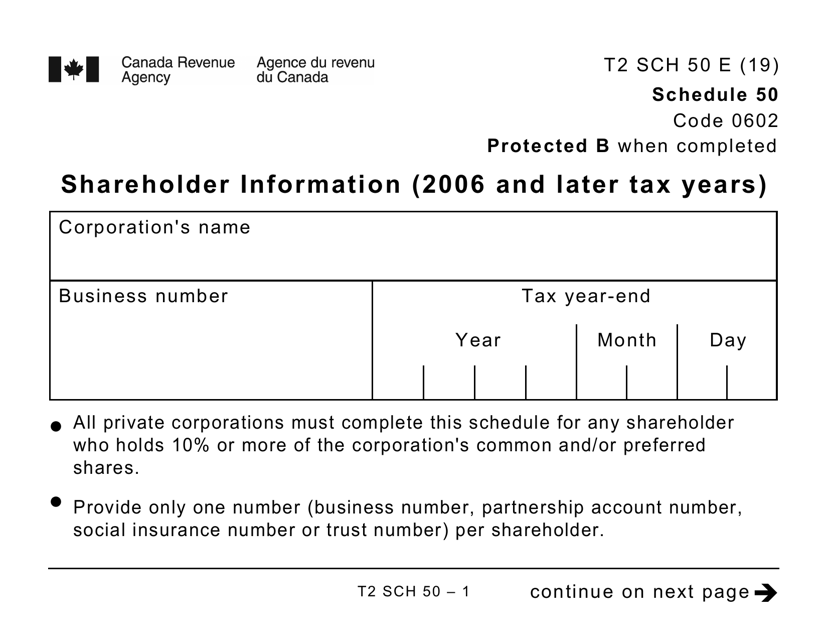

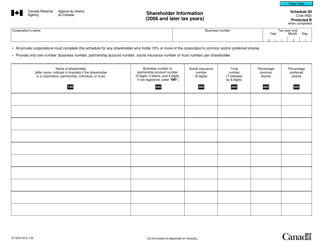

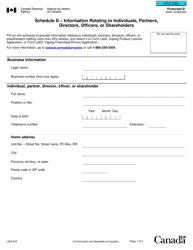

Form T2 Schedule 50 Shareholder Information (2006 and Later Tax Years) - Large Print - Canada

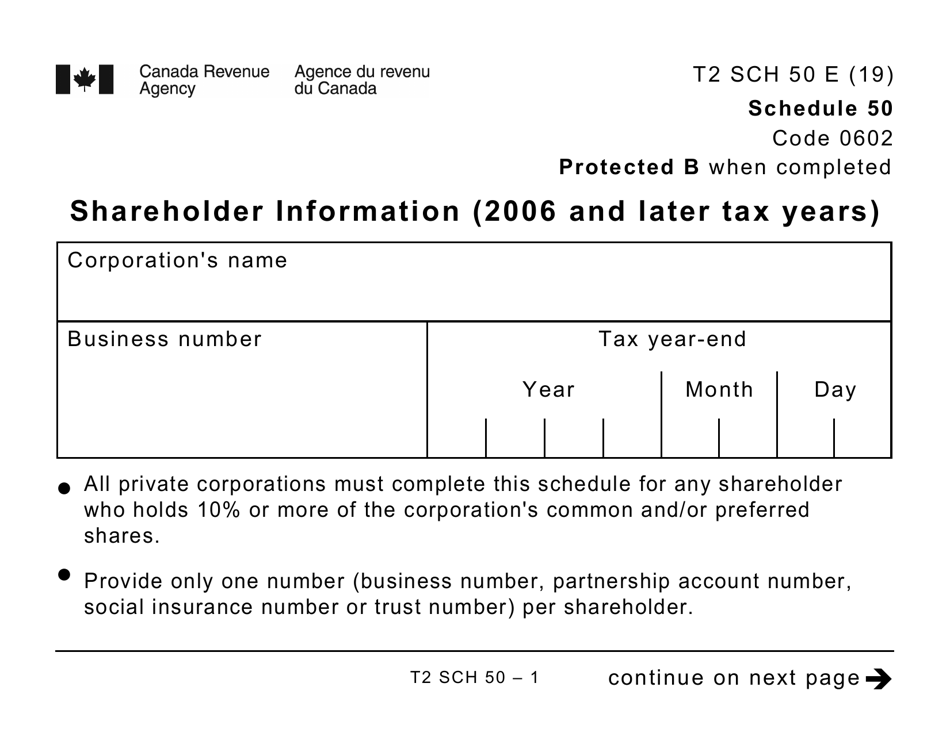

Form T2 Schedule 50 Shareholder Information (2006 and Later Tax Years) - Large Print - Canada is used to provide information about shareholders of a corporation for tax purposes.

The Form T2 Schedule 50 Shareholder Information is filed by corporations in Canada.

FAQ

Q: What is Form T2 Schedule 50?

A: Form T2 Schedule 50 is a form used by Canadian corporations to provide information about their shareholders.

Q: What is the purpose of Form T2 Schedule 50?

A: The purpose of Form T2 Schedule 50 is to report detailed information about the shareholders of a Canadian corporation.

Q: Who needs to file Form T2 Schedule 50?

A: Canadian corporations are required to file Form T2 Schedule 50 if they have shareholders.

Q: Is Form T2 Schedule 50 only for large corporations?

A: No, Form T2 Schedule 50 is required for all Canadian corporations, regardless of their size.

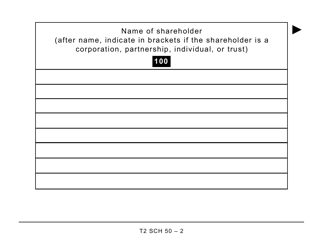

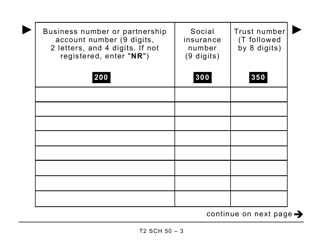

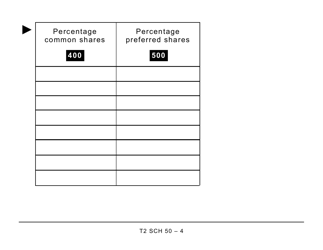

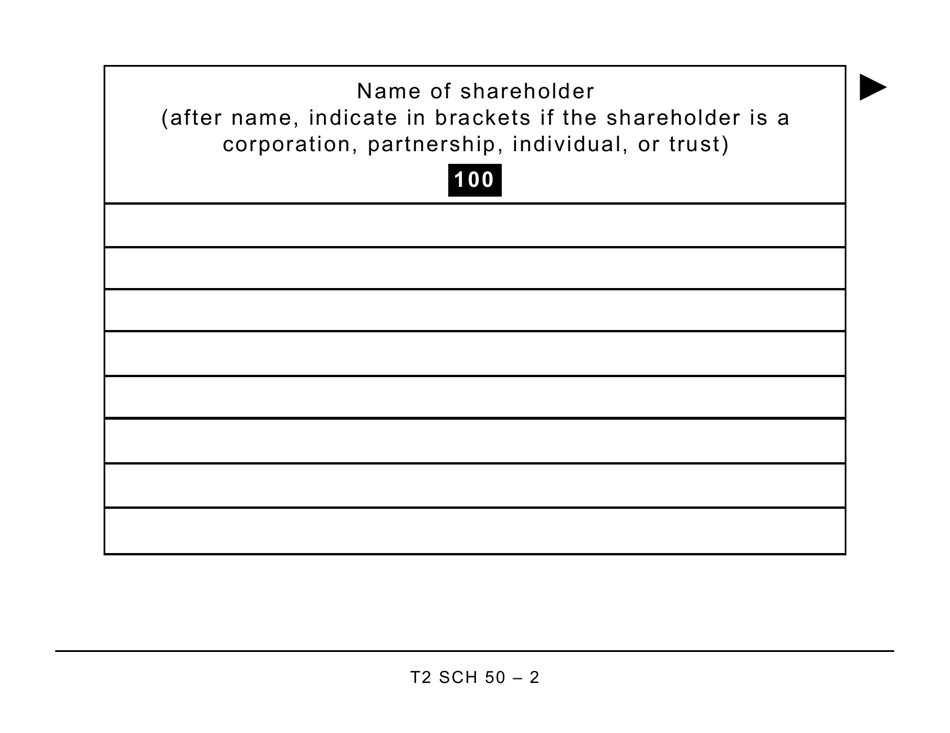

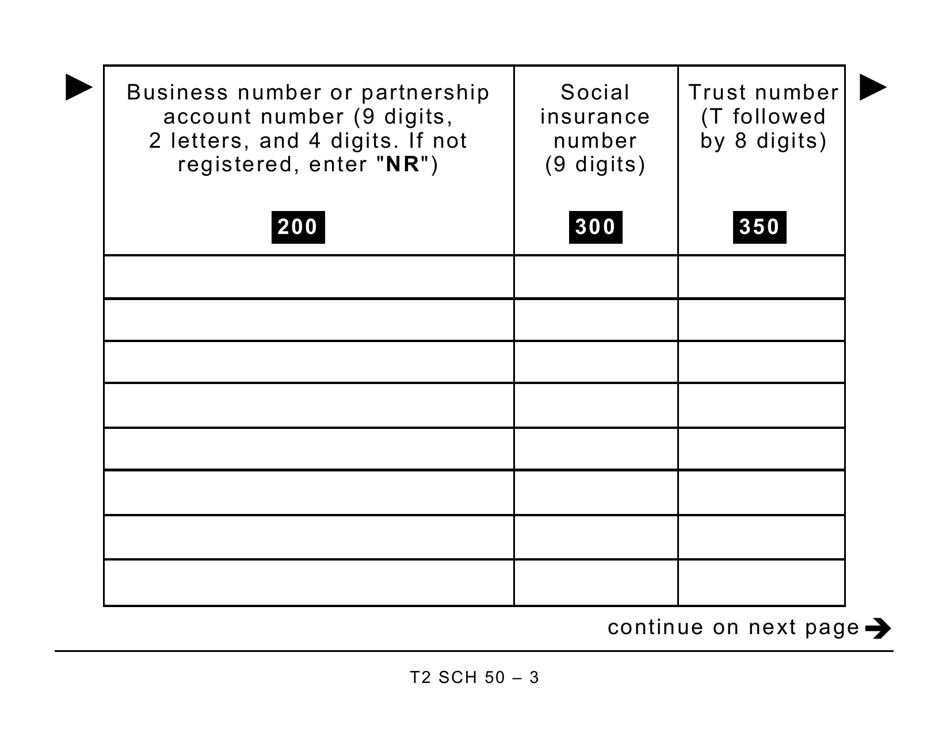

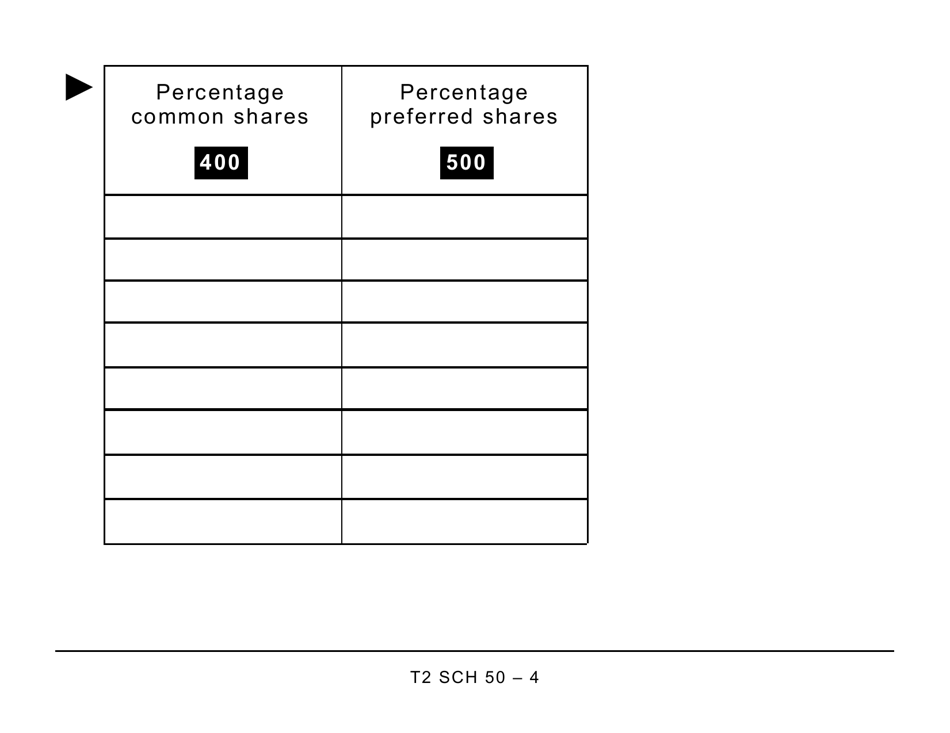

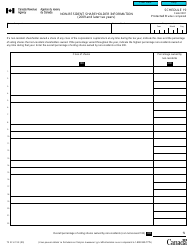

Q: What information is required on Form T2 Schedule 50?

A: Form T2 Schedule 50 requires information such as the name, address, and ownership percentage of each shareholder.

Q: Are there any penalties for not filing Form T2 Schedule 50?

A: Yes, there can be penalties for not filing Form T2 Schedule 50, as it is a required form for Canadian corporations.