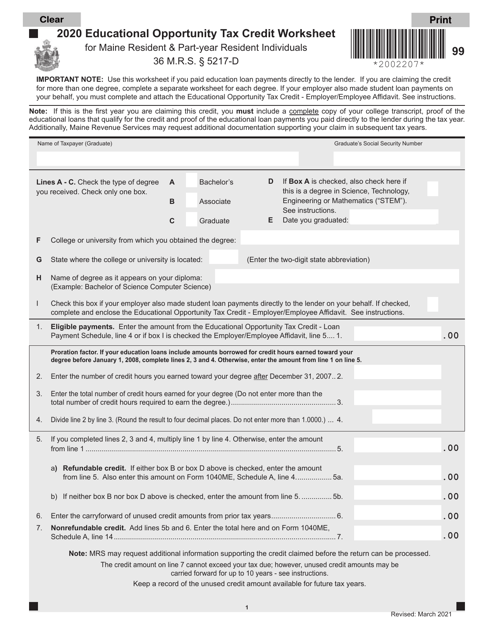

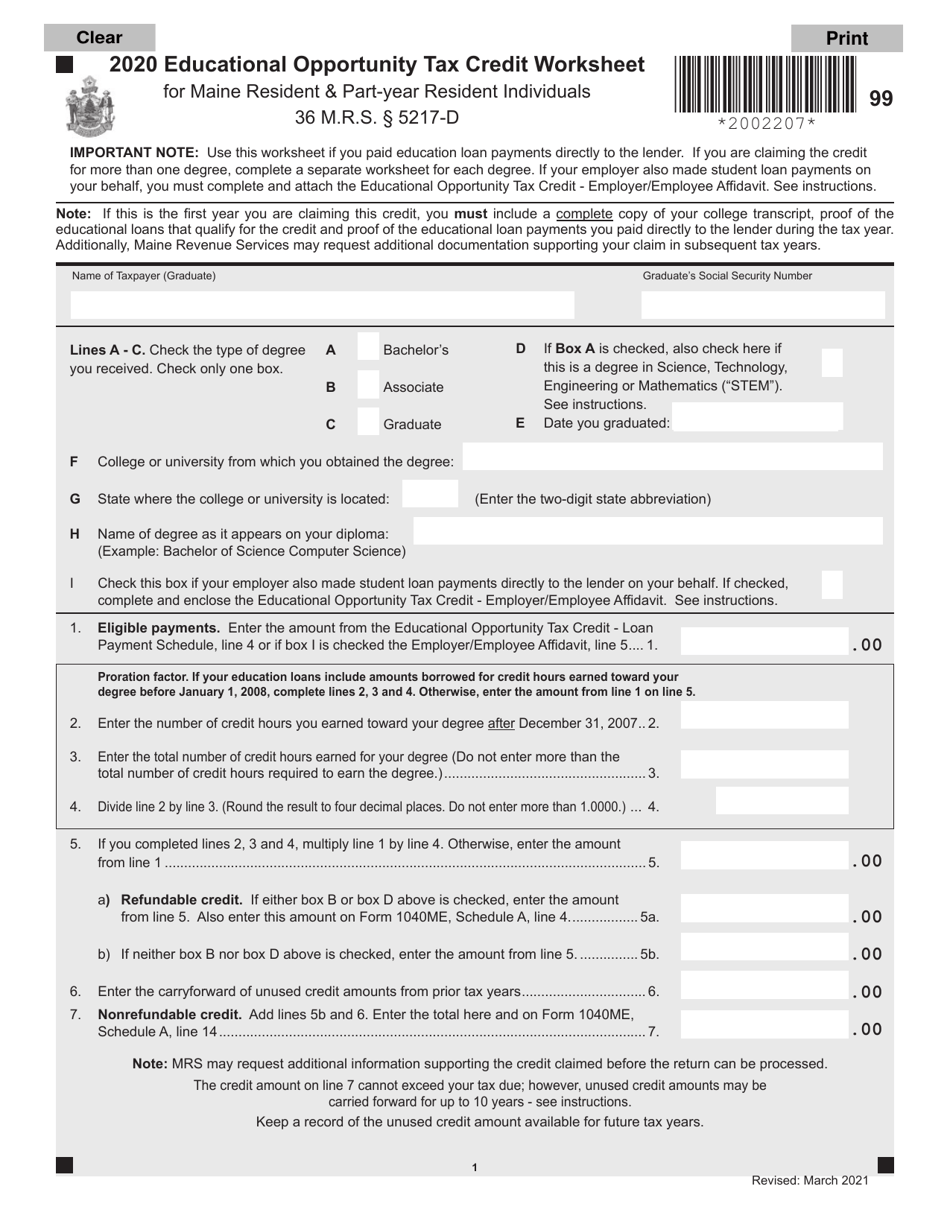

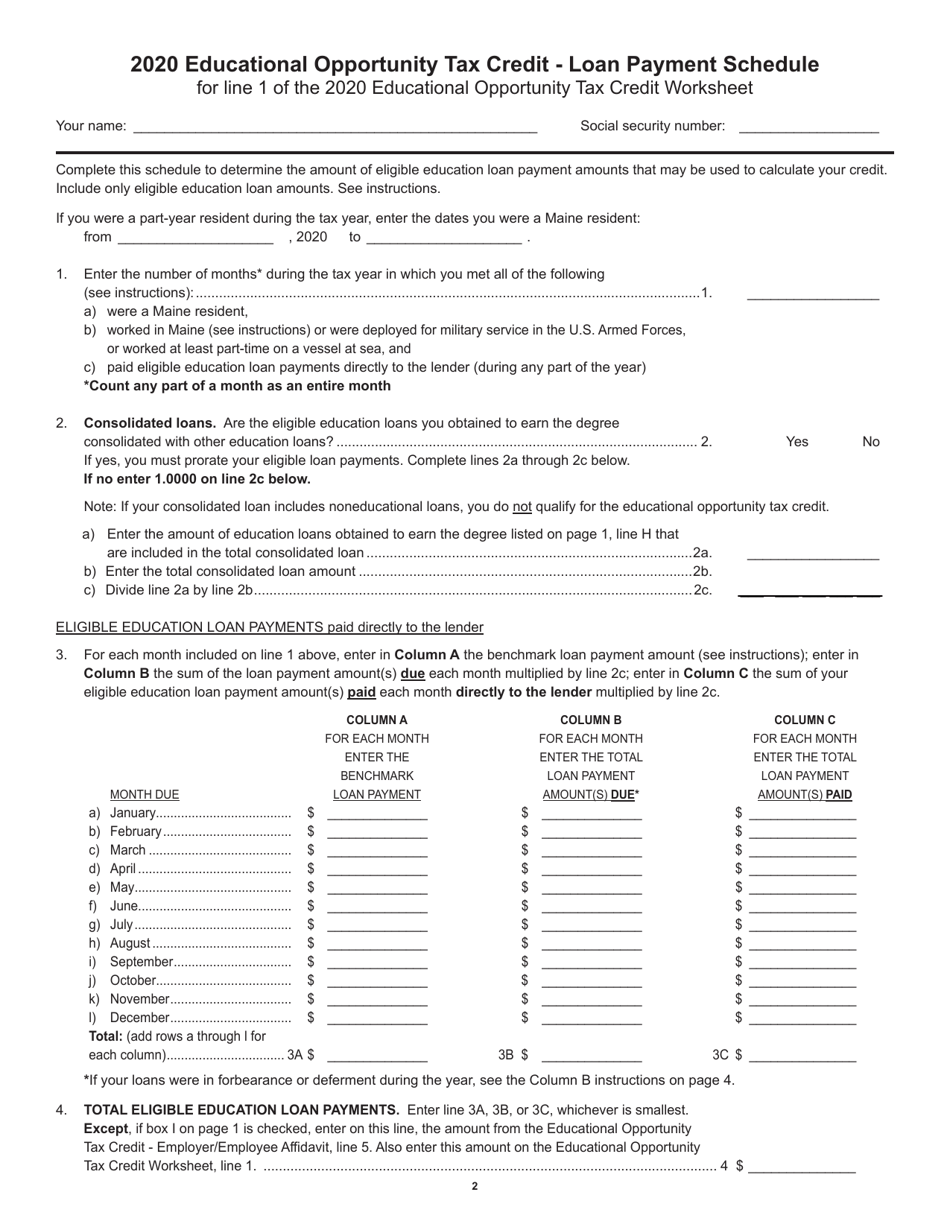

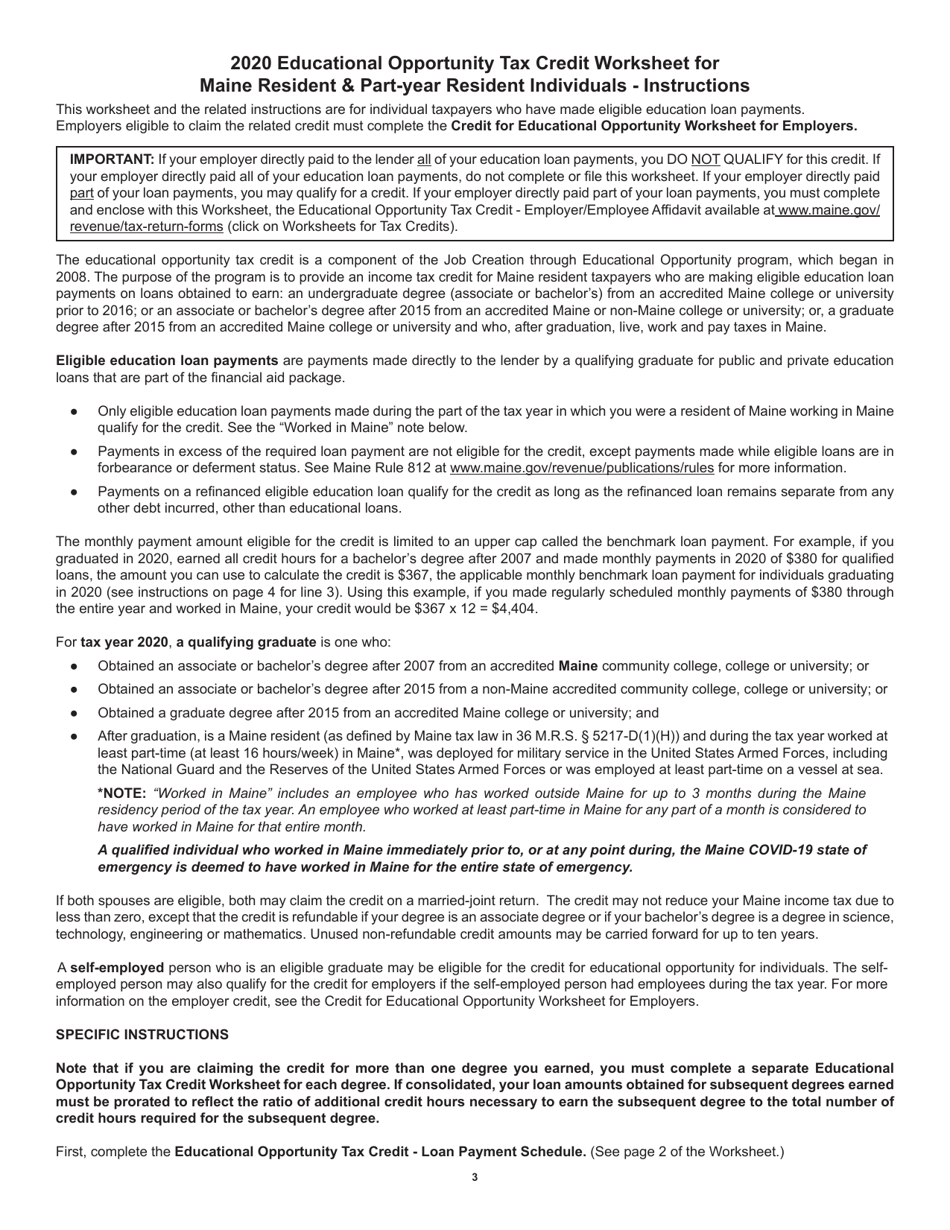

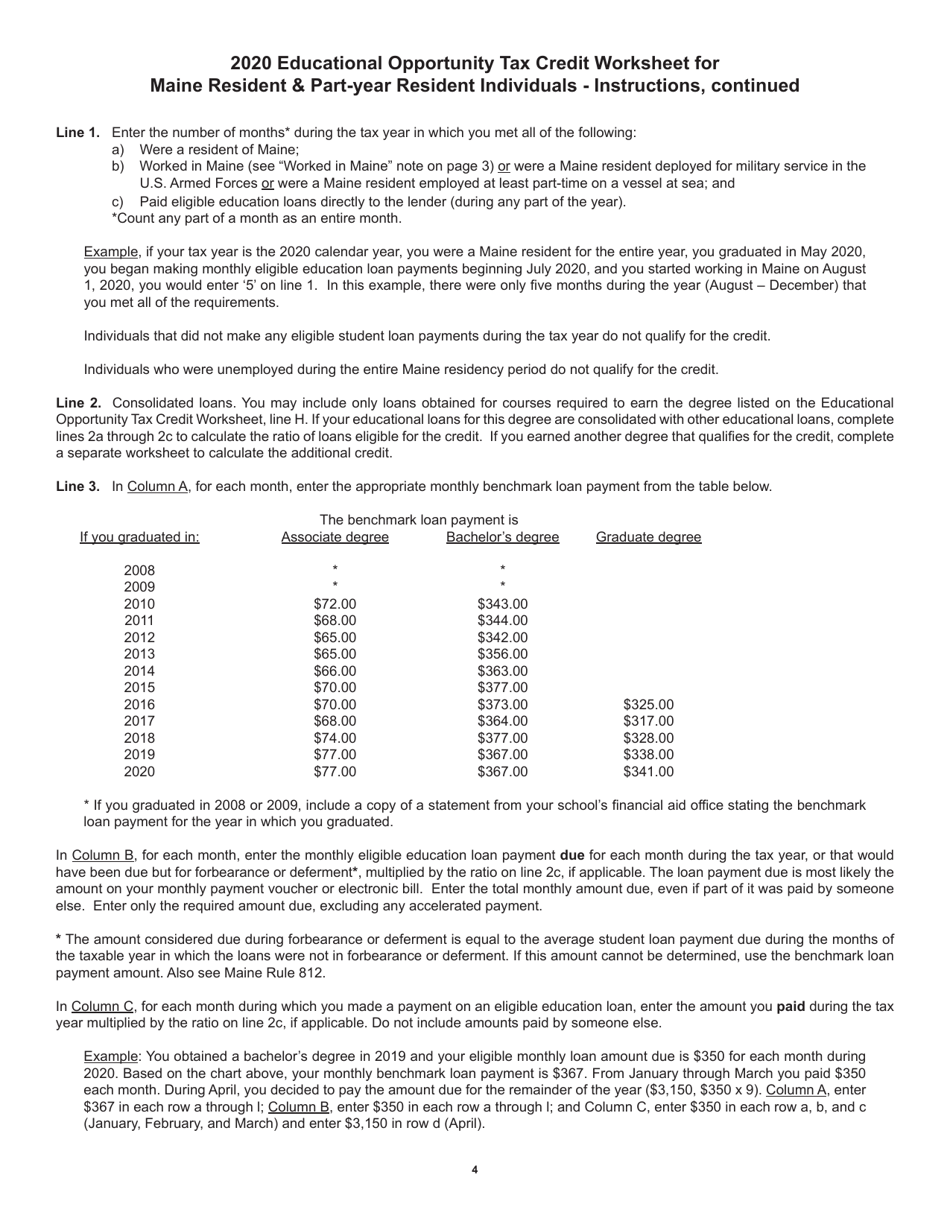

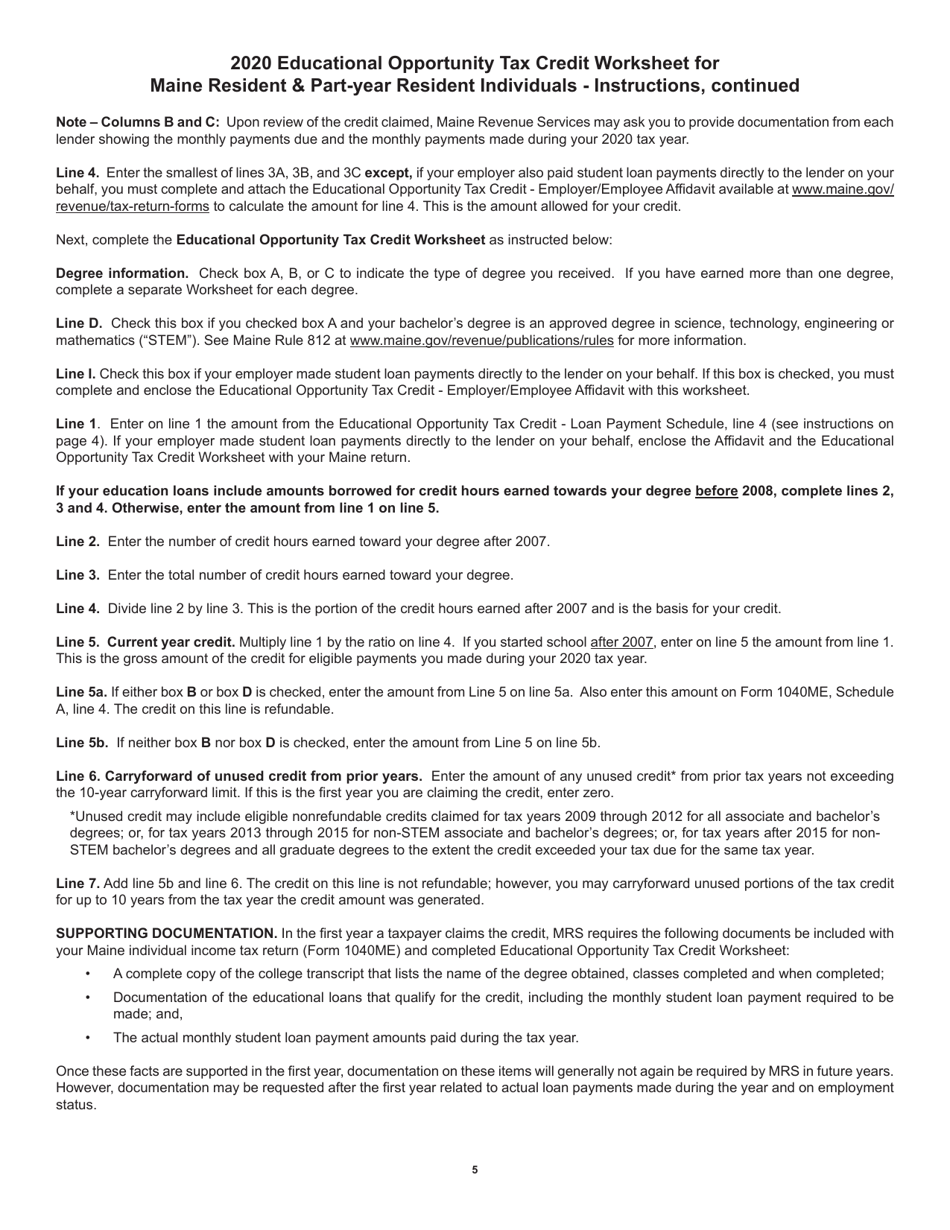

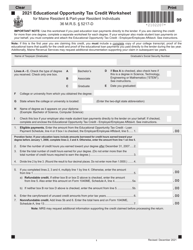

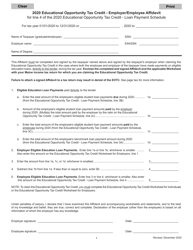

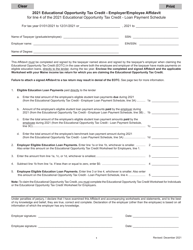

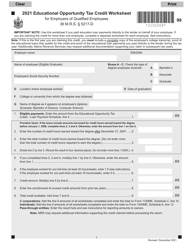

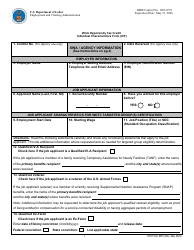

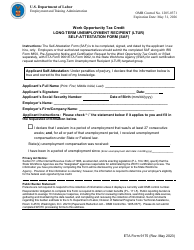

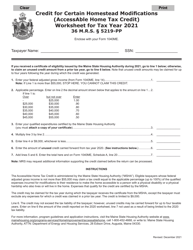

Educational Opportunity Tax Credit Worksheet for Maine Resident & Part-Year Resident Individuals - Maine

Educational Opportunity Tax Credit Worksheet for Maine Resident & Part-Year Resident Individuals is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

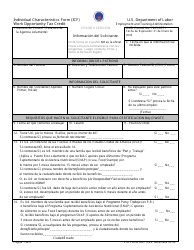

Q: What is the Educational Opportunity Tax Credit?

A: The Educational Opportunity Tax Credit is a tax credit available to Maine residents and part-year residents who have student loan payments.

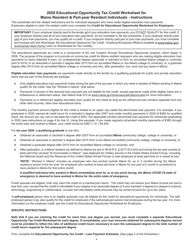

Q: Who is eligible for the Educational Opportunity Tax Credit?

A: Maine residents and part-year residents who have student loan payments are eligible for the tax credit.

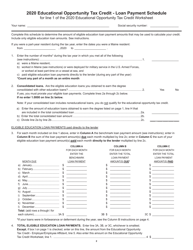

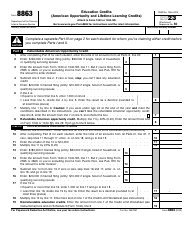

Q: What expenses are eligible for the tax credit?

A: Expenses related to qualified higher education loans and loan payments are eligible for the tax credit.

Q: How much is the tax credit?

A: The tax credit amount depends on the individual's total eligible student loan payments.

Q: How can I claim the tax credit?

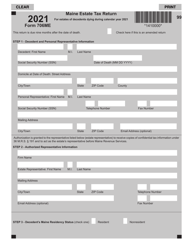

A: You can claim the tax credit by completing the Educational Opportunity Tax Credit Worksheet on your Maine state tax return.

Q: Are there any income limits for claiming the tax credit?

A: Yes, there are income limits for claiming the tax credit. Please refer to the specific requirements outlined in the Maine state tax instructions.

Form Details:

- Released on March 1, 2021;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.