines for filing Form RW1126?

A: Yes, there are strict deadlines for filing Form RW1126. It must be filed within nine months of the date of death, or within six months after the will is probated, whichever is later.

Q: What information is required on Form RW1126?

A: Form RW1126 requires the surviving spouse's personal and contact information, information about the deceased spouse, details about the estate, and a statement indicating the intent to take the elective share.

Q: Is there a fee for filing Form RW1126?

A: Yes, there is a fee for filing Form RW1126. The fee varies depending on the value of the estate.

Q: Can an attorney help with filing Form RW1126?

A: Yes, it is recommended to seek the assistance of an attorney when filing Form RW1126, as the process can be complex and legal advice may be needed.

Q: What happens after Form RW1126 is filed?

A: After Form RW1126 is filed, the probate court will review the claim and determine if the surviving spouse is entitled to an elective share of the estate.

Q: Can the filing of Form RW1126 be challenged?

A: Yes, the filing of Form RW1126 can be challenged by interested parties, such as other beneficiaries named in the will. The court will consider all relevant evidence before making a decision.

Q: What if I have more questions about Form RW1126?

A: If you have more questions about Form RW1126, it is recommended to consult with an attorney or contact the Maryland Department of Assessments and Taxation for further guidance.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Maryland Offices of the Registers of Wills;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW1126 by clicking the link below or browse more documents and templates provided by the Maryland Offices of the Registers of Wills.