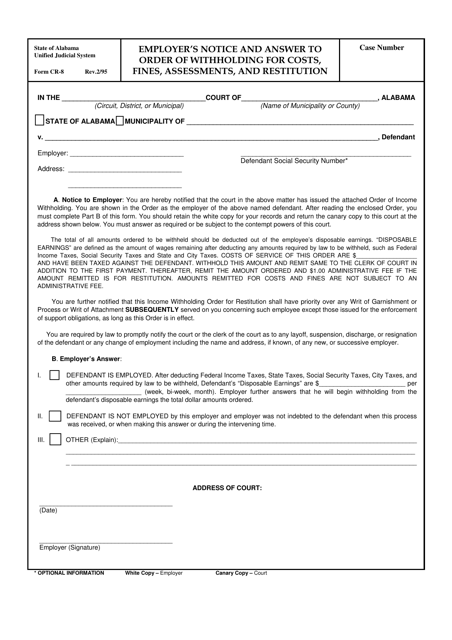

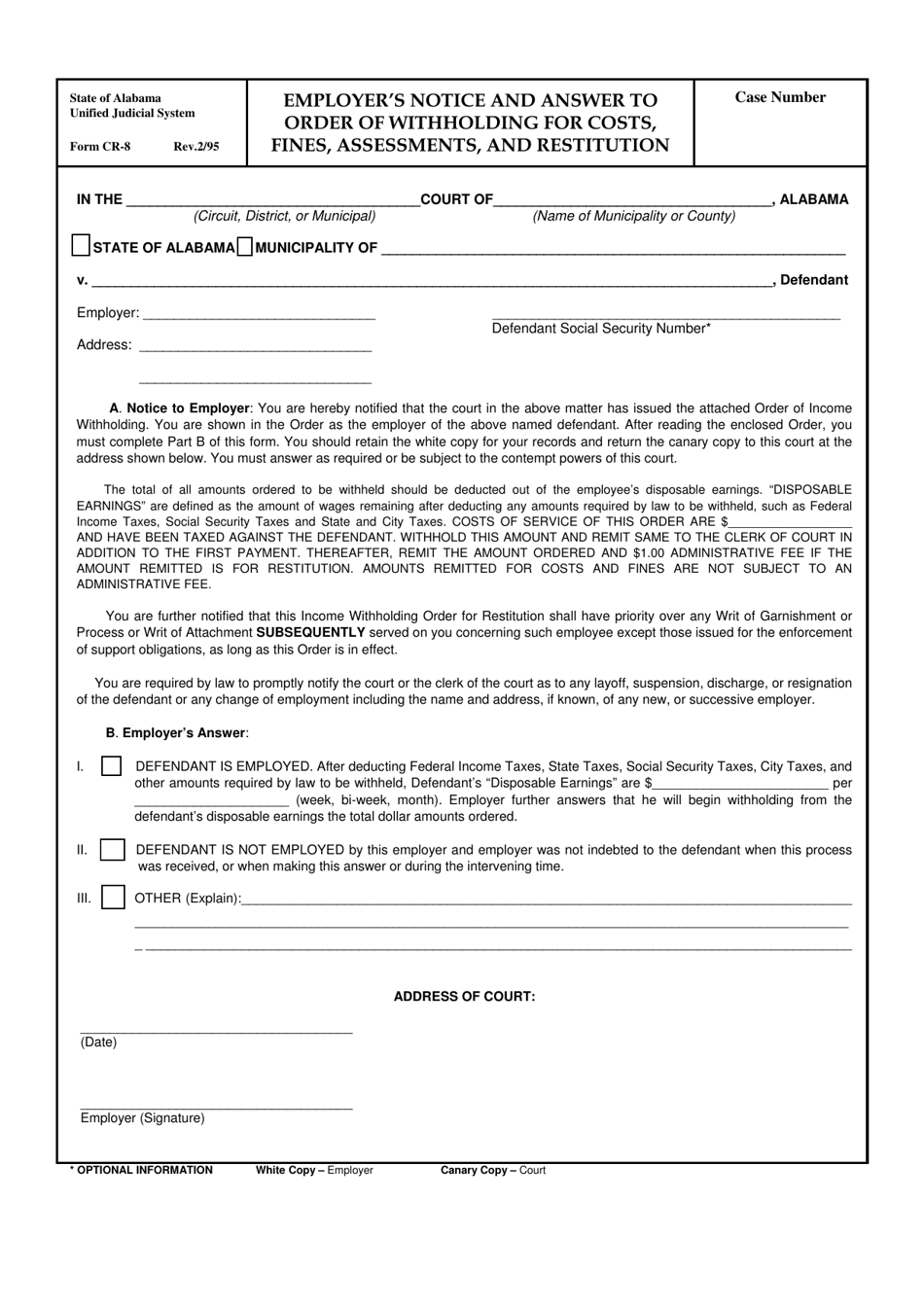

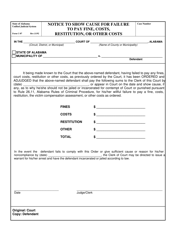

Form CR-8 Employer's Notice and Answer to Order of Withholding for Costs, Fines, Assessments, and Restitution - Alabama

What Is Form CR-8?

This is a legal form that was released by the Alabama Judicial System - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR-8?

A: Form CR-8 is the Employer's Notice and Answer to Order of Withholding for Costs, Fines, Assessments, and Restitution in the state of Alabama.

Q: What is the purpose of Form CR-8?

A: The purpose of Form CR-8 is for employers to notify the court of the withholding of an employee's wages to satisfy costs, fines, assessments, and restitution.

Q: Who should fill out Form CR-8?

A: Employers should fill out Form CR-8.

Q: What information is required on Form CR-8?

A: Form CR-8 requires information such as the employee's name, Social Security number, amount of the order, and the employer's name and address.

Q: Is there a deadline for submitting Form CR-8?

A: Yes, Form CR-8 must be submitted within 15 days after receipt of the order of withholding.

Q: What should I do if there are changes in the employee's employment status?

A: If there are changes in the employee's employment status, such as termination or change of employer, you should promptly notify the court.

Q: Can an employer refuse to withhold wages?

A: No, an employer cannot refuse to withhold wages if ordered by the court.

Q: What are the consequences of non-compliance with Form CR-8?

A: Non-compliance with Form CR-8 may result in penalties and sanctions imposed by the court.

Form Details:

- Released on February 1, 1995;

- The latest edition provided by the Alabama Judicial System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR-8 by clicking the link below or browse more documents and templates provided by the Alabama Judicial System.