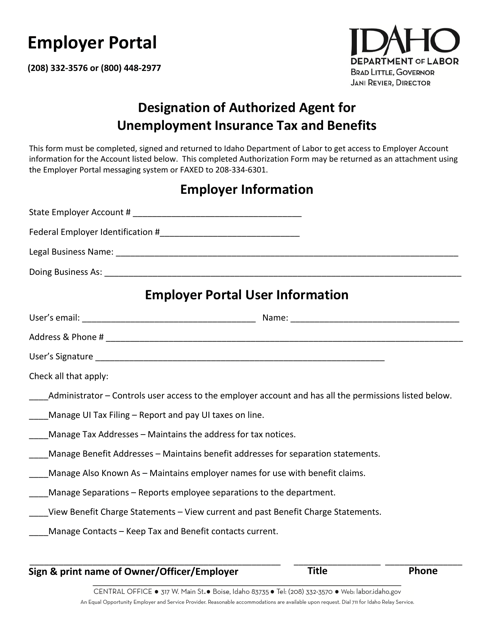

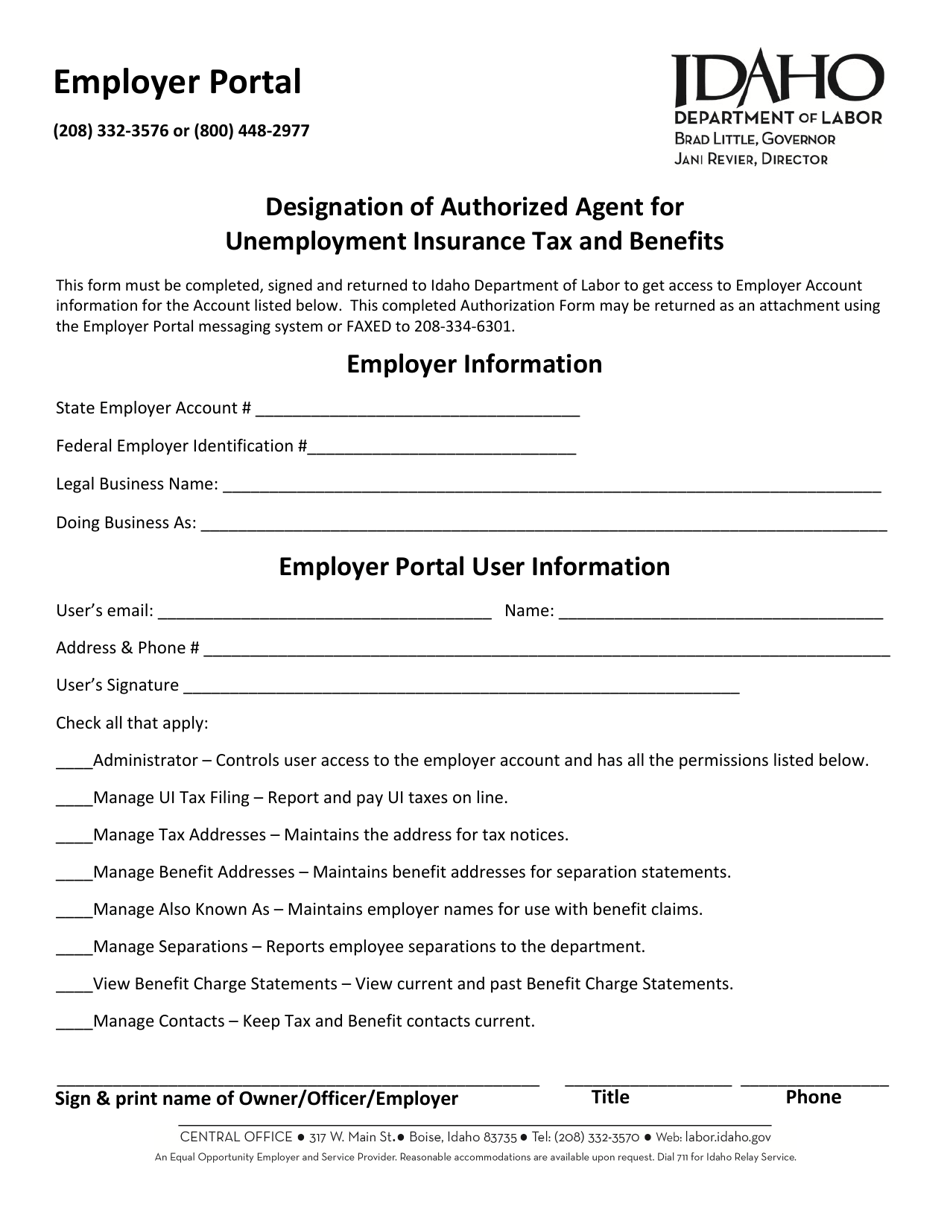

Designation of Authorized Agent for Unemployment Insurance Tax and Benefits - Idaho

Designation of Authorized Agent for Unemployment Insurance Tax and Benefits is a legal document that was released by the Idaho Department of Labor - a government authority operating within Idaho.

FAQ

Q: What is the Designation of Authorized Agent for Unemployment Insurance Tax and Benefits?

A: The Designation of Authorized Agent for Unemployment Insurance Tax and Benefits is a form used in Idaho to designate an authorized agent to handle unemployment insurance tax and benefits on behalf of an employer.

Q: Why would I need to fill out a Designation of Authorized Agent for Unemployment Insurance Tax and Benefits form?

A: You would need to fill out this form if you want to authorize someone to handle your unemployment insurance tax and benefits matters on your behalf in Idaho.

Q: Who can be designated as an authorized agent?

A: An authorized agent can be any individual or organization that you trust to handle your unemployment insurance tax and benefits matters in Idaho.

Q: Is there a deadline for submitting the Designation of Authorized Agent for Unemployment Insurance Tax and Benefits form?

A: There is no specific deadline for submitting this form, but it is recommended to submit it as soon as possible if you want to authorize an agent to handle your unemployment insurance tax and benefits matters.

Form Details:

- The latest edition currently provided by the Idaho Department of Labor;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Department of Labor.