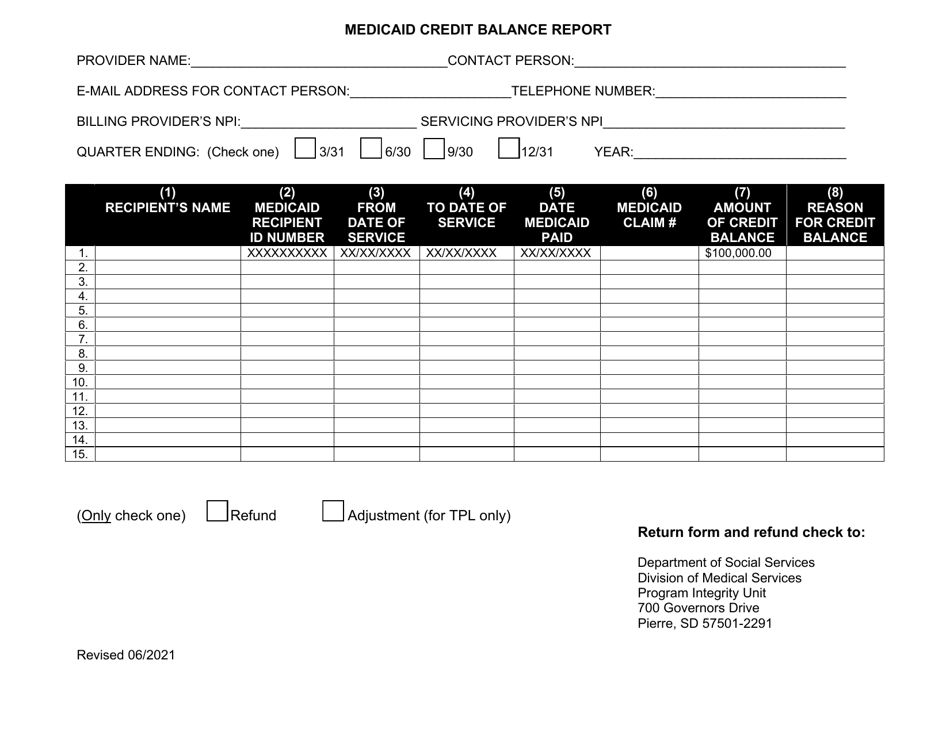

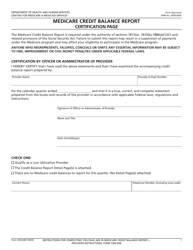

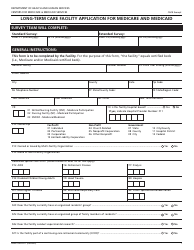

Form MS-116 Medicaid Credit Balance Report - South Dakota

What Is Form MS-116?

This is a legal form that was released by the South Dakota Department of Social Services - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form MS-116?

A: Form MS-116 is the Medicaid Credit Balance Report.

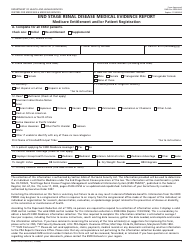

Q: Who is required to submit form MS-116?

A: Healthcare providers who have Medicaid credit balances in South Dakota are required to submit form MS-116.

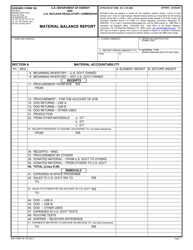

Q: What is a Medicaid credit balance?

A: A Medicaid credit balance refers to an amount that was reimbursed to a healthcare provider by Medicaid, but was later found to be an overpayment.

Q: How often should form MS-116 be submitted?

A: Form MS-116 should be submitted on a quarterly basis.

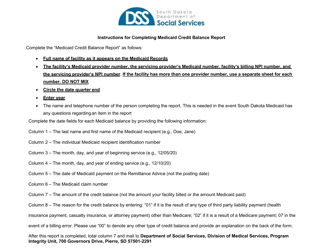

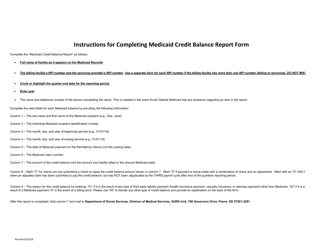

Q: What information is required to complete form MS-116?

A: To complete form MS-116, you will need to provide details about the credit balance, including the amount, date, and reason for the overpayment.

Q: Are there any deadlines for submitting form MS-116?

A: Yes, form MS-116 must be submitted within 30 days of the end of each quarter.

Q: What happens if I fail to submit form MS-116?

A: Failure to submit form MS-116 may result in penalties and fines.

Q: Can I submit form MS-116 electronically?

A: Yes, the South Dakota Department of Social Services allows electronic submission of form MS-116.

Q: Who can I contact for assistance with form MS-116?

A: For assistance with form MS-116, you can contact the South Dakota Department of Social Services.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the South Dakota Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MS-116 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Social Services.