This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2290

for the current year.

Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax Return

This document contains official instructions for IRS Form 2290 , Heavy Highway Vehicle Use Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2290 is available for download through this link.

FAQ

Q: What is IRS Form 2290?

A: IRS Form 2290 is a tax form used to report and pay the Heavy Highway Vehicle Use Tax.

Q: Who needs to file Form 2290?

A: Anyone who owns and operates a heavy highway vehicle weighing 55,000 pounds or more needs to file Form 2290.

Q: When is the deadline for filing Form 2290?

A: The deadline for filing Form 2290 is typically August 31st.

Q: How do I file Form 2290?

A: Form 2290 can be filed electronically through the IRS e-file system or by mail.

Q: What information do I need to file Form 2290?

A: You will need the Vehicle Identification Number (VIN) and Gross Weight of each vehicle, as well as your Employer Identification Number (EIN) and contact information.

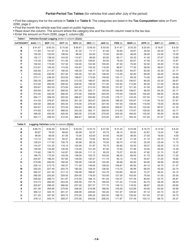

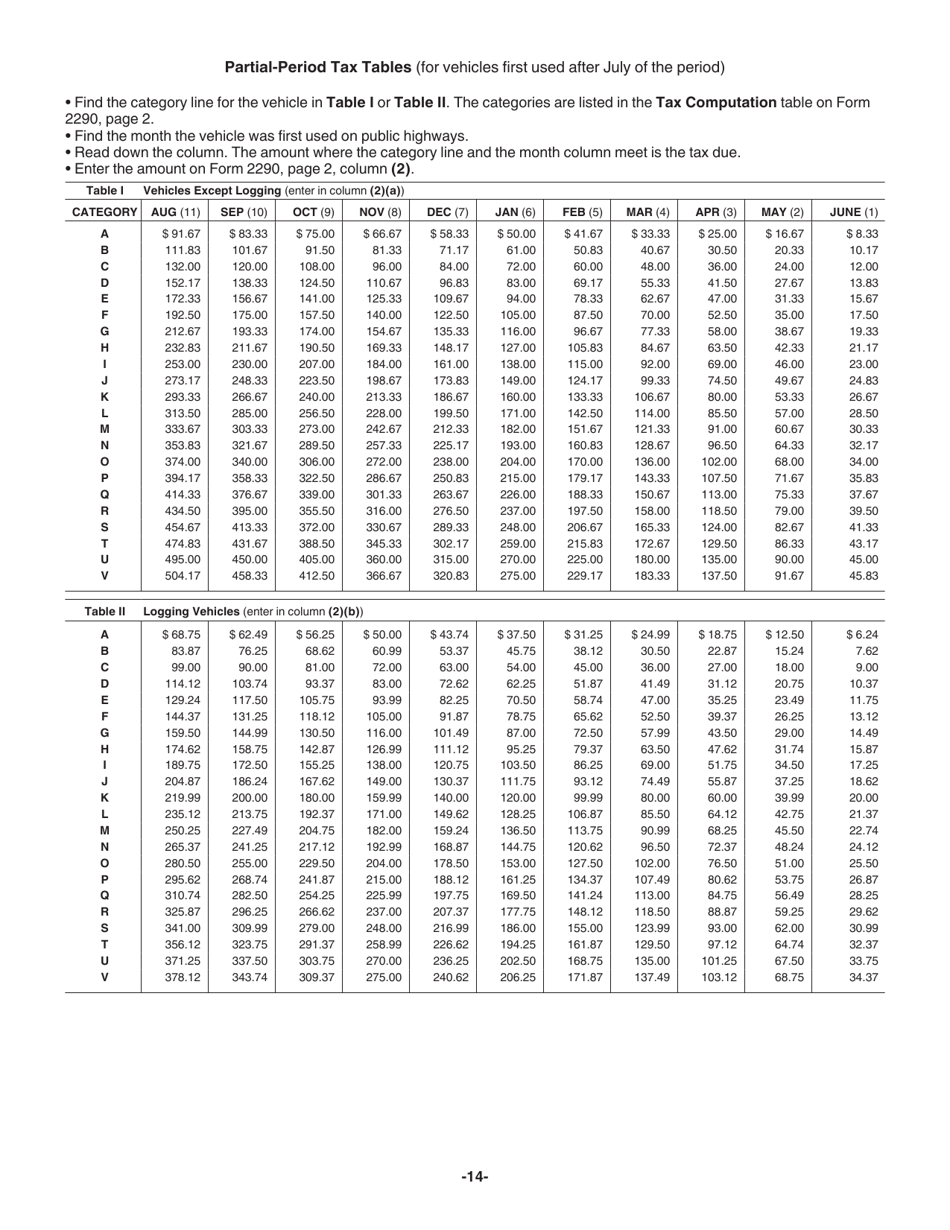

Q: How much is the Heavy Highway Vehicle Use Tax?

A: The tax amount is based on the weight of the vehicle, with a maximum tax of $550.

Q: Are there any exemptions to the Heavy Highway Vehicle Use Tax?

A: Yes, certain vehicles, such as agricultural vehicles or government-owned vehicles, may be exempt from the tax.

Q: What happens if I don't file Form 2290?

A: Failure to file Form 2290 or pay the tax can result in penalties and interest charges.

Q: Can I claim a refund if I overpaid the Heavy Highway Vehicle Use Tax?

A: Yes, you can claim a refund if you overpaid the tax or if the vehicle was sold or destroyed during the tax period.

Instruction Details:

- This 16-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.