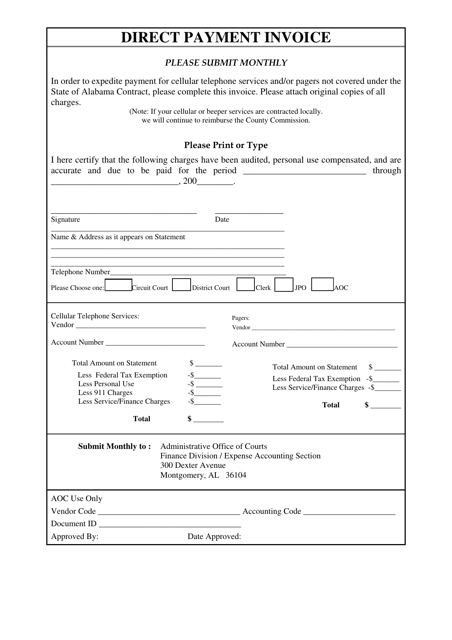

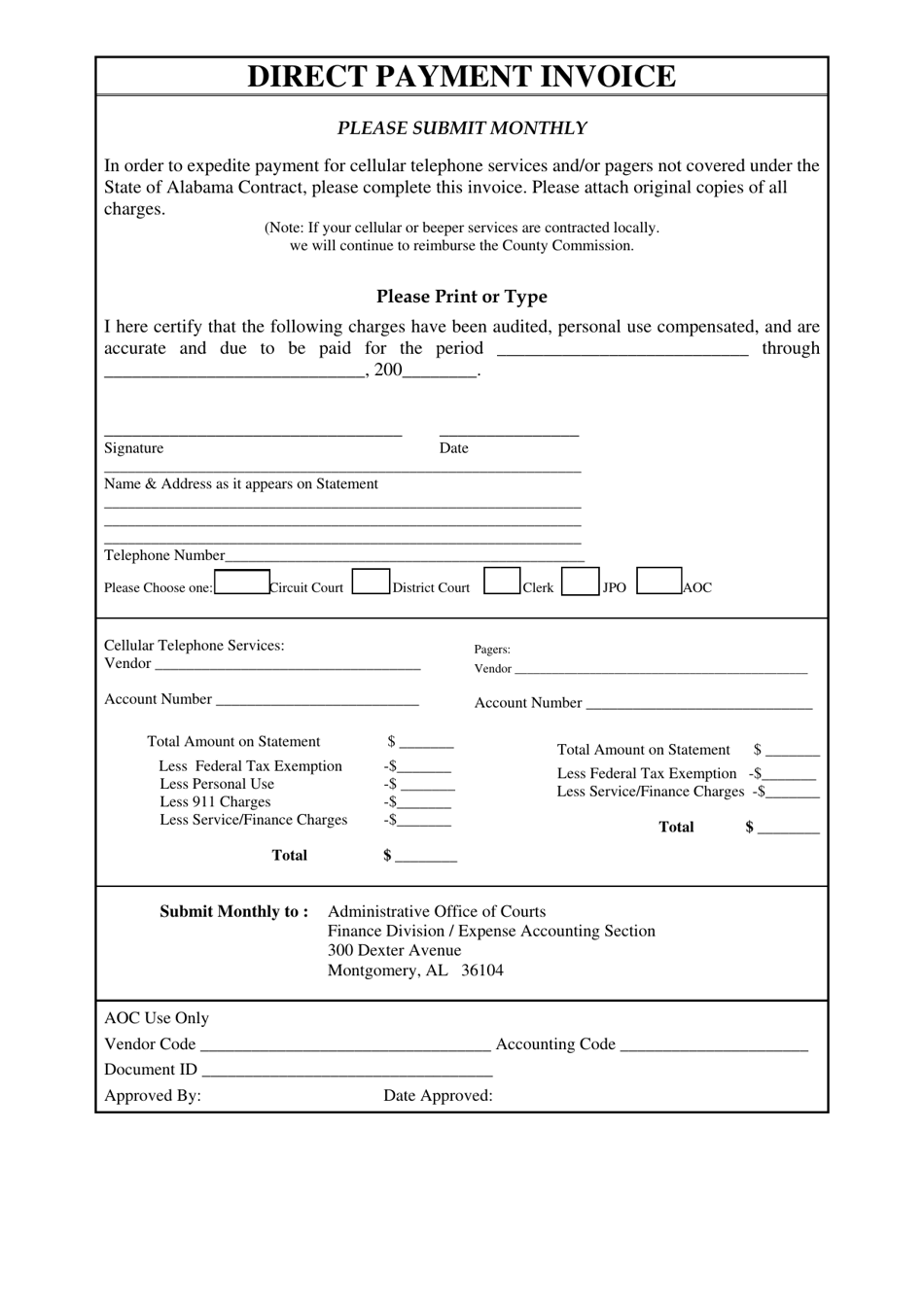

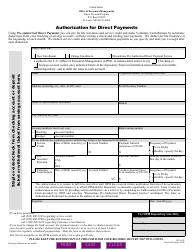

Direct Payment Invoice - Alabama

Direct Payment Invoice is a legal document that was released by the Alabama Judicial System - a government authority operating within Alabama.

FAQ

Q: What is a direct payment invoice?

A: A direct payment invoice is a type of invoice used in Alabama to directly pay taxes.

Q: How does a direct payment invoice work?

A: A direct payment invoice allows businesses to pay their state sales and use tax directly to the Alabama Department of Revenue.

Q: Who can use a direct payment invoice?

A: Businesses registered for sales and use tax can use a direct payment invoice in Alabama.

Q: What are the benefits of using a direct payment invoice?

A: Using a direct payment invoice allows businesses to streamline their tax payment process and avoid penalties for late or incorrect payments.

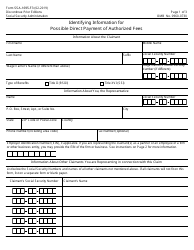

Q: Are there any fees associated with using a direct payment invoice?

A: No, there are no additional fees for using a direct payment invoice in Alabama.

Q: Can I use a direct payment invoice for other types of taxes in Alabama?

A: No, a direct payment invoice can only be used for state sales and use tax in Alabama.

Q: Is a direct payment invoice valid for filing sales and use tax returns?

A: No, a direct payment invoice is not valid for filing sales and use tax returns. It is solely for making direct tax payments.

Q: Can I make partial payments using a direct payment invoice?

A: Yes, businesses can make partial payments using a direct payment invoice in Alabama.

Form Details:

- The latest edition currently provided by the Alabama Judicial System;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Judicial System.