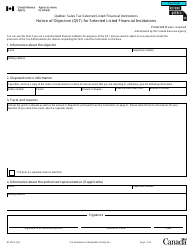

This version of the form is not currently in use and is provided for reference only. Download this version of

Form E680

for the current year.

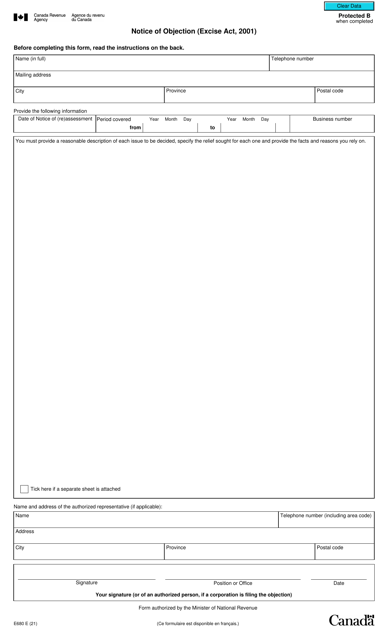

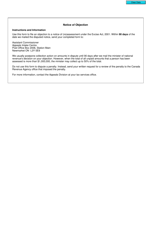

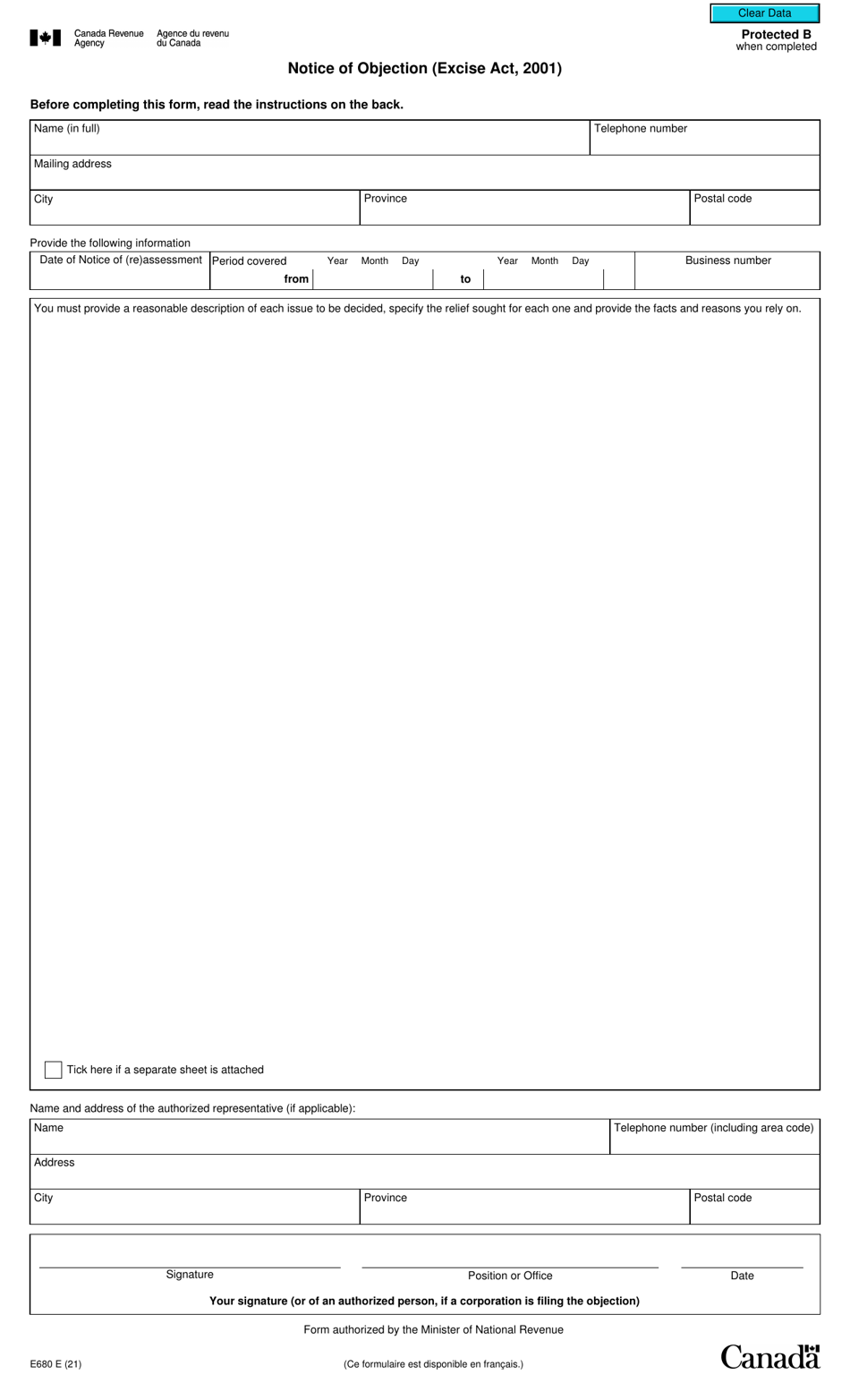

Form E680 Notice of Objection (Excise Act, 2001) - Canada

Form E680 Notice of Objection (Excise Act, 2001) is used in Canada to file a formal objection against excise tax assessments or decisions made by the Canada Revenue Agency (CRA). It allows individuals or businesses to challenge the CRA's determination and provide supporting information to support their objection.

The Form E680 Notice of Objection (Excise Act, 2001) in Canada is filed by the person or business who disagrees with a decision made by the Canada Revenue Agency (CRA) regarding an excise tax matter.

FAQ

Q: What is Form E680?

A: Form E680 is a Notice of Objection form used for excise tax objections under the Excise Act, 2001 in Canada.

Q: What is the Excise Act, 2001?

A: The Excise Act, 2001 is a Canadian law that governs the administration of excise taxes on various goods and activities.

Q: When do I need to use Form E680?

A: You need to use Form E680 when you want to object to a decision made by the Canada Revenue Agency (CRA) regarding excise tax.

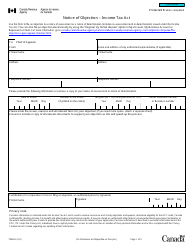

Q: How do I fill out Form E680?

A: To fill out Form E680, provide your personal information, describe the reasons for your objection, and attach any supporting documents.

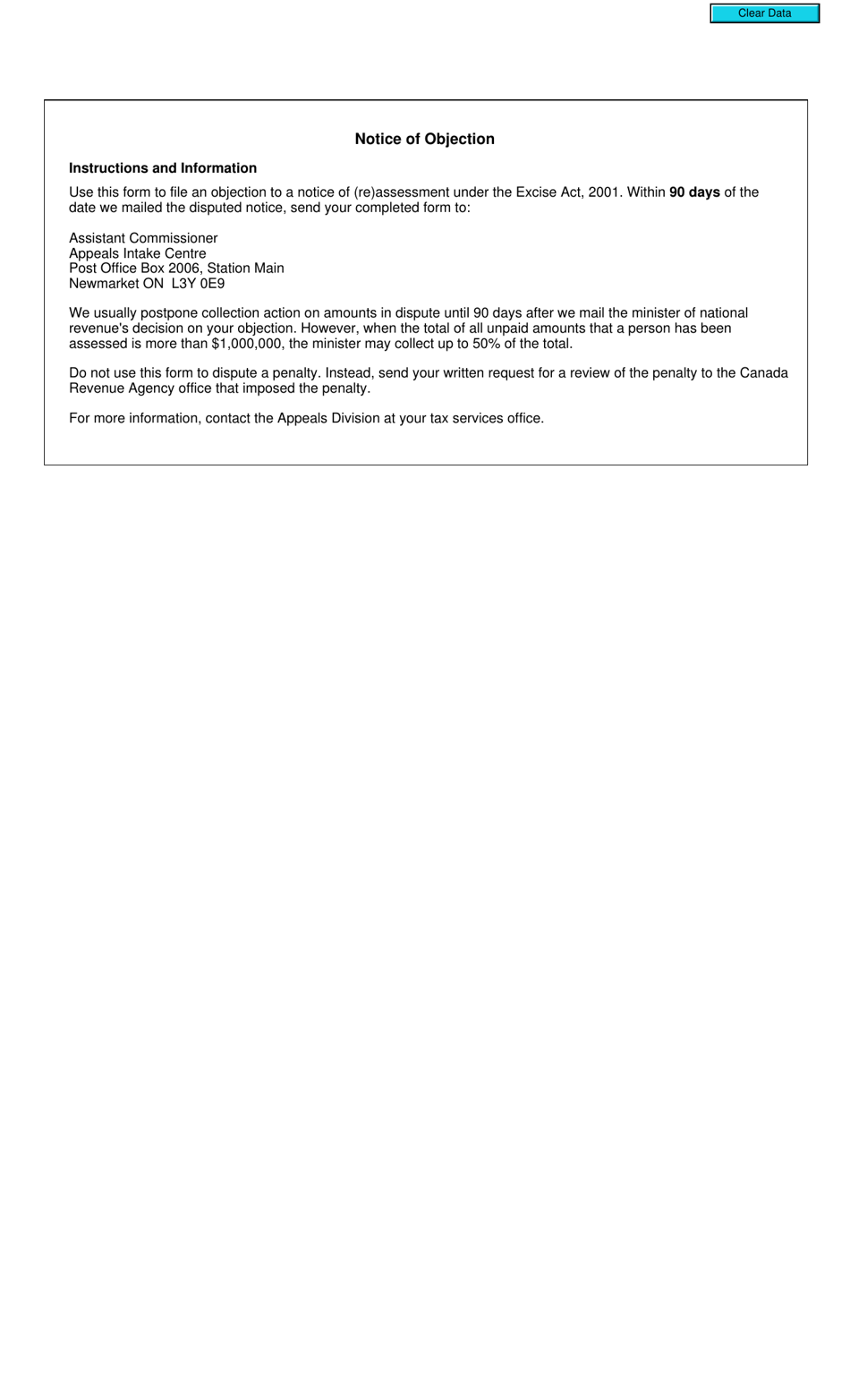

Q: Is there a deadline for submitting Form E680?

A: Yes, there is a deadline for submitting Form E680. Generally, you have 90 days from the date of the CRA's decision to file your objection.

Q: What happens after I submit Form E680?

A: After you submit Form E680, the CRA will review your objection and either confirm their original decision or make changes based on your objection.

Q: Can I appeal the CRA's decision after submitting Form E680?

A: Yes, if you disagree with the CRA's decision on your objection, you can appeal to the Tax Court of Canada.

Q: Do I need to pay the disputed excise tax while my objection is being reviewed?

A: Yes, you generally need to pay the disputed excise tax while your objection is being reviewed. However, you may be eligible for a refund if your objection is successful.