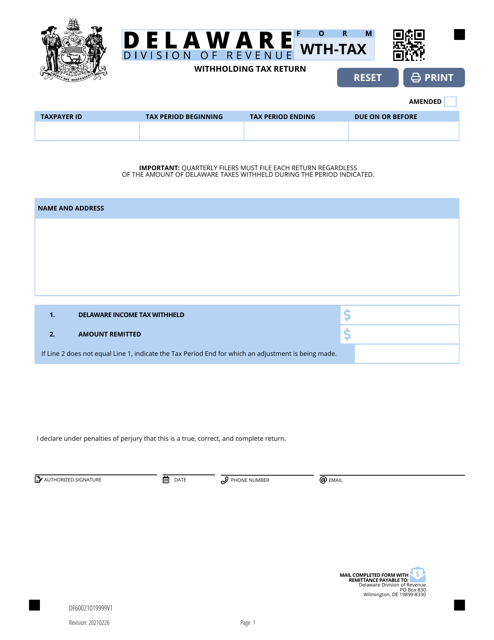

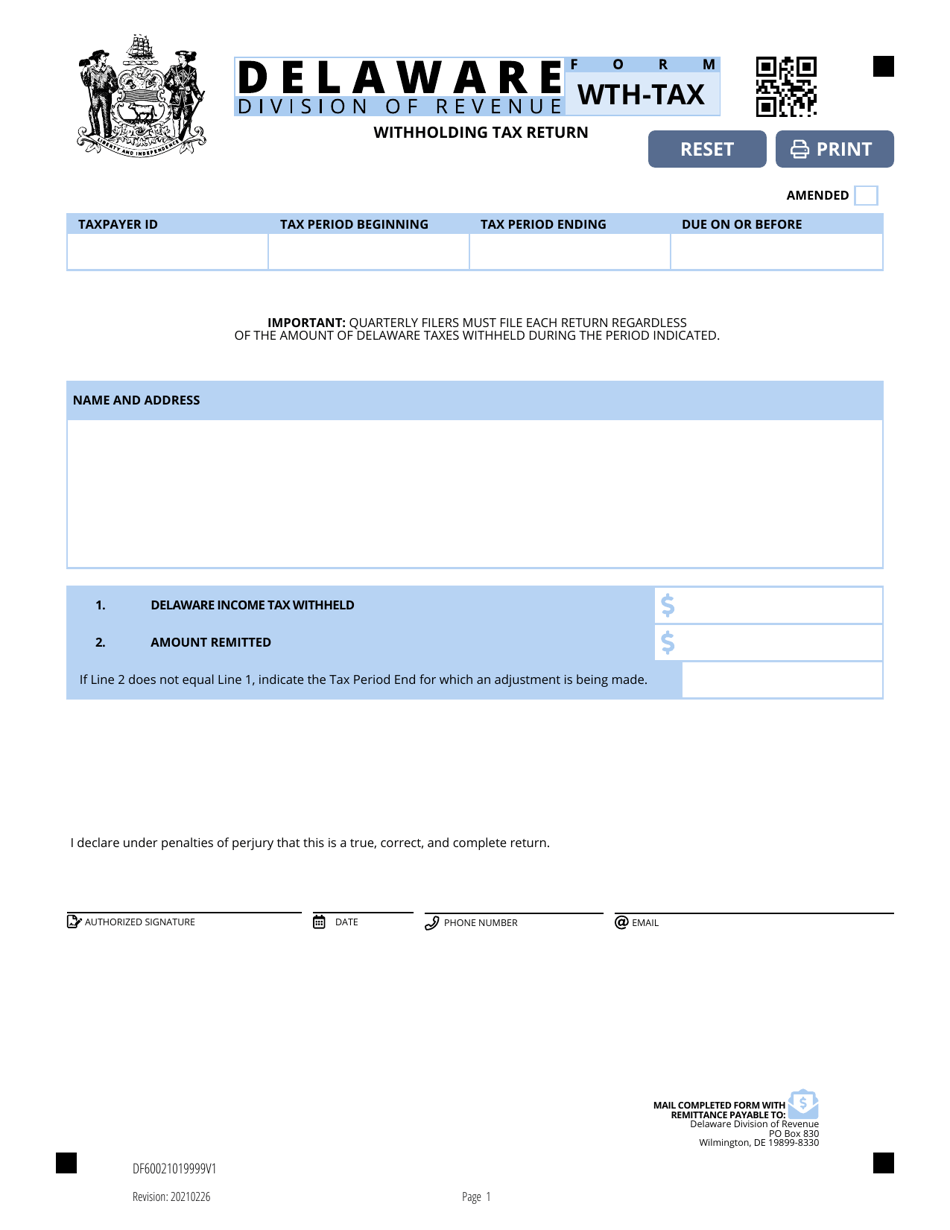

Form WTH-TAX Withholding Tax Return - Delaware

What Is Form WTH-TAX?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form WTH-TAX?

A: Form WTH-TAX is the Withholding Tax Return form used in the state of Delaware.

Q: Who needs to file Form WTH-TAX?

A: Employers in Delaware who are required to withhold state income tax from their employees' wages need to file Form WTH-TAX.

Q: When is Form WTH-TAX due?

A: Form WTH-TAX is due on a quarterly basis. The due dates are April 30th, July 31st, October 31st, and January 31st.

Q: What information is required on Form WTH-TAX?

A: Form WTH-TAX requires information such as the employer's name and identification number, total wages paid during the quarter, and the amount of state income tax withheld.

Q: Is there a penalty for late or incorrect filing of Form WTH-TAX?

A: Yes, there may be penalties for late or incorrect filing of Form WTH-TAX. It is important to file the form accurately and on time to avoid penalties.

Form Details:

- Released on February 26, 2021;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WTH-TAX by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.