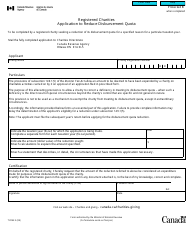

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3010

for the current year.

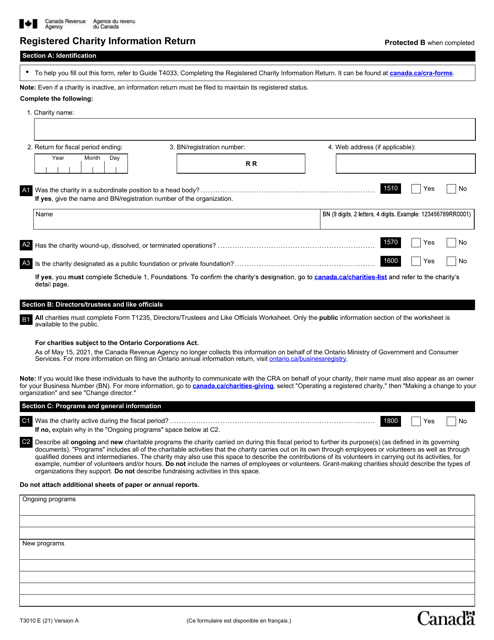

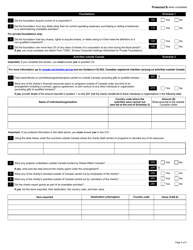

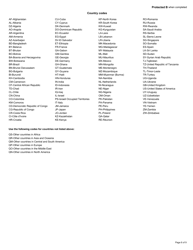

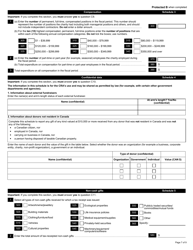

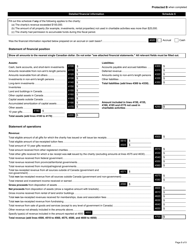

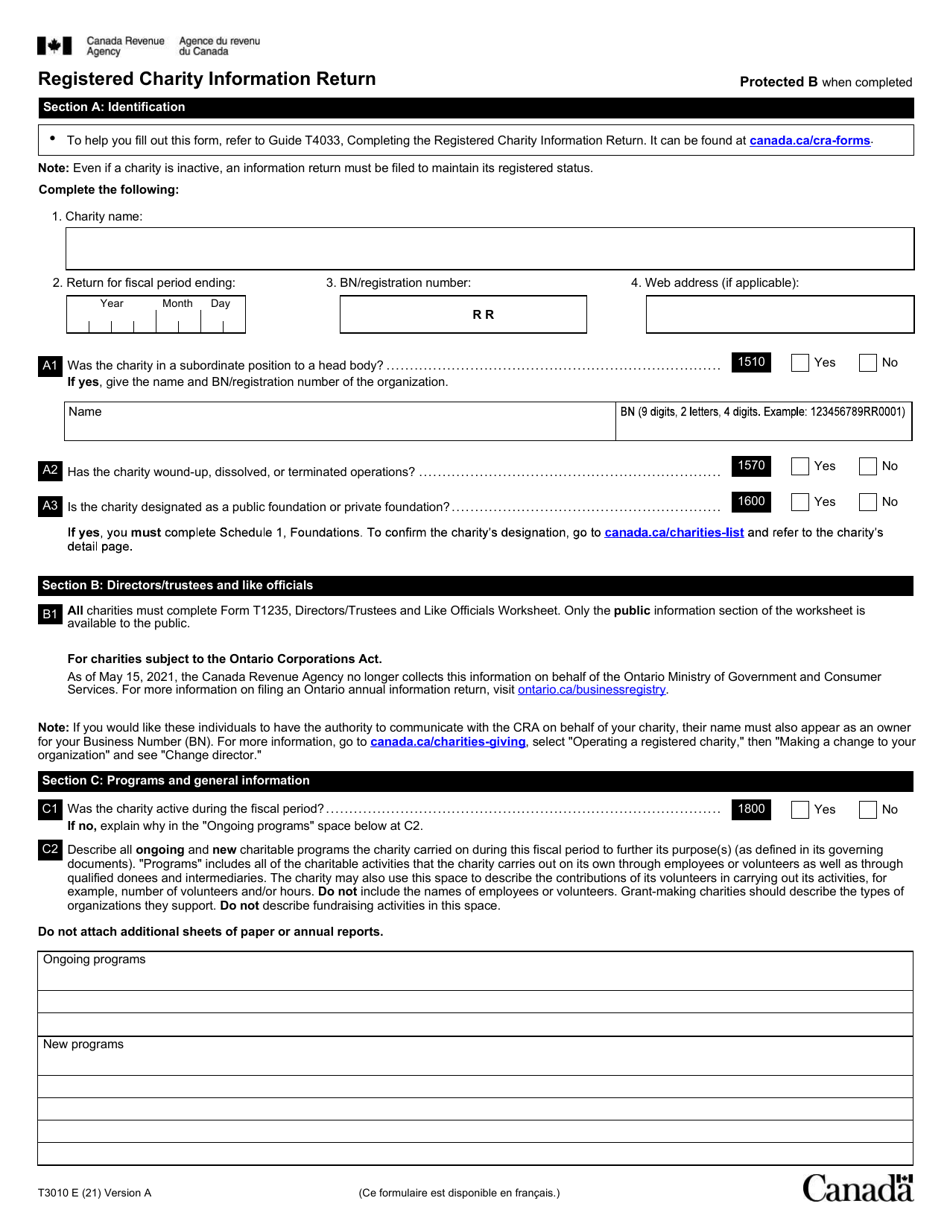

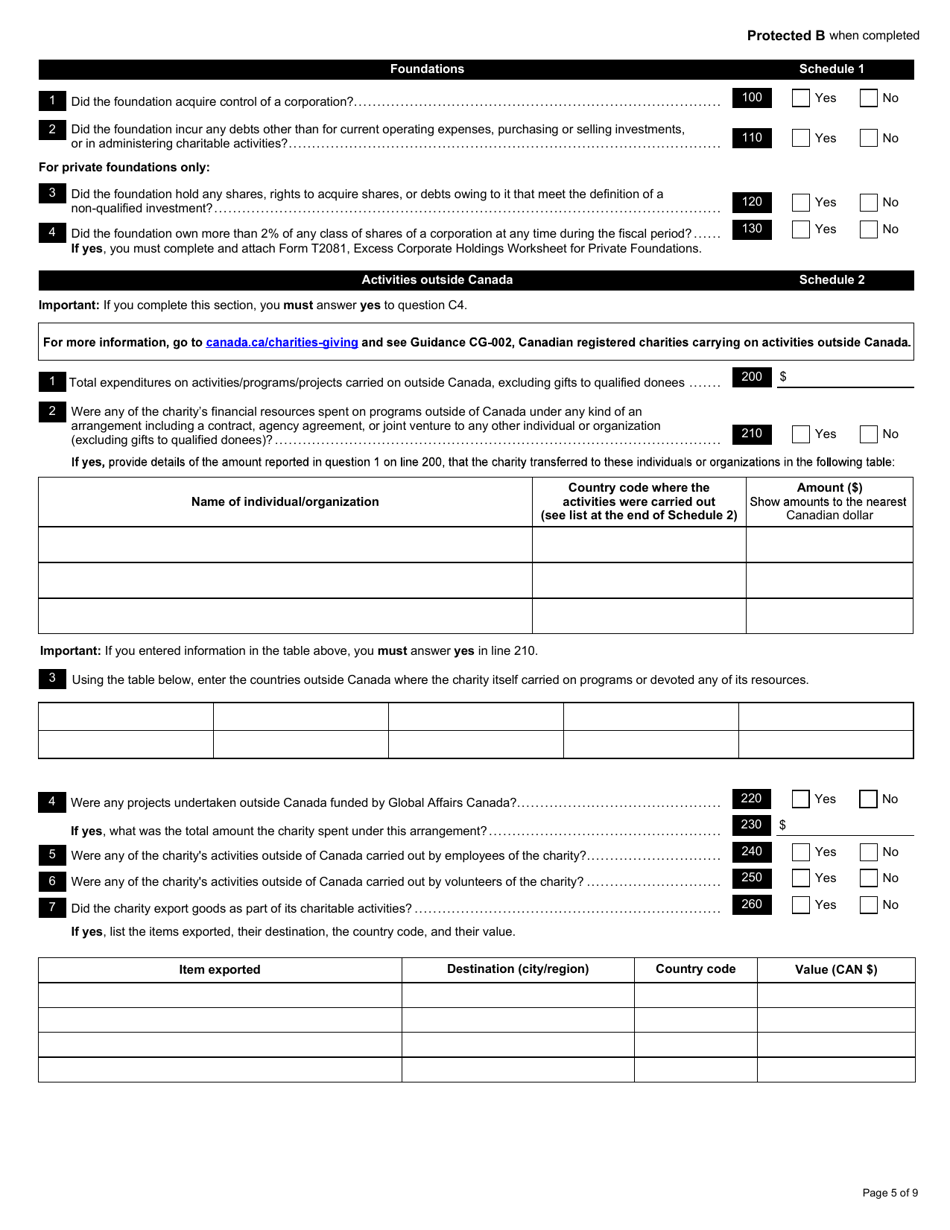

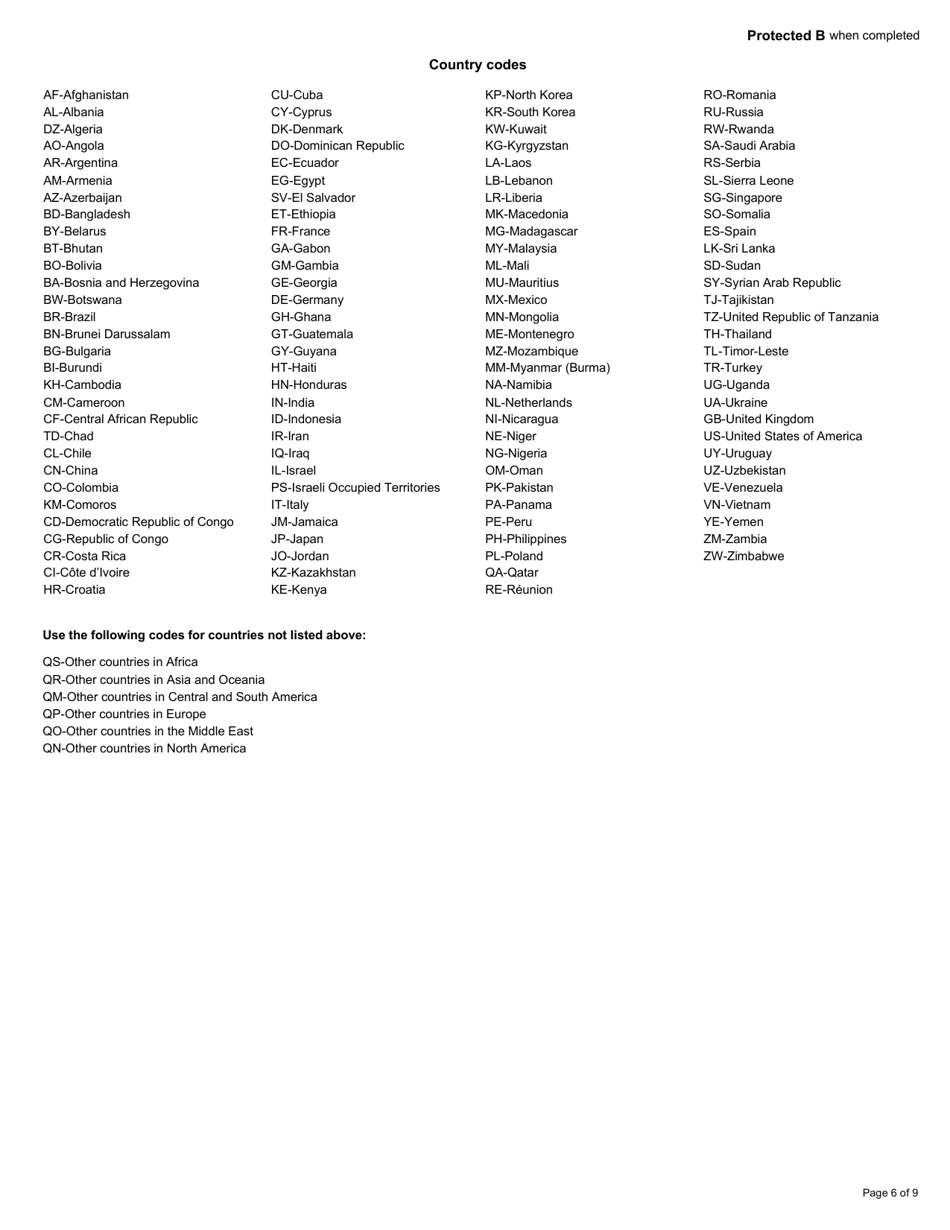

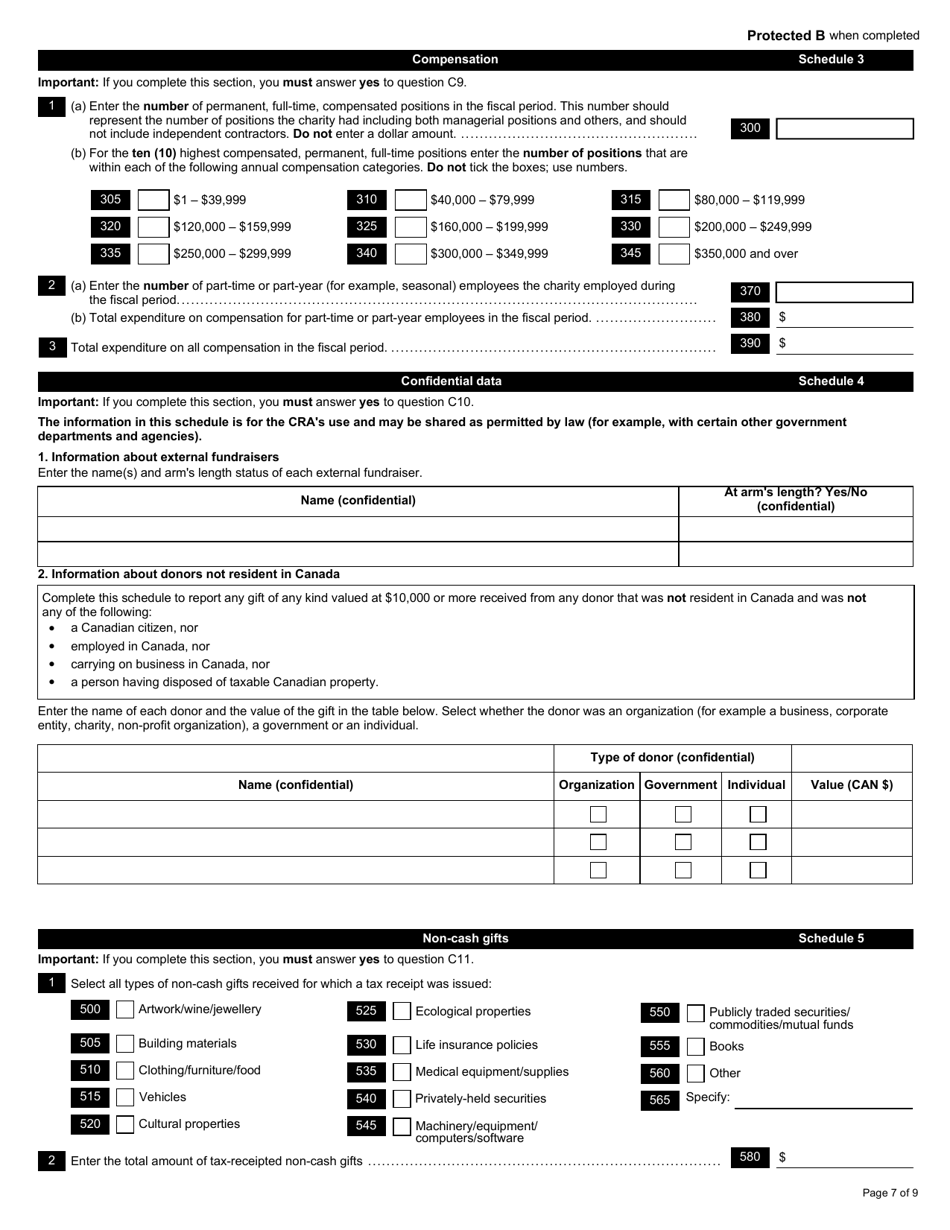

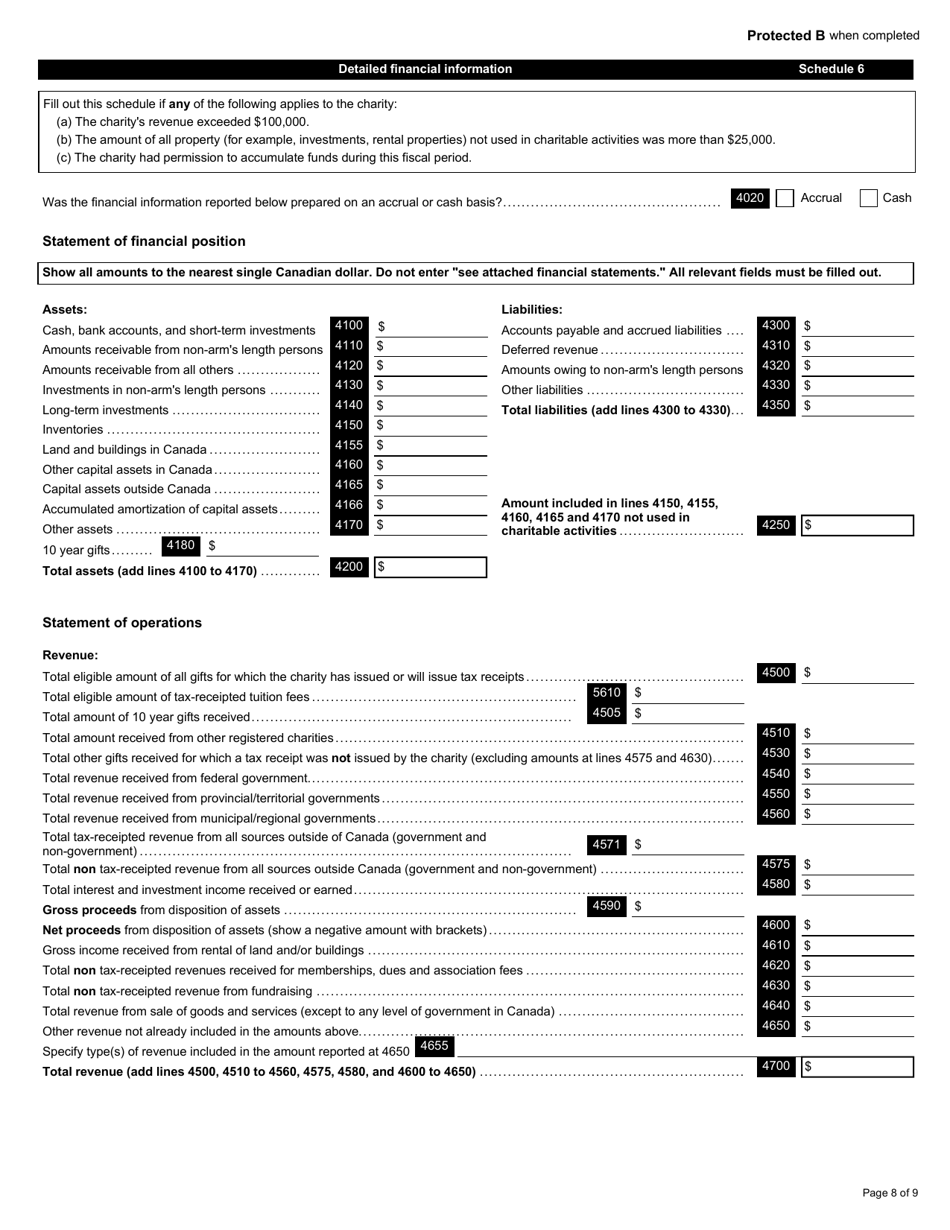

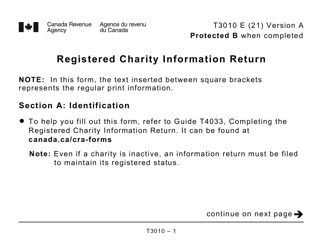

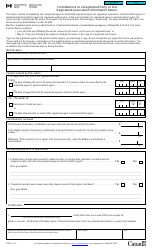

Form T3010 Registered Charity Information Return - Canada

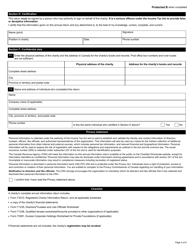

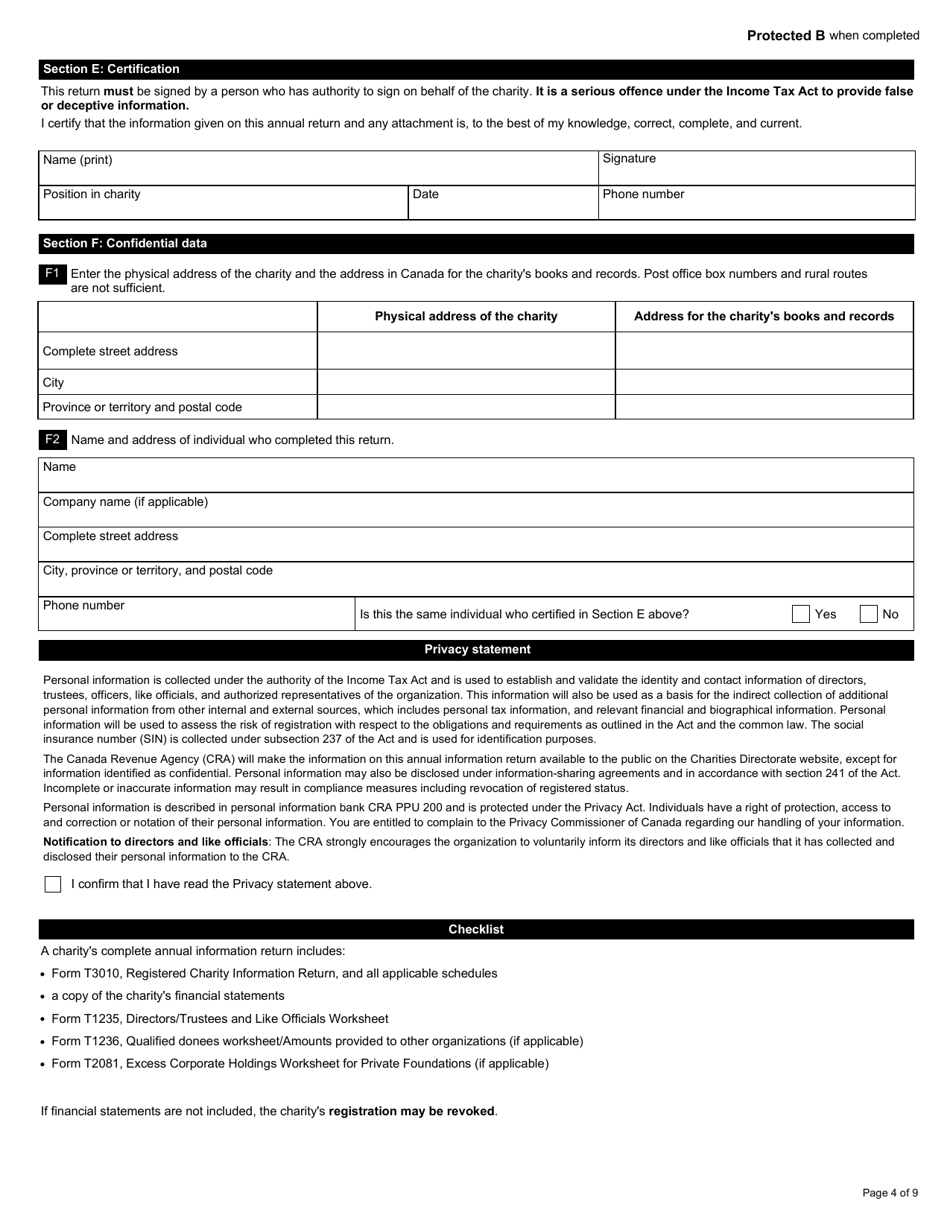

Form T3010 Registered Charity Information Return is a document used by registered charities in Canada to report their annual financial information to the Canada Revenue Agency (CRA). It provides transparency and accountability by ensuring that charities comply with the regulations and disclose information about their activities and finances.

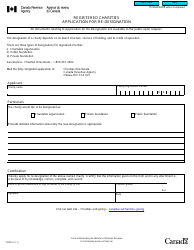

The Form T3010 Registered Charity Information Return in Canada is filed by registered charities.

FAQ

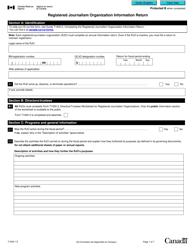

Q: What is a T3010 Registered Charity Information Return?

A: The T3010 Registered Charity Information Return is a form that registered charities in Canada must file with the Canada Revenue Agency (CRA) to report their financial information and maintain their charitable status.

Q: Who is required to file a T3010 return?

A: All registered charities in Canada are required to file a T3010 return, regardless of their size or level of activity.

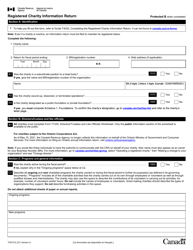

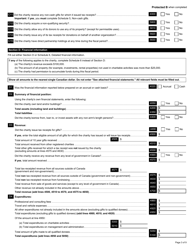

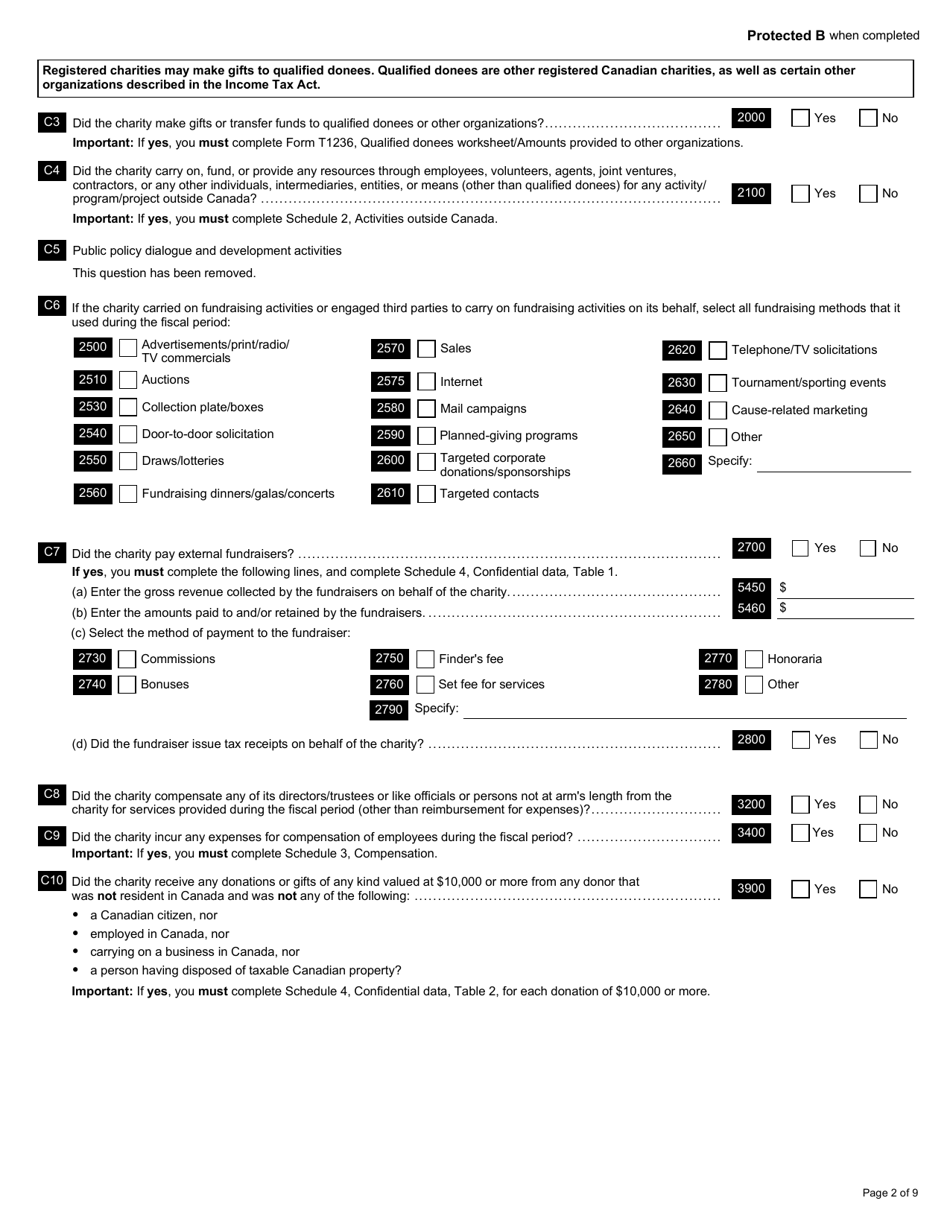

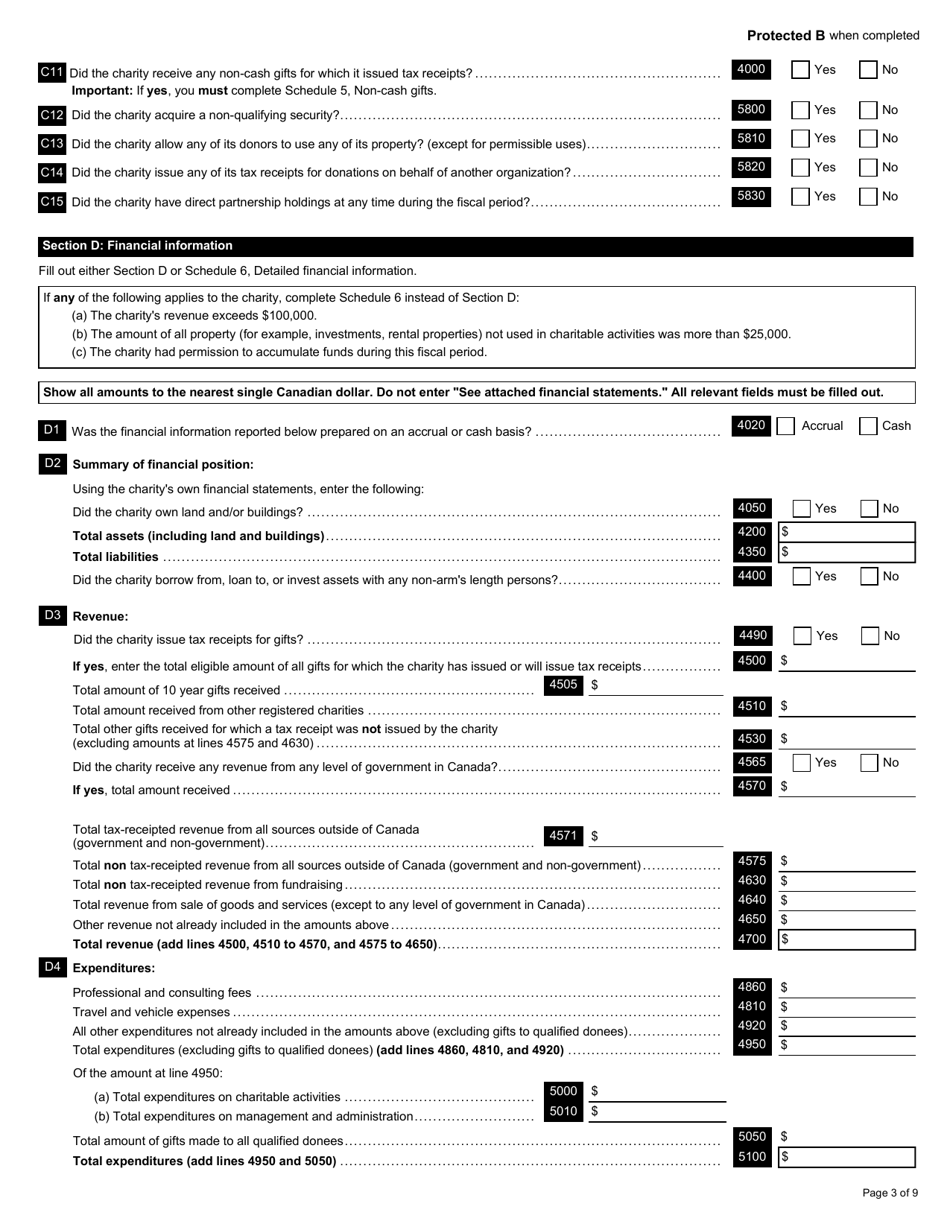

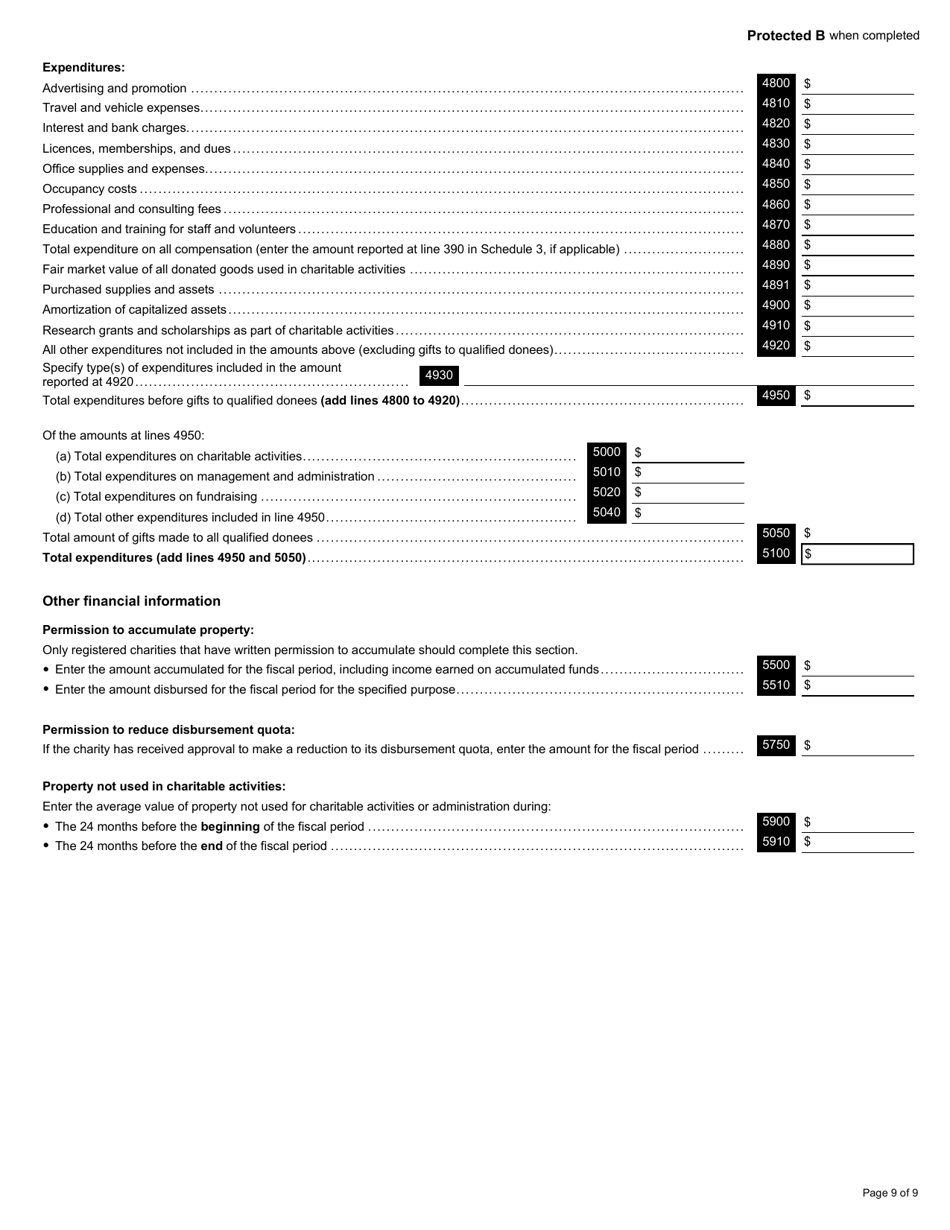

Q: What information does the T3010 return require?

A: The T3010 return requires charities to provide detailed financial information, including their sources of revenue, expenses, and asset holdings.

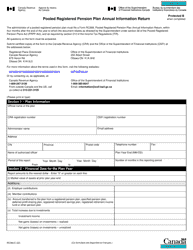

Q: When is the deadline to file a T3010 return?

A: The deadline to file a T3010 return is within six months of the end of the charity's fiscal year.

Q: What happens if a charity fails to file a T3010 return?

A: If a charity fails to file a T3010 return, it may lose its registered charity status and, as a result, its ability to issue official donation receipts and receive tax-exempt status.

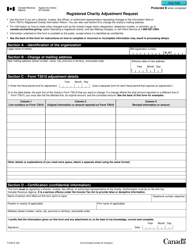

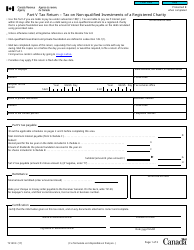

Q: Are there any penalties for errors or omissions on the T3010 return?

A: Yes, errors or omissions on the T3010 return can result in penalties or sanctions imposed by the CRA, depending on the severity of the non-compliance.