This version of the form is not currently in use and is provided for reference only. Download this version of

Form GST518

for the current year.

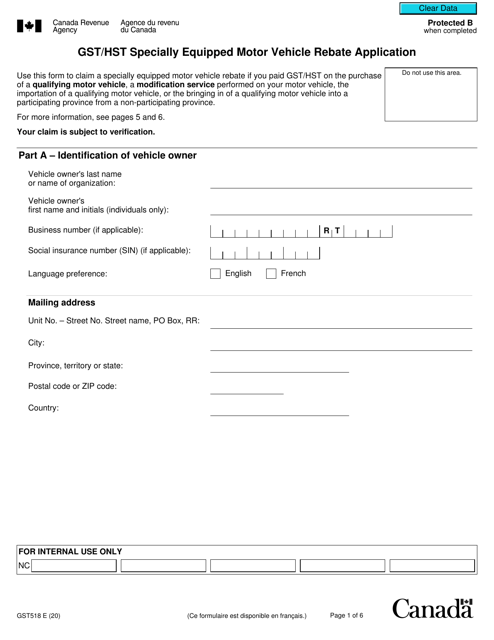

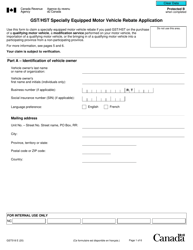

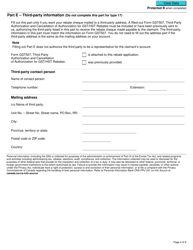

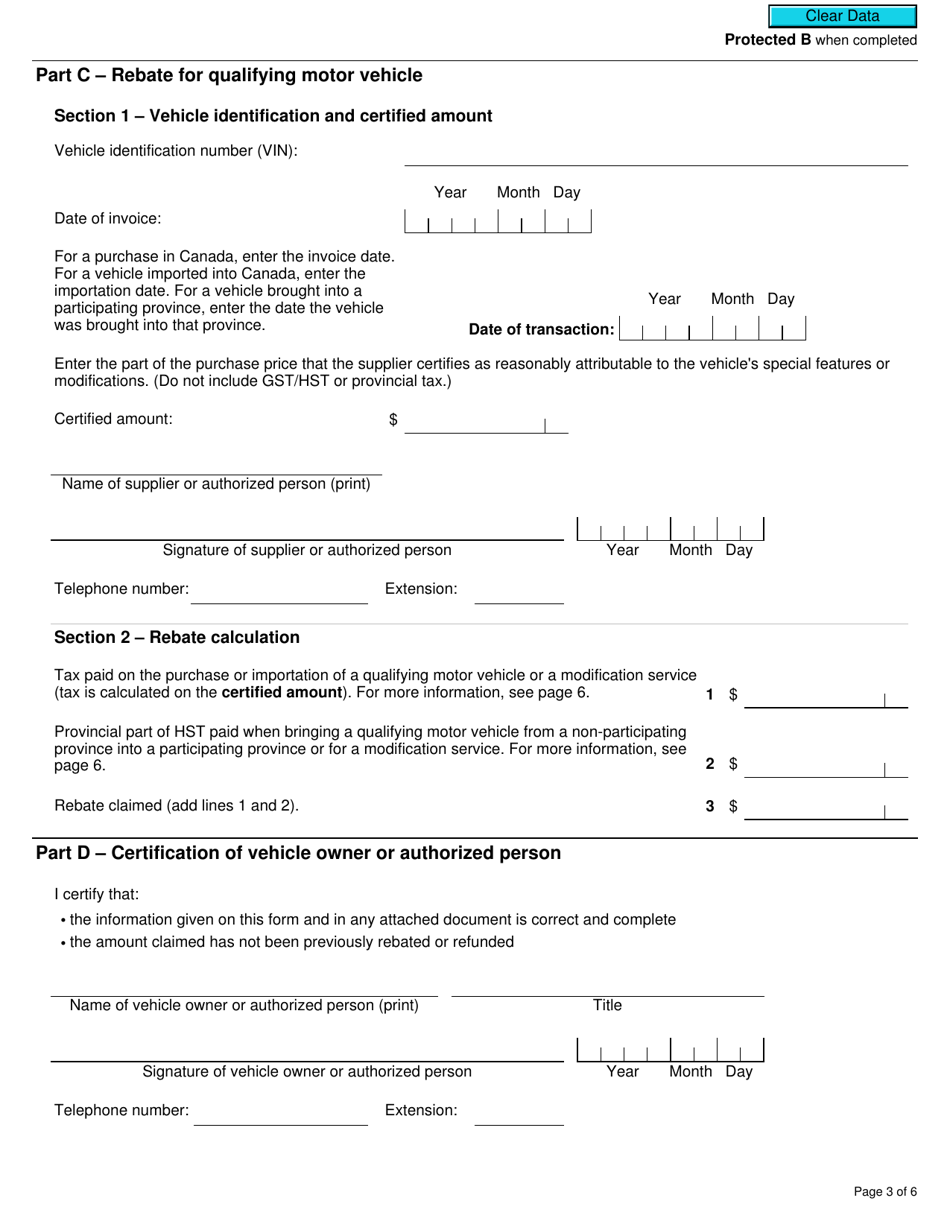

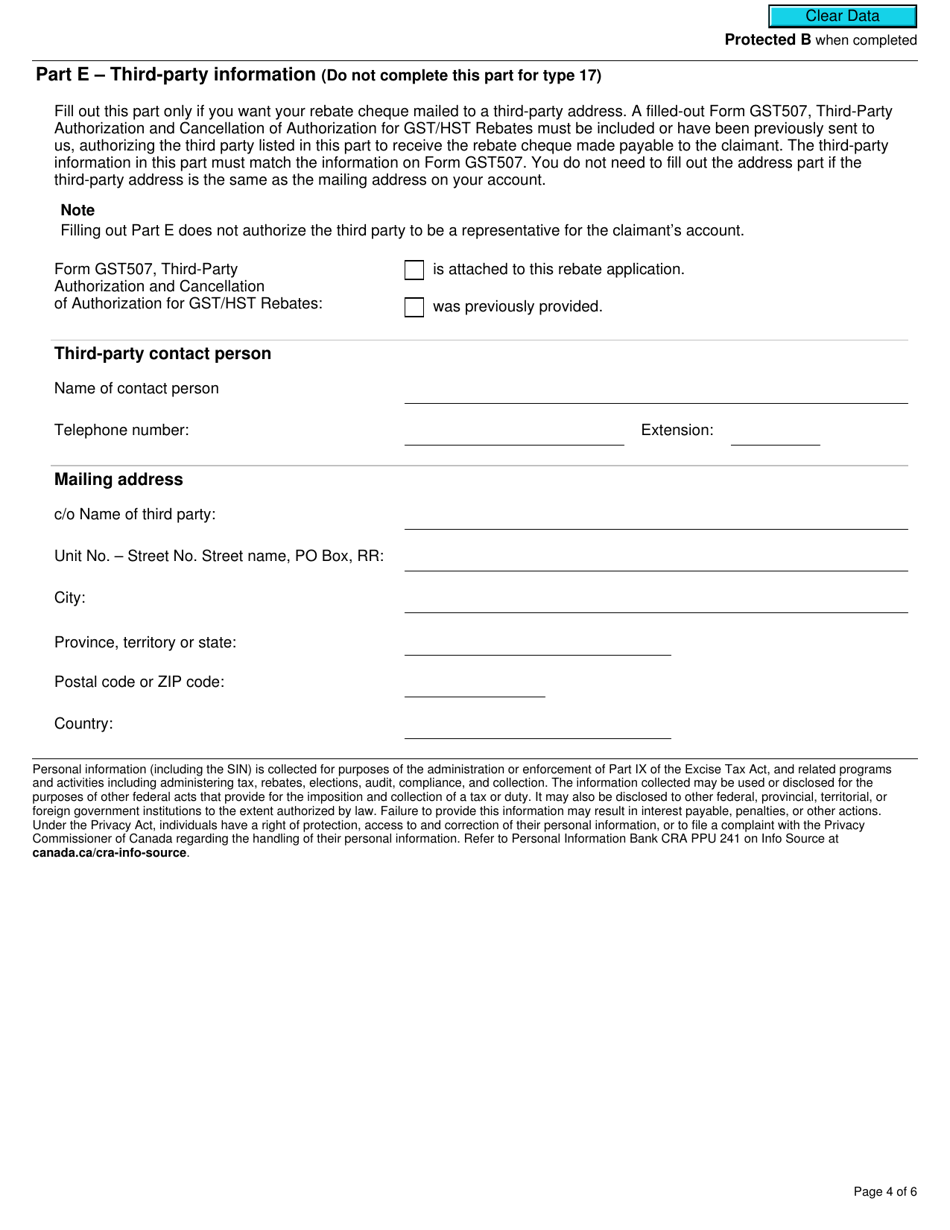

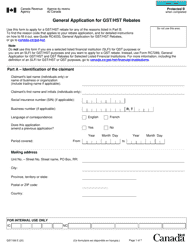

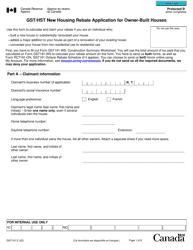

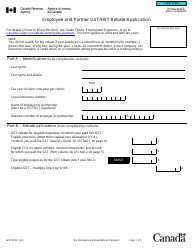

Form GST518 Gst / Hst Specially Equipped Motor Vehicle Rebate Application - Canada

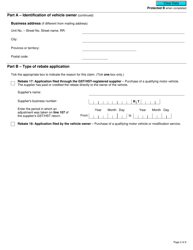

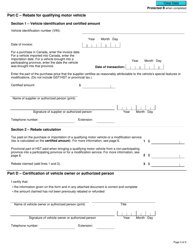

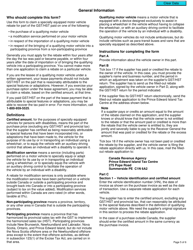

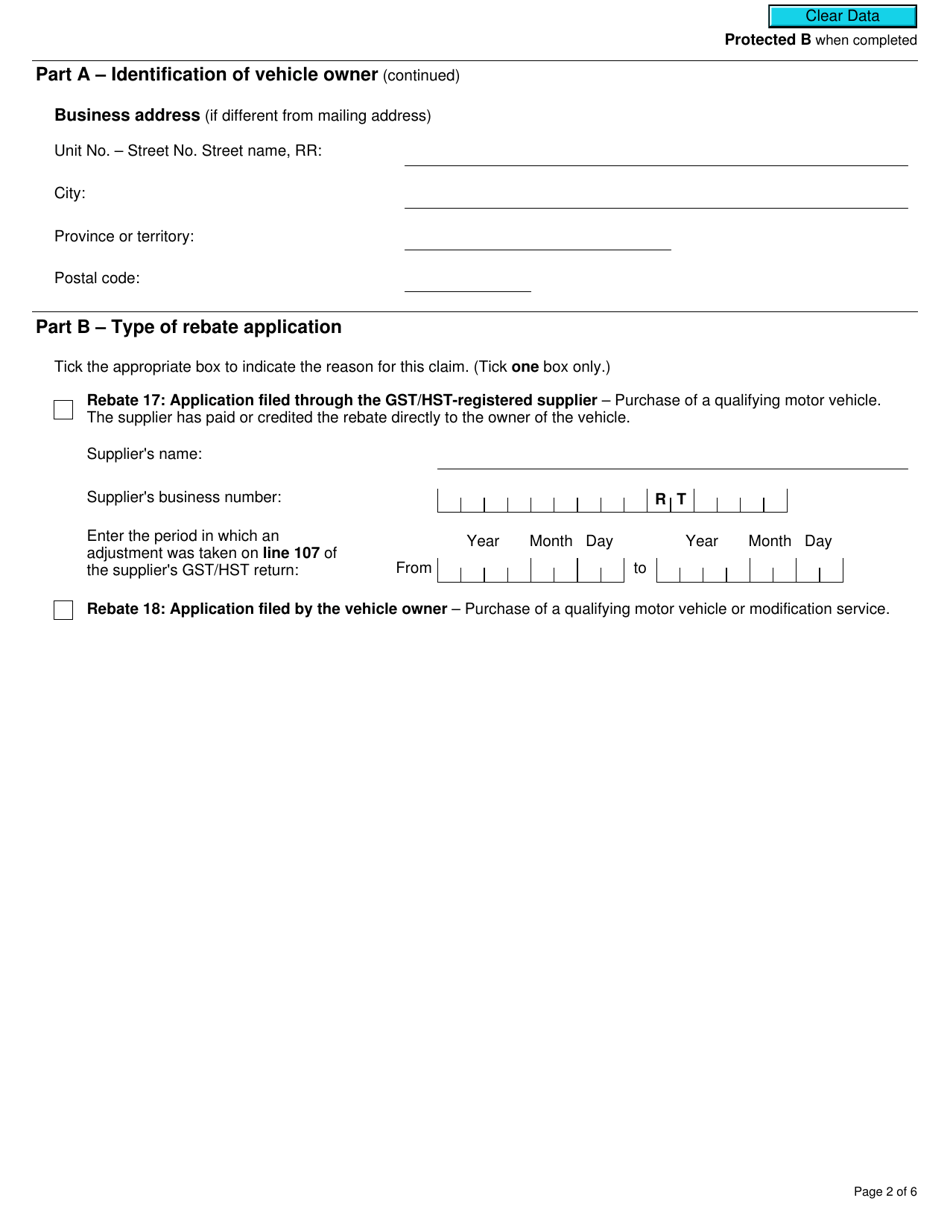

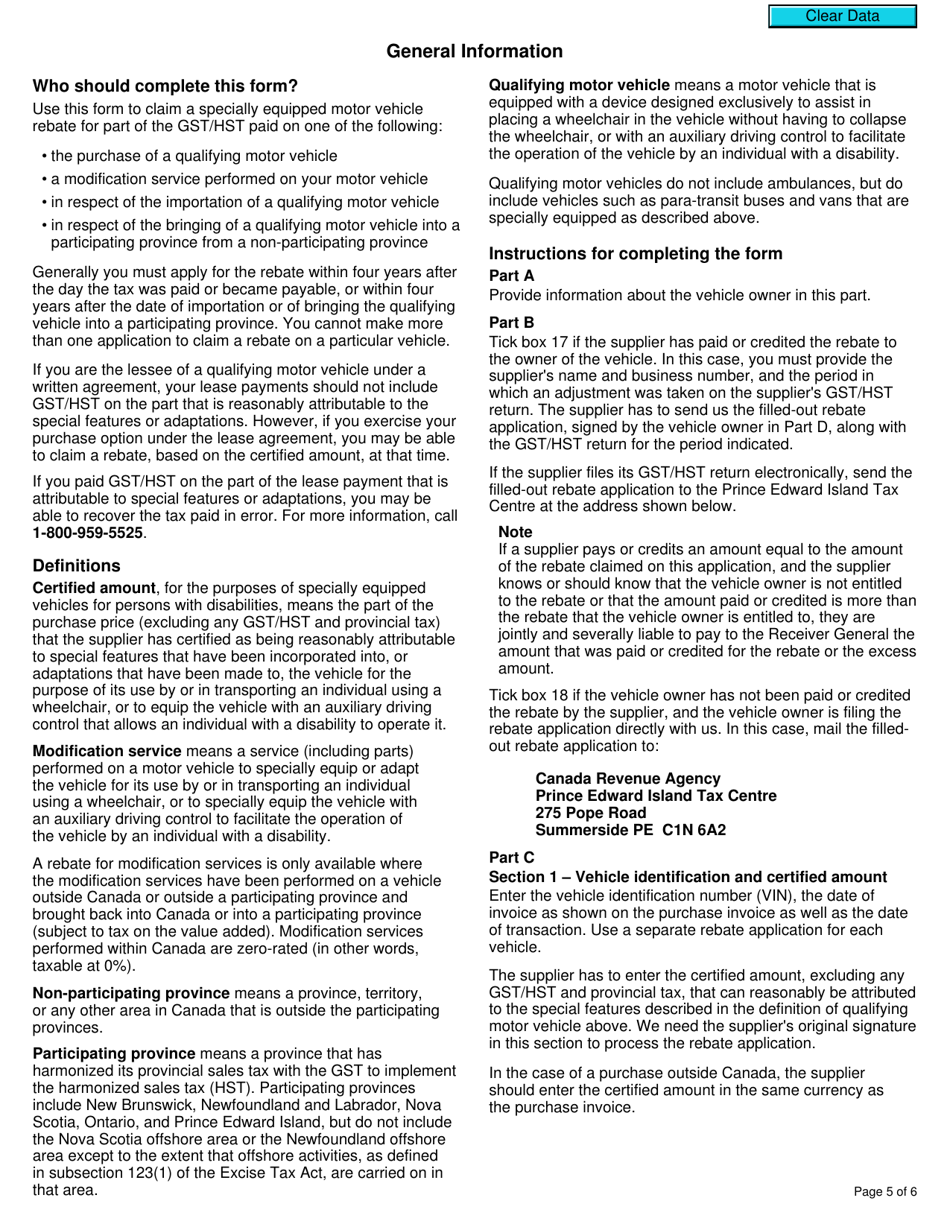

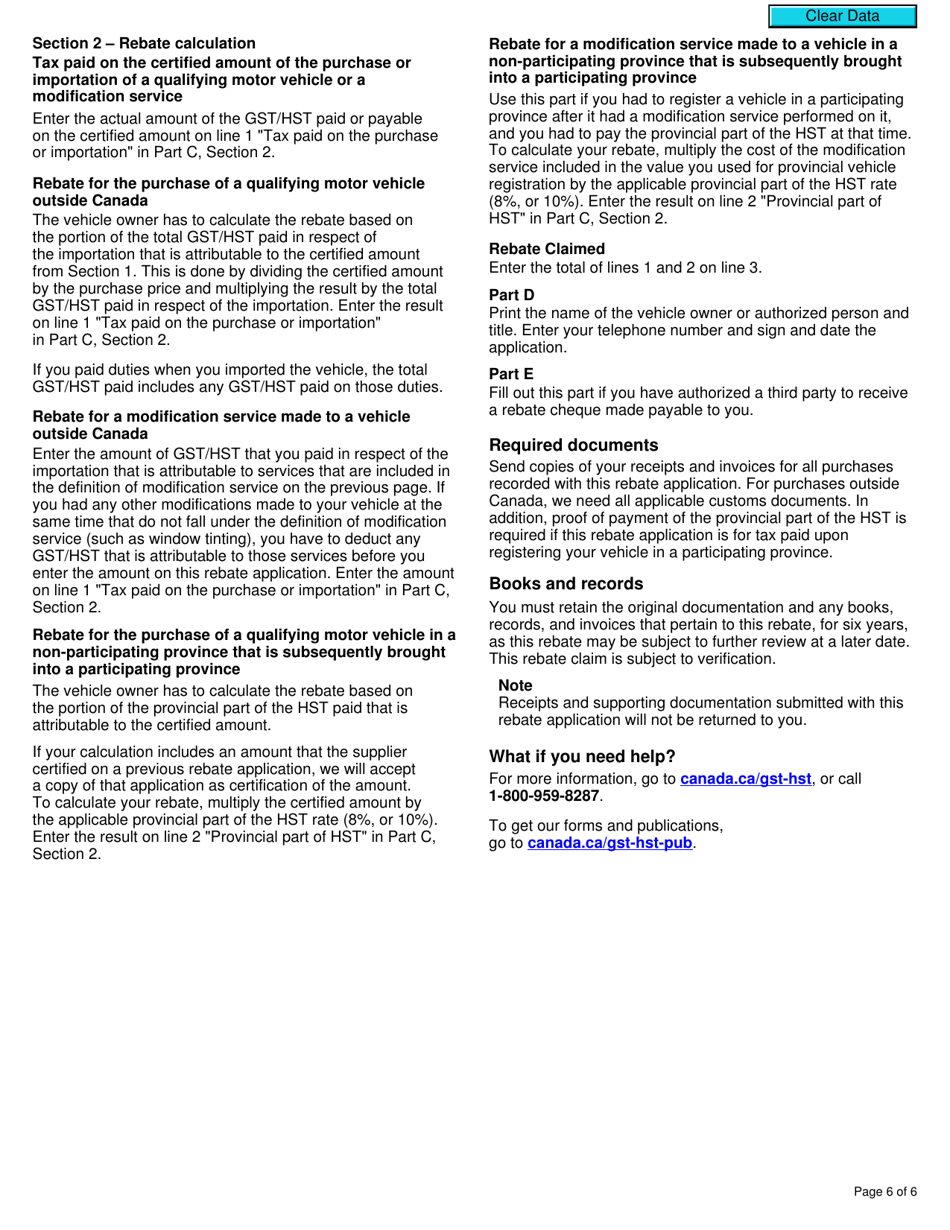

Form GST518 GST/HST Specially Equipped Motor Vehicle Rebate Application in Canada is used to apply for a rebate on the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) for specially equipped motor vehicles.

The Form GST518 GST/HST Specially Equipped Motor Vehicle Rebate Application in Canada is filed by individuals or businesses who have purchased a specially equipped motor vehicle and are eligible for a GST/HST rebate.

FAQ

Q: What is the Form GST518?

A: Form GST518 is the GST/HST Specially Equipped Motor Vehicle Rebate Application in Canada.

Q: What is the purpose of Form GST518?

A: The purpose of Form GST518 is to apply for a rebate on the GST/HST paid on a specially equipped motor vehicle in Canada.

Q: Who is eligible to use Form GST518?

A: Individuals or businesses who have purchased a specially equipped motor vehicle and paid GST/HST on it in Canada are eligible to use Form GST518.

Q: What is a specially equipped motor vehicle?

A: A specially equipped motor vehicle refers to vehicles that have been adapted for use by individuals with disabilities or certain medical conditions.

Q: Is there a deadline for submitting Form GST518?

A: Yes, Form GST518 must be submitted within two years from the end of the year in which the GST/HST was paid on the specially equipped motor vehicle.