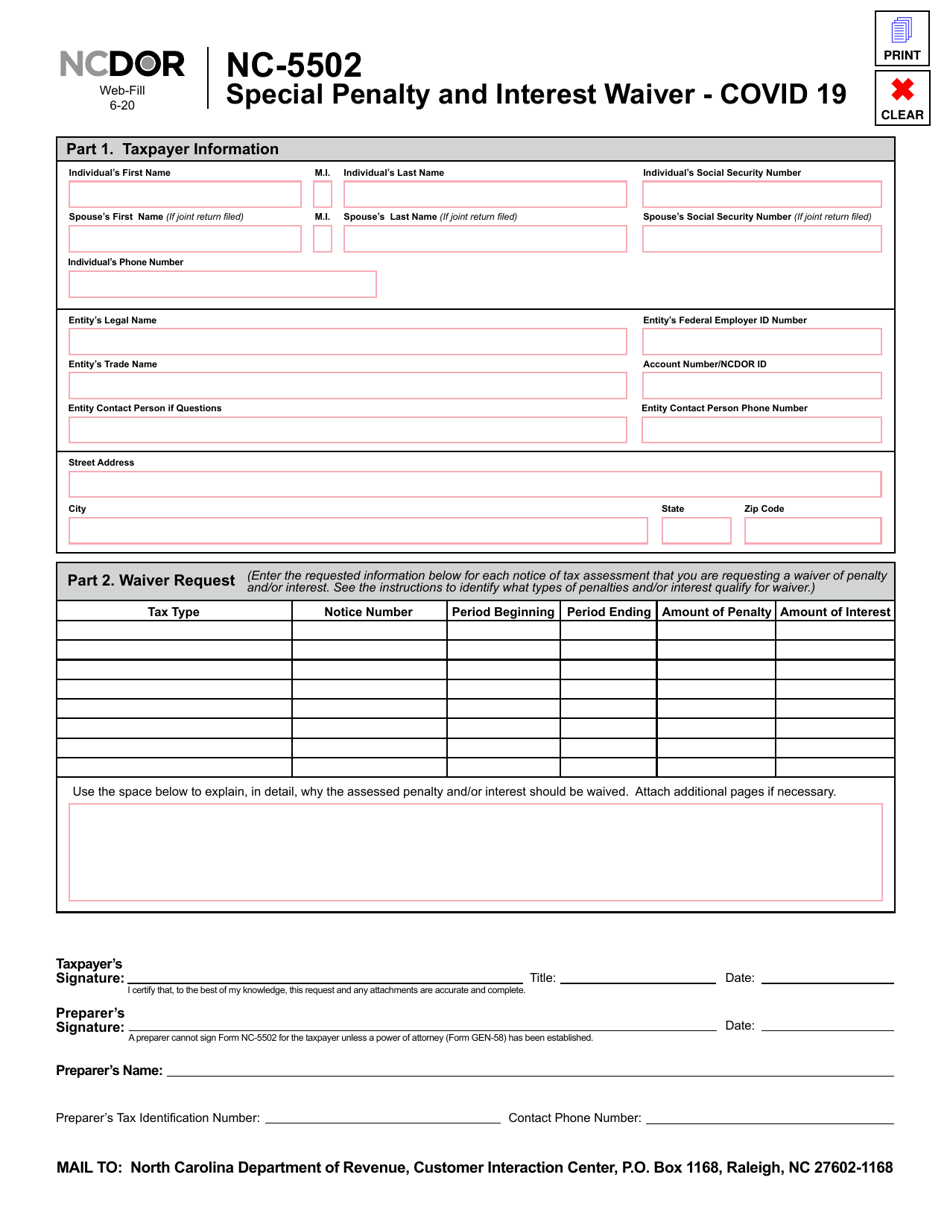

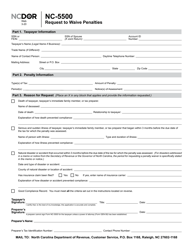

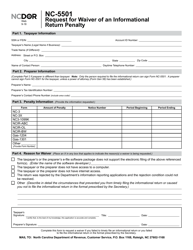

Form NC-5502 Special Penalty and Interest Waiver - Covid 19 - North Carolina

What Is Form NC-5502?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-5502?

A: Form NC-5502 is a form used in North Carolina for requesting special penalty and interest waivers due to COVID-19.

Q: What is the purpose of Form NC-5502?

A: The purpose of Form NC-5502 is to request a waiver of penalties and interest on certain tax liabilities in North Carolina as a result of COVID-19.

Q: Who can use Form NC-5502?

A: Any individual or business entity with eligible tax liabilities in North Carolina due to COVID-19 can use Form NC-5502.

Q: What are eligible tax liabilities for using Form NC-5502?

A: Eligible tax liabilities include individual income tax, corporate income tax, franchise tax, and sales and use tax owed to the North Carolina Department of Revenue.

Q: When is the deadline to submit Form NC-5502?

A: The deadline to submit Form NC-5502 is determined by the North Carolina Department of Revenue and may vary depending on the specific circumstances.

Q: What information do I need to provide on Form NC-5502?

A: You will need to provide your contact information, tax account number, tax period, the amount of penalties and interest you are requesting a waiver for, and a detailed explanation of how COVID-19 impacted your ability to pay.

Q: Will submitting Form NC-5502 guarantee a waiver of penalties and interest?

A: Submitting Form NC-5502 does not guarantee a waiver of penalties and interest. The North Carolina Department of Revenue will review each request on a case-by-case basis and determine eligibility.

Q: What supporting documents should I include with Form NC-5502?

A: You should include any relevant documents that support your claim of being impacted by COVID-19, such as financial records, business closure notices, or medical documentation.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

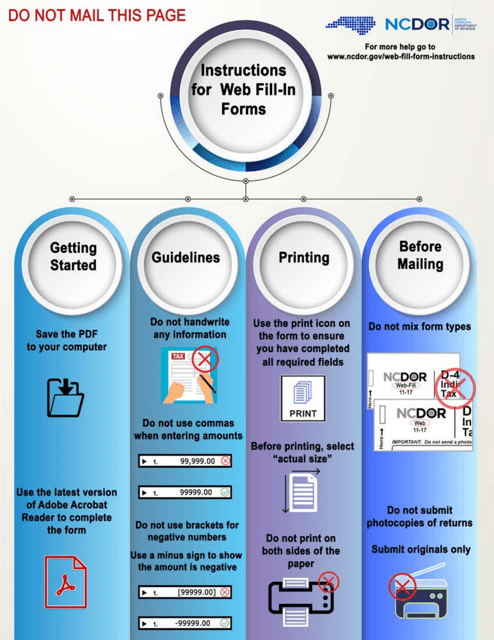

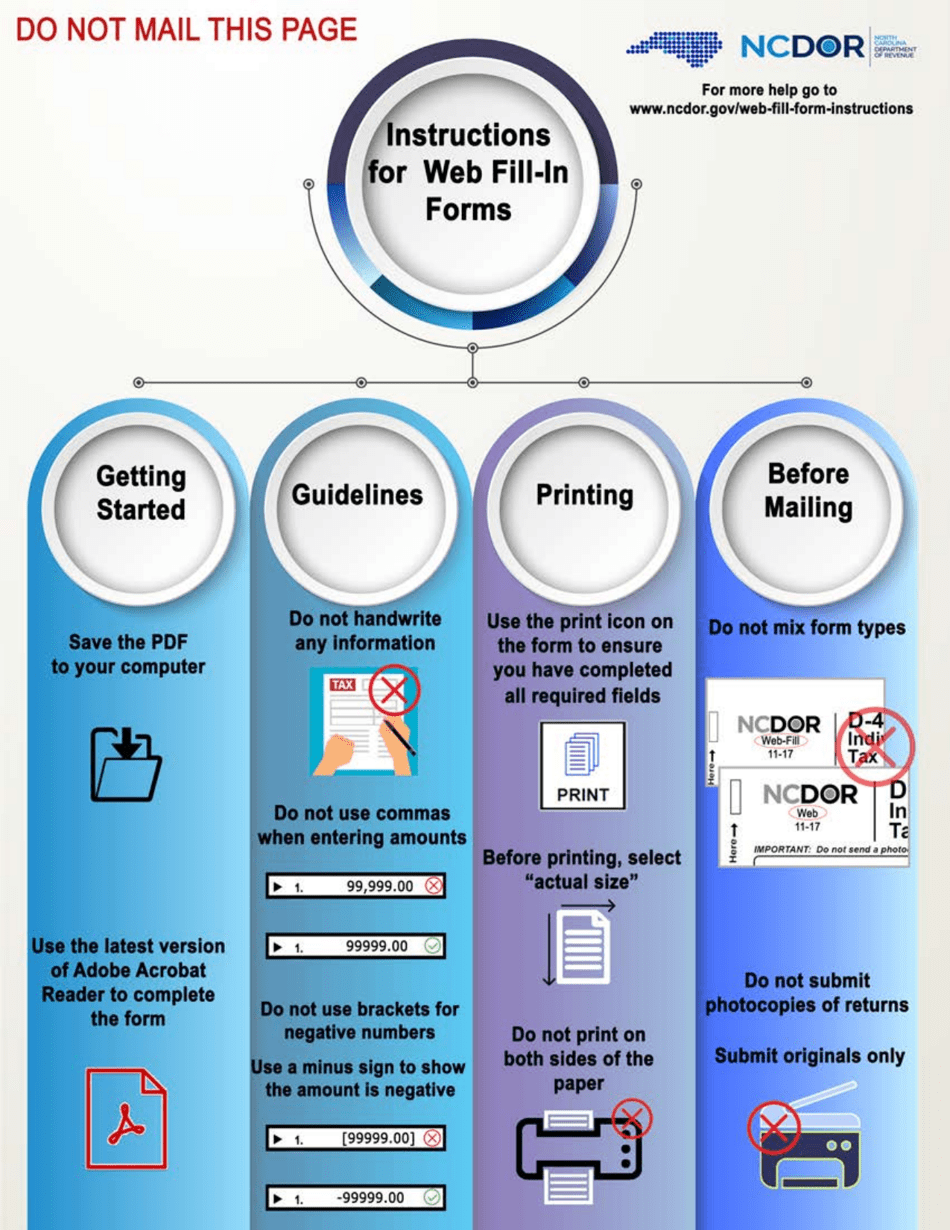

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NC-5502 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.