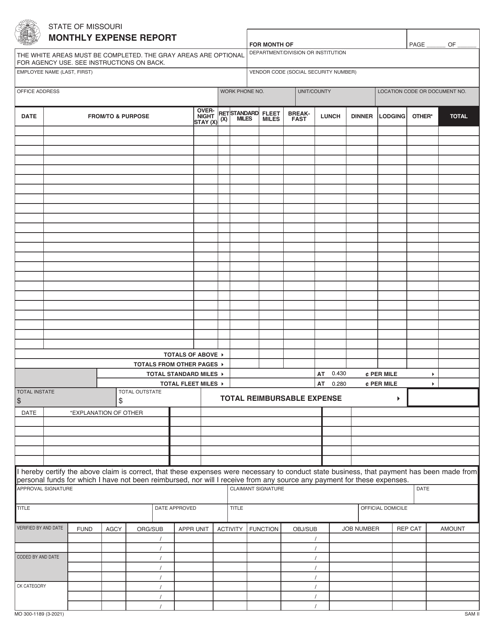

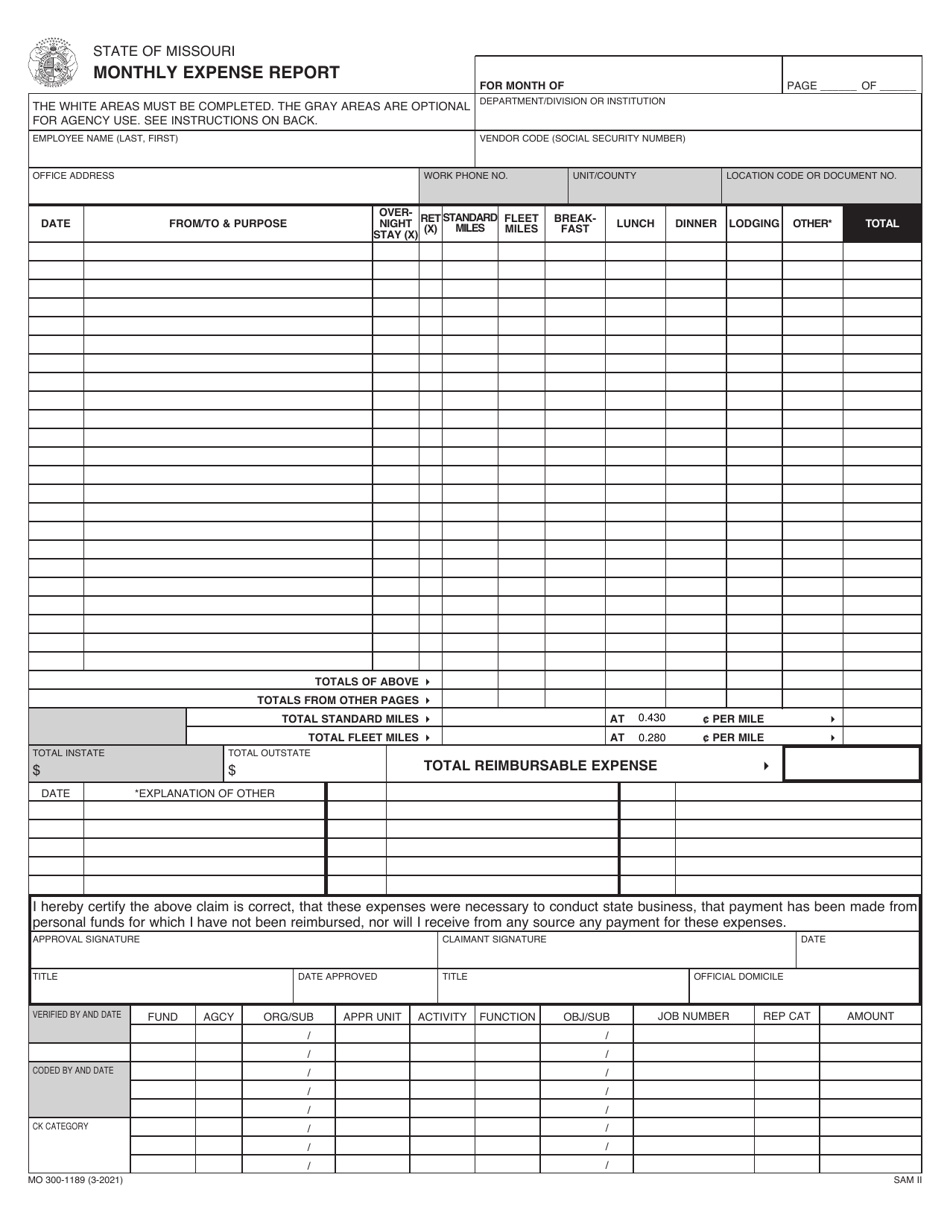

This version of the form is not currently in use and is provided for reference only. Download this version of

Form MO300-1189

for the current year.

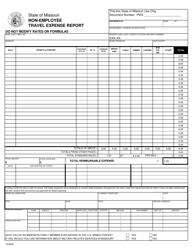

Form MO300-1189 Monthly Expense Report - Missouri

What Is Form MO300-1189?

This is a legal form that was released by the Missouri Office of Administration - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form MO300-1189?

A: Form MO300-1189 is a Monthly Expense Report used in Missouri.

Q: Who is required to fill out Form MO300-1189?

A: Employees or individuals who need to report their monthly expenses in Missouri.

Q: What information is required on Form MO300-1189?

A: Form MO300-1189 requires information such as the employee's name, department, supervisor's name, and details of the expenses incurred.

Q: What expenses can be reported on Form MO300-1189?

A: Expenses such as travel, meals, lodging, and other business-related expenses can be reported on Form MO300-1189.

Q: Is Form MO300-1189 for personal expenses?

A: No, Form MO300-1189 is specifically for reporting business-related expenses.

Q: When is Form MO300-1189 due?

A: The due date for Form MO300-1189 may vary, so it is best to check with your employer or the Missouri Department of Revenue for the specific deadline.

Q: Are there any penalties for late submission of Form MO300-1189?

A: Penalties for late submission of Form MO300-1189 may vary, so it is important to comply with the deadline to avoid any potential penalties.

Q: Can I claim reimbursements for expenses on Form MO300-1189?

A: Yes, you can claim reimbursements for eligible expenses on Form MO300-1189. Make sure to attach the necessary supporting documents.

Q: Who should I contact for further assistance with Form MO300-1189?

A: For further assistance with Form MO300-1189, you can contact your employer's HR department or the Missouri Department of Revenue.

Q: Can I deduct business expenses reported on Form MO300-1189 from my taxes?

A: Consult a tax professional or refer to the IRS guidelines to determine if the business expenses reported on Form MO300-1189 are eligible for tax deductions.

Q: Is Form MO300-1189 used in other states besides Missouri?

A: No, Form MO300-1189 is specific to Missouri and is not used in other states.

Q: Do I need to keep a copy of Form MO300-1189 for my records?

A: Yes, it is advisable to keep a copy of Form MO300-1189 for your personal records.

Q: Is Form MO300-1189 confidential?

A: Form MO300-1189 may contain sensitive and confidential information, so it should be treated with caution and only shared with authorized individuals.

Q: Are there any fees associated with submitting Form MO300-1189?

A: There are generally no fees associated with submitting Form MO300-1189, but it is recommended to check with your employer or the Missouri Department of Revenue for any exceptions.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Missouri Office of Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO300-1189 by clicking the link below or browse more documents and templates provided by the Missouri Office of Administration.