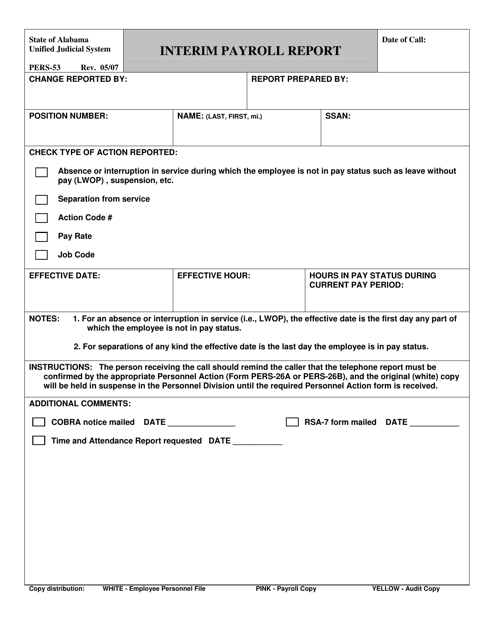

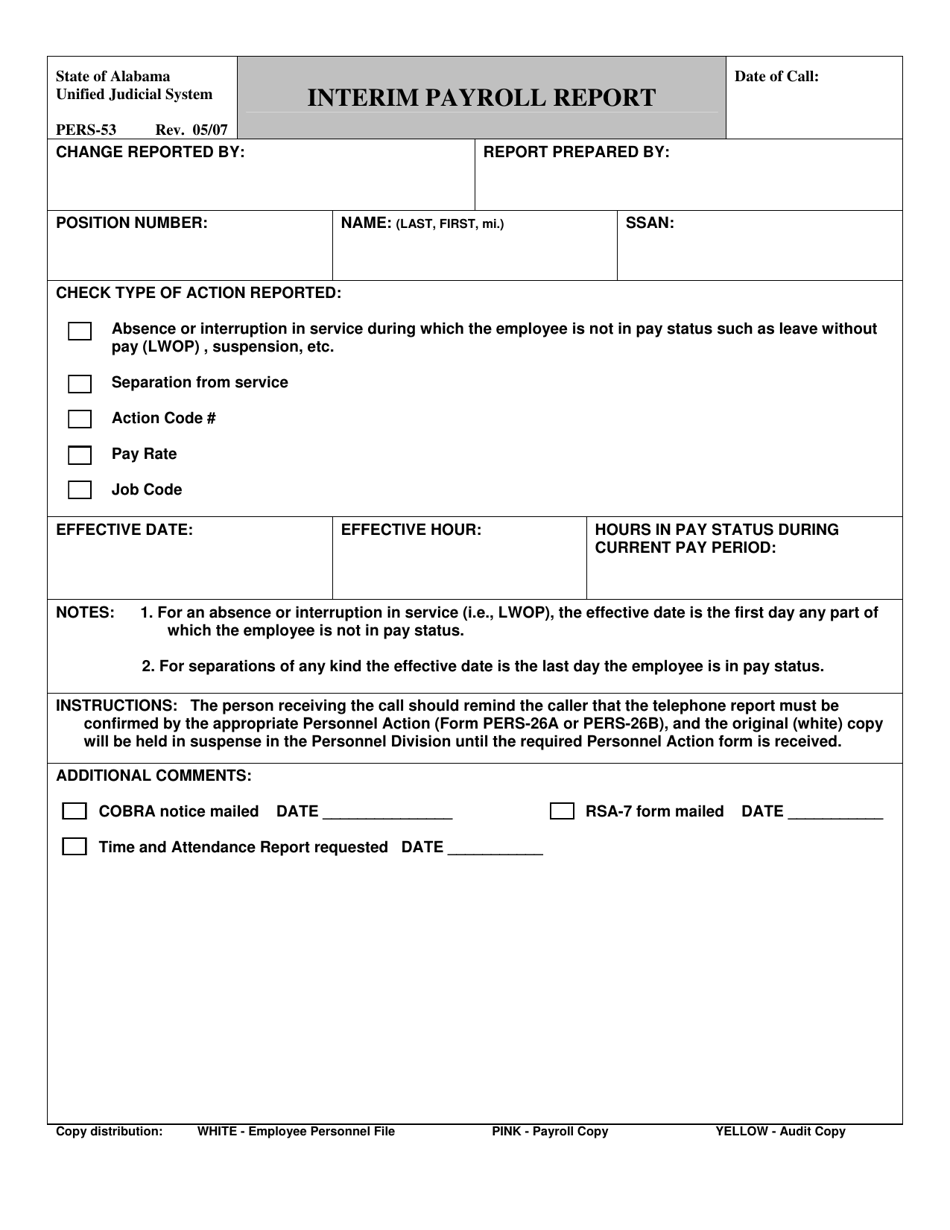

This version of the form is not currently in use and is provided for reference only. Download this version of

Form PERS-53

for the current year.

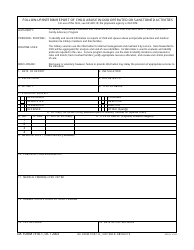

Form PERS-53 Interim Payroll Report - Alabama

What Is Form PERS-53?

This is a legal form that was released by the Alabama Judicial System - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form PERS-53 Interim Payroll Report?

A: The Form PERS-53 Interim Payroll Report is a payroll report specific to the Alabama Public Employees' Retirement System (PERS).

Q: Who needs to fill out the Form PERS-53 Interim Payroll Report?

A: Employers participating in the Alabama PERS need to fill out the Form PERS-53 Interim Payroll Report.

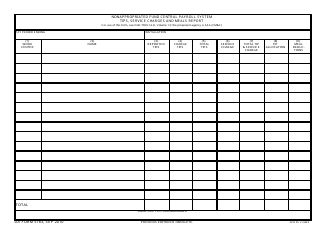

Q: What information is required on the Form PERS-53 Interim Payroll Report?

A: The Form PERS-53 Interim Payroll Report requires information such as employee names, Social Security numbers, gross earnings, contributions to retirement accounts, and other relevant payroll data.

Q: When is the Form PERS-53 Interim Payroll Report due?

A: The due date for the Form PERS-53 Interim Payroll Report varies and is determined by the Alabama PERS. It is typically due monthly or quarterly.

Q: Are there any penalties for not filing the Form PERS-53 Interim Payroll Report?

A: Failure to file the Form PERS-53 Interim Payroll Report or filing it late may result in penalties or interest charges imposed by the Alabama PERS.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the Alabama Judicial System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PERS-53 by clicking the link below or browse more documents and templates provided by the Alabama Judicial System.