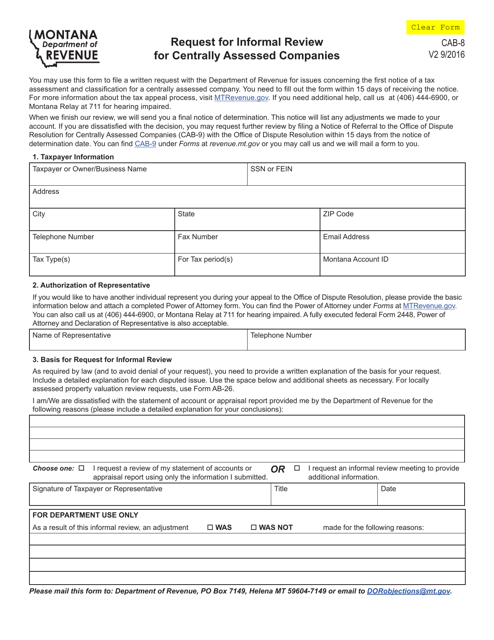

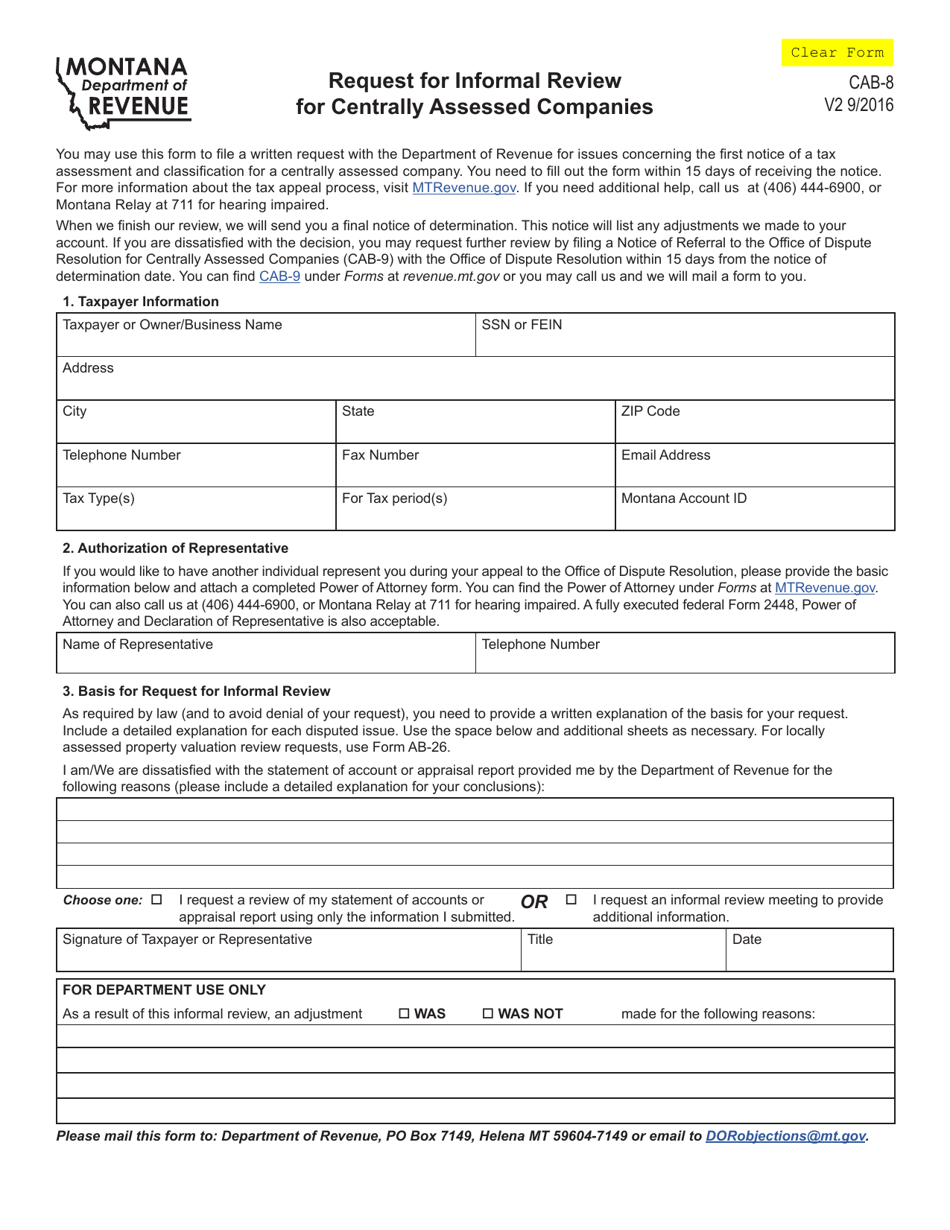

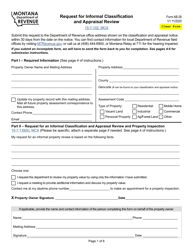

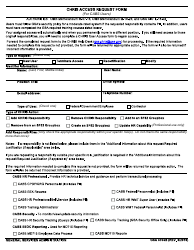

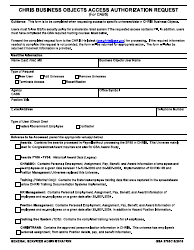

Form CAB-8 Request for Informal Review for Centrally Assessed Companies - Montana

What Is Form CAB-8?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAB-8?

A: CAB-8 is a form used for requesting an informal review for centrally assessed companies in Montana.

Q: What is a centrally assessed company?

A: A centrally assessed company is a company whose property is valued and assessed by the state, rather than by the local county.

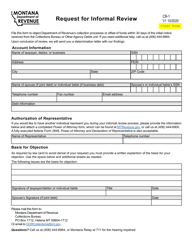

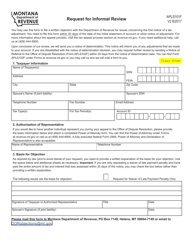

Q: What is an informal review?

A: An informal review is a process where a company can request a review of their property's assessment value.

Q: Who can use the CAB-8 form?

A: The CAB-8 form is specifically for centrally assessed companies in Montana.

Q: What is the purpose of the informal review?

A: The purpose of the informal review is to address any discrepancies or errors in the assessment value of a company's property.

Q: Is there a deadline for submitting the CAB-8 form?

A: Yes, the CAB-8 form must be submitted within a specific timeframe, typically within 30 days of receiving the initial assessment notice.

Q: What happens after submitting the CAB-8 form?

A: After submitting the CAB-8 form, the company may be contacted by the Department of Revenue for additional information or to schedule an informal meeting to discuss the assessment.

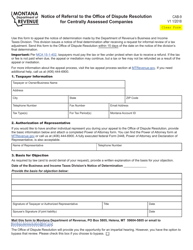

Q: Is the decision from the informal review final?

A: No, the decision from the informal review is not final and the company has the option to appeal the decision if they disagree with it.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAB-8 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.