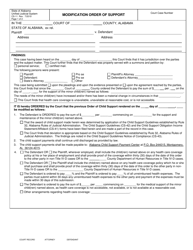

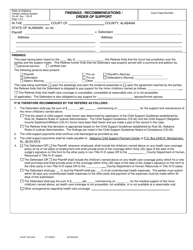

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CS-35

for the current year.

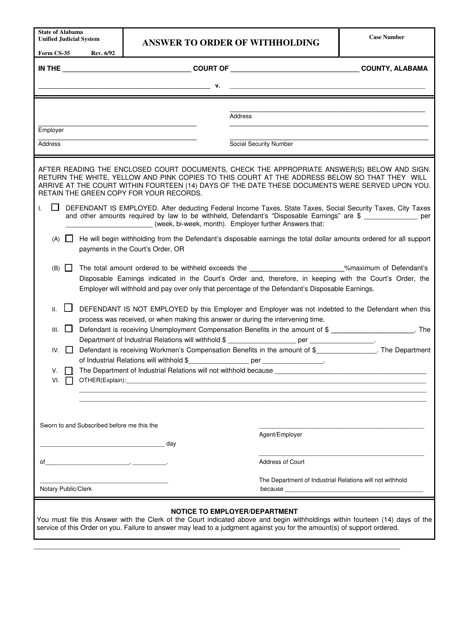

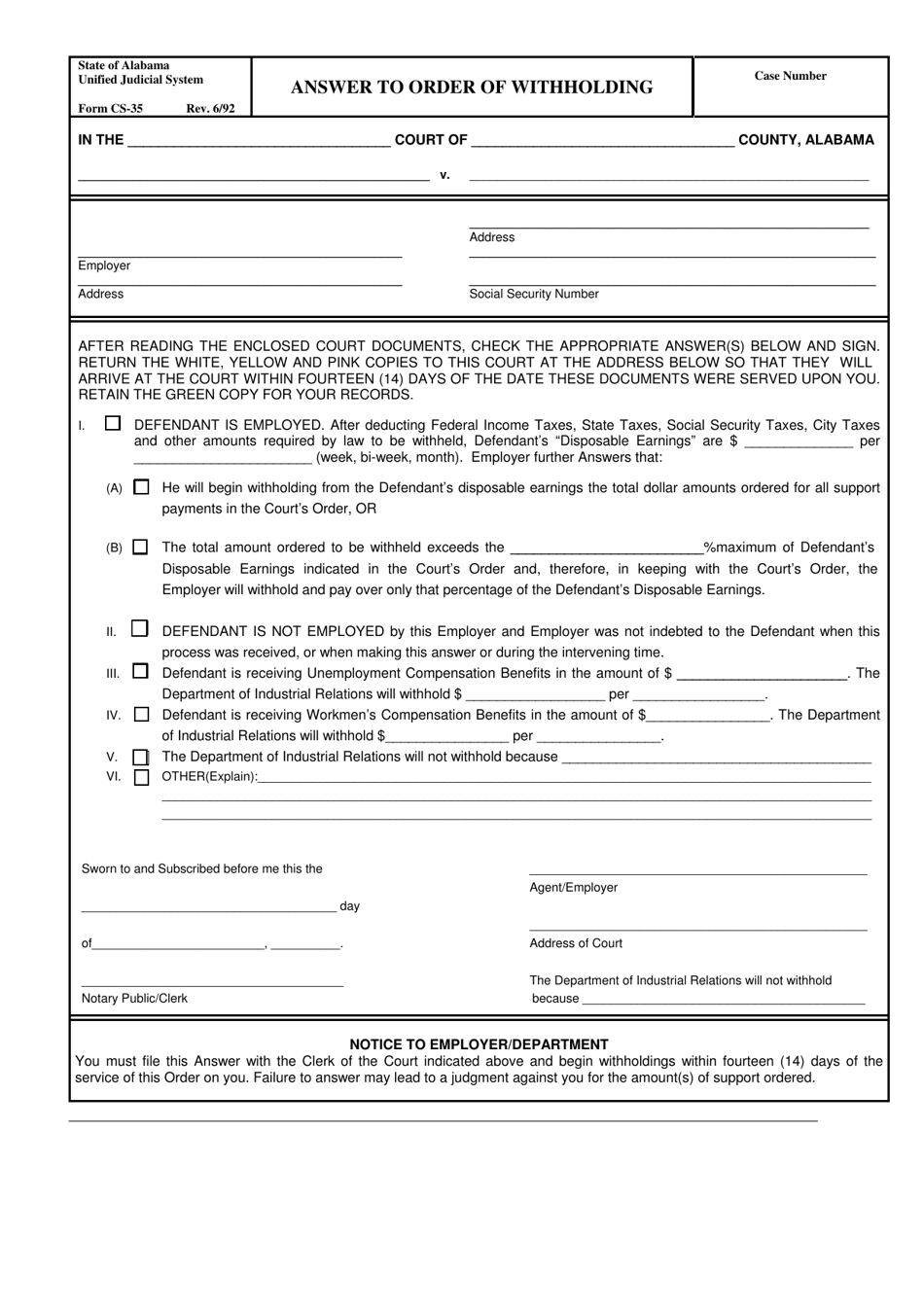

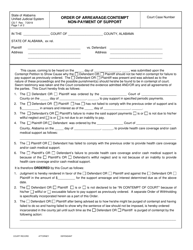

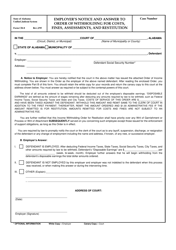

Form CS-35 Answer to Order of Withholding - Alabama

What Is Form CS-35?

This is a legal form that was released by the Alabama Judicial System - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

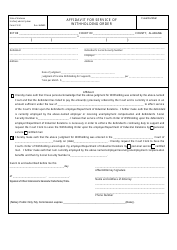

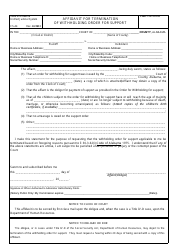

Q: What is Form CS-35?

A: Form CS-35 is the form used to provide the answer to an Order of Withholding in Alabama.

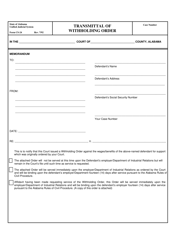

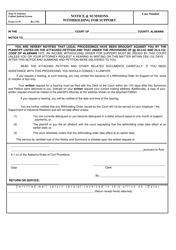

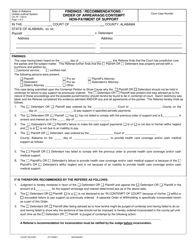

Q: What is an Order of Withholding?

A: An Order of Withholding is a legal document issued by a court that requires an employer to withhold a certain amount of an employee's wages for the payment of a debt, such as child support or a judgment.

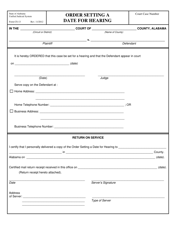

Q: When should Form CS-35 be completed?

A: Form CS-35 should be completed within 7 days of receiving the Order of Withholding.

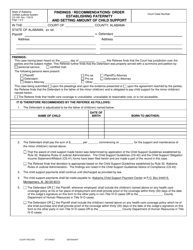

Q: What information is needed to complete Form CS-35?

A: To complete Form CS-35, you will need information such as the employee's name, social security number, employer's name and address, and the amount to be withheld.

Q: What happens after submitting Form CS-35?

A: After submitting Form CS-35, the employer is required to withhold the specified amount from the employee's wages and send it to the appropriate recipient as instructed by the court.

Q: What are the consequences of not complying with an Order of Withholding?

A: Failure to comply with an Order of Withholding can result in penalties, fines, or legal consequences for the employer.

Q: Can an employee challenge an Order of Withholding?

A: Yes, an employee can challenge an Order of Withholding by filing a motion with the court and presenting evidence to support their claim.

Q: Is Form CS-35 specific to Alabama?

A: Yes, Form CS-35 is specific to Alabama and is not used in other states.

Form Details:

- Released on June 1, 1992;

- The latest edition provided by the Alabama Judicial System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CS-35 by clicking the link below or browse more documents and templates provided by the Alabama Judicial System.