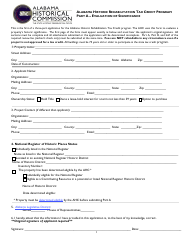

This version of the form is not currently in use and is provided for reference only. Download this version of

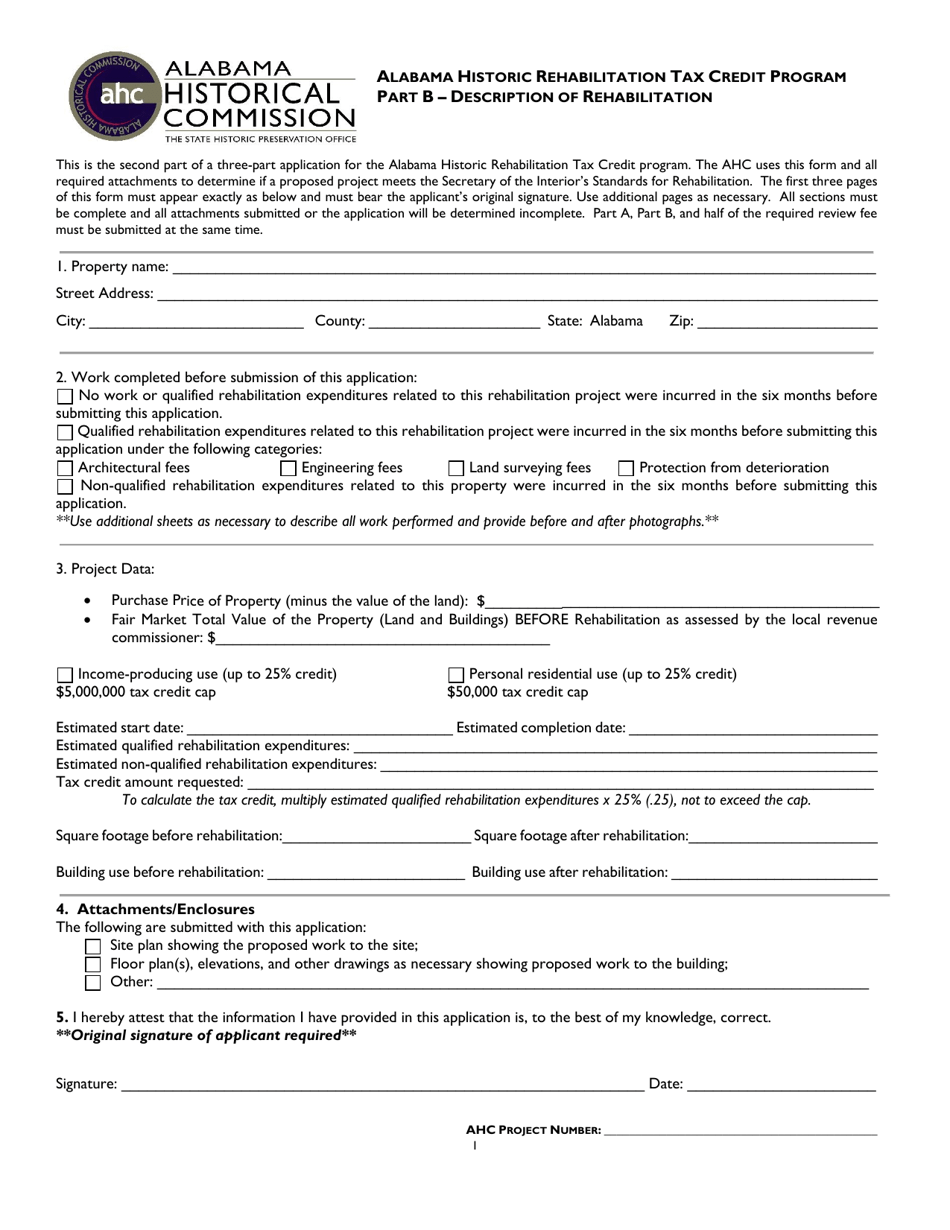

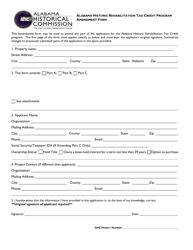

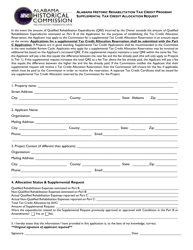

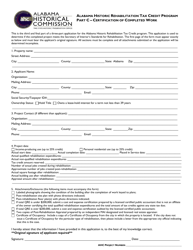

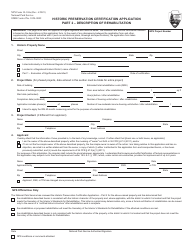

Part B

for the current year.

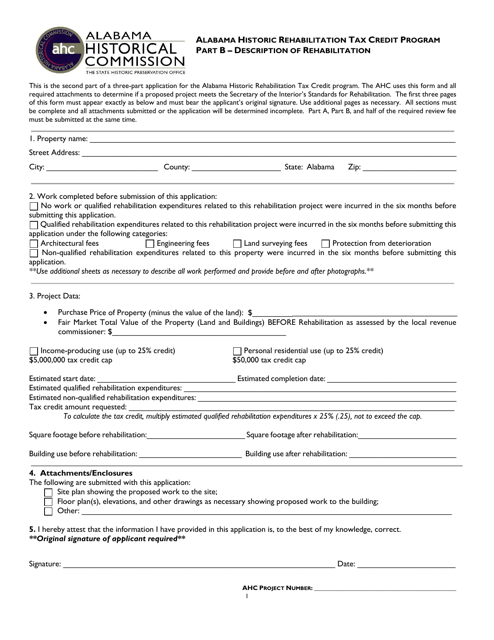

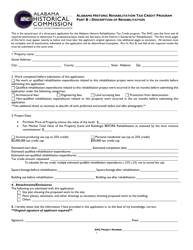

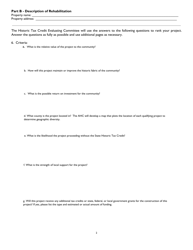

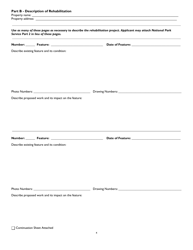

Part B Description of Rehabilitation - Alabama Historic Rehabilitation Tax Credit Program - Alabama

What Is Part B?

This is a legal form that was released by the Alabama Historical Commission - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

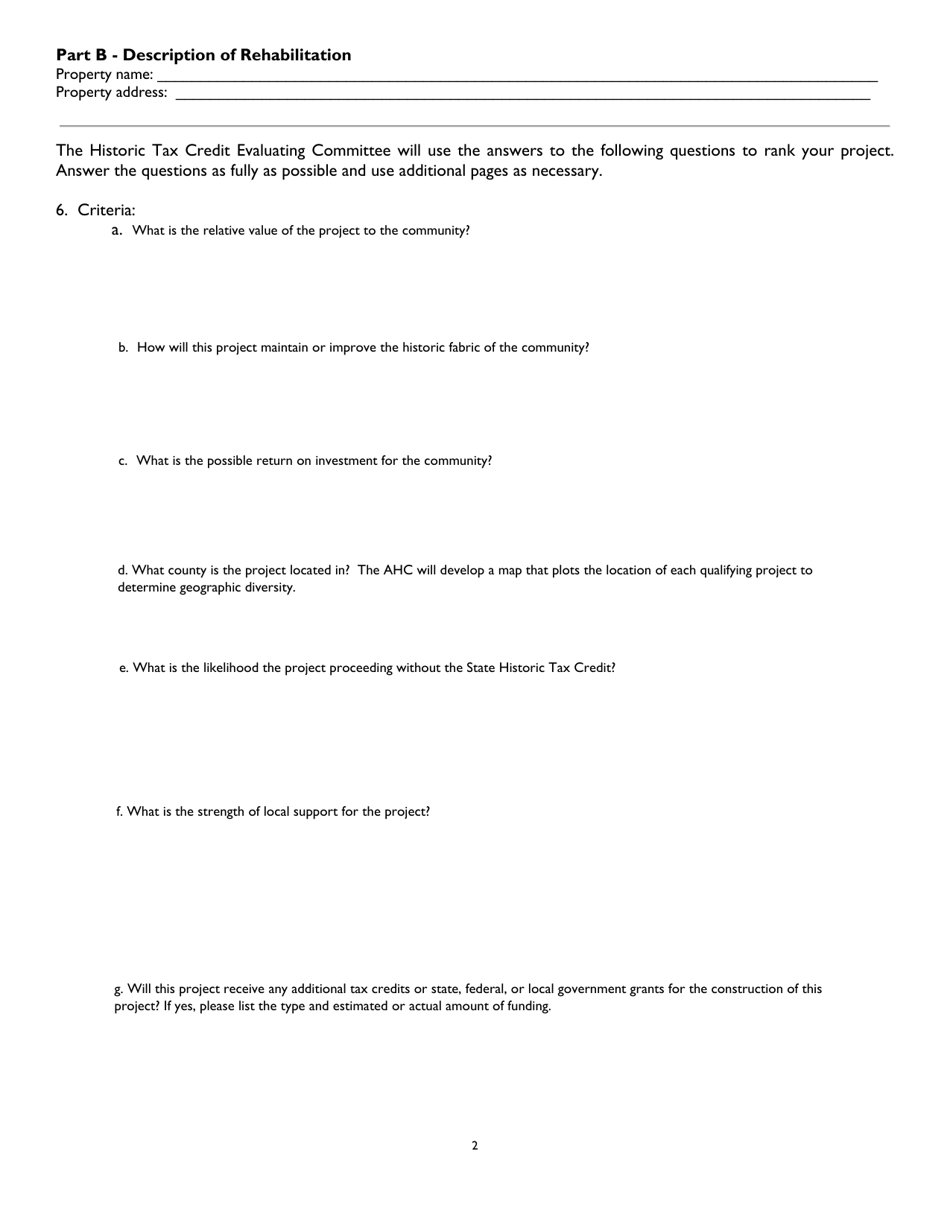

Q: What is the Alabama Historic Rehabilitation Tax Credit Program?

A: The Alabama Historic RehabilitationTax Credit Program is a program that provides tax credits to individuals and businesses who rehabilitate historic buildings in Alabama.

Q: How does the program work?

A: The program allows eligible property owners to receive tax credits equal to a percentage of the qualified rehabilitation expenses incurred for the restoration of a historic building.

Q: Who is eligible for the program?

A: Both individuals and businesses that own historic buildings in Alabama and undertake qualified rehabilitation projects may be eligible for the tax credits.

Q: What are qualified rehabilitation expenses?

A: Qualified rehabilitation expenses include costs related to the physical restoration of the historic building, such as construction, renovation, and preservation expenses.

Q: What is the benefit of participating in the program?

A: By participating in the program, property owners can receive tax credits that can be used to offset their state tax liability.

Q: Are there any limitations or restrictions to the program?

A: Yes, there are certain limitations and restrictions, such as a minimum qualified rehabilitation expense threshold, a maximum amount of tax credits that can be claimed, and compliance with Secretary of the Interior’s Standards for Rehabilitation.

Form Details:

- The latest edition provided by the Alabama Historical Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Part B by clicking the link below or browse more documents and templates provided by the Alabama Historical Commission.