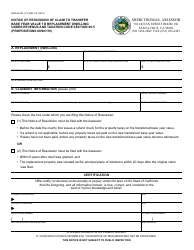

This version of the form is not currently in use and is provided for reference only. Download this version of

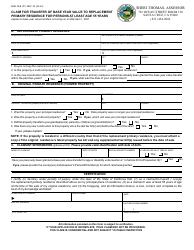

Form BOE-60-NR

for the current year.

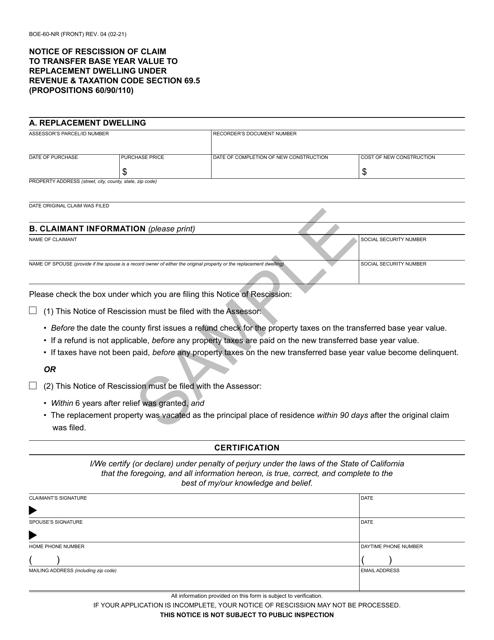

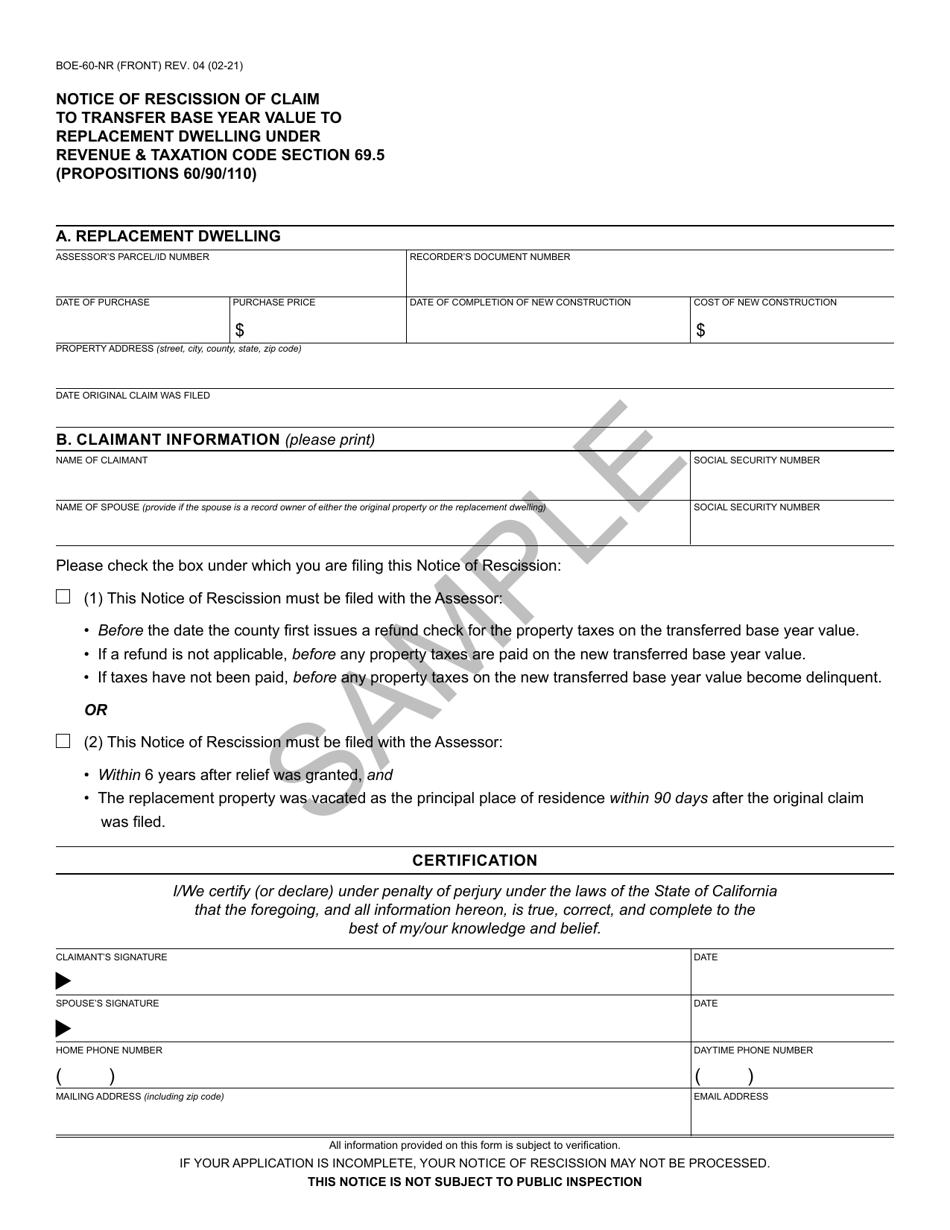

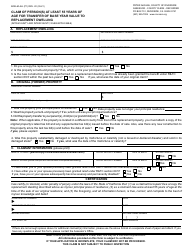

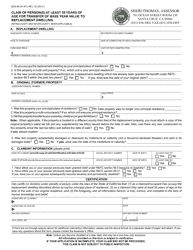

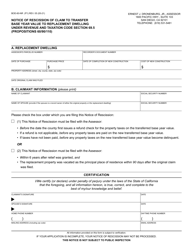

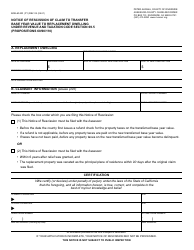

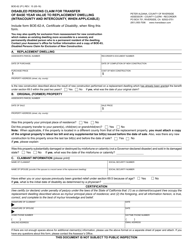

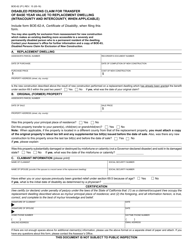

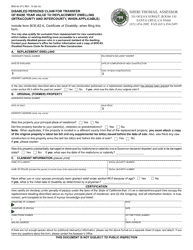

Form BOE-60-NR Notice of Rescission of Claim to Transfer Base Year Value to Replacement Dwelling Under Revenue & Taxation Code Section 69.5 (Propositions 60 / 90 / 110) - Sample - California

What Is Form BOE-60-NR?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

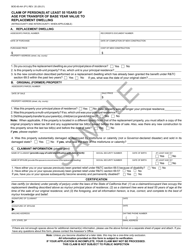

Q: What is Form BOE-60-NR used for?

A: Form BOE-60-NR is used to rescind a claim to transfer the base year value to a replacement dwelling under Propositions 60/90/110 in California.

Q: What is the purpose of Propositions 60/90/110?

A: Propositions 60/90/110 allow homeowners who are 55 years or older to transfer the base year value of their original home to a replacement dwelling.

Q: Who can use Form BOE-60-NR?

A: Form BOE-60-NR can be used by homeowners who previously filed a claim to transfer the base year value but now wish to rescind that claim.

Q: What is the Revenue & Taxation Code Section 69.5?

A: Revenue & Taxation Code Section 69.5 is the section of the law that governs the transfer of base year value in California.

Q: Is Form BOE-60-NR specific to California?

A: Yes, Form BOE-60-NR is specific to California and is used for property tax purposes in the state.

Q: Can homeowners use Form BOE-60-NR for the initial claim to transfer base year value?

A: No, Form BOE-60-NR is only used to rescind a previous claim. Homeowners should use other specific forms for the initial claim.

Q: Are there any requirements to be eligible for Propositions 60/90/110?

A: Yes, there are certain requirements, including age, ownership, and residency criteria. Homeowners should review the regulations and guidelines for detailed eligibility requirements.

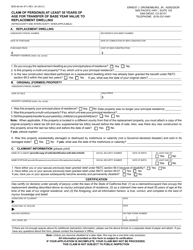

Q: What is the deadline for filing Form BOE-60-NR?

A: The deadline for filing Form BOE-60-NR may vary, so it is important to check with the county assessor's office or refer to the instructions provided with the form.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-60-NR by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.