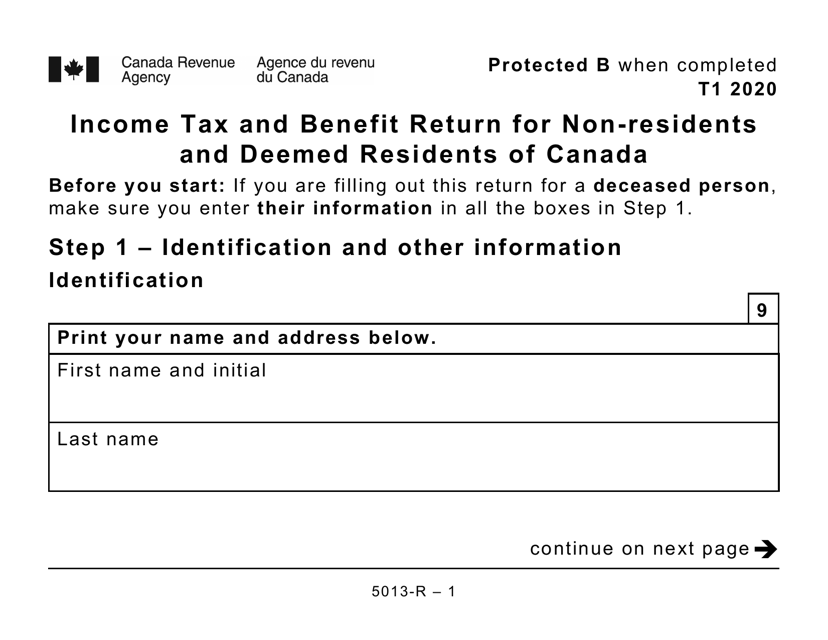

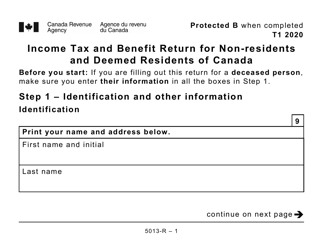

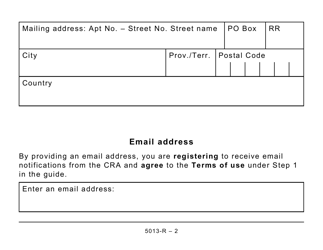

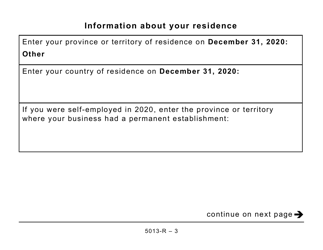

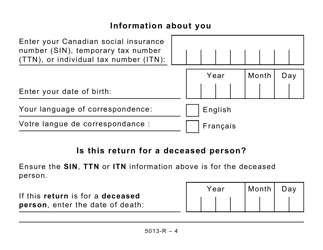

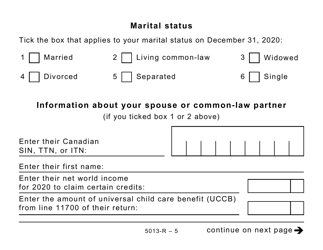

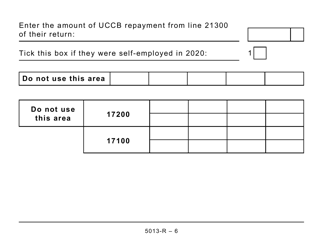

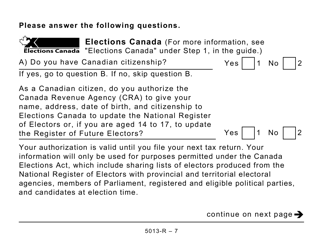

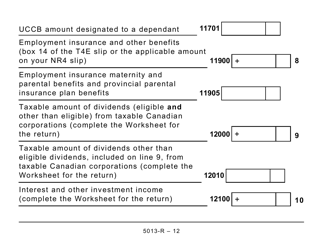

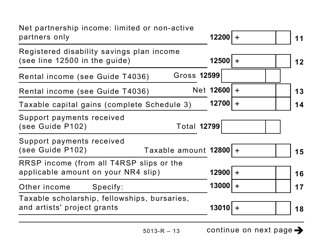

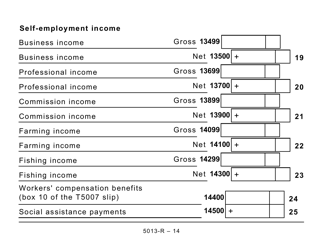

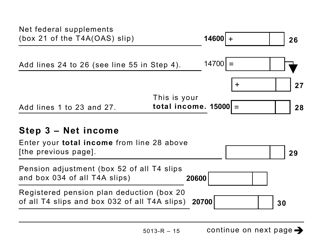

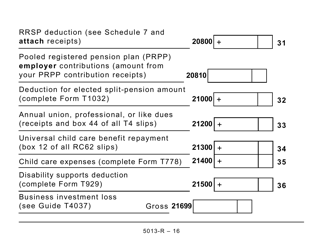

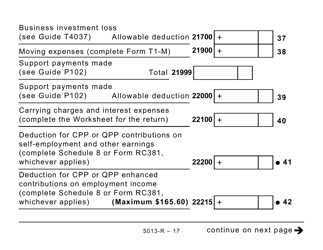

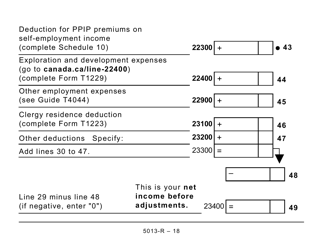

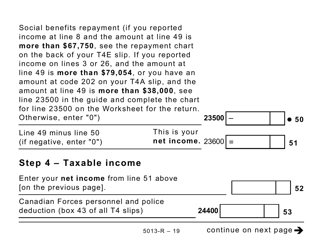

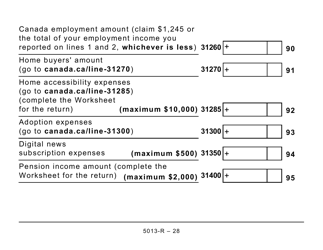

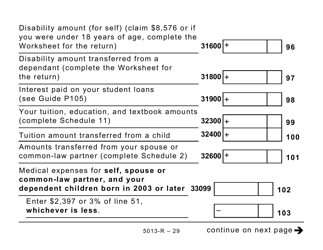

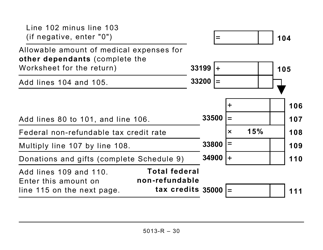

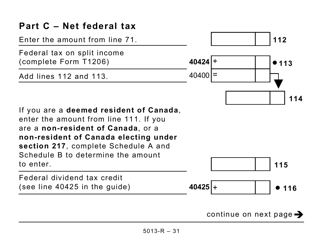

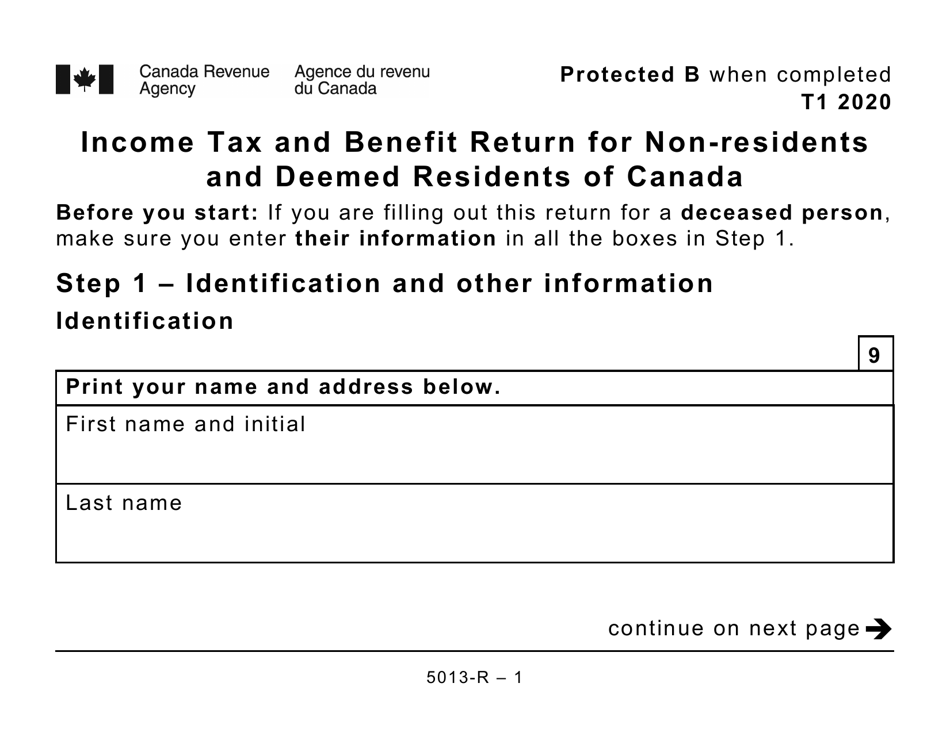

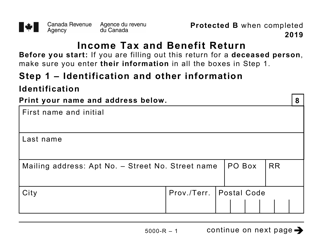

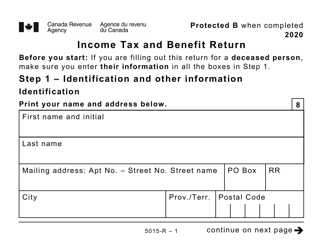

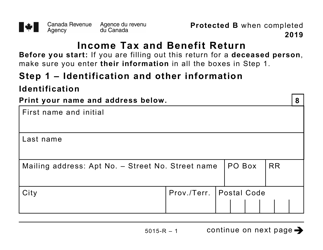

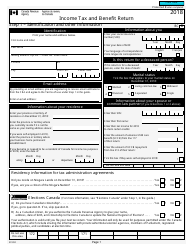

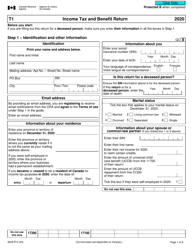

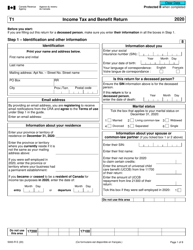

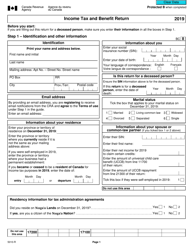

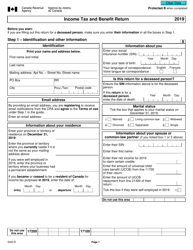

Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada - Large Print - Canada

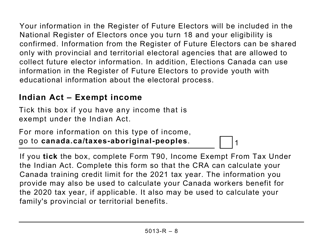

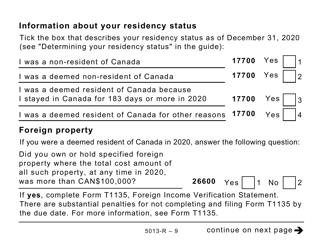

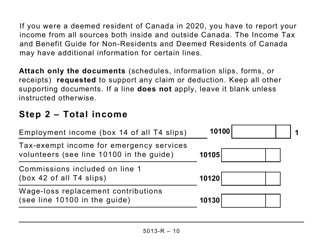

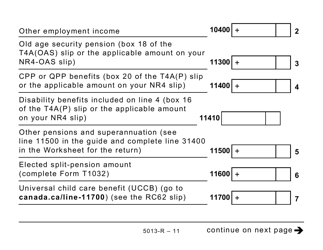

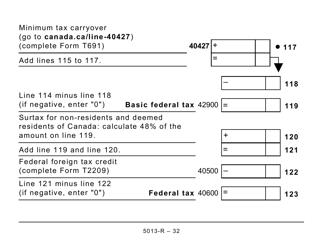

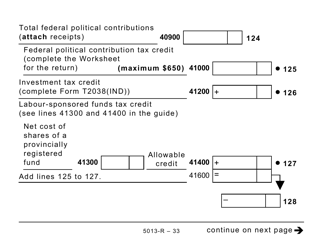

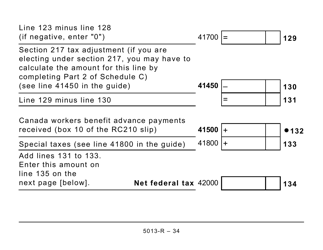

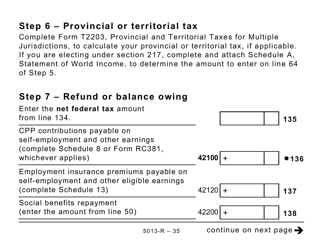

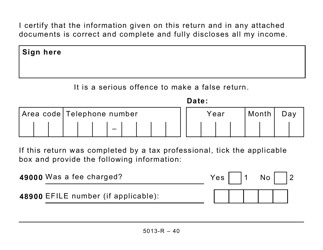

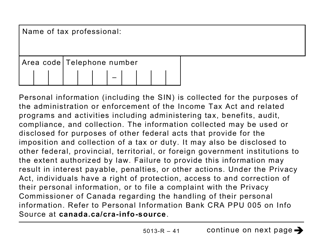

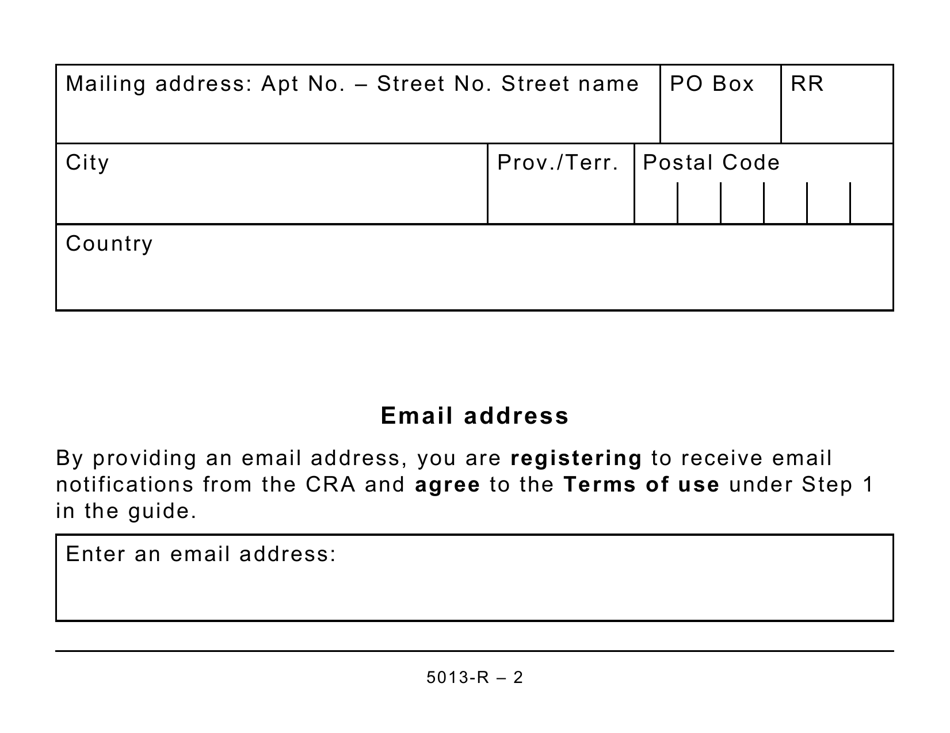

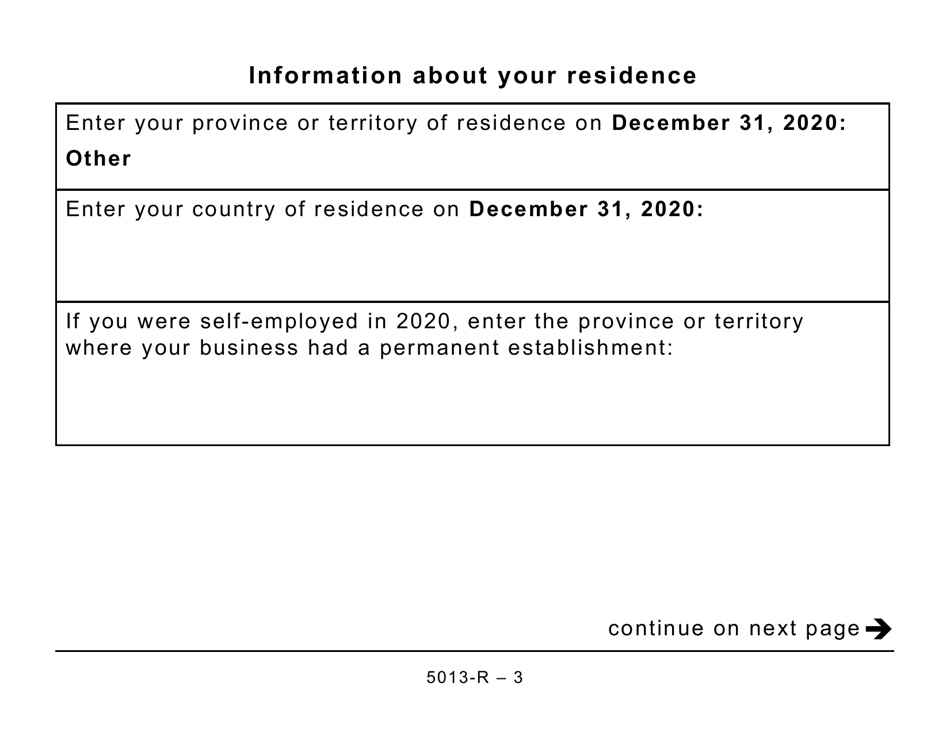

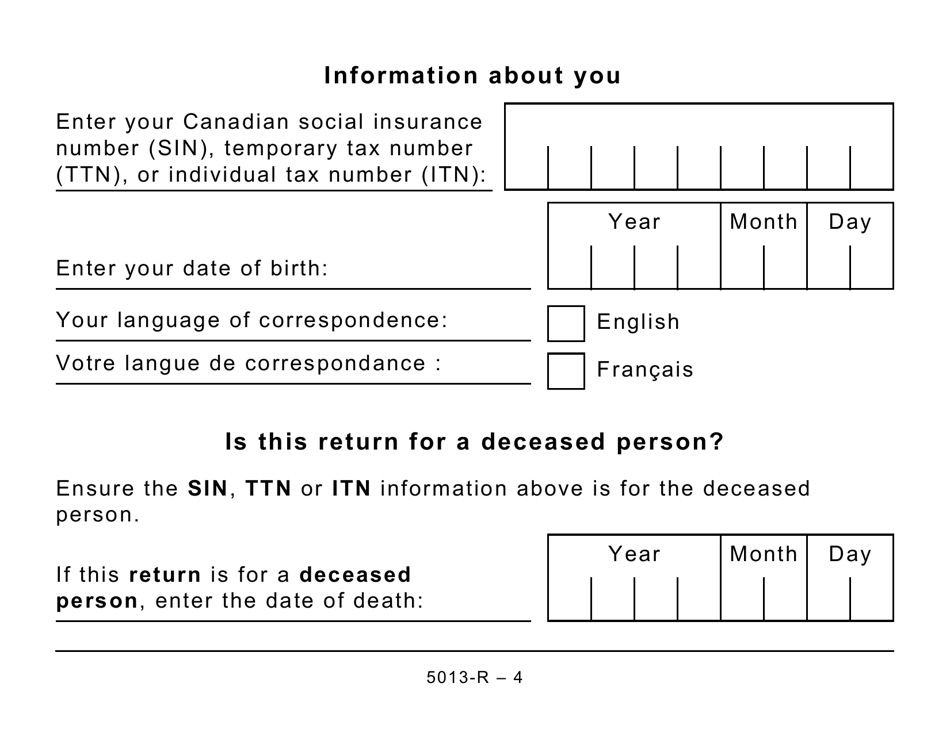

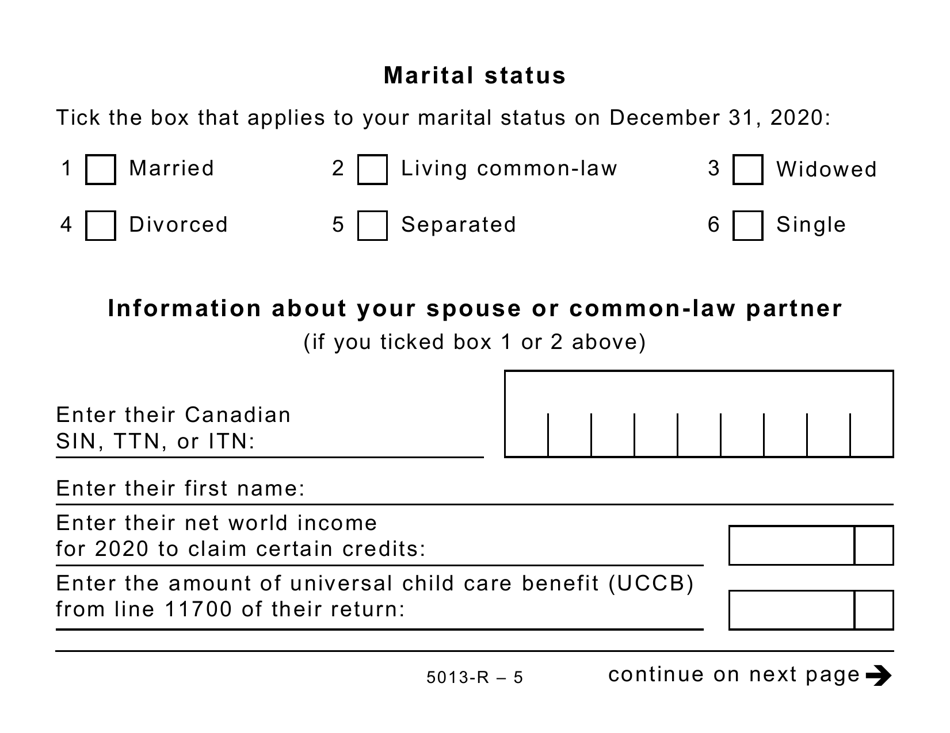

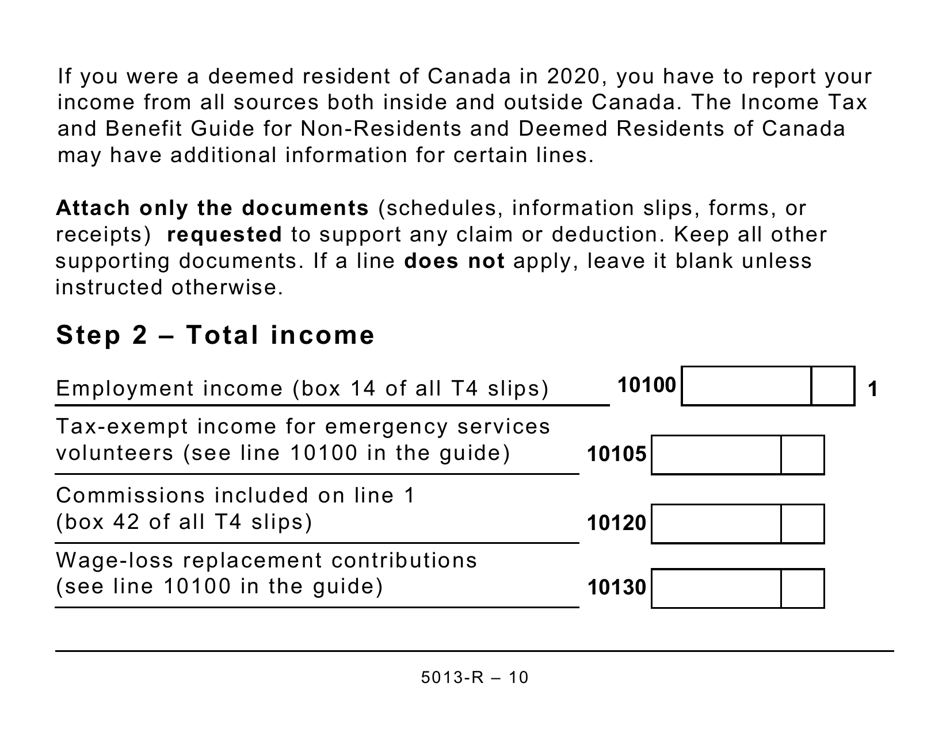

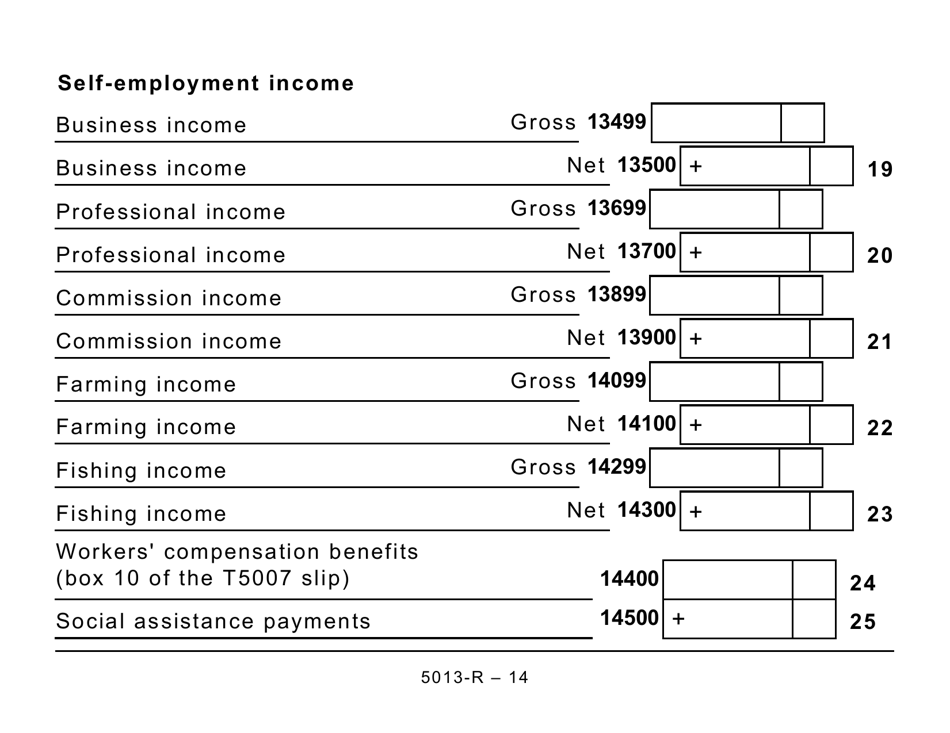

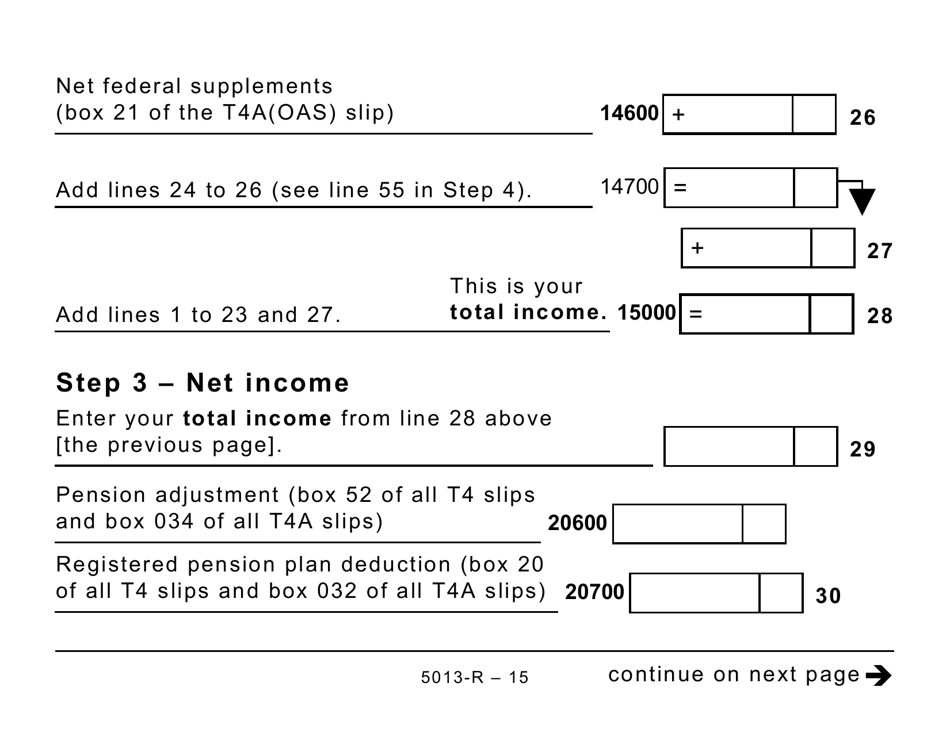

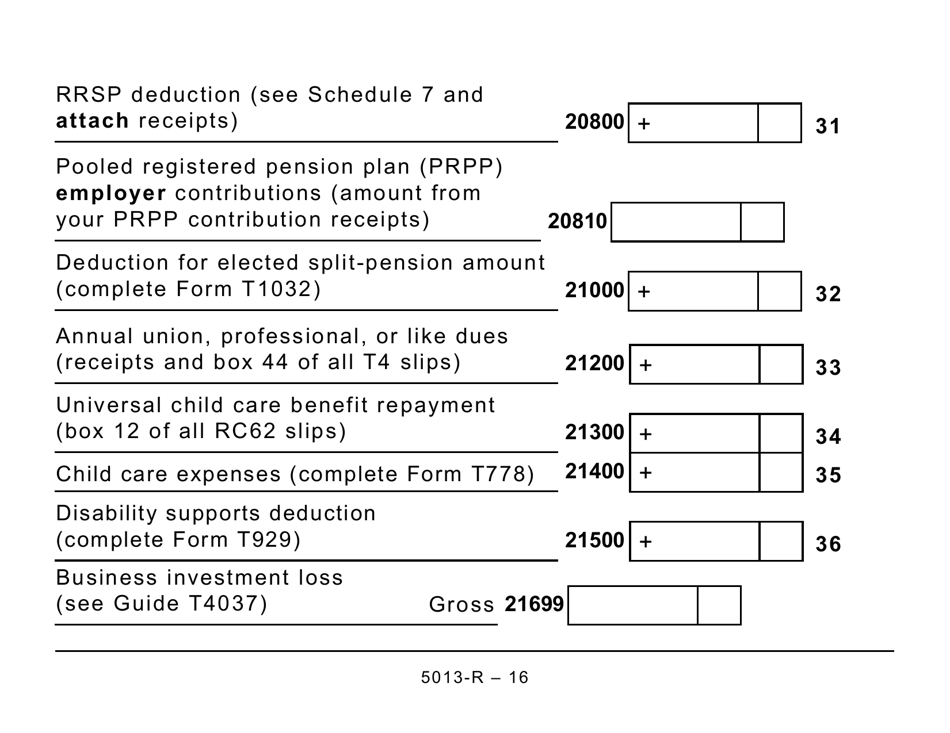

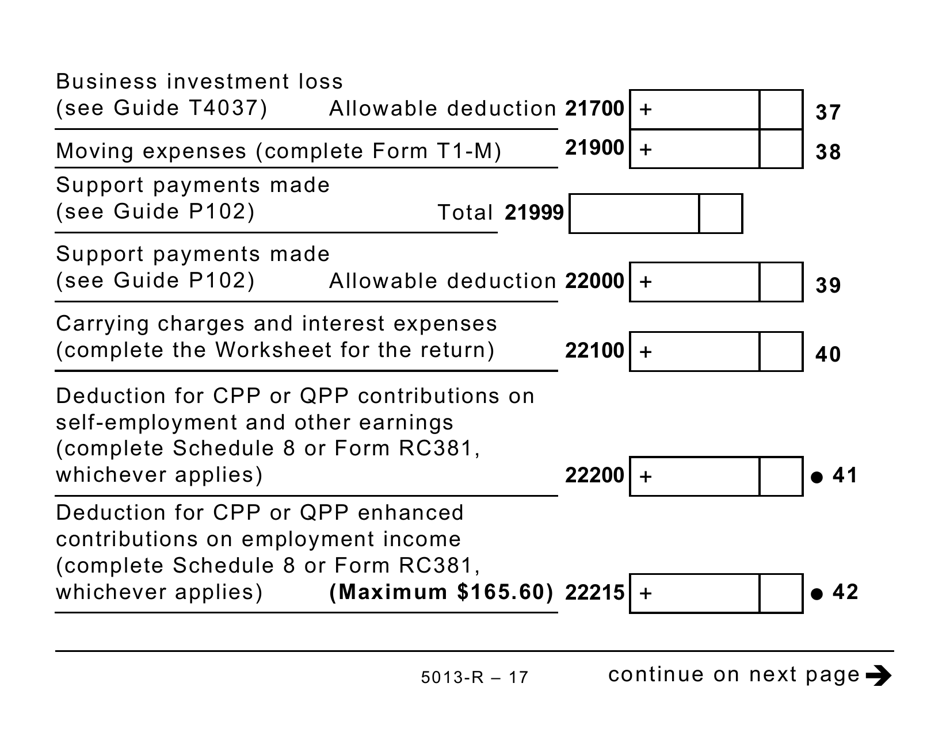

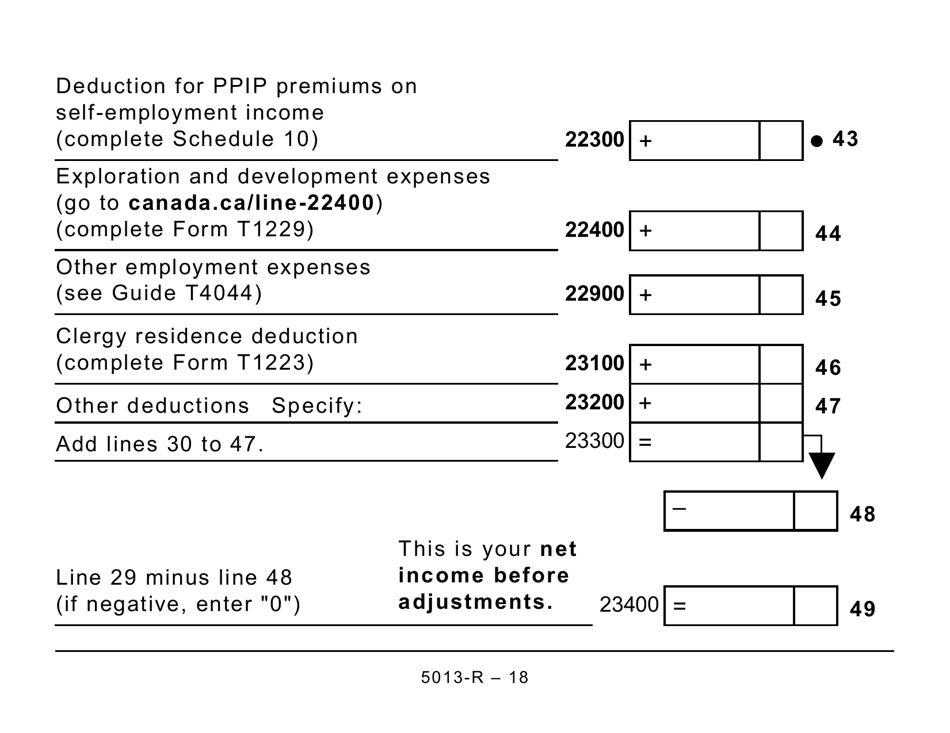

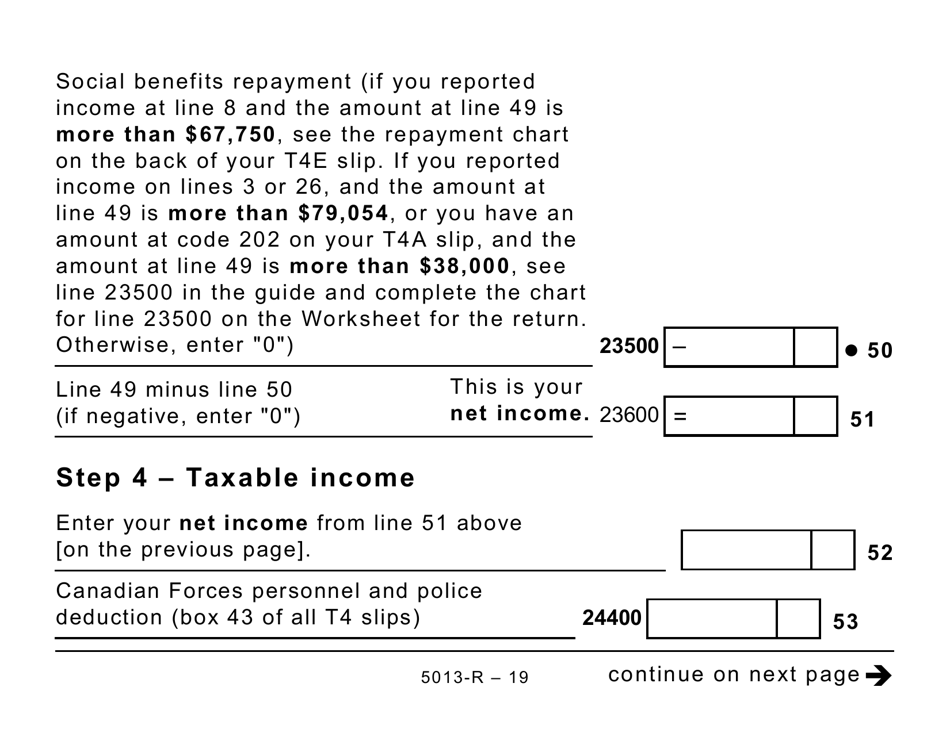

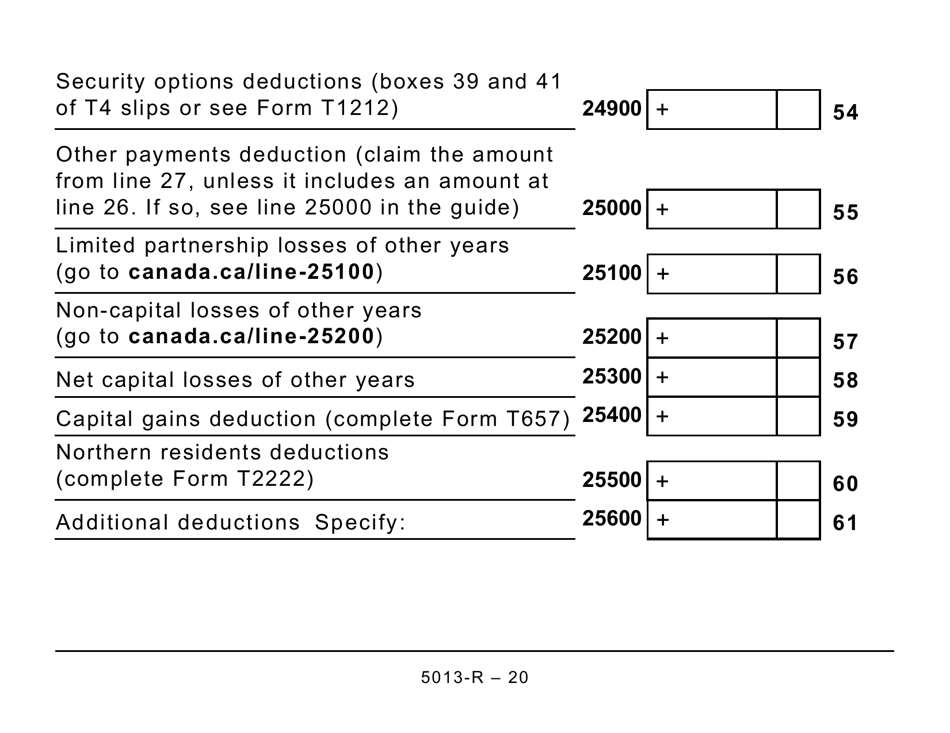

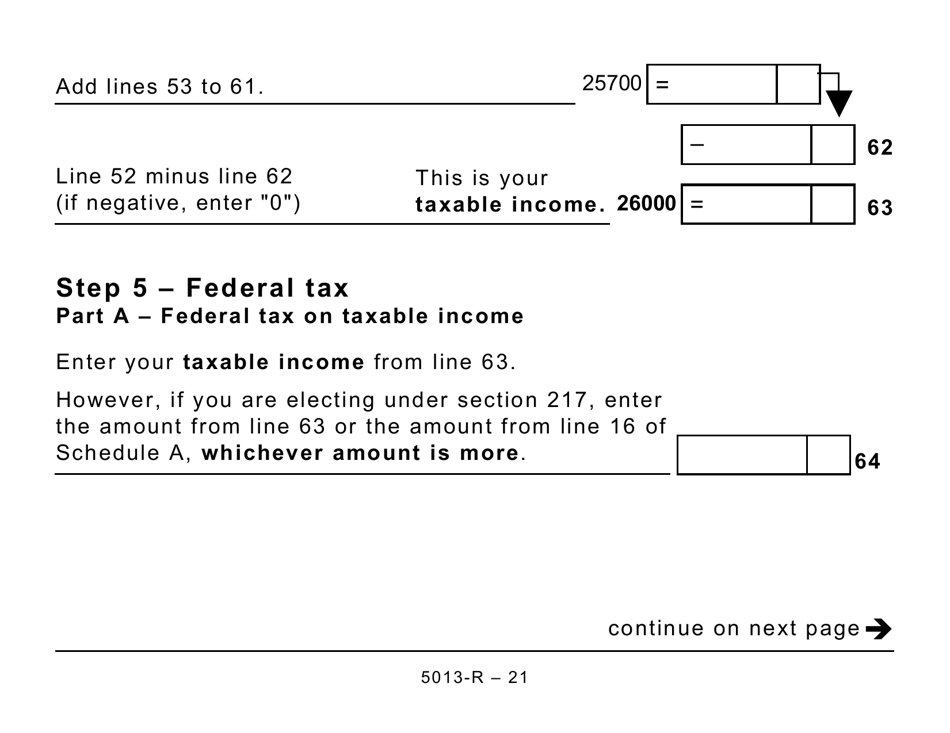

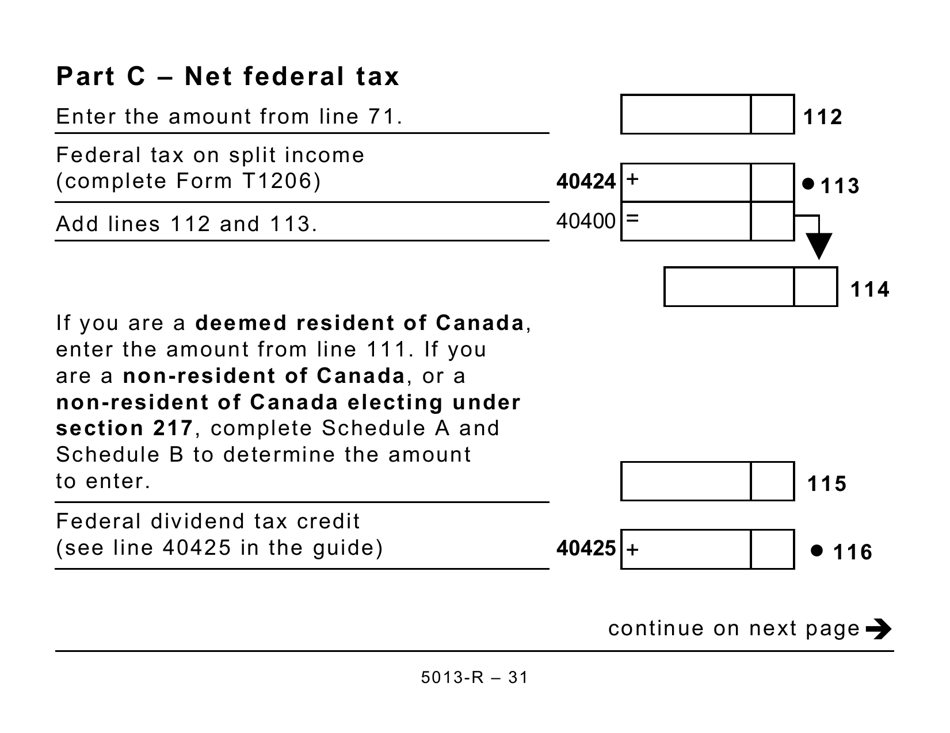

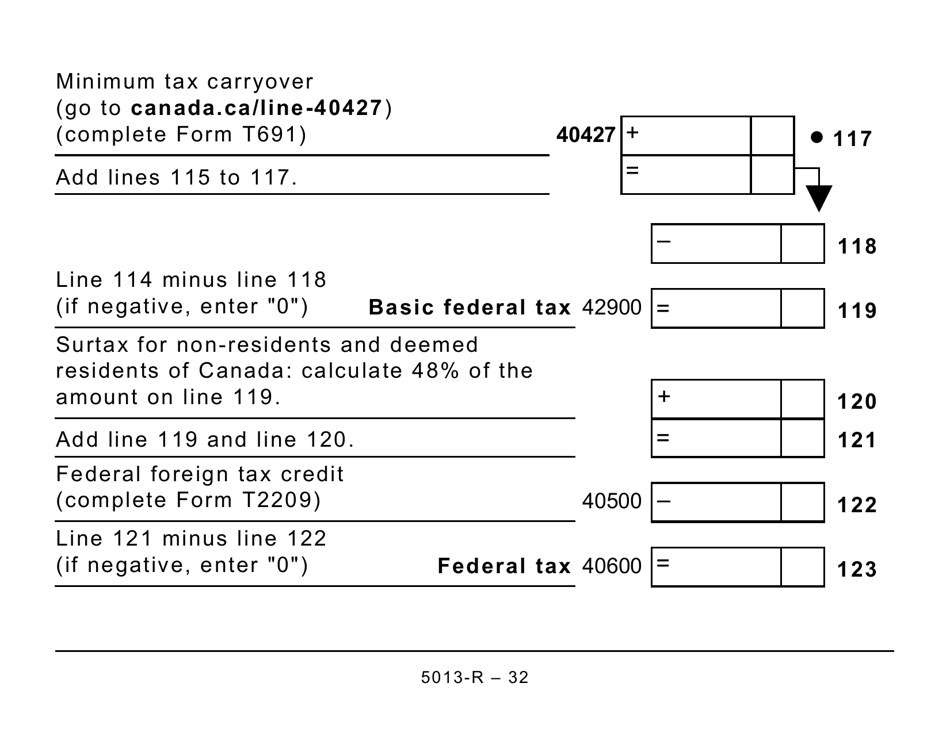

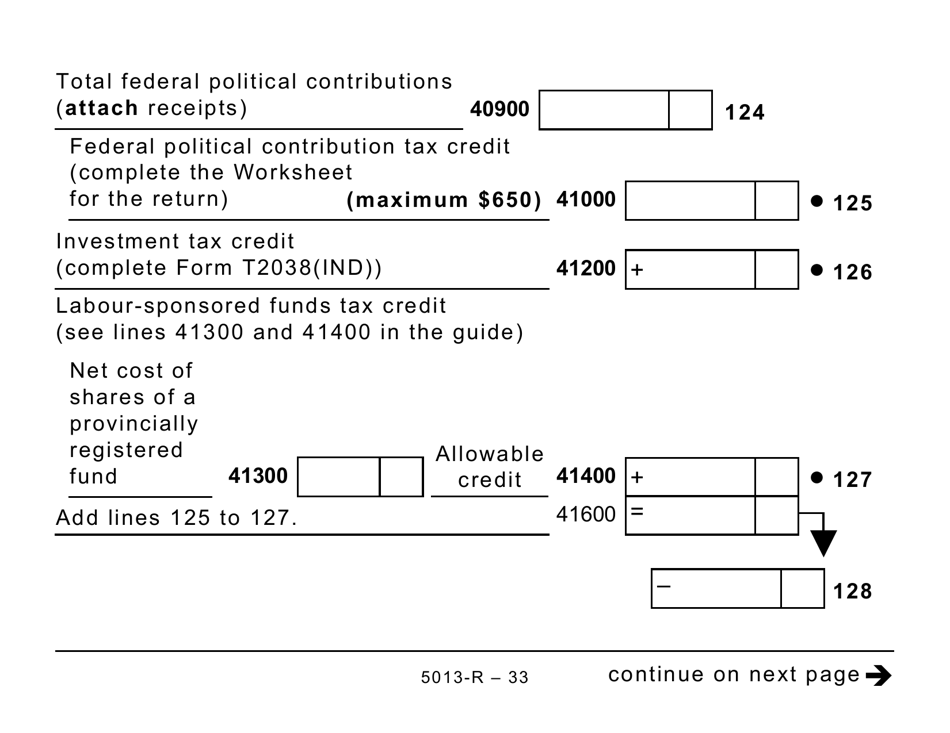

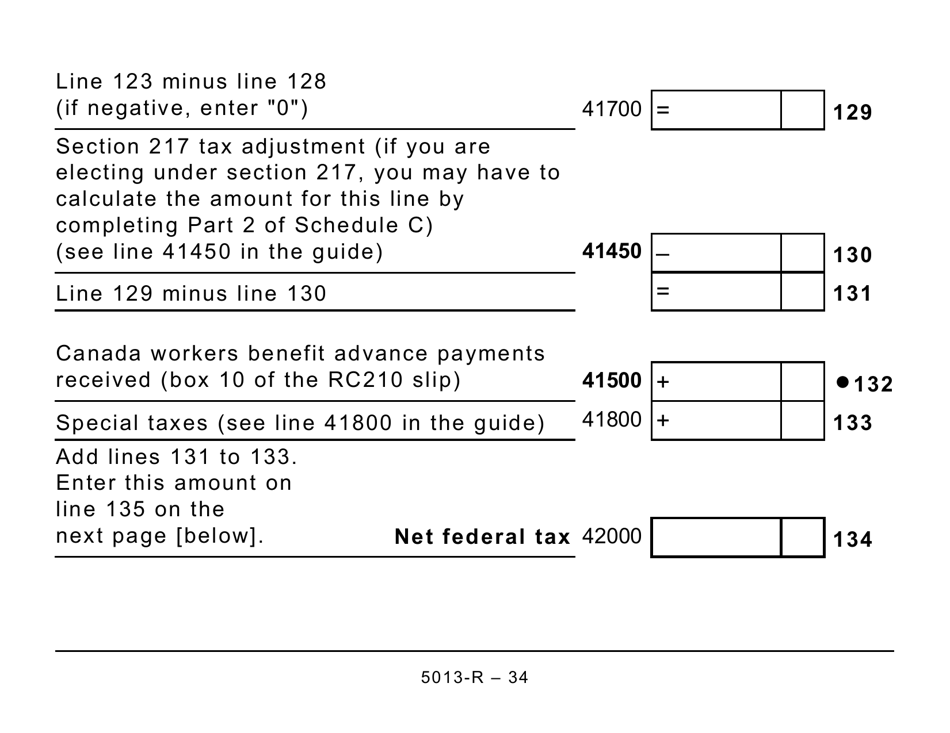

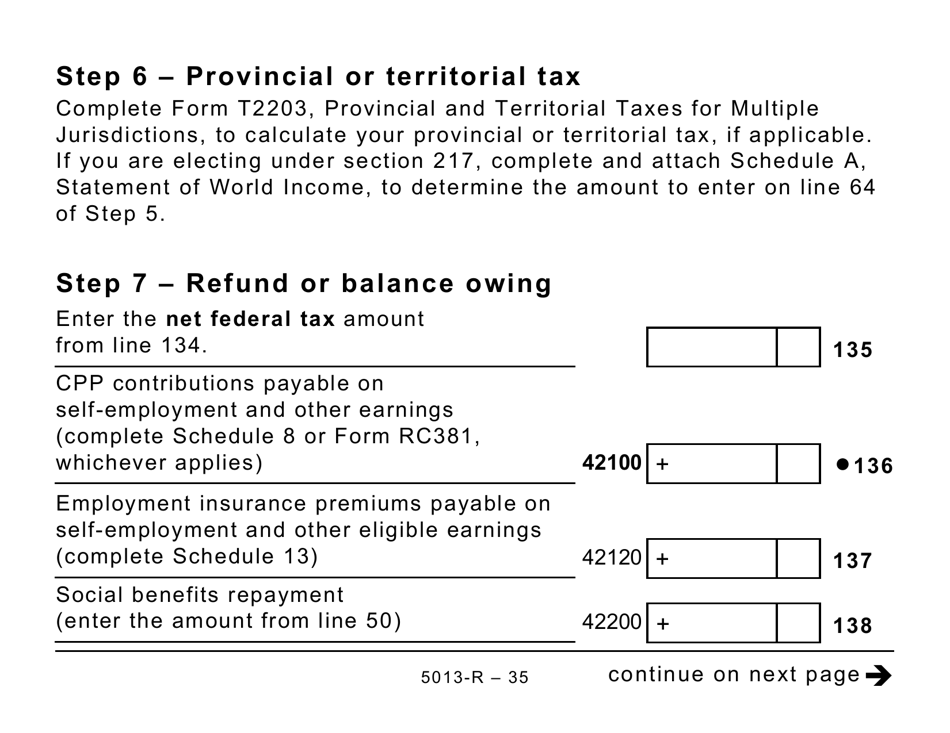

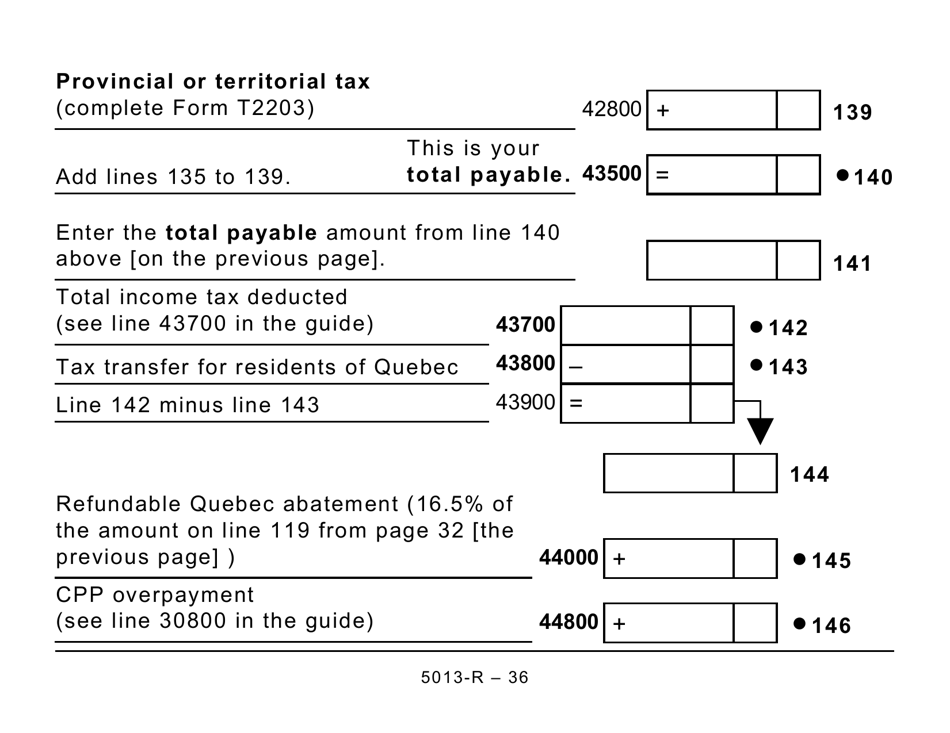

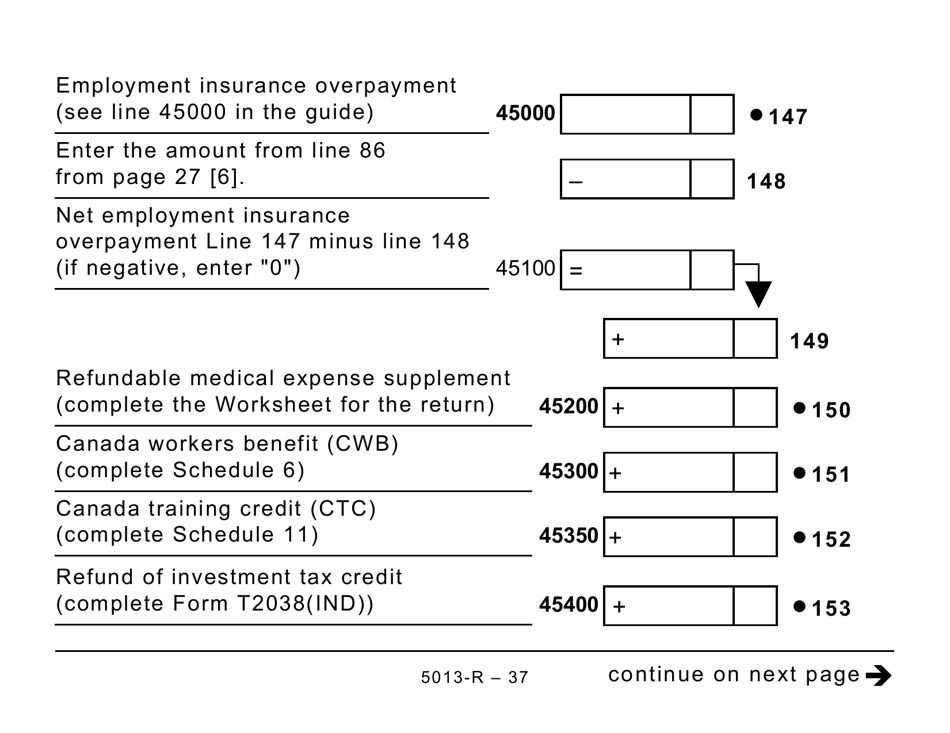

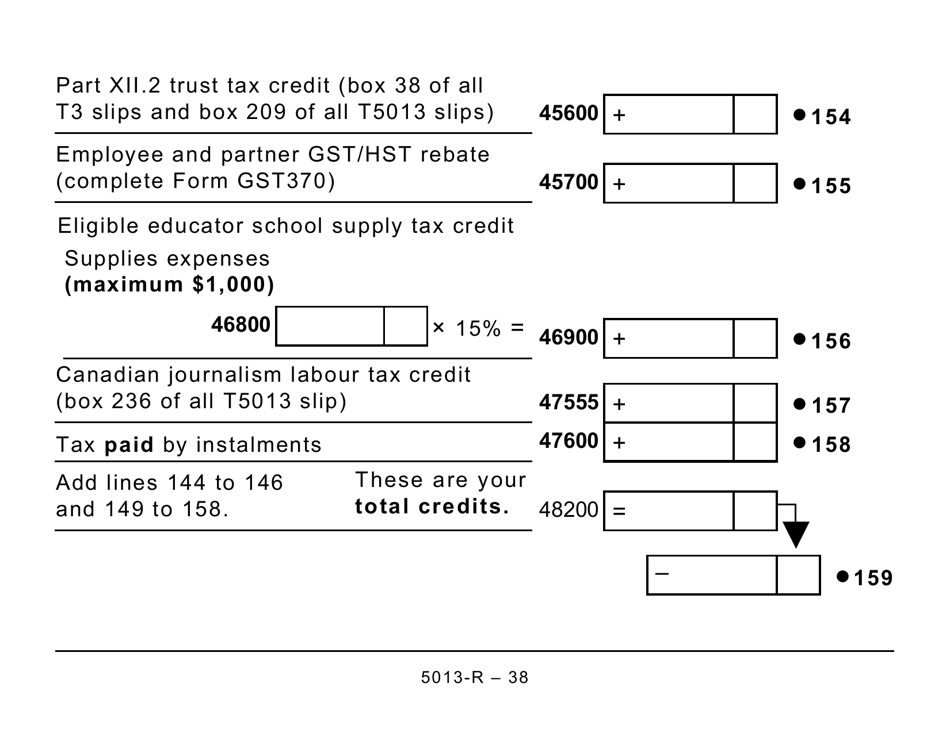

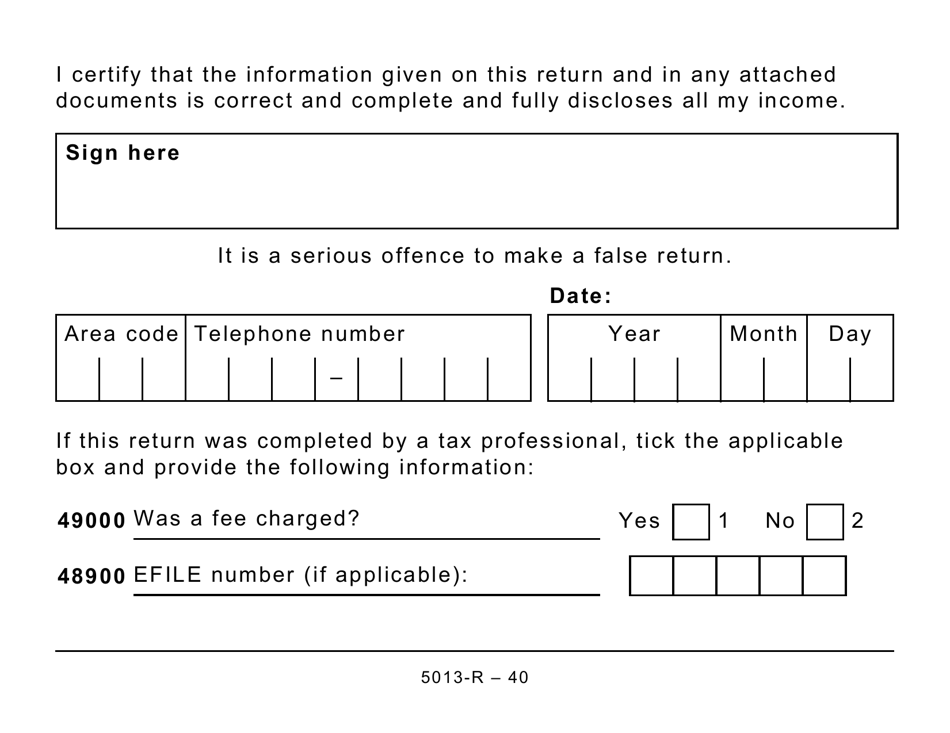

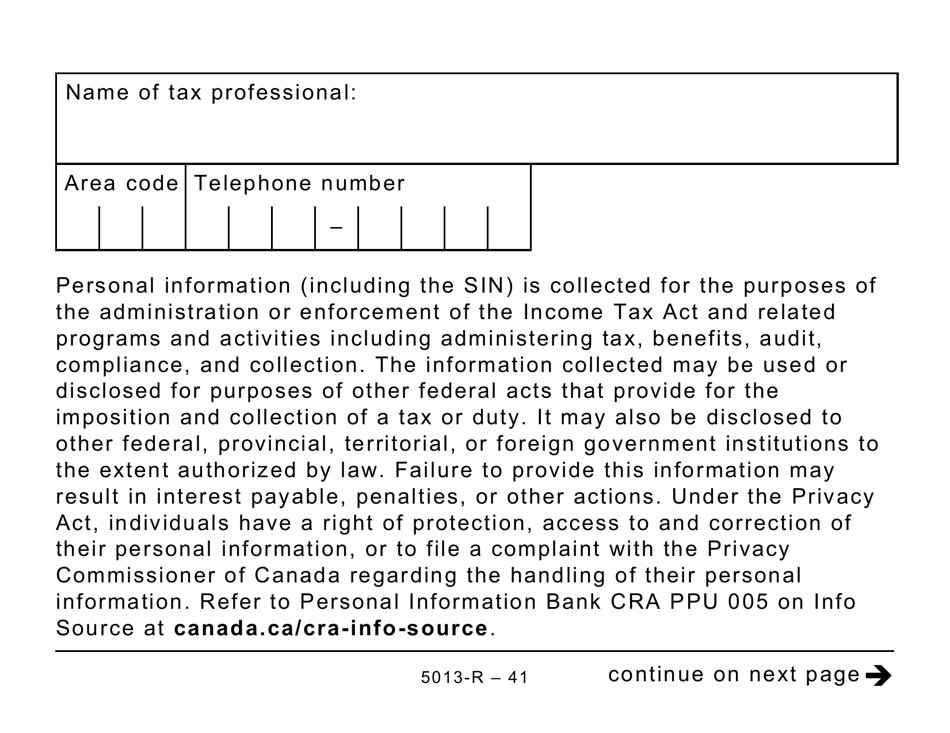

Form 5013-R is the Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada. It is specifically designed for individuals who are not resident in Canada for tax purposes but have Canadian income or want to claim certain benefits. The "Large Print" version of the form is intended to provide better readability for individuals with visual impairments.

FAQ

Q: What is form 5013-R?

A: Form 5013-R is the Income Tax and Benefit Return specifically designed for non-residents and deemed residents of Canada.

Q: Who needs to file form 5013-R?

A: Non-residents and deemed residents of Canada need to file form 5013-R if they have income from Canadian sources.

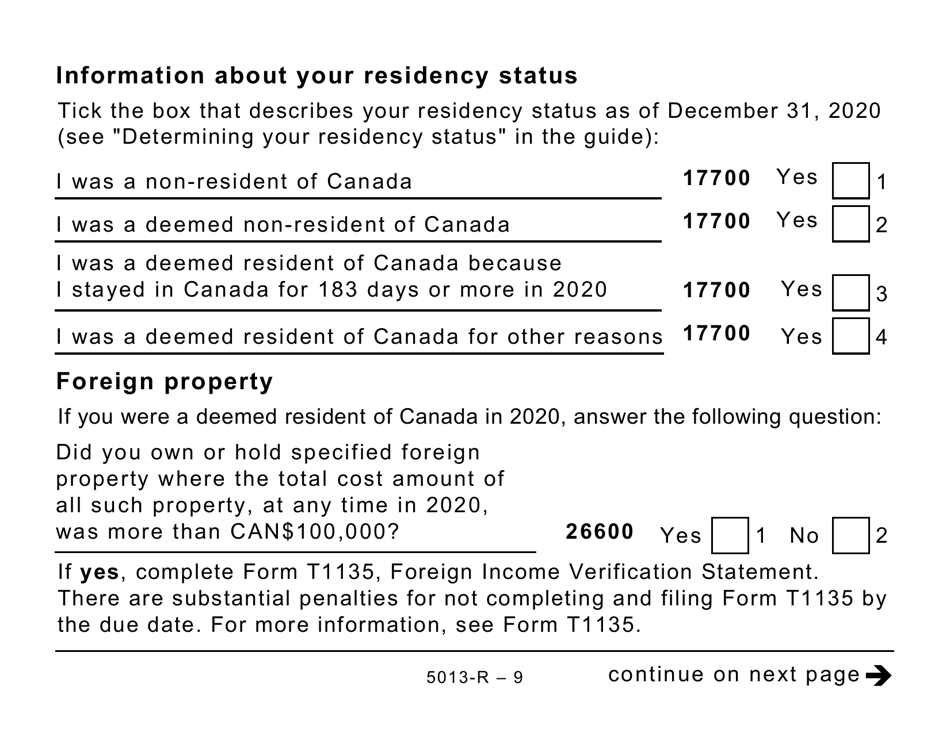

Q: What is considered a non-resident of Canada?

A: A non-resident of Canada is someone who does not have significant residential ties to the country.

Q: Who is considered a deemed resident of Canada?

A: A deemed resident of Canada is someone who is not a resident of Canada for tax purposes but has enough residential ties to be treated as a resident.

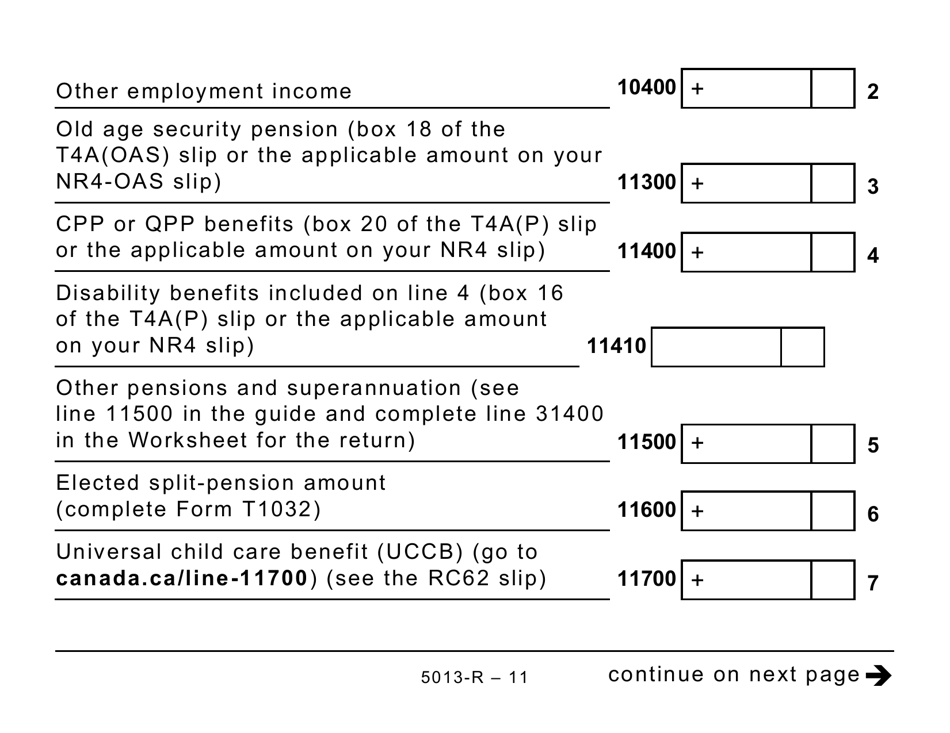

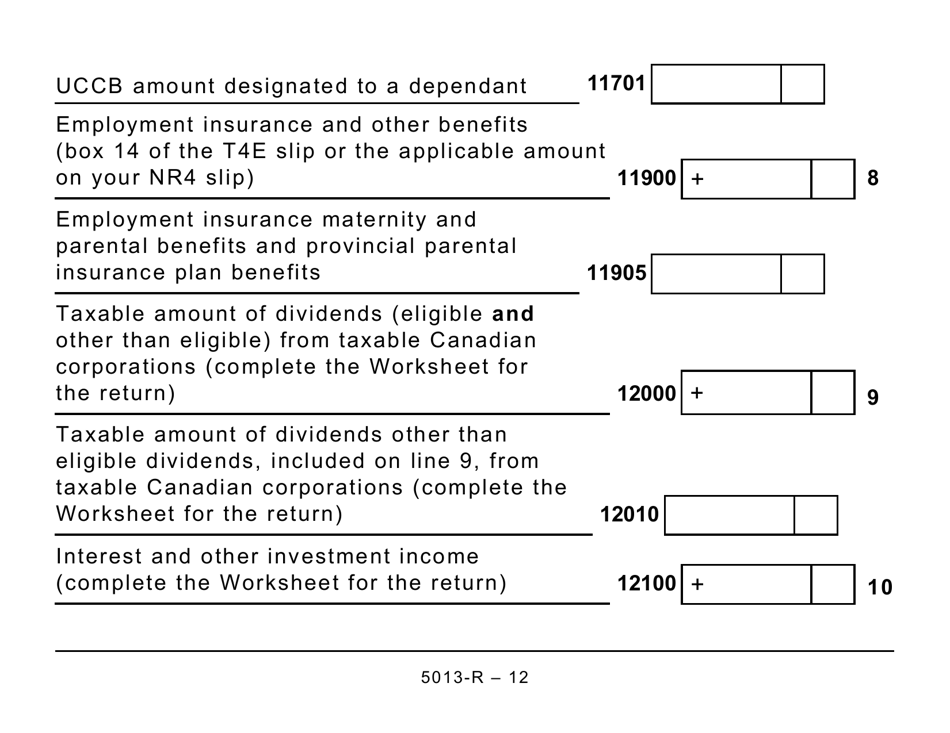

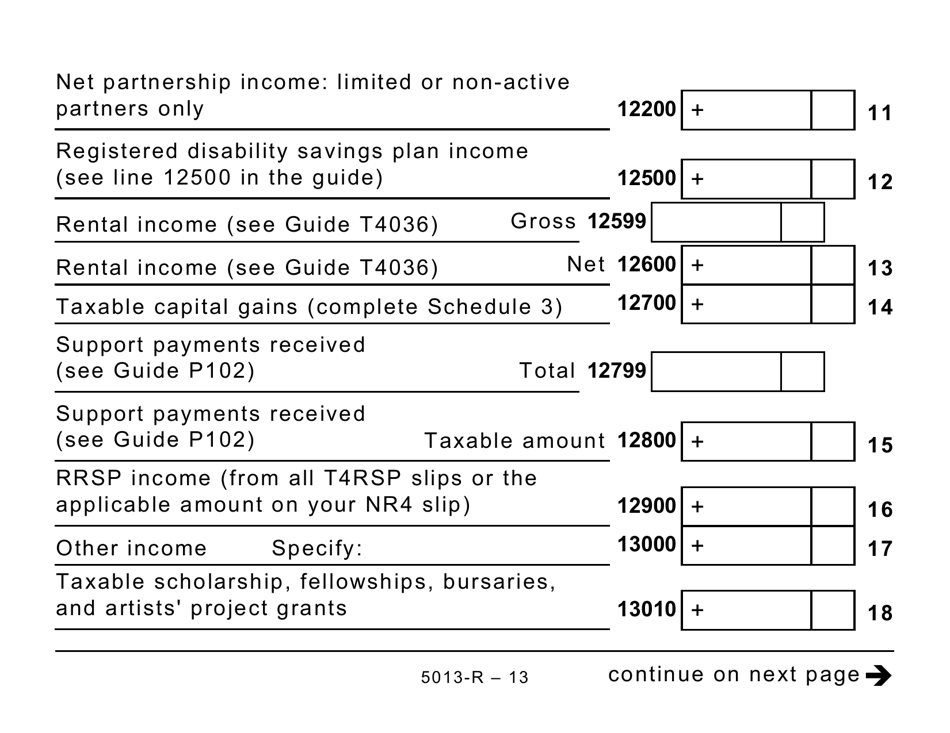

Q: What kind of income should be reported on form 5013-R?

A: All income from Canadian sources, including employment income, rental income, and investments, should be reported on this form.

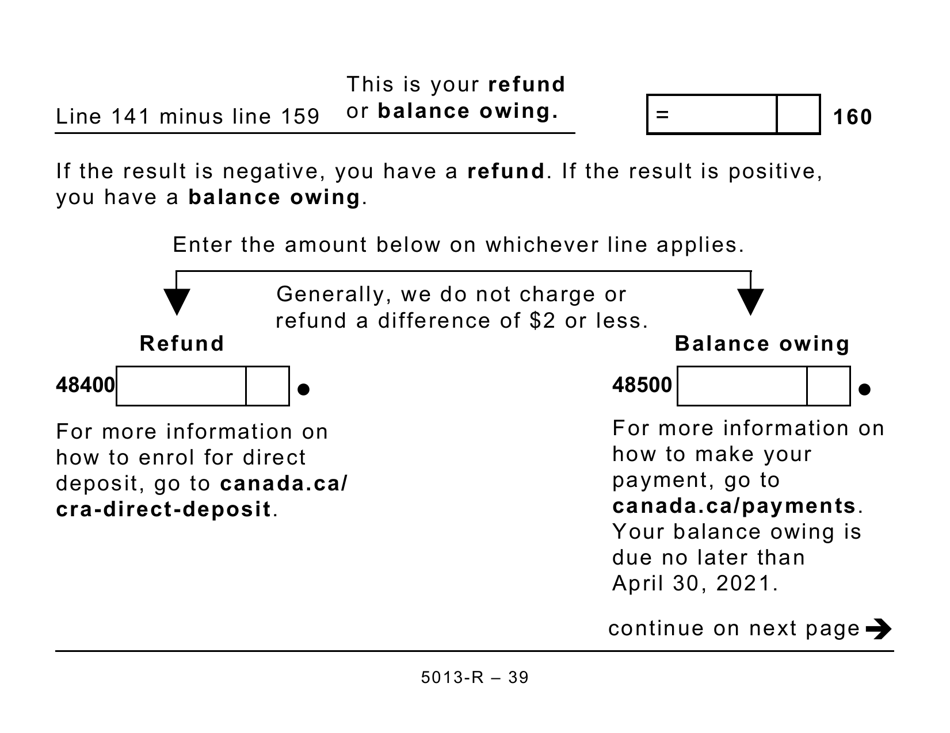

Q: Is there a deadline for filing form 5013-R?

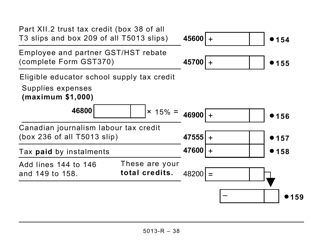

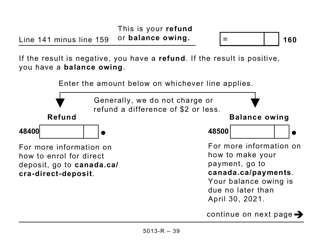

A: Yes, form 5013-R must be filed by April 30th of the following year, or June 15th if the taxpayer or their spouse is self-employed.

Q: Can I e-file form 5013-R?

A: No, form 5013-R cannot be e-filed and must be sent by mail to the Canada Revenue Agency.

Q: Are there any penalties for late filing of form 5013-R?

A: Yes, there may be penalties for late filing, so it is important to file the form on time.

Q: Do I need to file form 5013-R if I have no income from Canadian sources?

A: If you have no income from Canadian sources, you generally do not need to file form 5013-R.