This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

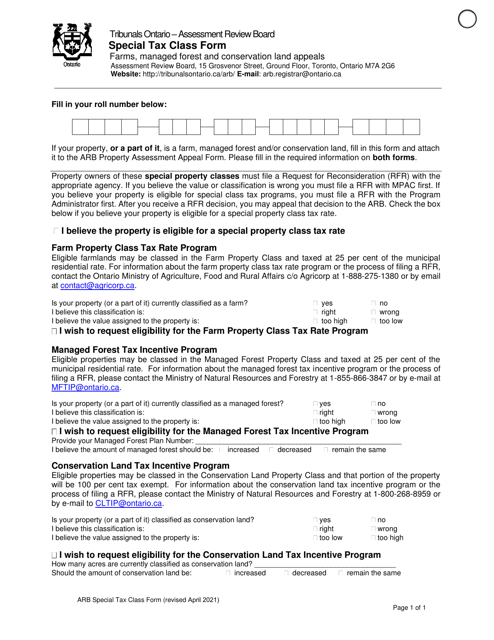

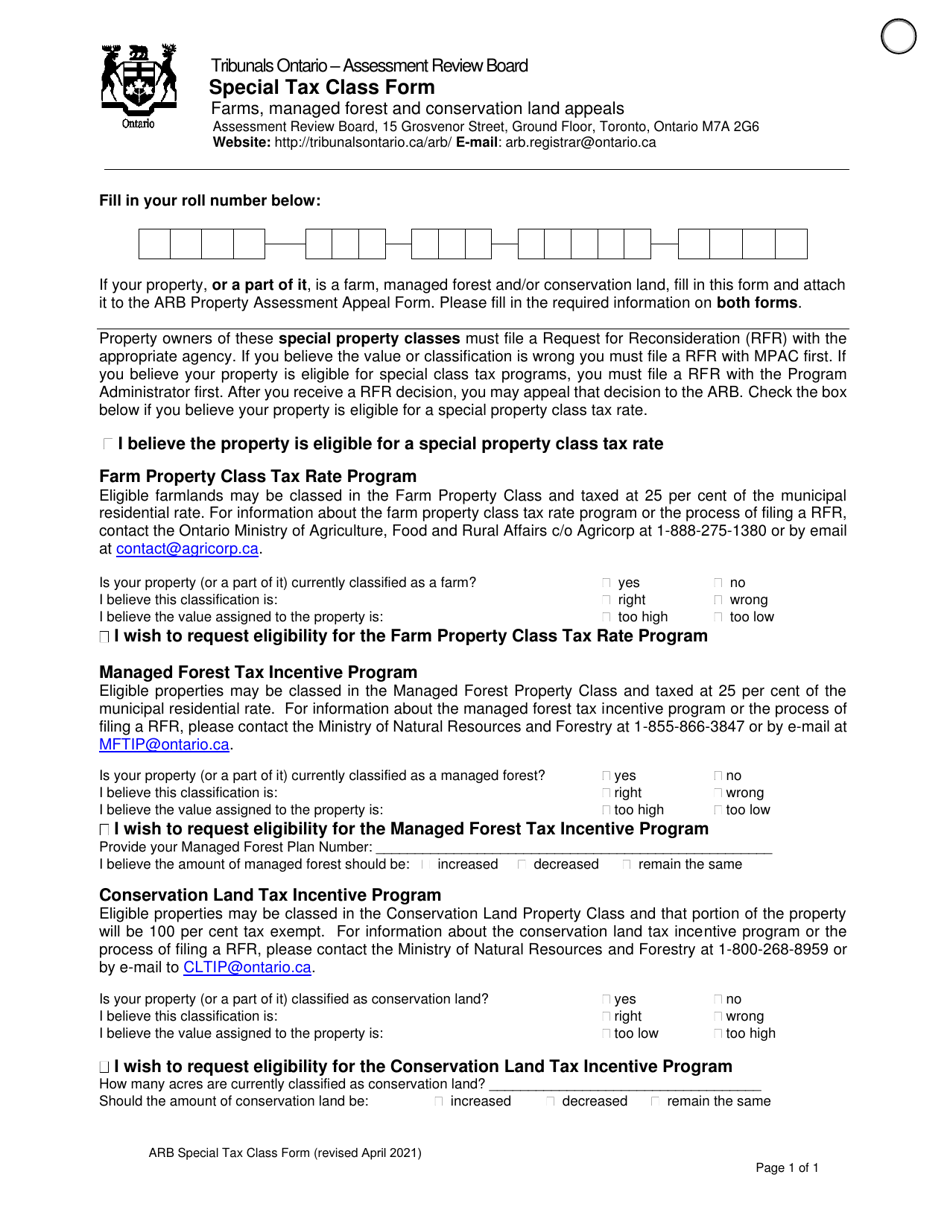

Special Tax Class Form - Ontario, Canada

The Special Tax Class Form in Ontario, Canada is used to apply for a tax reduction or exemption for certain types of property, such as farmland or managed forests. It allows eligible property owners to be taxed at a lower rate or even be exempt from property taxes altogether.

In Ontario, Canada, the special tax class form is typically filed by individuals or businesses who meet the criteria for the specific special tax class. However, without specific details about the type of special tax class form you are referring to, it is difficult to provide a more precise answer. Can you please provide more information or context about the special tax class form you are referring to?

FAQ

Q: What is a special tax class form?

A: A special tax class form is a specific form used in Ontario, Canada to declare any special tax class for tax purposes.

Q: Who needs to fill out a special tax class form?

A: Individuals in Ontario, Canada who have a special tax class, such as farmers or artisans, may need to fill out a special tax class form.

Q: What is the purpose of the special tax class form?

A: The purpose of the special tax class form is to declare any special tax class and ensure appropriate taxation on the income generated from activities in that class.

Q: Is the special tax class form mandatory?

A: It depends on your situation. If you qualify for a special tax class, it is recommended to fill out the form to ensure proper taxation on your income.

Q: What are some examples of special tax classes in Ontario?

A: Some examples of special tax classes in Ontario include farmers, artisans, and artists who generate income from their work.

Q: Is there a deadline to submit the special tax class form?

A: The deadline to submit the special tax class form may vary. It is best to check with the Ontario Ministry of Finance or consult with a tax professional for specific deadlines.

Q: What happens if I don't submit a special tax class form?

A: If you qualify for a special tax class and do not submit the form, you may not receive appropriate tax benefits and could be subject to penalties for incorrect reporting of income.

Q: Can I make changes to my special tax class form once it is submitted?

A: Once the special tax class form is submitted, changes or amendments may be possible, but it is best to contact the Ontario Ministry of Finance for guidance.