This version of the form is not currently in use and is provided for reference only. Download this version of

Form 4527

for the current year.

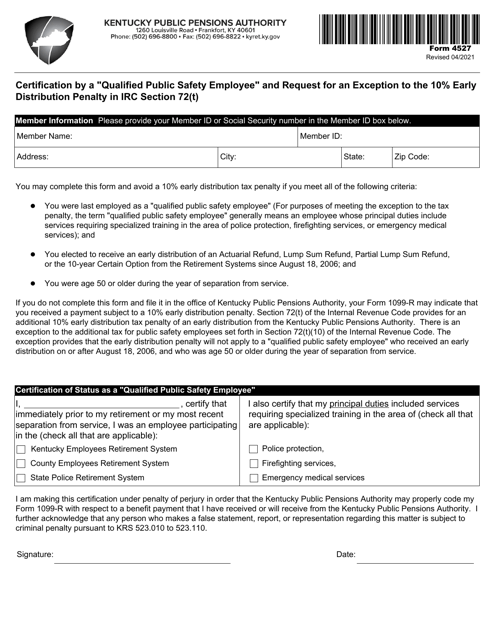

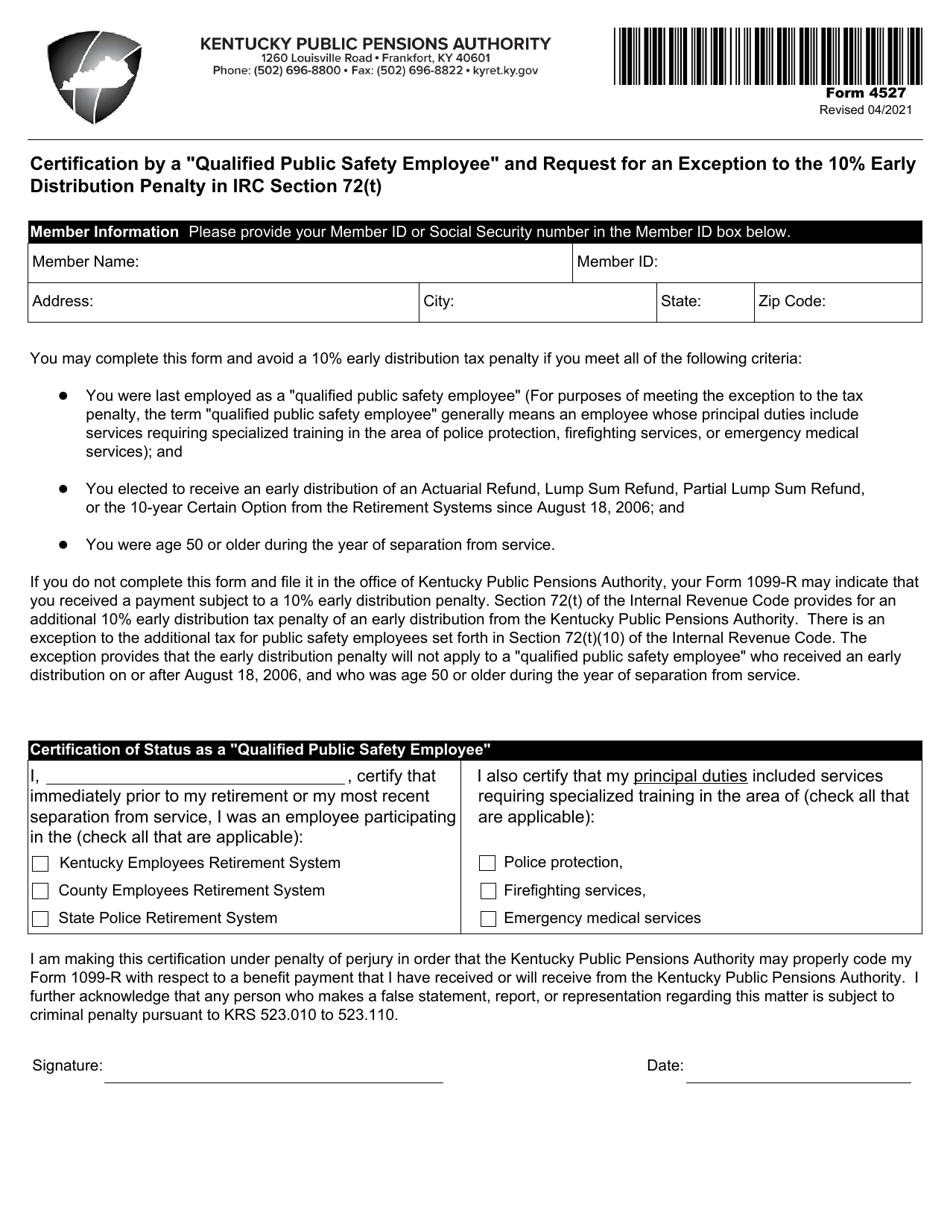

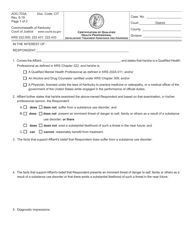

Form 4527 Certification by a "qualified Public Safety Employee" and Request for an Exception to the 10% Early Distribution Penalty in IRC Section 72(T) - Kentucky

What Is Form 4527?

This is a legal form that was released by the Kentucky Public Pensions Authority - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4527?

A: Form 4527 is a certification form used by qualified public safety employees in Kentucky.

Q: Who is considered a qualified public safety employee?

A: A qualified public safety employee is an individual employed as a police officer, firefighter, paramedic, or other public safety official.

Q: What is the purpose of Form 4527?

A: The purpose of Form 4527 is to certify that the individual qualifies for an exception to the 10% early distribution penalty for withdrawals from a retirement plan.

Q: What is the 10% early distribution penalty?

A: The 10% early distribution penalty is a penalty imposed by the IRS on withdrawals from a retirement plan made before the age of 59 and a half.

Q: What is IRC Section 72(T)?

A: IRC Section 72(T) is a section of the Internal Revenue Code that provides exceptions to the early distribution penalty for certain individuals, including qualified public safety employees.

Q: How can Form 4527 be used to request an exception to the 10% early distribution penalty?

A: By completing and submitting Form 4527, a qualified public safety employee can request an exception to the 10% early distribution penalty for withdrawals from their retirement plan.

Q: Is Form 4527 specific to the state of Kentucky?

A: Yes, Form 4527 is specific to the state of Kentucky and is used by public safety employees in that state to certify their eligibility for the exception to the early distribution penalty.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Kentucky Public Pensions Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4527 by clicking the link below or browse more documents and templates provided by the Kentucky Public Pensions Authority.