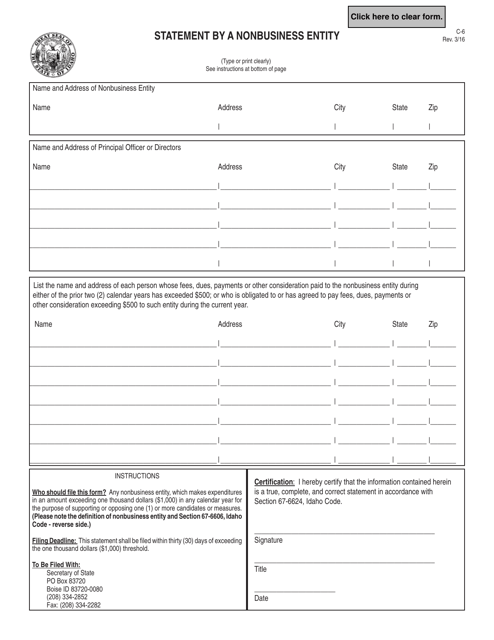

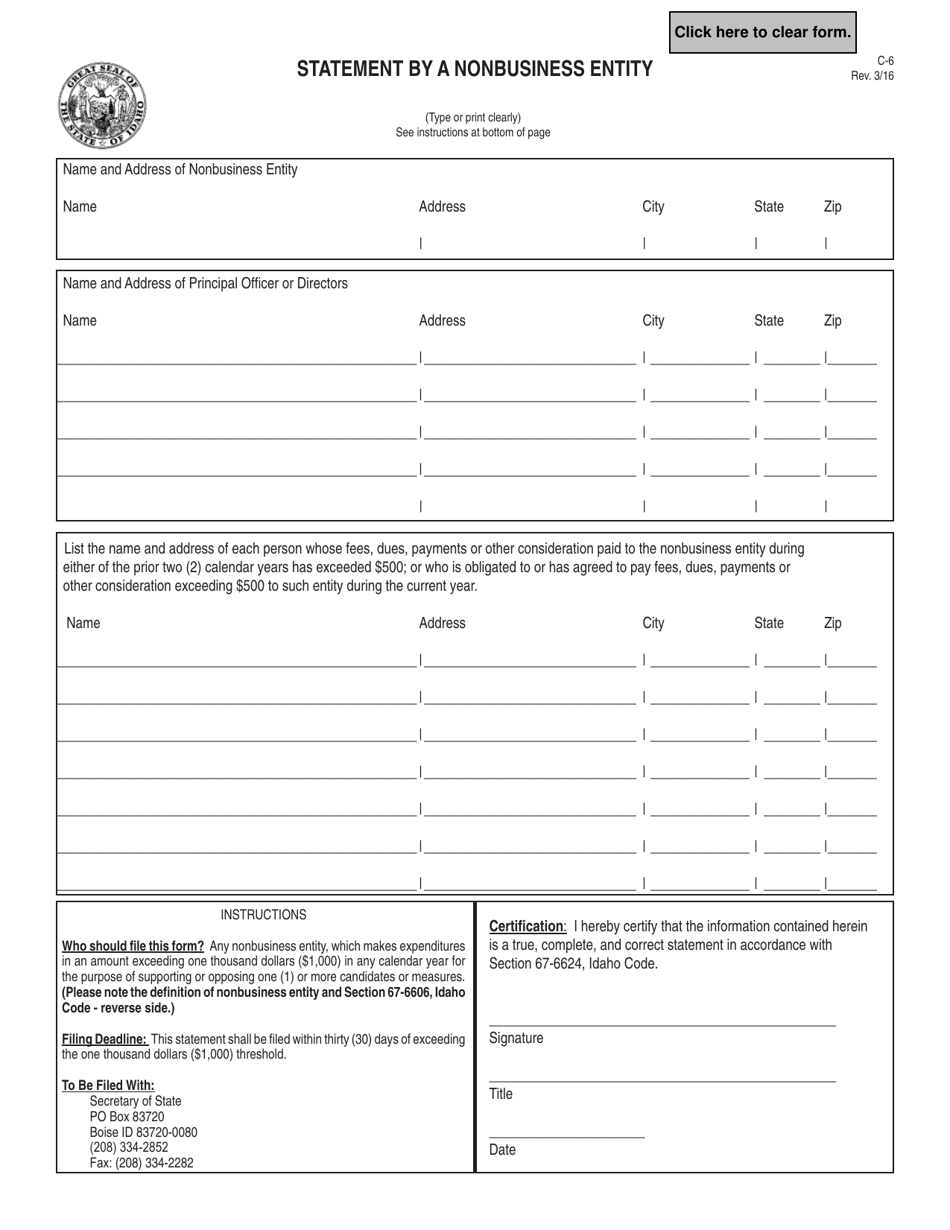

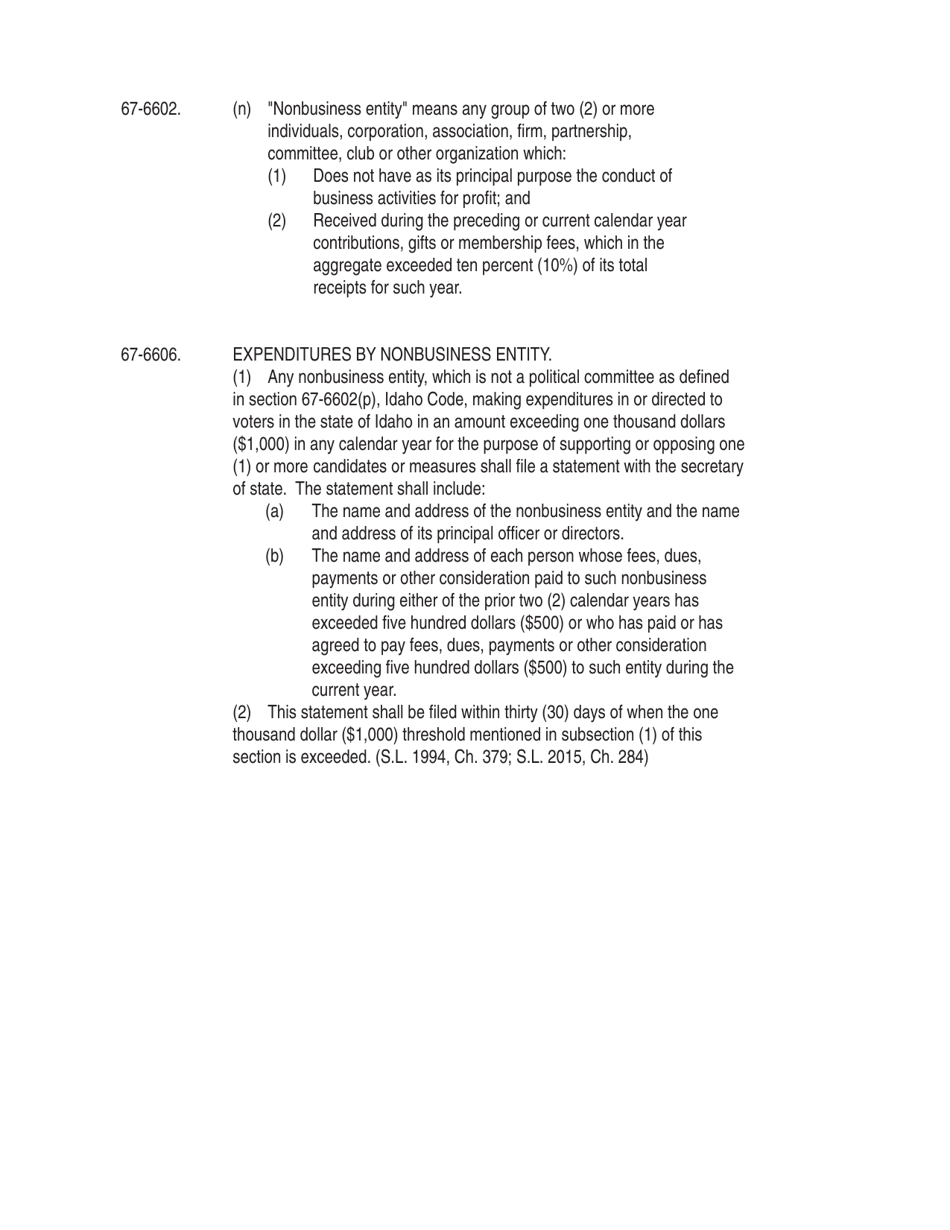

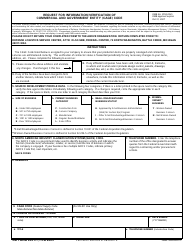

Form C-6 Statement by a Nonbusiness Entity - Idaho

What Is Form C-6?

This is a legal form that was released by the Idaho Secretary of State - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-6?

A: Form C-6 is a statement form used by nonbusiness entities in Idaho.

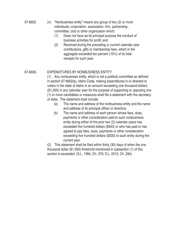

Q: Who needs to file Form C-6?

A: Nonbusiness entities in Idaho need to file Form C-6.

Q: What information is required on Form C-6?

A: Form C-6 requires information about the nonbusiness entity, such as its name, address, and taxpayer identification number.

Q: When is the deadline for filing Form C-6?

A: The deadline for filing Form C-6 varies and is typically determined by the Idaho State Tax Commission.

Q: Are there any fees associated with filing Form C-6?

A: There are no specific fees mentioned for filing Form C-6, but you may need to check with the Idaho State Tax Commission for any applicable charges.

Q: Can Form C-6 be filed electronically?

A: At the time of this document's creation, it is not specified if Form C-6 can be filed electronically. You should verify with the Idaho State Tax Commission for the most up-to-date filing methods.

Q: What should I do after filing Form C-6?

A: After filing Form C-6, you should retain a copy of the form for your records.

Q: What happens if I don't file Form C-6?

A: Failure to file Form C-6 when required may result in penalties or other consequences determined by the Idaho State Tax Commission.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Idaho Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-6 by clicking the link below or browse more documents and templates provided by the Idaho Secretary of State.