This version of the form is not currently in use and is provided for reference only. Download this version of

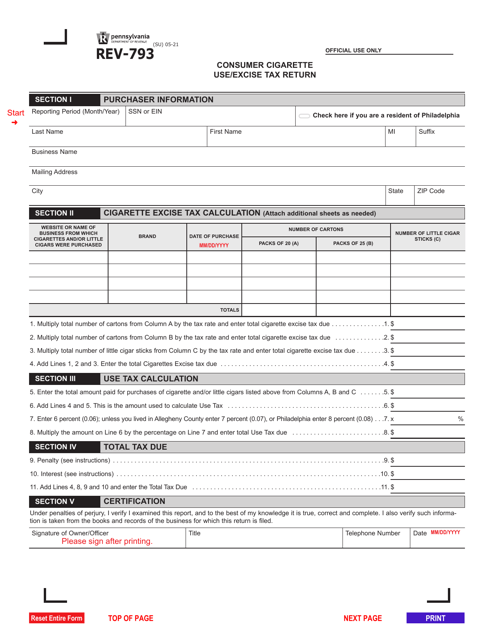

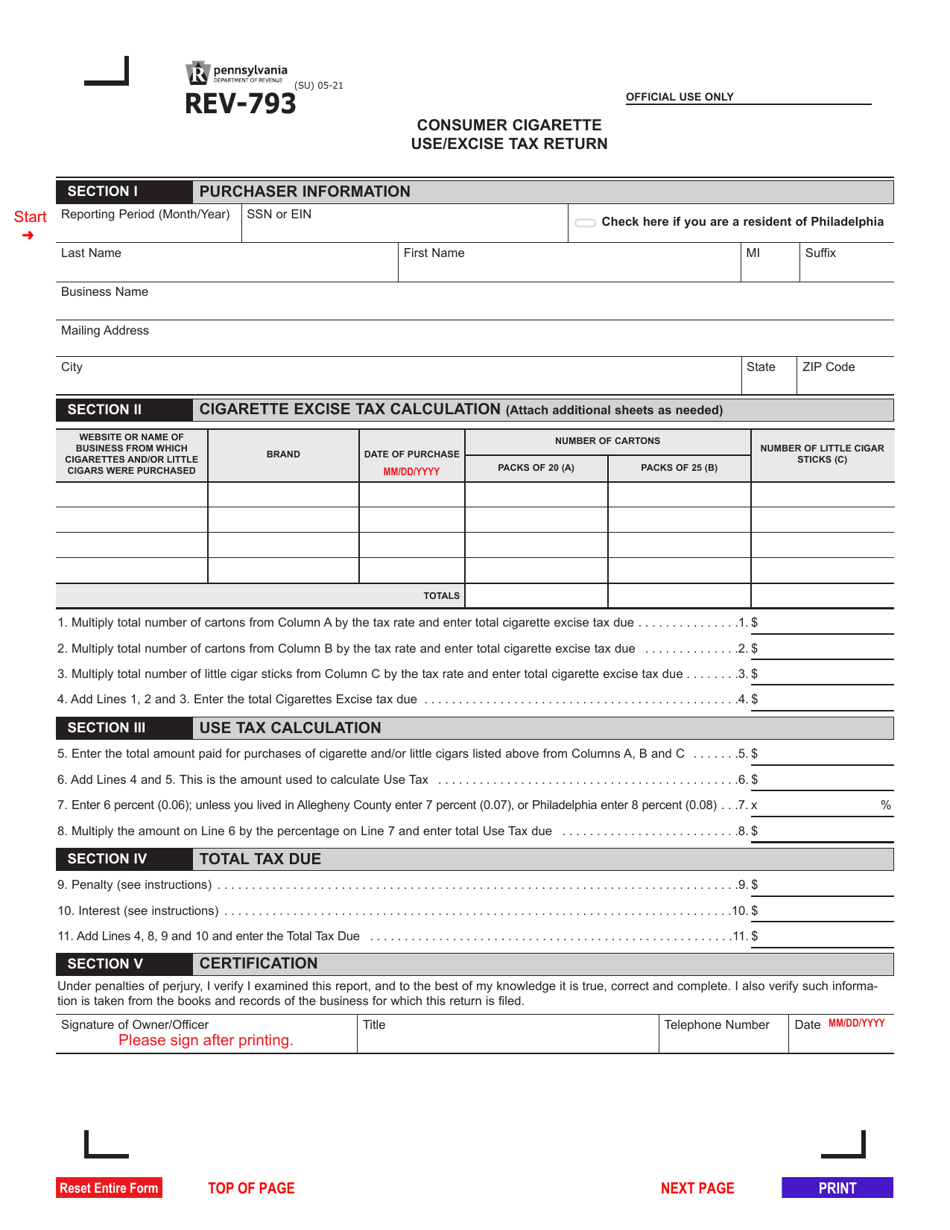

Form REV-793

for the current year.

Form REV-793 Consumer Cigarette Use / Excise Tax Return - Pennsylvania

What Is Form REV-793?

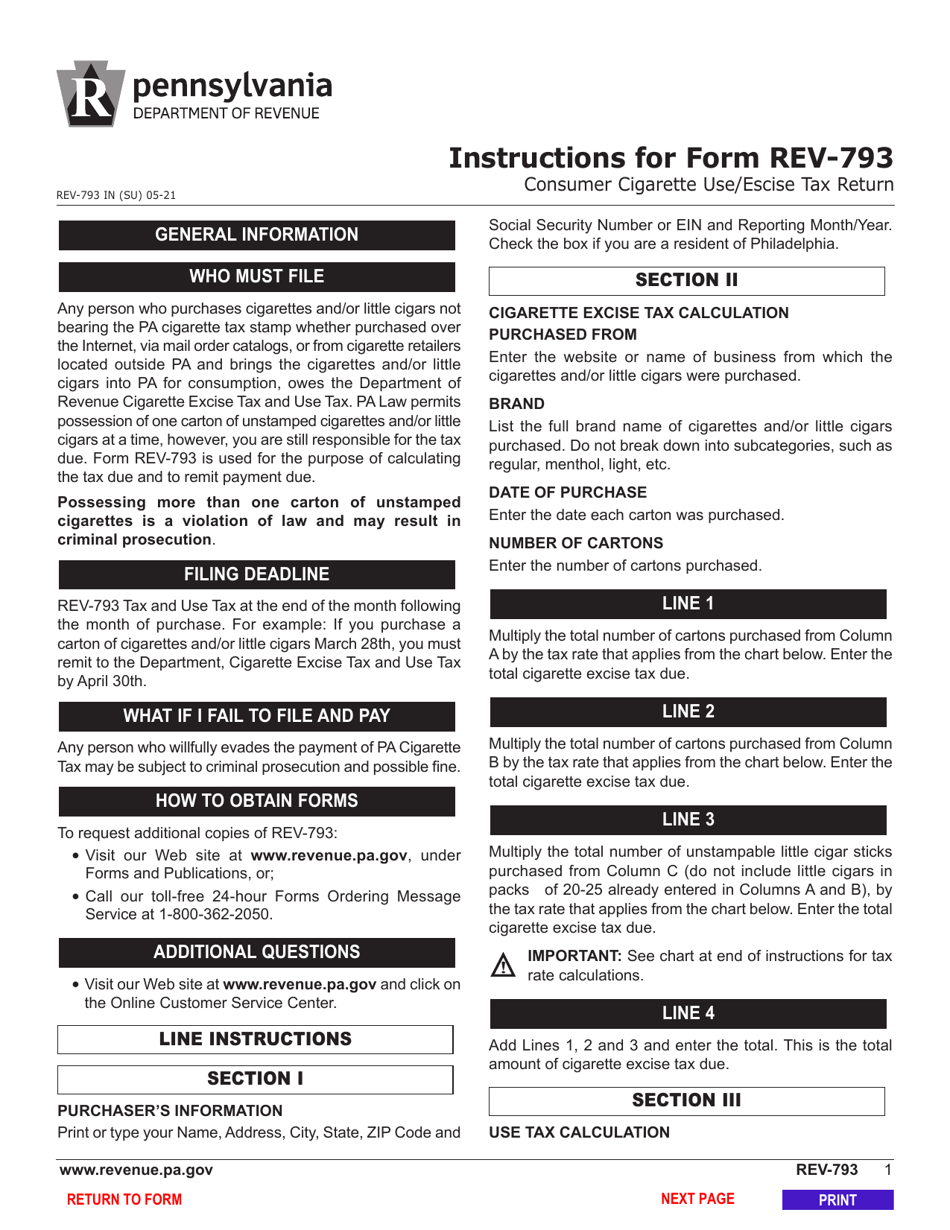

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-793?

A: Form REV-793 is the Consumer Cigarette Use/Excise Tax Return for Pennsylvania.

Q: Who is required to file Form REV-793?

A: Any individual or business that sells cigarettes in Pennsylvania is required to file Form REV-793.

Q: What is the purpose of Form REV-793?

A: The purpose of Form REV-793 is to report and remit the cigarette excise tax due to the state of Pennsylvania.

Q: How often is Form REV-793 filed?

A: Form REV-793 is filed on a monthly basis.

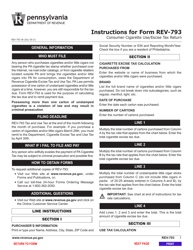

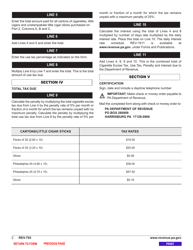

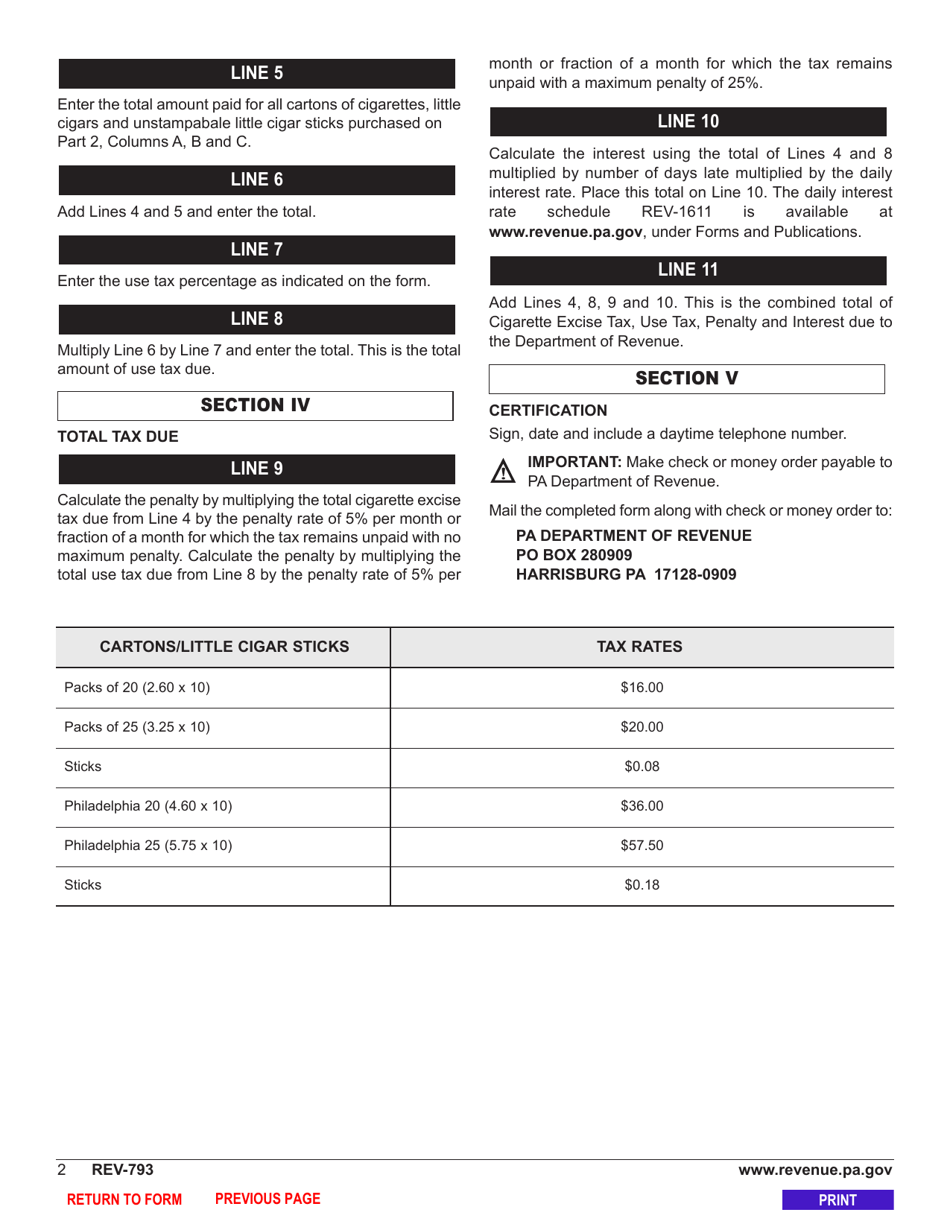

Q: What information is required on Form REV-793?

A: Form REV-793 requires information such as the number of cigarettes sold, the brand of cigarettes, and the amount of excise tax due.

Q: When is Form REV-793 due?

A: Form REV-793 is due on the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form REV-793?

A: Yes, there are penalties for not filing Form REV-793, including late filing penalties and interest on any unpaid tax.

Q: Can Form REV-793 be filed electronically?

A: Yes, Form REV-793 can be filed electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Q: Is Form REV-793 required for personal use of cigarettes?

A: No, Form REV-793 is not required for personal use of cigarettes. It is only required for businesses that sell cigarettes in Pennsylvania.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-793 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.