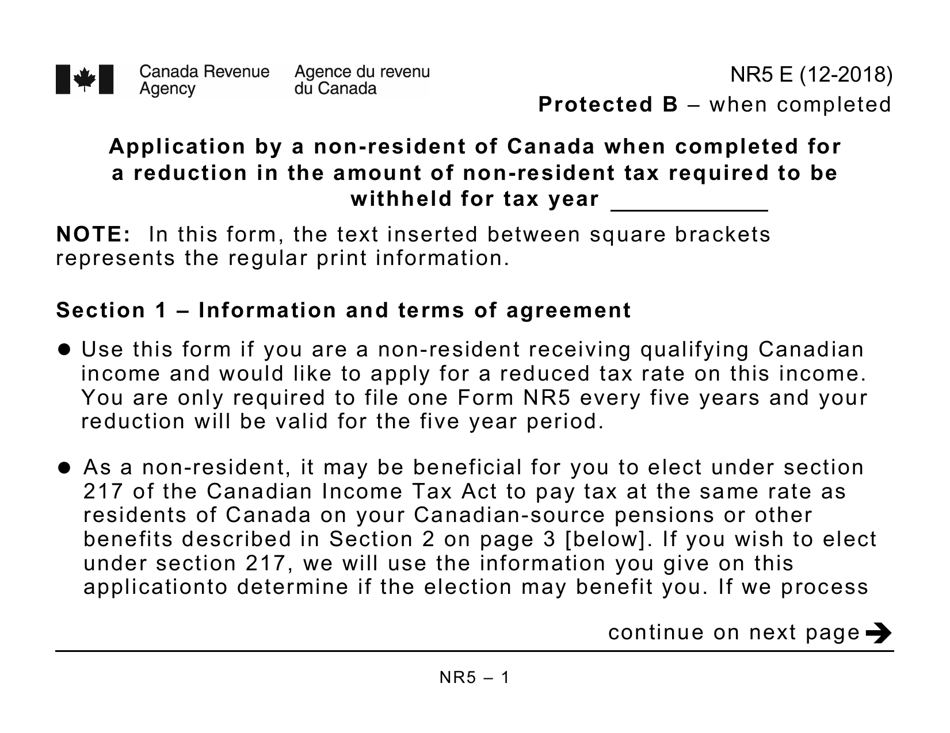

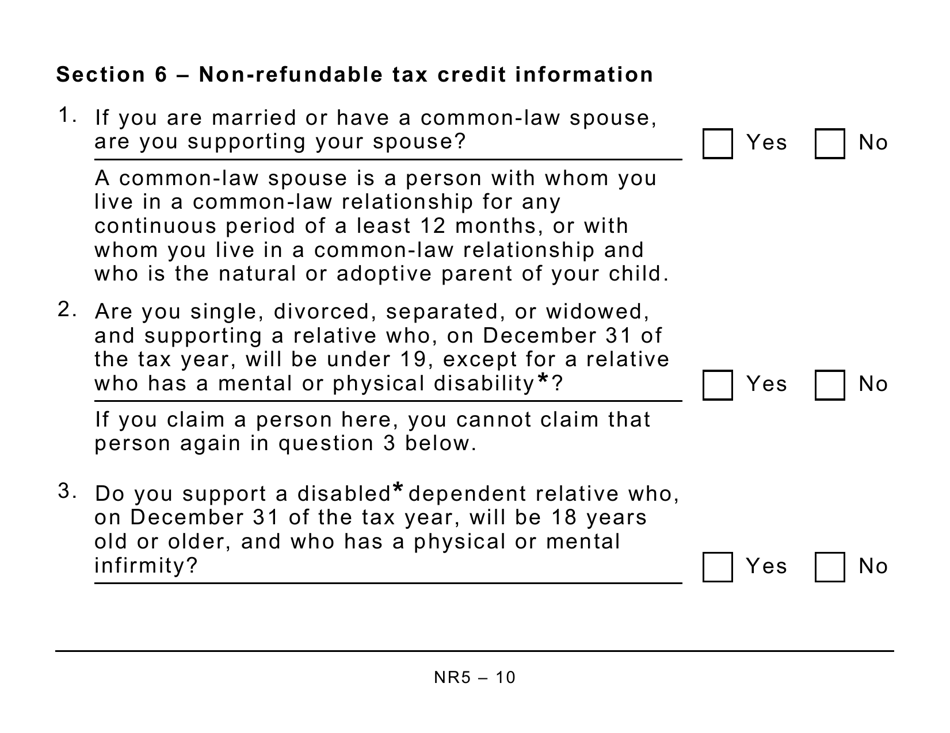

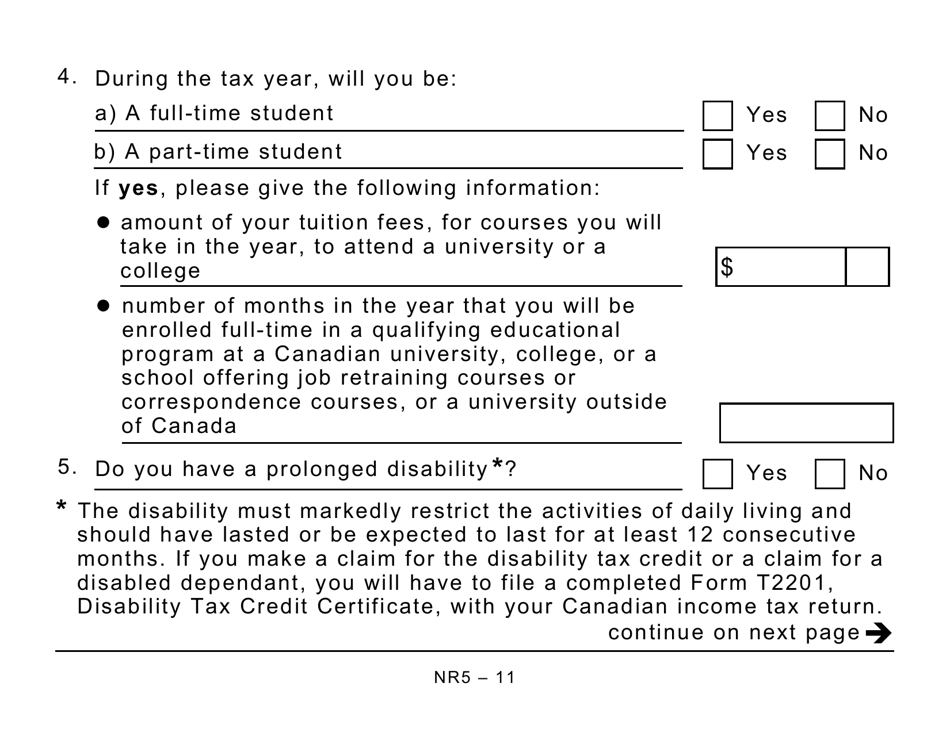

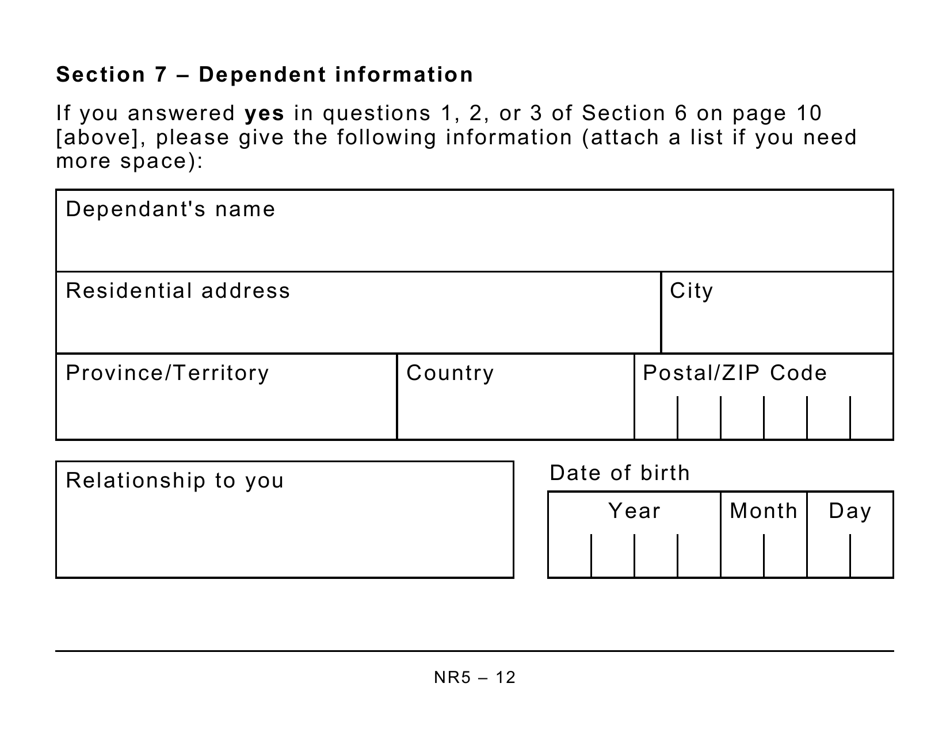

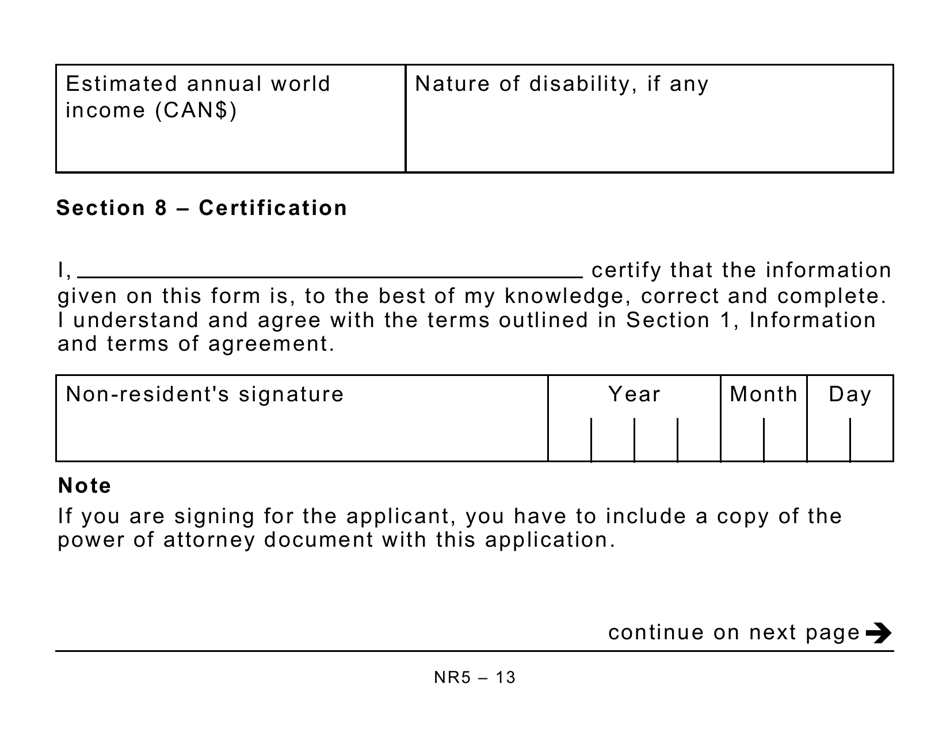

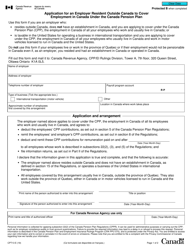

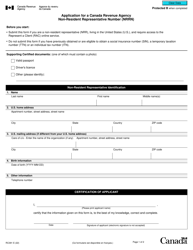

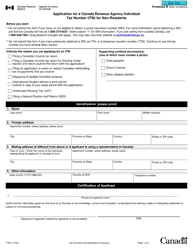

Form NR5 Application by a Non-resident of Canada When Completed for a Reduction in the Amount of Non-resident Tax Required to Be Withheld - Large Print - Canada

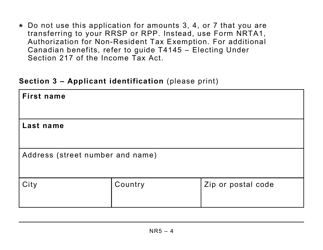

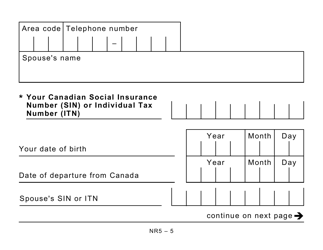

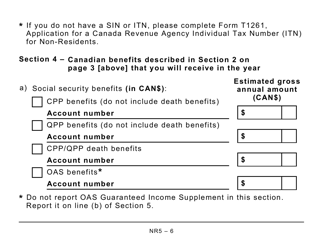

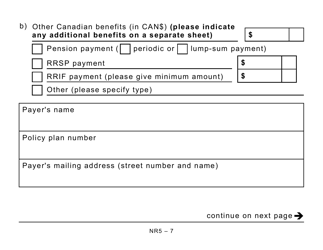

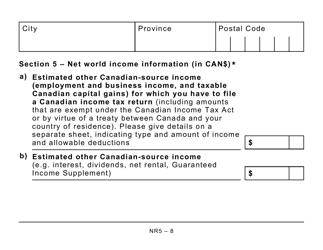

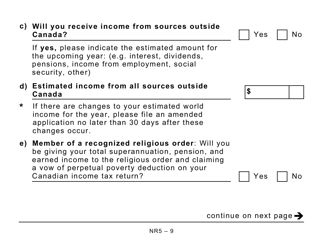

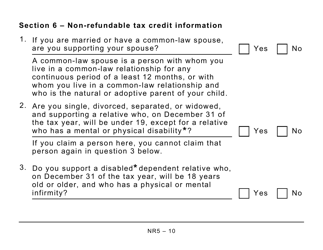

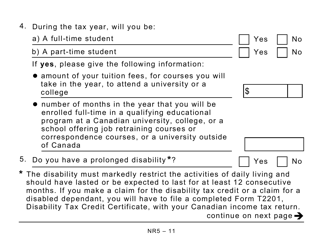

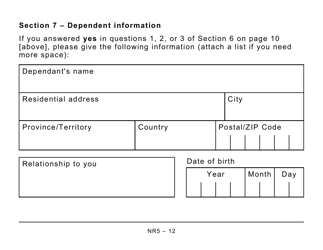

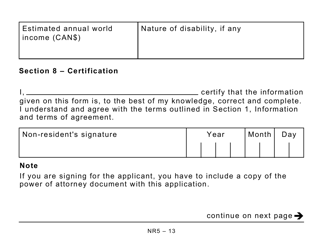

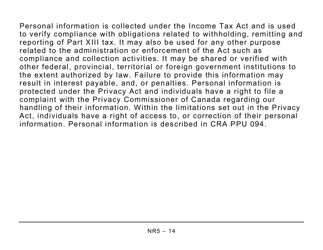

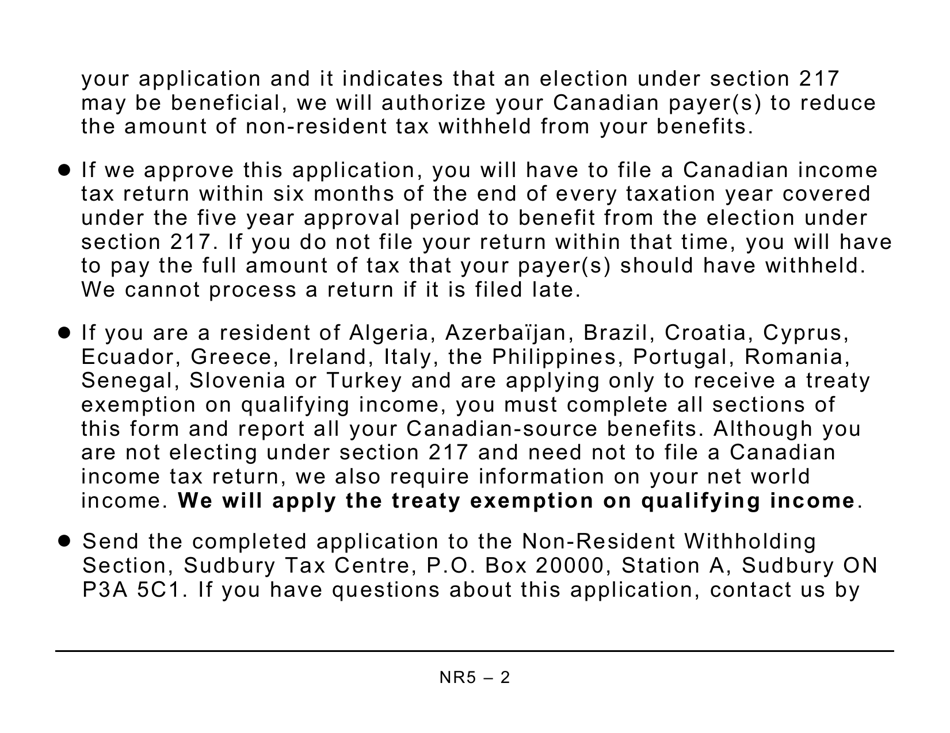

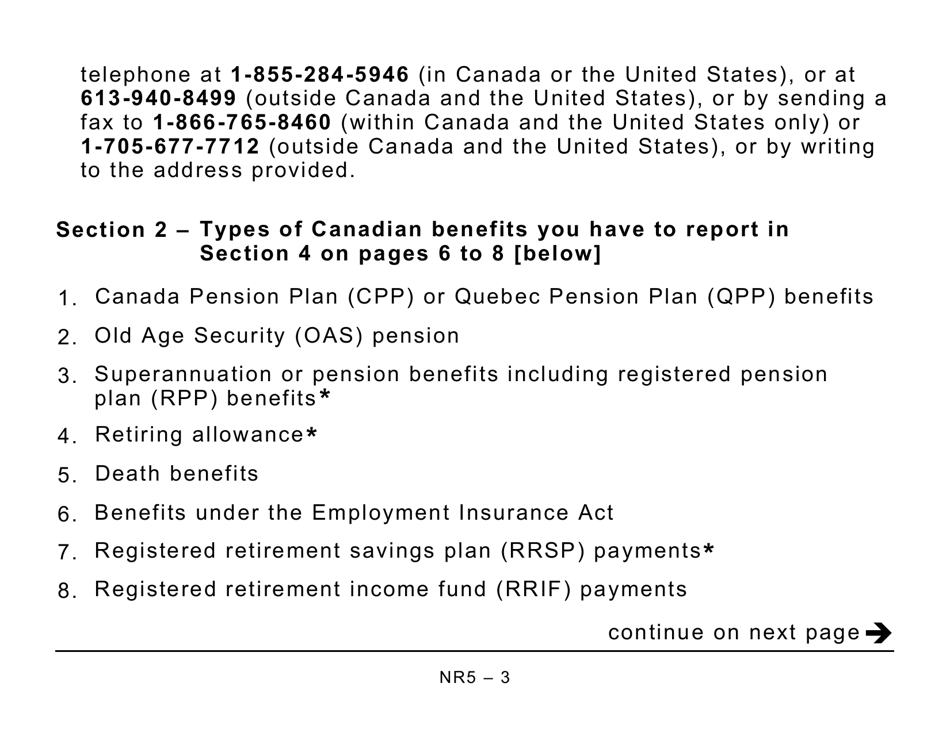

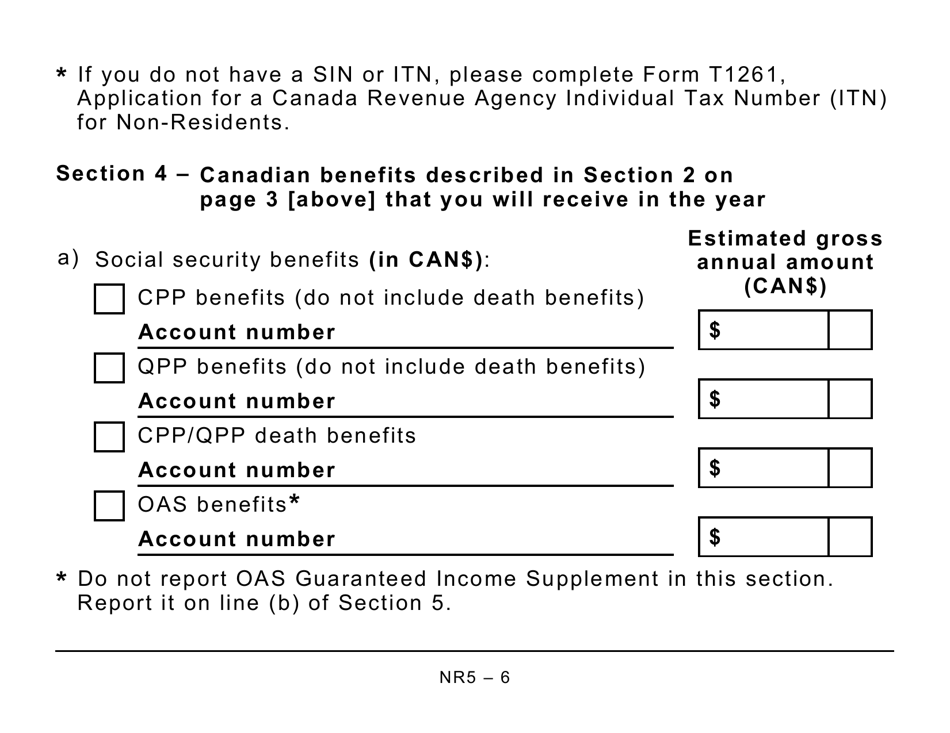

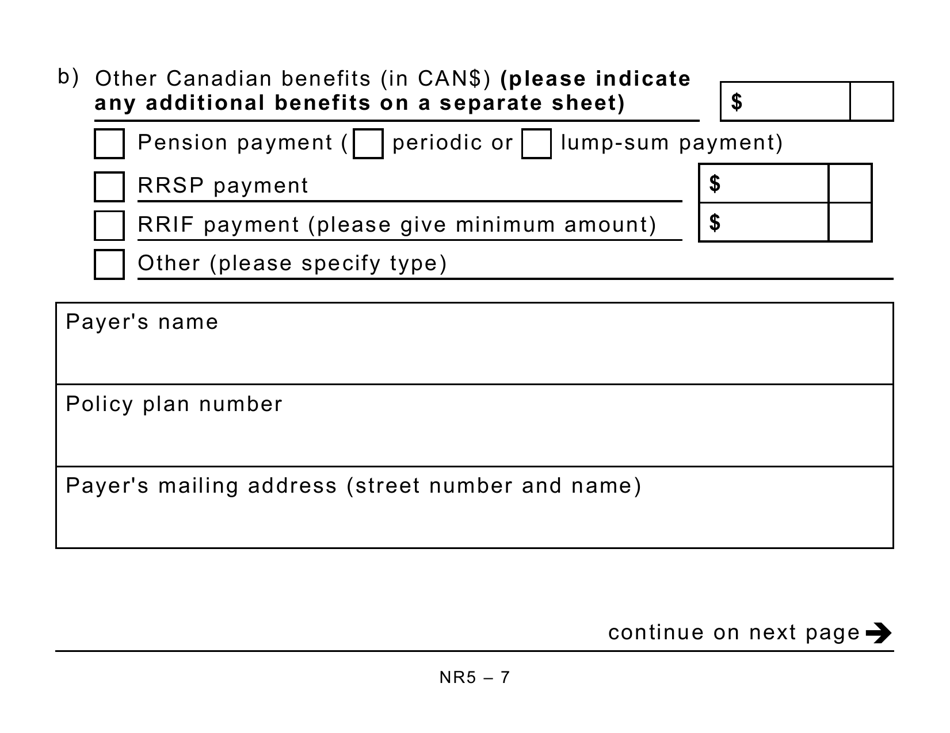

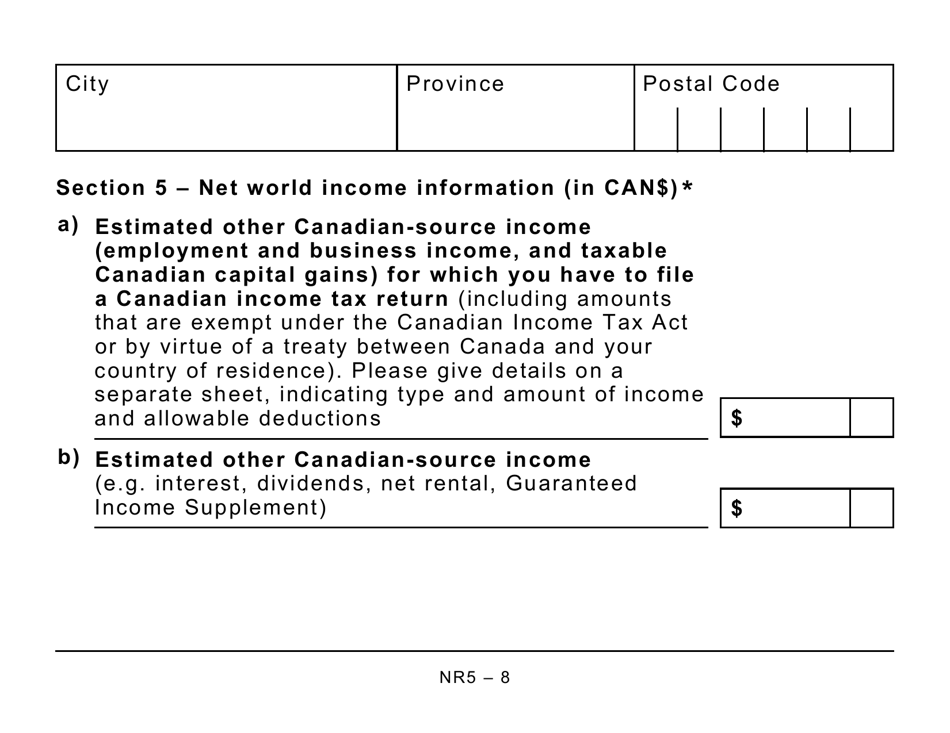

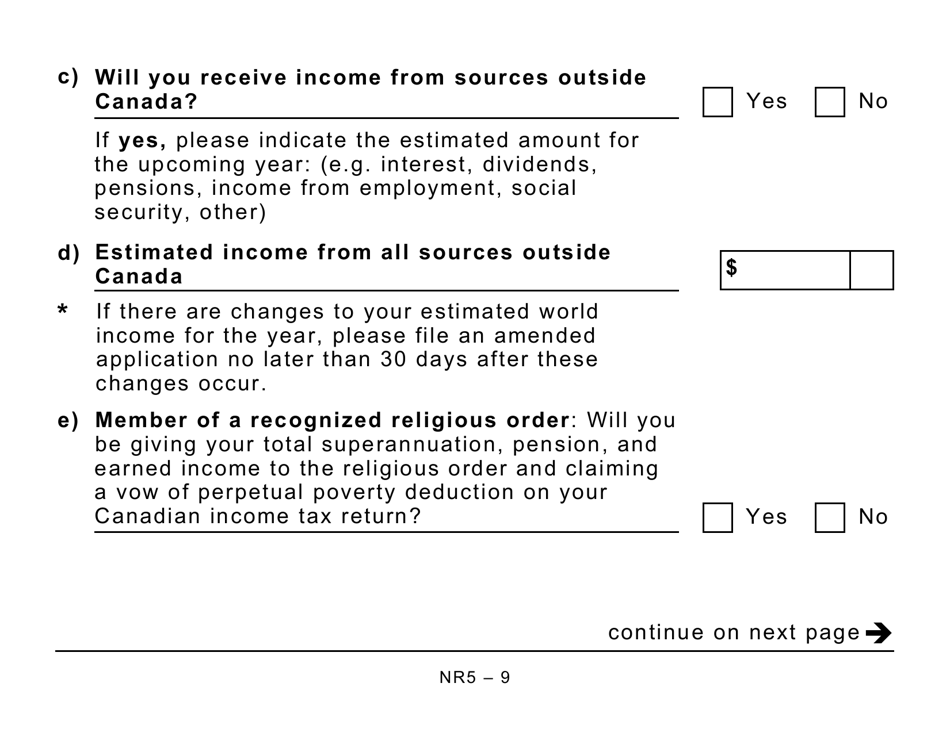

Form NR5 Application by a Non-resident of Canada When Completed for a Reduction in the Amount of Non-resident Tax Required to Be Withheld - Large Print - Canada is used by non-residents of Canada to apply for a reduction in the amount of non-resident tax that needs to be withheld from their Canadian income. This form helps non-residents claim tax benefits and prevent over-withholding.

The Form NR5 application is filed by a non-resident of Canada who wants to request a reduction in the amount of non-resident tax required to be withheld.

FAQ

Q: What is Form NR5?

A: Form NR5 is an application by a non-resident of Canada for a reduction in the amount of non-resident tax required to be withheld.

Q: Who is eligible to use Form NR5?

A: Non-residents of Canada who are eligible to claim a reduced withholding tax can use Form NR5.

Q: What is the purpose of Form NR5?

A: The purpose of Form NR5 is to request a reduced amount of non-resident tax to be withheld on income earned in Canada.

Q: Is Form NR5 available in Large Print?

A: Yes, Form NR5 is available in Large Print.