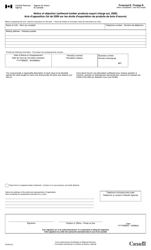

This version of the form is not currently in use and is provided for reference only. Download this version of

Form ON100

for the current year.

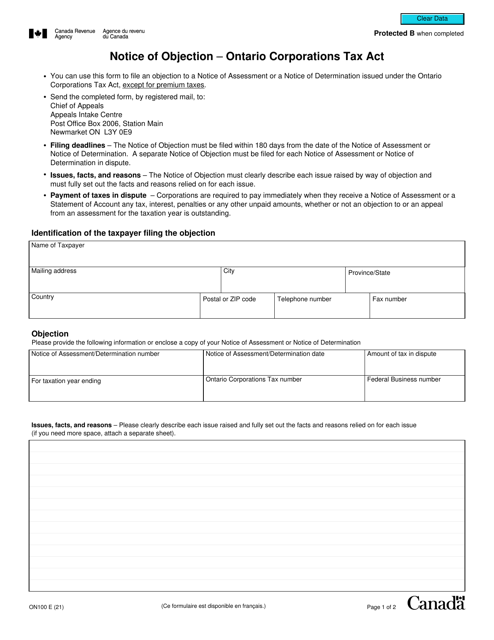

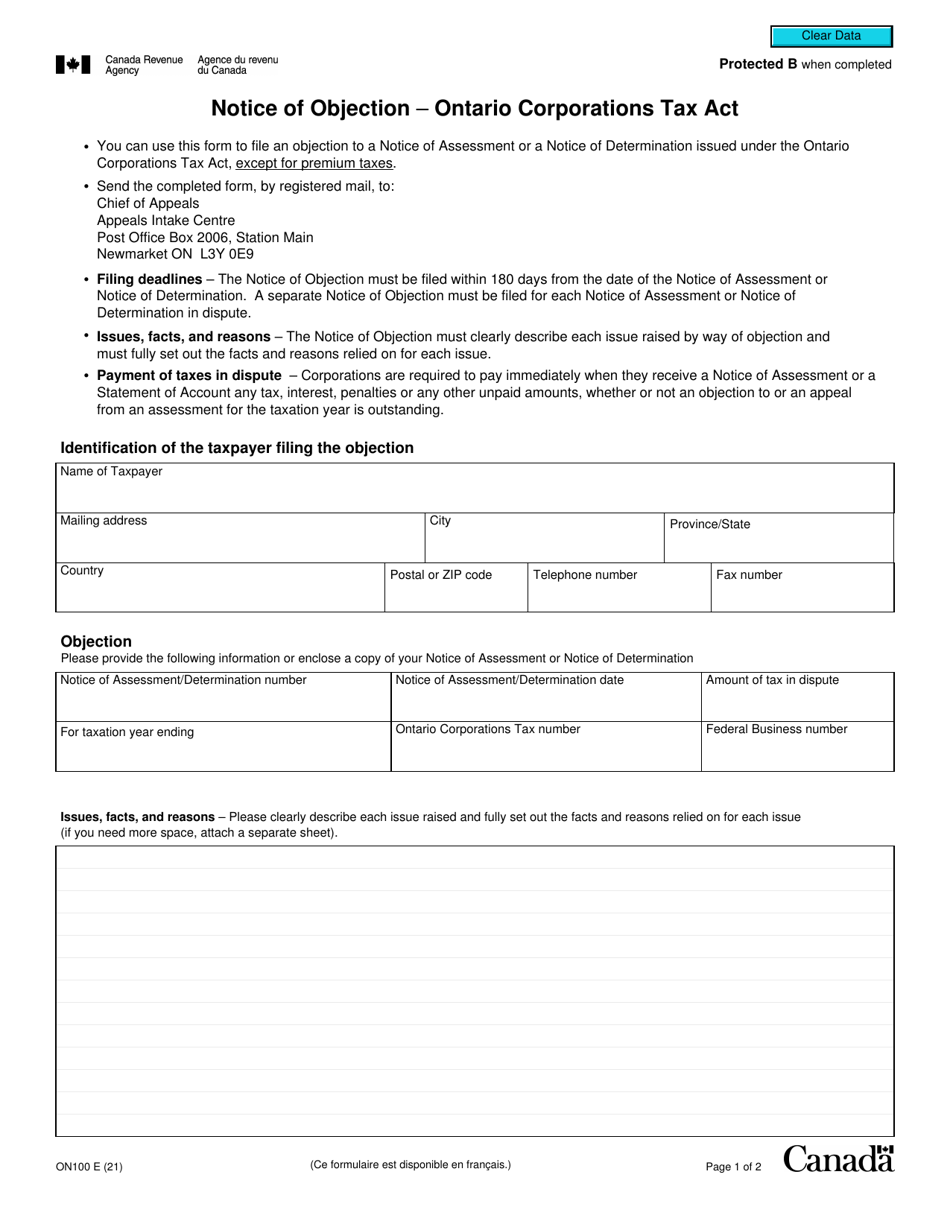

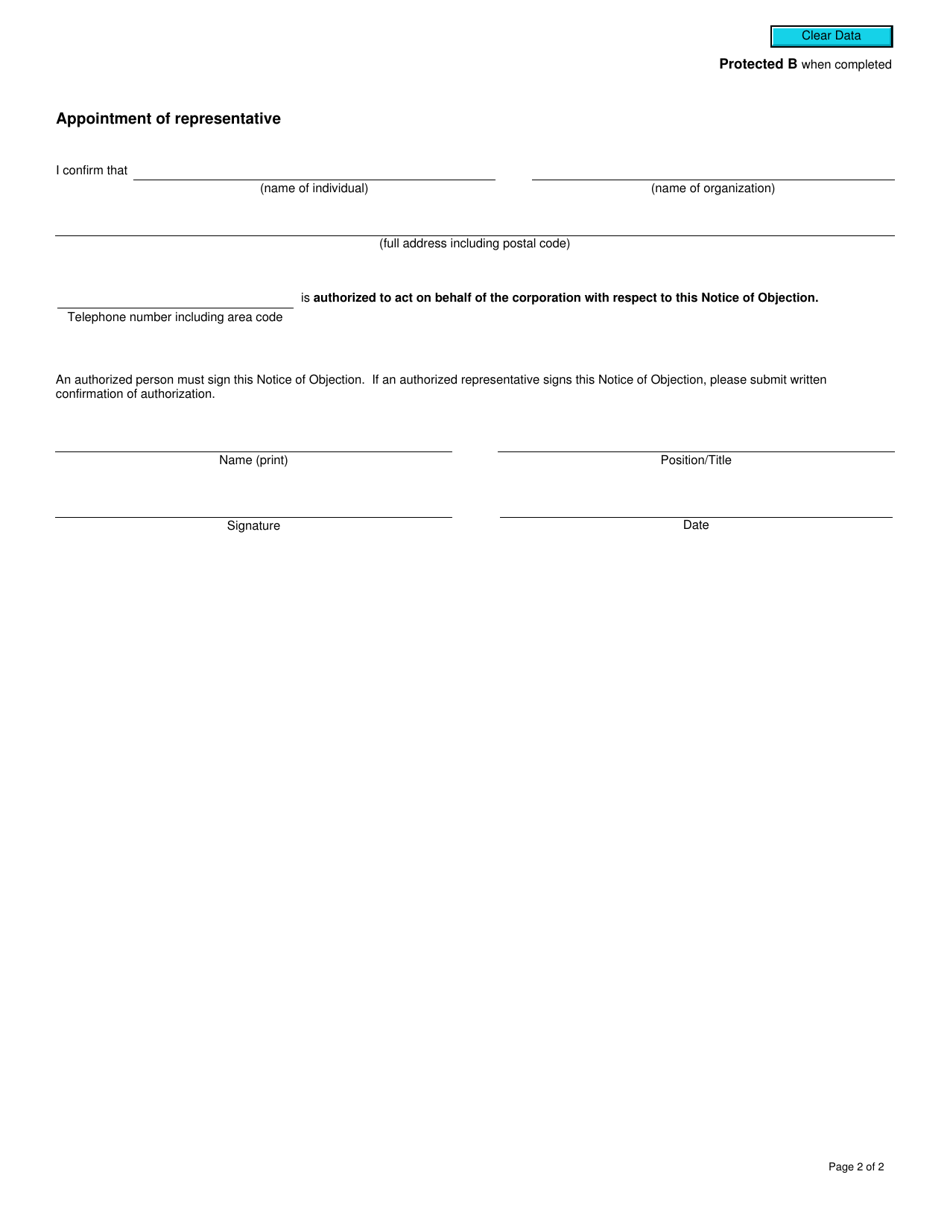

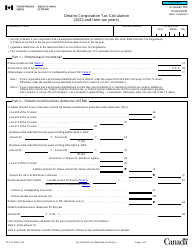

Form ON100 Notice of Objection - Ontario Corporations Tax Act - Canada

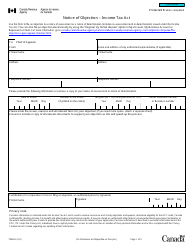

Form ON100 Notice of Objection is used in Ontario, Canada for taxpayers to dispute or object to a decision made by the Ontario Ministry of Finance regarding their corporation tax. It allows taxpayers to present their arguments and supporting evidence to challenge the tax assessment or decision.

The Ontario corporations themselves file the Form ON100 Notice of Objection under the Ontario Corporations Tax Act in Canada.

FAQ

Q: What is Form ON100?

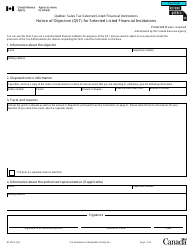

A: Form ON100 is the Notice of Objection form used for filing an objection under the Ontario Corporations Tax Act in Canada.

Q: What is the Ontario Corporations Tax Act?

A: The Ontario Corporations Tax Act is a provincial tax legislation in Ontario, Canada that governs the taxation of corporations.

Q: When should I use Form ON100?

A: You should use Form ON100 when you want to file an objection against a decision made by the Ontario Ministry of Finance regarding your corporation's tax liability or assessment.

Q: What information is required in Form ON100?

A: Form ON100 requires your corporation's name and address, tax year being disputed, details of the decision being objected to, grounds for objection, and supporting documents.