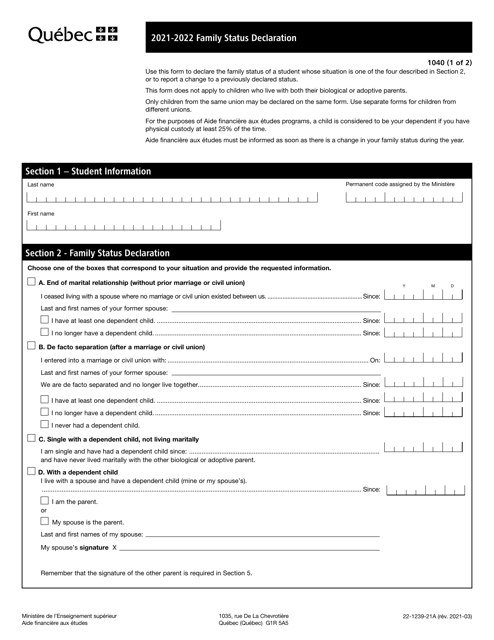

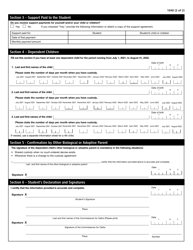

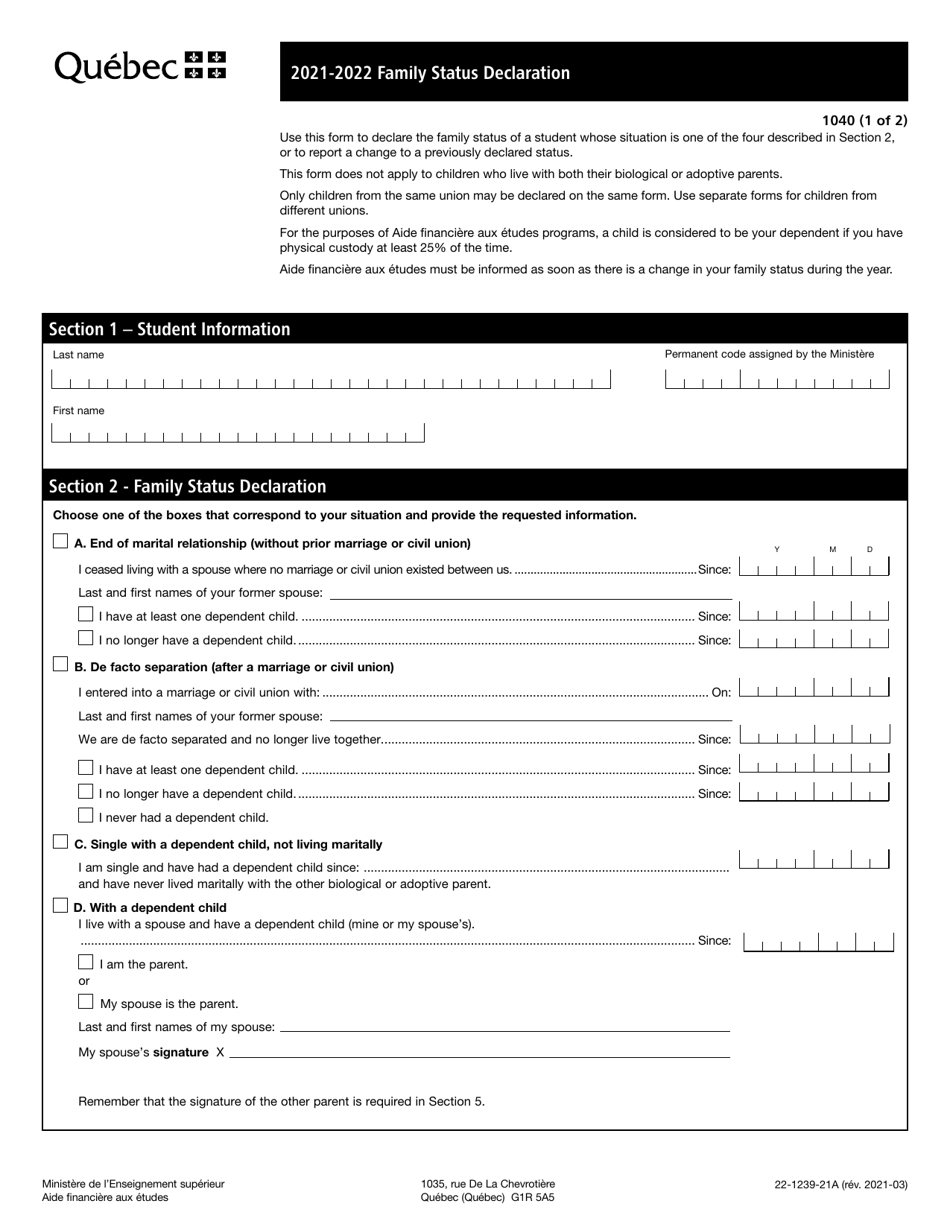

Form 1040 (22-1239-21A) Family Status Declaration - Quebec, Canada

FAQ

Q: What is Form 1040?

A: Form 1040 is an income tax form used by taxpayers to report their annual income to the Internal Revenue Service (IRS).

Q: What is the purpose of Form 1040?

A: The purpose of Form 1040 is to calculate and report your federal income tax liability.

Q: What is a Family Status Declaration?

A: A Family Status Declaration is a form used in Quebec, Canada to declare your family status for tax purposes.

Q: Who needs to fill out the Form 1040?

A: The Form 1040 is used by individual taxpayers in the United States to report their income and calculate their federal incometax liability.

Q: Is the Form 1040 used in Canada?

A: No, the Form 1040 is specifically for taxpayers in the United States. Canada has its own tax forms and filing requirements.

Q: What information is required on the Form 1040?

A: The Form 1040 requires you to provide information about your income, deductions, credits, and tax payments.

Q: Do I need to include the Form 1040 with my tax return?

A: Yes, you generally need to include a completed Form 1040 with your federal tax return.

Q: Are there any additional forms or schedules that need to be attached to the Form 1040?

A: Yes, depending on your individual circumstances, you may need to attach additional forms or schedules to the Form 1040.

Q: Can I e-file the Form 1040?

A: Yes, you can e-file the Form 1040 using electronic tax preparation software or by using the IRS's Free File program.