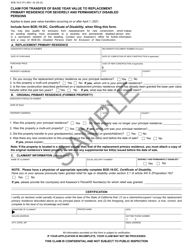

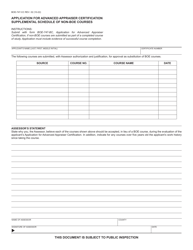

This version of the form is not currently in use and is provided for reference only. Download this version of

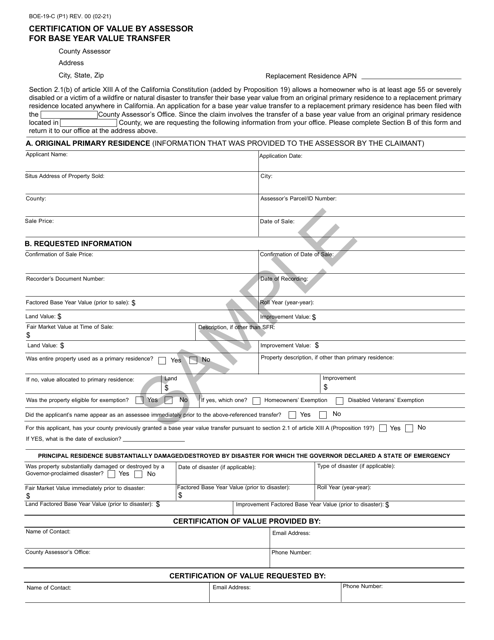

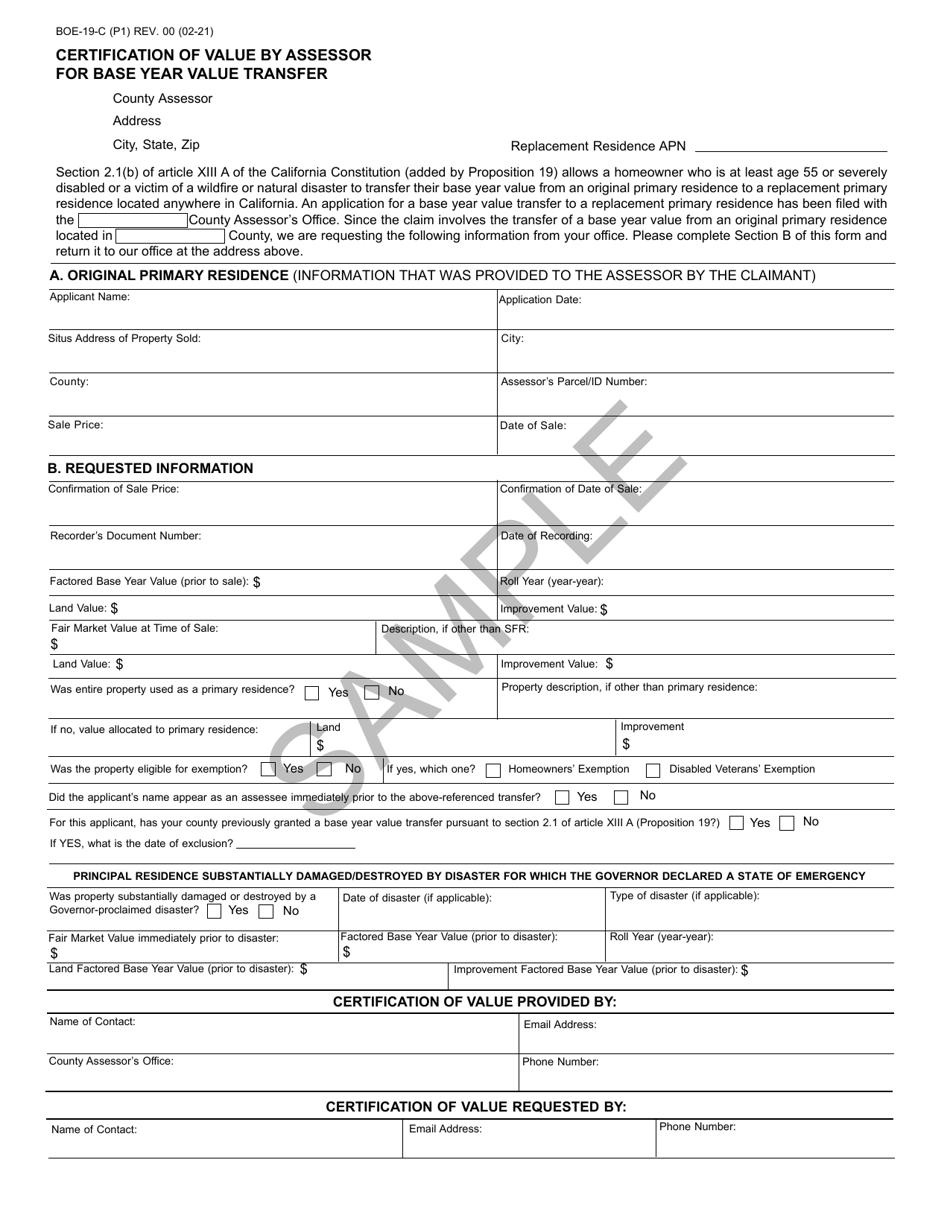

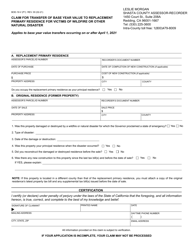

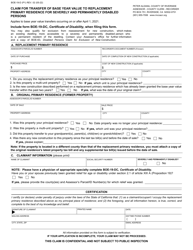

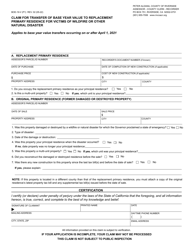

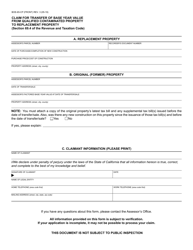

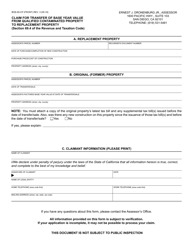

Form BOE-19-C

for the current year.

Form BOE-19-C Certification of Value by Assessor for Base Year Value Transfer - Sample - California

What Is Form BOE-19-C?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

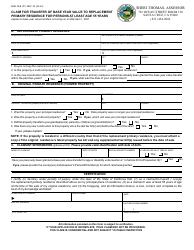

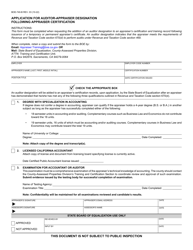

Q: What is Form BOE-19-C?

A: Form BOE-19-C is a certification of value by the assessor for base year value transfer in California.

Q: What is the purpose of Form BOE-19-C?

A: The purpose of Form BOE-19-C is to transfer the base year value of a property to a newly constructed or purchased property.

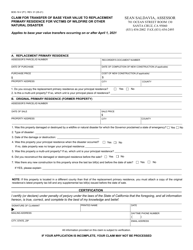

Q: Who can use Form BOE-19-C?

A: Form BOE-19-C can be used by property owners in California who are eligible for a base year value transfer.

Q: What is a base year value transfer?

A: A base year value transfer allows property owners to transfer their property's assessed value from an old property to a newly constructed or purchased property, which may result in lower property taxes.

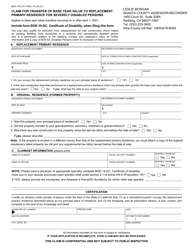

Q: Are there any fees associated with Form BOE-19-C?

A: There are no fees associated with submitting Form BOE-19-C.

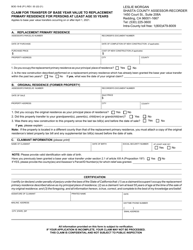

Q: What documentation is required with Form BOE-19-C?

A: The documentation required with Form BOE-19-C may vary, but generally includes proof of eligibility, such as permits or receipts, and a completed application form.

Q: Can I appeal if my Form BOE-19-C is denied?

A: Yes, if your Form BOE-19-C is denied, you have the right to appeal the decision.

Q: When should I submit Form BOE-19-C?

A: You should submit Form BOE-19-C as soon as possible after completing construction or purchasing the property, but before the 45th day after the completion of the new construction or the purchase date.

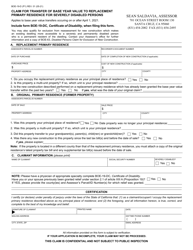

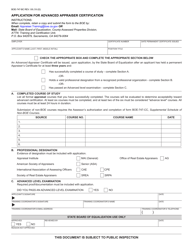

Form Details:

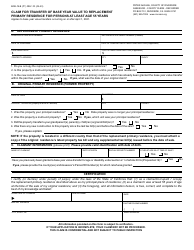

- Released on February 1, 2021;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-19-C by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.