This version of the form is not currently in use and is provided for reference only. Download this version of

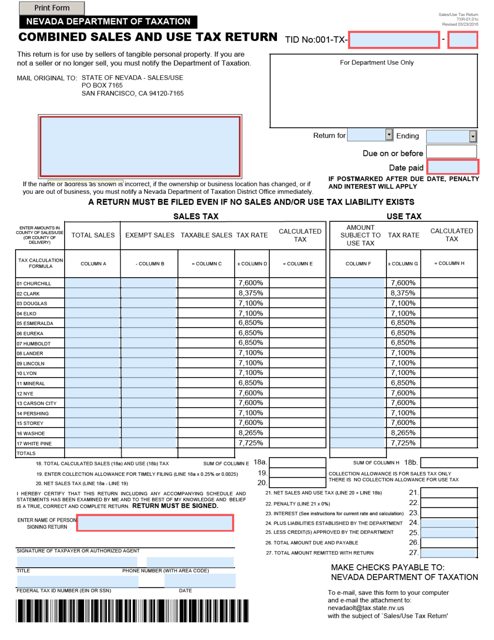

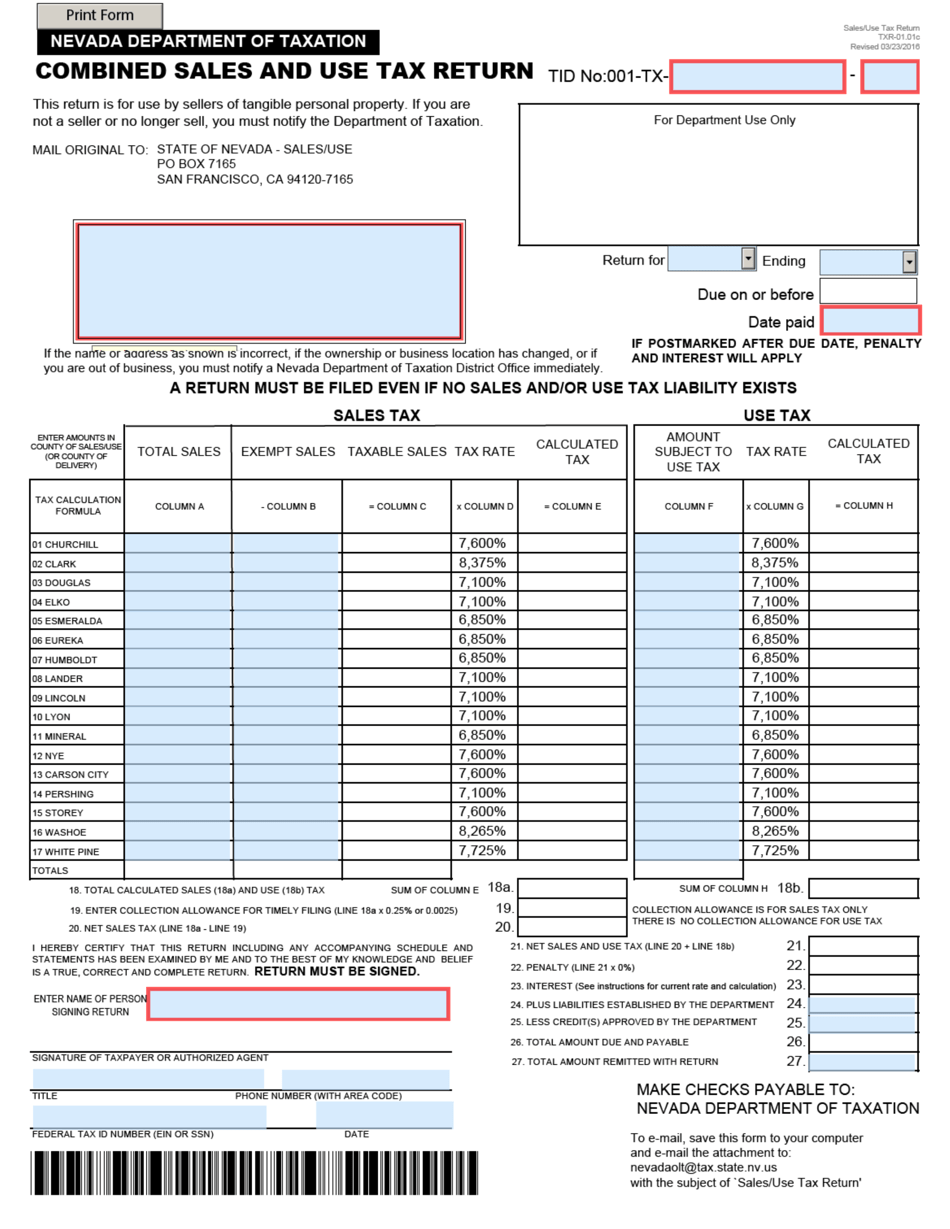

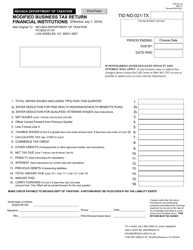

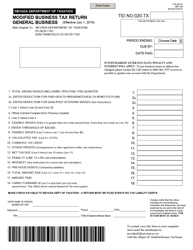

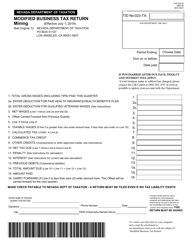

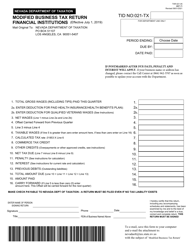

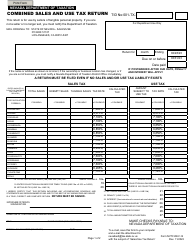

Form TXR-01.01C

for the current year.

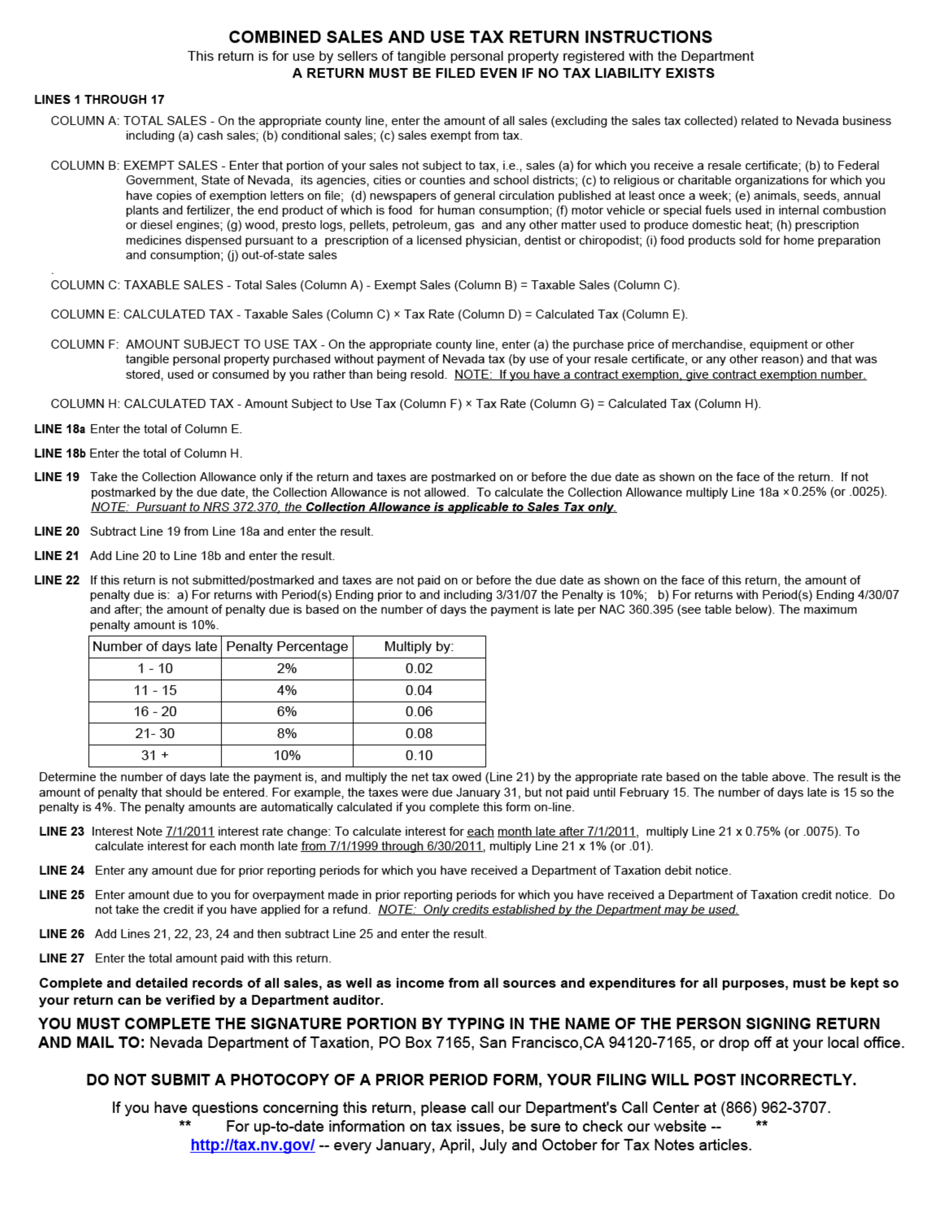

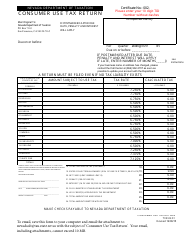

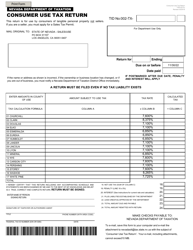

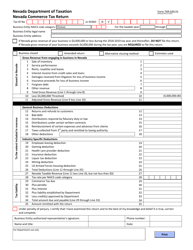

Form TXR-01.01C Combined Sales and Use Tax Return - Nevada

What Is Form TXR-01.01C?

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TXR-01.01C?

A: Form TXR-01.01C is the Combined Sales and Use Tax Return for Nevada.

Q: Who needs to file Form TXR-01.01C?

A: Businesses in Nevada that are engaged in selling or leasing tangible personal property, and in certain cases services, are required to file Form TXR-01.01C.

Q: What is the purpose of Form TXR-01.01C?

A: Form TXR-01.01C is used to report and remit sales and use tax collected by businesses in Nevada.

Q: When is Form TXR-01.01C due?

A: Form TXR-01.01C is due on or before the last day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form TXR-01.01C?

A: Yes, there may be penalties for late filing or failure to file Form TXR-01.01C.

Q: What other documents may be required to accompany Form TXR-01.01C?

A: Depending on the type of business and its activities, additional documents such as schedules or supporting documentation may be required to accompany Form TXR-01.01C.

Q: Is Form TXR-01.01C only for sales tax purposes?

A: No, Form TXR-01.01C is a combined sales and use tax return, meaning it is used to report both sales tax and use tax.

Q: What is the difference between sales tax and use tax?

A: Sales tax is imposed on the sale or lease of tangible personal property in Nevada, while use tax is imposed on the storage, use, or consumption of taxable goods or services in Nevada.

Form Details:

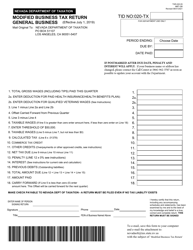

- Released on March 23, 2016;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TXR-01.01C by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.