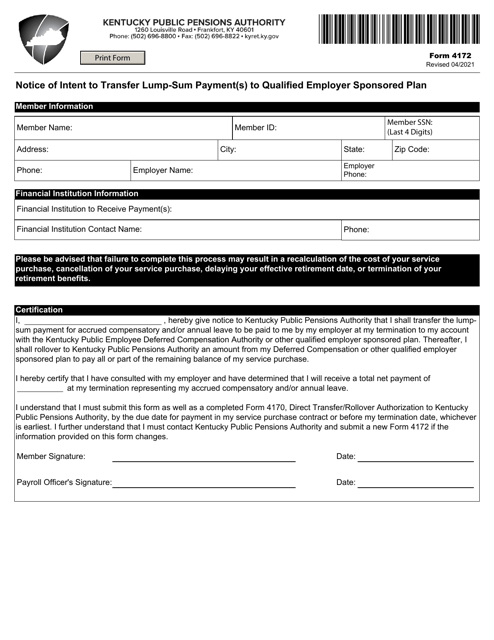

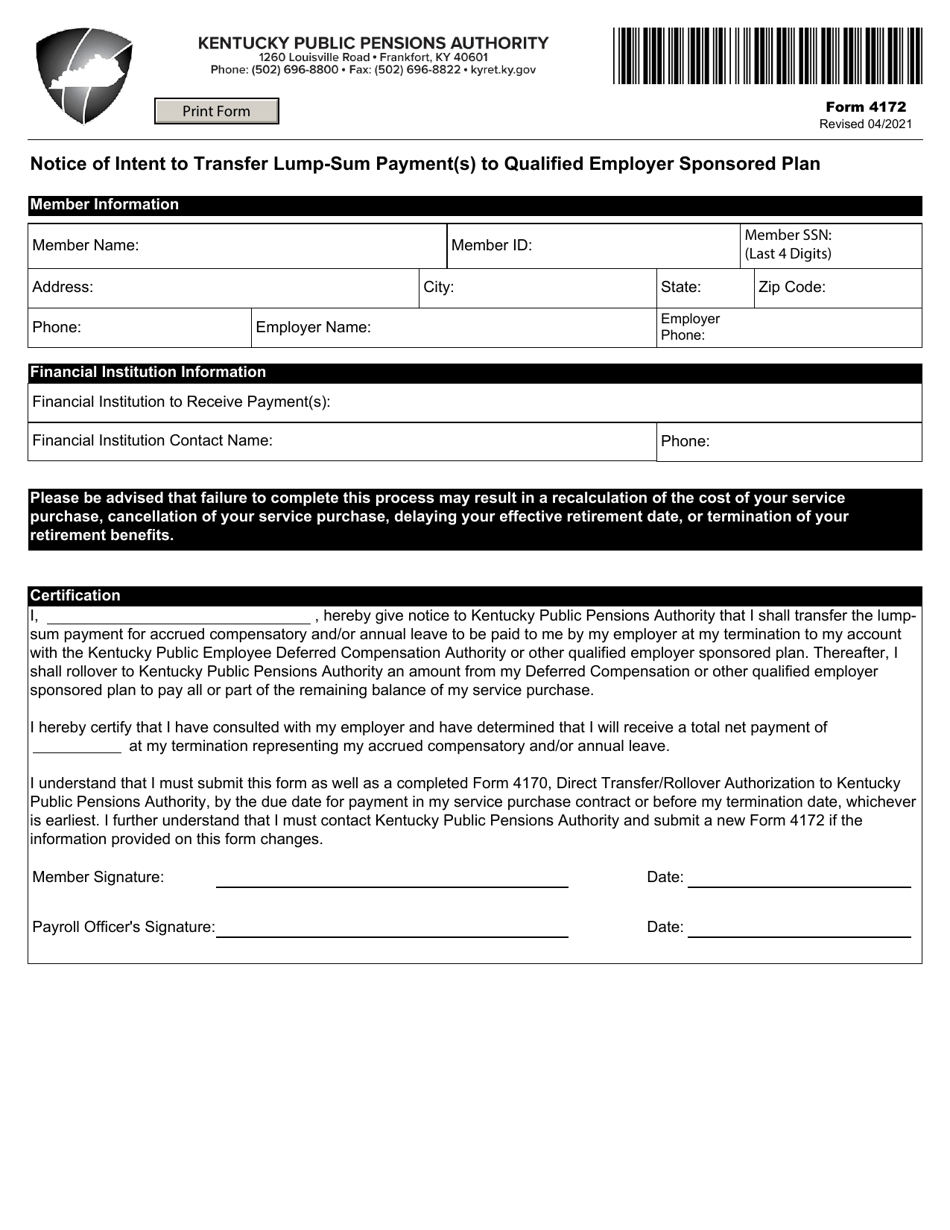

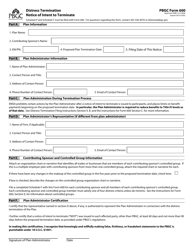

Form 4172 Notice of Intent to Transfer Lump-Sum Payment(S) to Qualified Employer Sponsored Plan - Kentucky

What Is Form 4172?

This is a legal form that was released by the Kentucky Public Pensions Authority - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4172?

A: Form 4172 is the Notice of Intent to Transfer Lump-Sum Payment(s) to Qualified Employer Sponsored Plan form.

Q: Who needs to file Form 4172?

A: Individuals who want to transfer lump-sum payments to a qualified employer-sponsored plan in Kentucky are required to file Form 4172.

Q: What is the purpose of Form 4172?

A: The purpose of Form 4172 is to notify the Kentucky Department of Revenue of your intent to transfer lump-sum payments to a qualified employer-sponsored plan.

Q: How do I file Form 4172?

A: Form 4172 should be completed and submitted to the Kentucky Department of Revenue.

Q: Are there any fees associated with filing Form 4172?

A: No, there are no fees associated with filing Form 4172.

Q: What is a lump-sum payment?

A: A lump-sum payment is a single payment made to a person that represents the total amount of an individual's benefits for a specified period.

Q: What is a qualified employer-sponsored plan?

A: A qualified employer-sponsored plan is a retirement savings plan, such as a 401(k) or 403(b) plan, that meets specific requirements under the Internal Revenue Code.

Q: Is Form 4172 specific to Kentucky?

A: Yes, Form 4172 is specific to the state of Kentucky.

Q: Is Form 4172 mandatory?

A: Yes, if you want to transfer lump-sum payments to a qualified employer-sponsored plan in Kentucky, filing Form 4172 is mandatory.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Kentucky Public Pensions Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4172 by clicking the link below or browse more documents and templates provided by the Kentucky Public Pensions Authority.