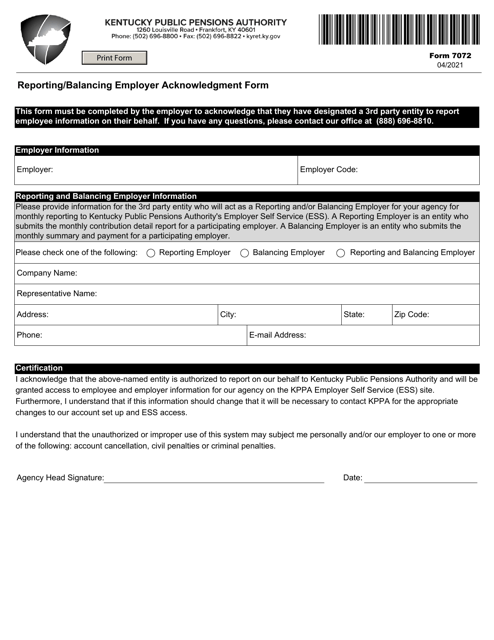

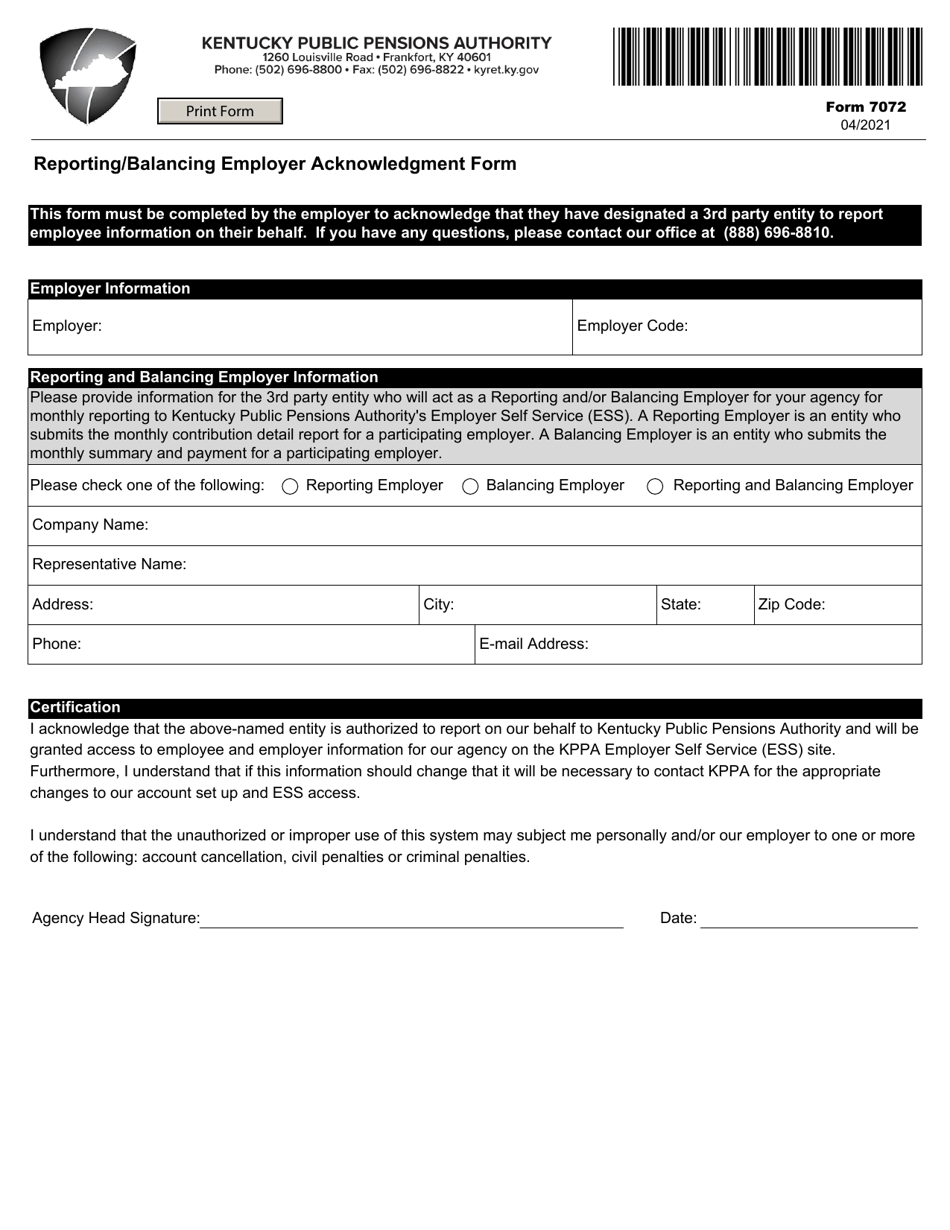

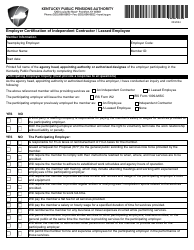

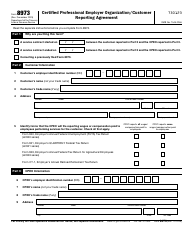

Form 7072 Reporting / Balancing Employer Acknowledgment Form - Kentucky

What Is Form 7072?

This is a legal form that was released by the Kentucky Public Pensions Authority - a government authority operating within Kentucky. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 7072?

A: Form 7072 is the Reporting/Balancing Employer Acknowledgment Form in Kentucky.

Q: Who needs to fill out Form 7072?

A: Employers in Kentucky need to fill out Form 7072.

Q: What is the purpose of Form 7072?

A: Form 7072 is used to acknowledge the employer's responsibility to accurately report and balance their employees' wages and tax withholdings.

Q: When is Form 7072 due?

A: Form 7072 is due on or before the last day of February.

Q: Is there a penalty for not filing Form 7072?

A: Yes, there may be penalties for failing to file or deliberately providing false information on Form 7072.

Q: Are there any instructions for filling out Form 7072?

A: Yes, the Kentucky Department of Revenue provides detailed instructions for filling out Form 7072.

Q: What other forms are related to Form 7072?

A: Form 7072 is part of the Kentucky Employer Withholding Tax Forms package, which includes other forms for reporting and withholding employee taxes.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Kentucky Public Pensions Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 7072 by clicking the link below or browse more documents and templates provided by the Kentucky Public Pensions Authority.