This version of the form is not currently in use and is provided for reference only. Download this version of

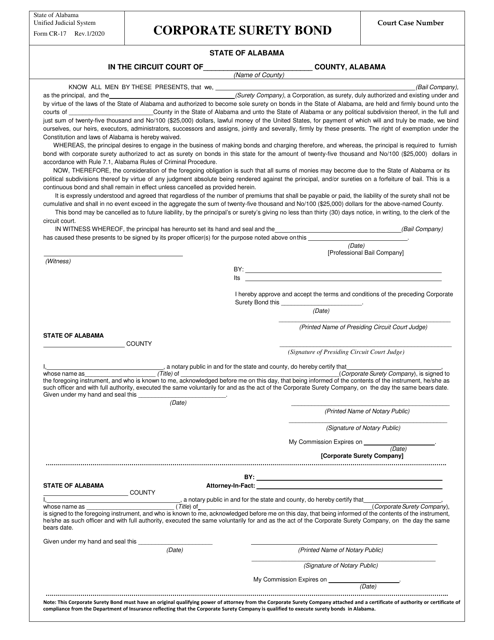

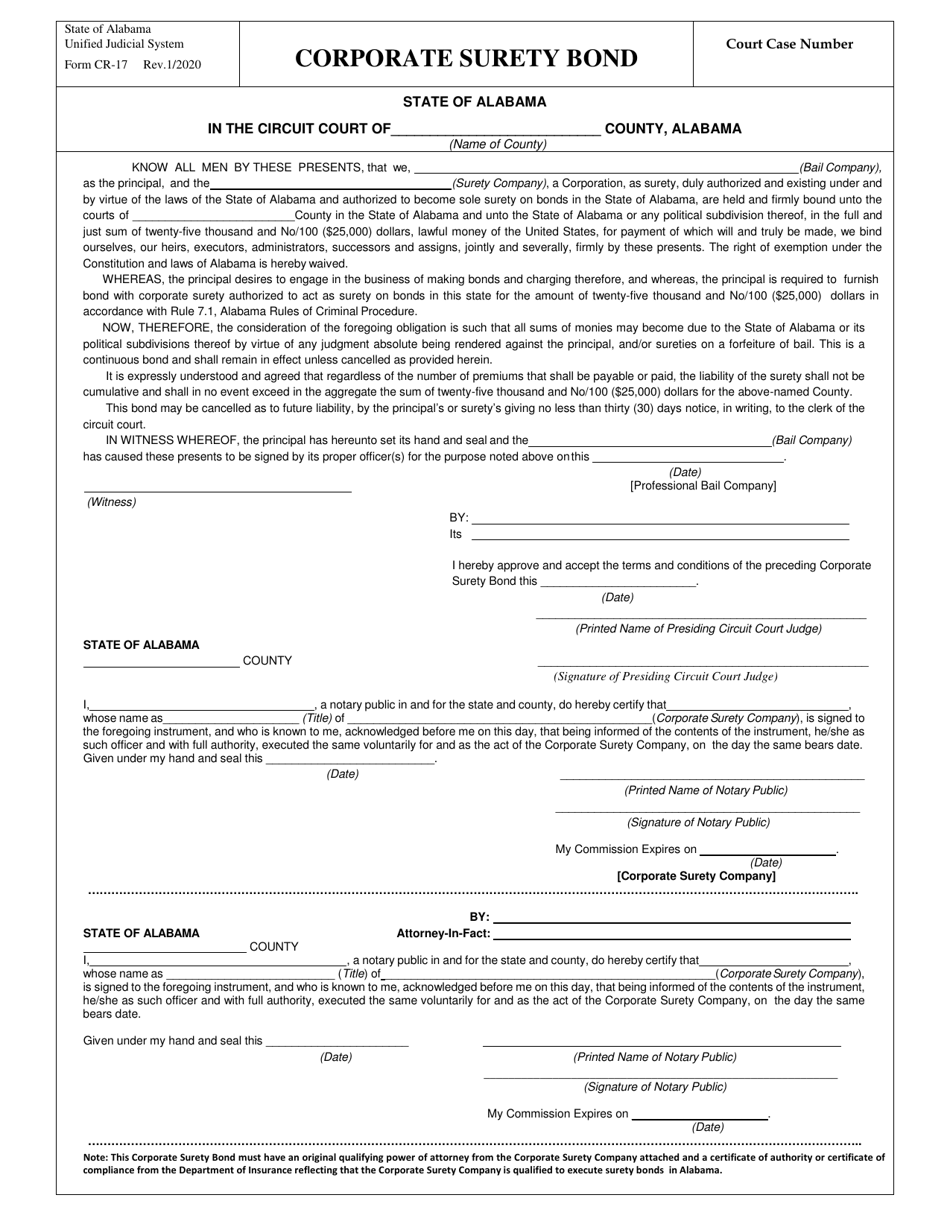

Form CR-17

for the current year.

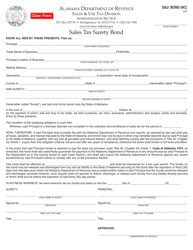

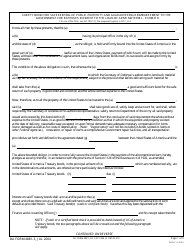

Form CR-17 Corporate Surety Bond - Alabama

What Is Form CR-17?

This is a legal form that was released by the Alabama Circuit Courts - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CR-17 Corporate Surety Bond?

A: A CR-17 Corporate Surety Bond is a type of bond required in Alabama for certain businesses as a form of financial guarantee.

Q: What is the purpose of a CR-17 Corporate Surety Bond?

A: The purpose of a CR-17 Corporate Surety Bond is to protect consumers by providing a financial guarantee that the bonded business will fulfill their obligations.

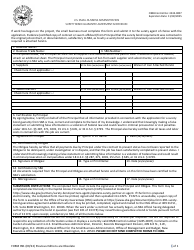

Q: Who needs to file a CR-17 Corporate Surety Bond?

A: Certain types of businesses in Alabama, such as mortgage brokers and money transmitters, are required to file a CR-17 Corporate Surety Bond.

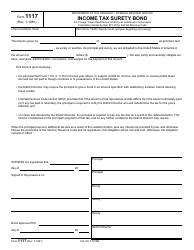

Q: How do I obtain a CR-17 Corporate Surety Bond?

A: To obtain a CR-17 Corporate Surety Bond, you need to contact a licensed surety bond provider who can guide you through the application and underwriting process.

Q: How much does a CR-17 Corporate Surety Bond cost?

A: The cost of a CR-17 Corporate Surety Bond varies depending on factors such as the bond amount and the applicant's creditworthiness. It is typically a percentage of the bond amount.

Q: What happens if a bonded business fails to meet its obligations?

A: If a bonded business fails to meet its obligations, individuals or entities that have been harmed by the business's actions can file a claim against the CR-17 Corporate Surety Bond to seek compensation.

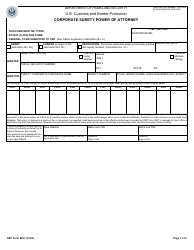

Q: Does a CR-17 Corporate Surety Bond expire?

A: Yes, a CR-17 Corporate Surety Bond has an expiration date. It needs to be renewed periodically to remain active and valid.

Q: Can I cancel a CR-17 Corporate Surety Bond?

A: A CR-17 Corporate Surety Bond cannot be canceled by the bondholder. Only the surety bond provider can cancel the bond in certain situations.

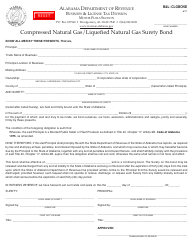

Q: What is the penalty for not having a CR-17 Corporate Surety Bond when required?

A: The penalty for not having a CR-17 Corporate Surety Bond when required can vary depending on the specific laws and regulations in Alabama. It can result in fines, license suspension, or other legal consequences.

Q: Can I get a CR-17 Corporate Surety Bond with bad credit?

A: It may be more challenging to obtain a CR-17 Corporate Surety Bond with bad credit, but it is still possible. The bond premium may be higher, and additional requirements or collateral may be necessary.

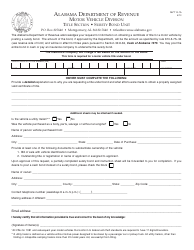

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Alabama Circuit Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-17 by clicking the link below or browse more documents and templates provided by the Alabama Circuit Courts.