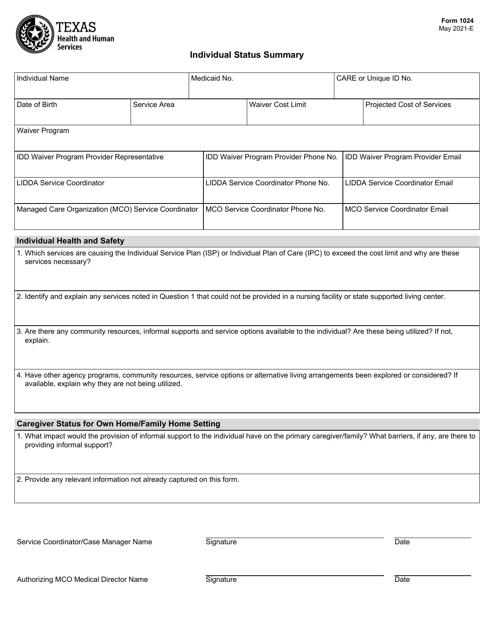

Form 1024 Individual Status Summary - Texas

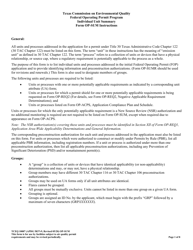

What Is Form 1024?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1024?

A: Form 1024 is used to apply for recognition of exemption under section 501(c)(4) or (c)(7) for social welfare organizations or clubs.

Q: What is the purpose of Form 1024?

A: The purpose of Form 1024 is to seek exemption from federal income tax for social welfare organizations or clubs.

Q: Who should file Form 1024?

A: Social welfare organizations or clubs seeking exemption from federal income tax under section 501(c)(4) or (c)(7) should file Form 1024.

Q: What information is required on Form 1024?

A: Form 1024 requires information about the organization's activities, finances, governance, and compliance with the requirements for exemption.

Q: Are there any fees associated with filing Form 1024?

A: Yes, there is a user fee that must be paid when submitting Form 1024. The fee amount and payment instructions are included in the form instructions.

Q: How long does it take to process Form 1024?

A: The processing time for Form 1024 may vary, but the IRS aims to process the application within 90 days.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1024 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.