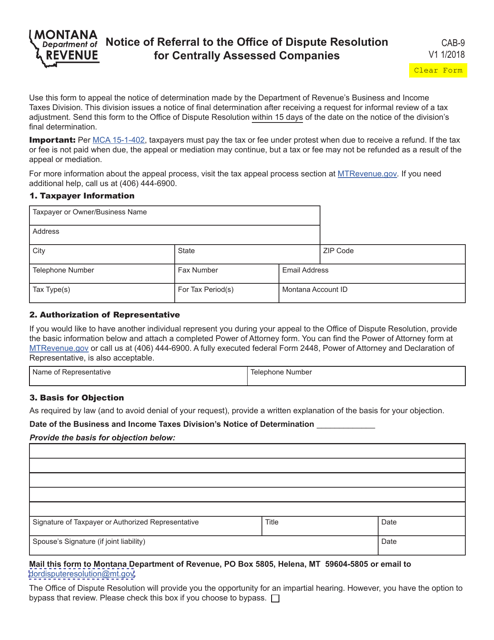

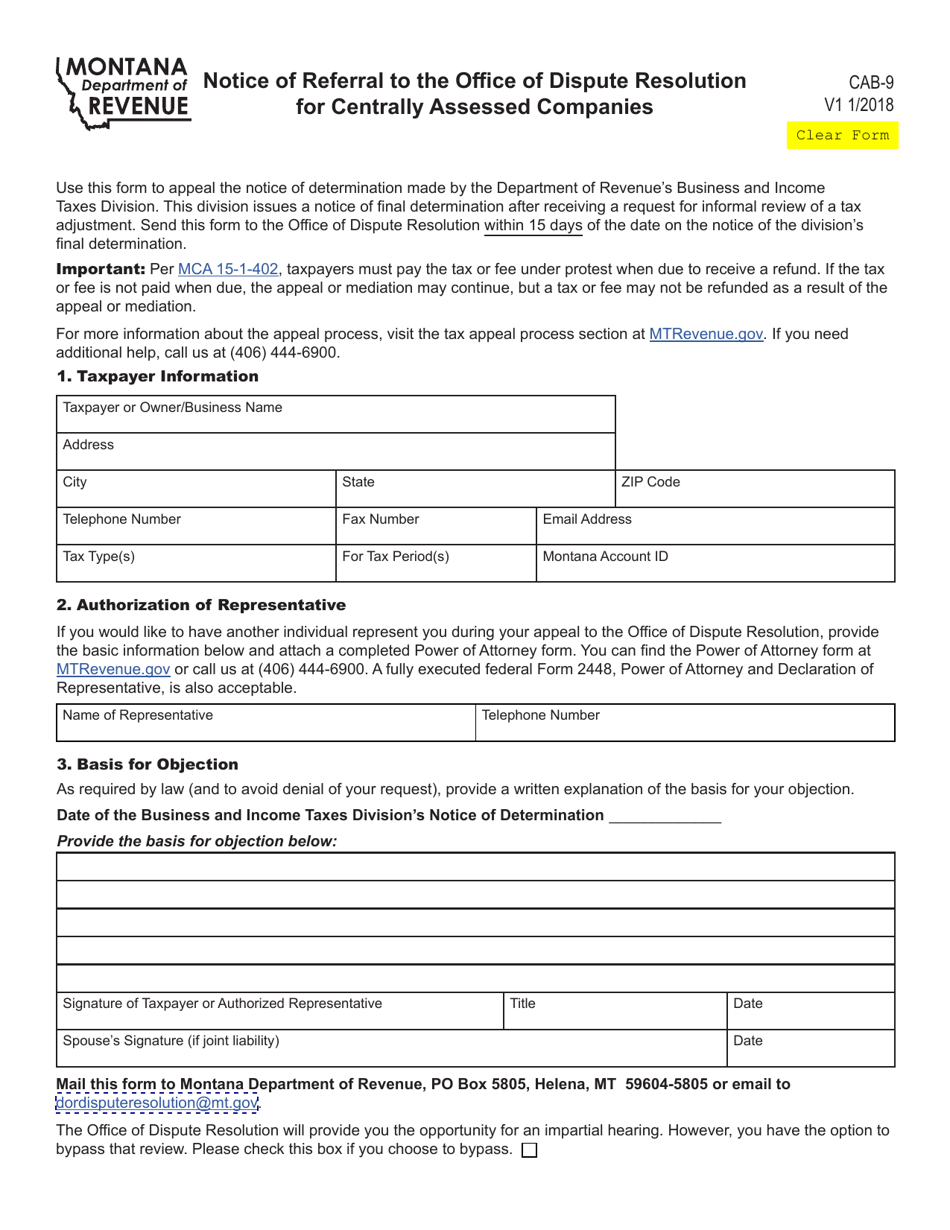

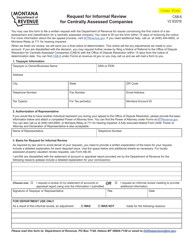

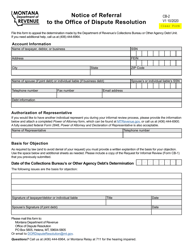

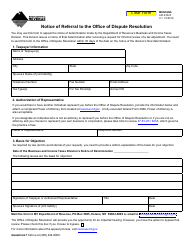

Form CAB-9 Notice of Referral to the Office of Dispute Resolution for Centrally Assessed Companies - Montana

What Is Form CAB-9?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CAB-9?

A: Form CAB-9 is a notice of referral to the Office of Dispute Resolution for Centrally Assessed Companies in Montana.

Q: What does this form do?

A: This form notifies the Office of Dispute Resolution about a dispute involving a centrally assessed company in Montana.

Q: What is a centrally assessed company?

A: A centrally assessed company is a business that operates in multiple locations and has its property assessed at the state level.

Q: When should this form be filed?

A: This form should be filed when there is a dispute between a centrally assessed company and the Montana Department of Revenue.

Q: Is there a deadline for filing this form?

A: Yes, there is a deadline for filing this form. It is specified on the form and instructions provided by the Montana Department of Revenue.

Q: What happens after I submit Form CAB-9?

A: After you submit Form CAB-9, the Office of Dispute Resolution will review your case and facilitate the resolution process.

Q: Can I appeal the decision made by the Office of Dispute Resolution?

A: Yes, you can appeal the decision made by the Office of Dispute Resolution through the Montana court system.

Q: What should I do if I have questions about Form CAB-9?

A: If you have questions about Form CAB-9, you should contact the Montana Department of Revenue for assistance.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAB-9 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.