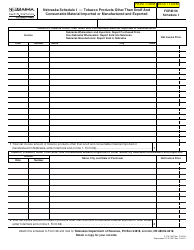

This version of the form is not currently in use and is provided for reference only. Download this version of

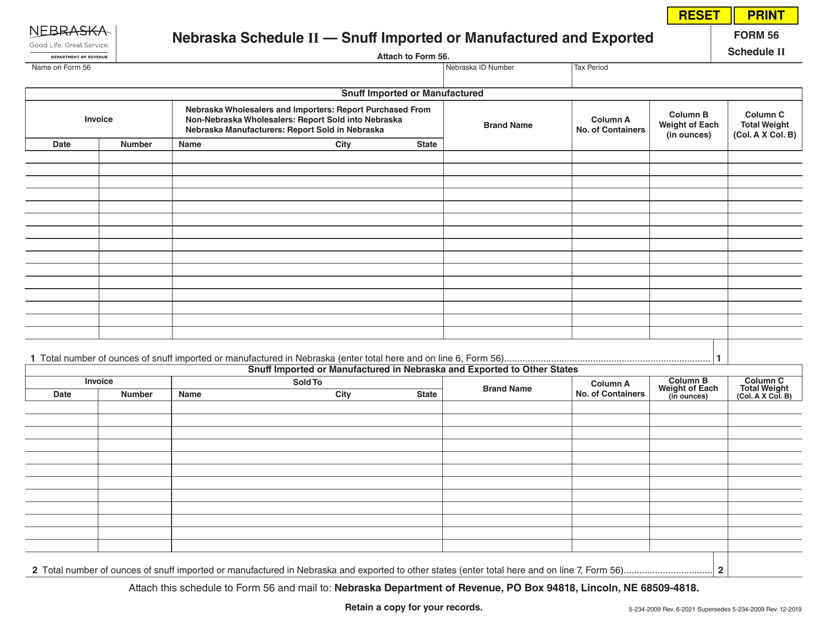

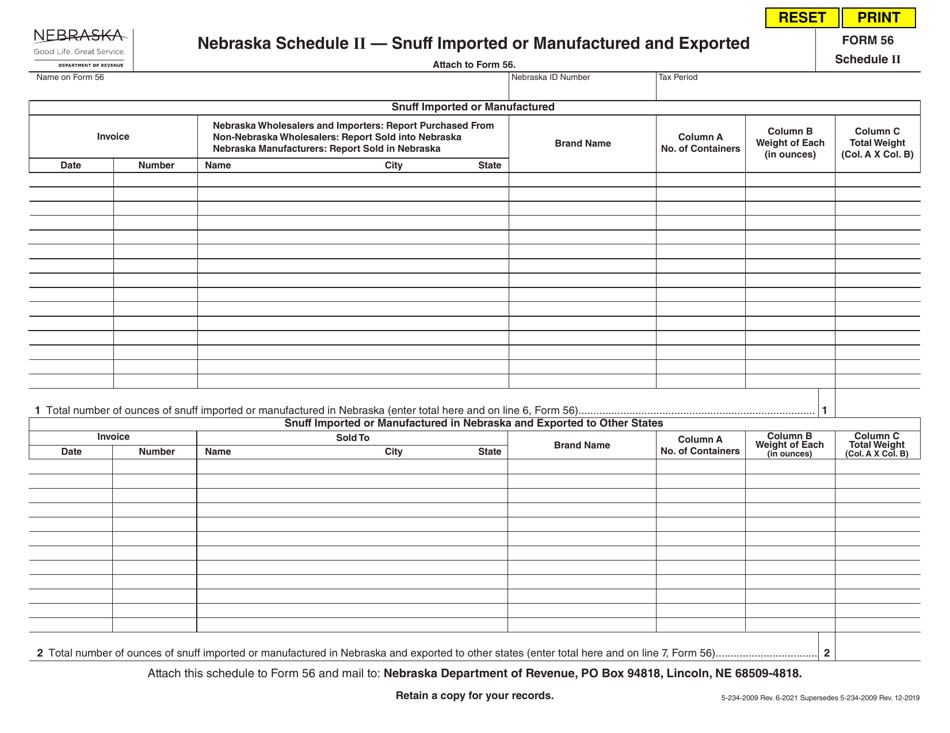

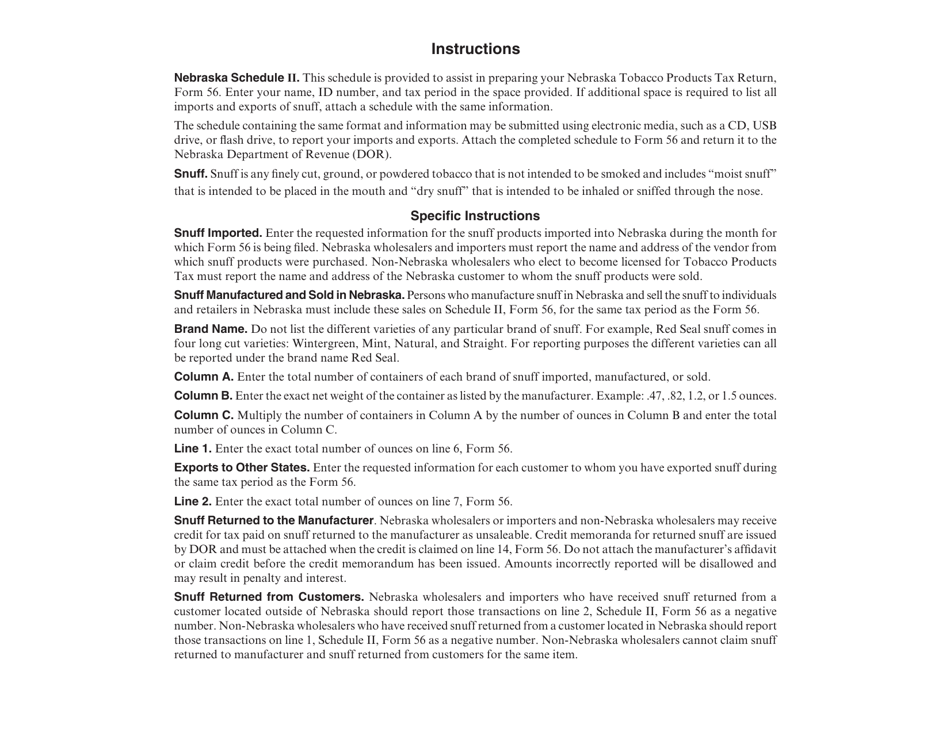

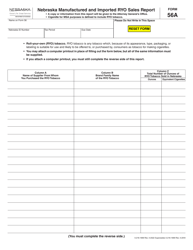

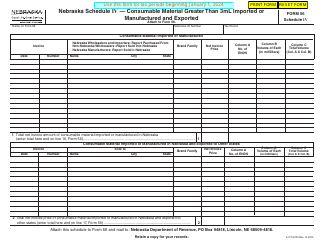

Form 56 Schedule II

for the current year.

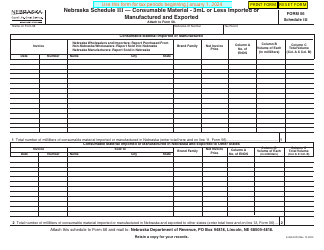

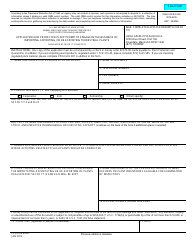

Form 56 Schedule II Snuff Imported or Manufactured and Exported - Nebraska

What Is Form 56 Schedule II?

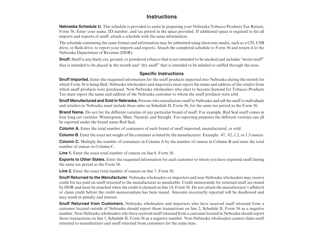

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 56, Nebraska Tobacco Products Tax Return for Products Other Than Cigarettes. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 56 Schedule II?

A: Form 56 Schedule II is a tax form used for reporting the importation or manufacturing and exportation of snuff products.

Q: Who needs to file Form 56 Schedule II?

A: Any person or business involved in the importation or manufacturing and exportation of snuff products needs to file Form 56 Schedule II.

Q: What is snuff?

A: Snuff is a type of smokeless tobacco product that is ground or shredded and is meant to be used by placing it inside the mouth.

Q: Why is Form 56 Schedule II important?

A: Form 56 Schedule II is important because it helps the government track the importation or manufacturing and exportation of snuff products, ensuring compliance with tax regulations.

Q: Do I have to pay taxes on snuff products?

A: Yes, taxes are typically due on snuff products, and Form 56 Schedule II is used to report and pay these taxes.

Q: What is the deadline for filing Form 56 Schedule II?

A: The deadline for filing Form 56 Schedule II is usually quarterly, with specific dates provided by the IRS. It is important to check the latest deadlines.

Q: Are there any penalties for not filing Form 56 Schedule II?

A: Yes, there can be penalties for failure to file or late filing of Form 56 Schedule II, so it is important to comply with the IRS regulations and deadlines.

Q: Are there any exemptions or deductions for snuff products?

A: There may be specific exemptions or deductions available for snuff products, so it is recommended to consult with a tax professional or refer to the IRS guidelines for more information.

Q: Can I e-file Form 56 Schedule II?

A: Currently, Form 56 Schedule II cannot be e-filed. It needs to be filed by mail or in person to the designated IRS office.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 56 Schedule II by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.