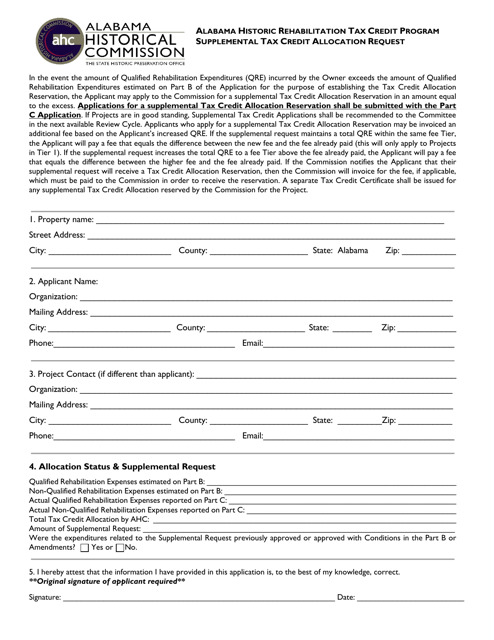

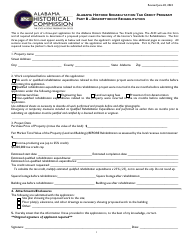

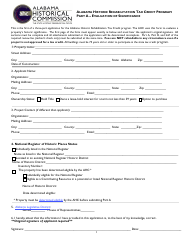

Supplemental Tax Credit Allocation Request - Alabama Historic Rehabilitation Tax Credit Program - Alabama

Supplemental Tax Credit Allocation Request - Alabama Historic Rehabilitation Tax Credit Program is a legal document that was released by the Alabama Historical Commission - a government authority operating within Alabama.

FAQ

Q: What is the Supplemental Tax Credit Allocation Request?

A: The Supplemental Tax Credit Allocation Request is a document used to request additional tax credits under the Alabama Historic RehabilitationTax Credit Program.

Q: What is the Alabama Historic Rehabilitation Tax Credit Program?

A: The Alabama Historic Rehabilitation Tax Credit Program is a program that provides tax credits to individuals or businesses who rehabilitate historic properties in Alabama.

Q: How can I obtain the Supplemental Tax Credit Allocation Request?

A: You can obtain the Supplemental Tax Credit Allocation Request form from the Alabama Department of Revenue.

Q: Who is eligible to request supplemental tax credits?

A: Individuals or businesses who have already received tax credits under the Alabama Historic Rehabilitation Tax Credit Program and need additional credits can request supplemental tax credits.

Q: What is the purpose of requesting supplemental tax credits?

A: The purpose of requesting supplemental tax credits is to obtain additional tax credits beyond the initial allocation, allowing for further rehabilitation of historic properties.

Q: Are there any requirements for requesting supplemental tax credits?

A: Yes, there are certain requirements that must be met, including demonstrating the need for additional tax credits and providing documentation of the rehabilitation work.

Q: Is there a deadline for submitting the Supplemental Tax Credit Allocation Request?

A: Yes, there is a deadline for submitting the Supplemental Tax Credit Allocation Request. The specific deadline will be stated in the program guidelines or instructions.

Q: What happens after submitting the Supplemental Tax Credit Allocation Request?

A: After submitting the Supplemental Tax Credit Allocation Request, the request will be reviewed by the Alabama Department of Revenue, and if approved, additional tax credits will be allocated.

Q: Can I submit multiple Supplemental Tax Credit Allocation Requests?

A: Yes, you can submit multiple Supplemental Tax Credit Allocation Requests if you require additional tax credits for multiple rehabilitation projects.

Q: Are there any limitations on the amount of supplemental tax credits that can be requested?

A: Yes, there may be limitations on the amount of supplemental tax credits that can be requested, depending on the available funding and program guidelines.

Form Details:

- The latest edition currently provided by the Alabama Historical Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Historical Commission.