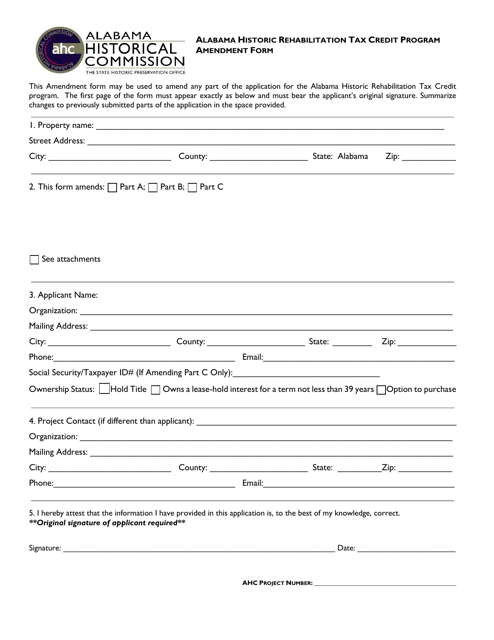

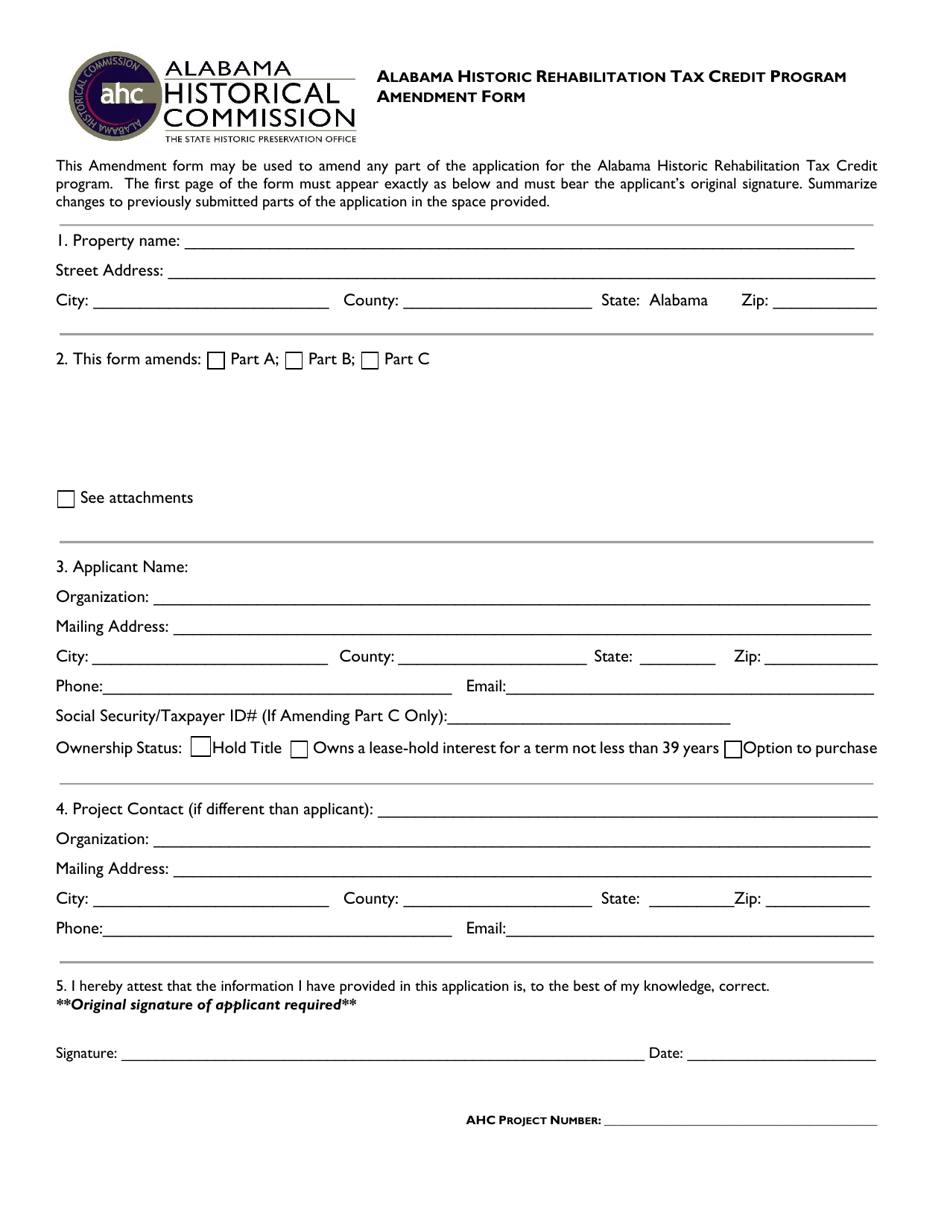

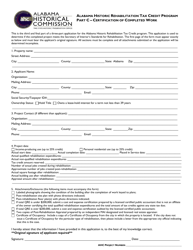

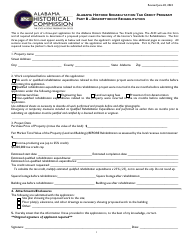

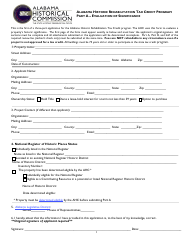

Alabama Historic Rehabilitation Tax Credit Program Amendment Form - Alabama

Alabama Historic Rehabilitation Tax Credit Program Amendment Form is a legal document that was released by the Alabama Historical Commission - a government authority operating within Alabama.

FAQ

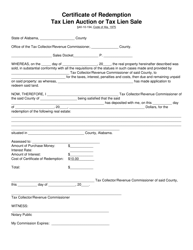

Q: What is the Alabama Historic Rehabilitation Tax Credit Program?

A: The Alabama Historic RehabilitationTax Credit Program is a program that offers tax credits to individuals and businesses who rehabilitate historic properties in Alabama.

Q: What is the purpose of the Amendment Form?

A: The purpose of the Amendment Form is to request changes or updates to a previously submitted application for the Alabama Historic Rehabilitation Tax Credit Program.

Q: Who is eligible for the Alabama Historic Rehabilitation Tax Credit Program?

A: Both individuals and businesses are eligible for the Alabama Historic Rehabilitation Tax Credit Program.

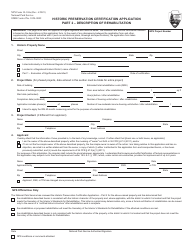

Q: What types of properties are eligible for the tax credit?

A: Properties that are listed on the National Register of Historic Places, contributing structures within a designated historic district, or properties that are deemed eligible for listing on the National Register are eligible for the tax credit.

Q: What expenses are eligible for the tax credit?

A: Expenses related to the rehabilitation and preservation of a historic property, such as construction costs, architectural fees, and engineering fees, are eligible for the tax credit.

Q: How much is the tax credit?

A: The tax credit is equal to 25% of qualified rehabilitation expenses for properties located in non-targeted areas and 35% for properties located in targeted areas.

Q: What is the maximum amount of tax credits available?

A: The maximum amount of tax credits that can be awarded for a single project is $5 million.

Q: How does the application process work?

A: Applicants must first submit a Pre-Application to determine eligibility, and if approved, they can then submit a Full Application with detailed project information.

Q: Is there a deadline to submit the Amendment Form?

A: Yes, the Amendment Form must be submitted within 90 days of the change or update being requested.

Form Details:

- The latest edition currently provided by the Alabama Historical Commission;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Historical Commission.